Interview with Jon Awde, President and CEO of Gold Standard Ventures (TSXV: GSV; NYSE MKT: GSV): Made a Significant Discovery of Shallow 3.95 Grams per Ton Oxide on Their Railroad-Pinion Property in the Carlin Trend, Nevada

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/21/2016

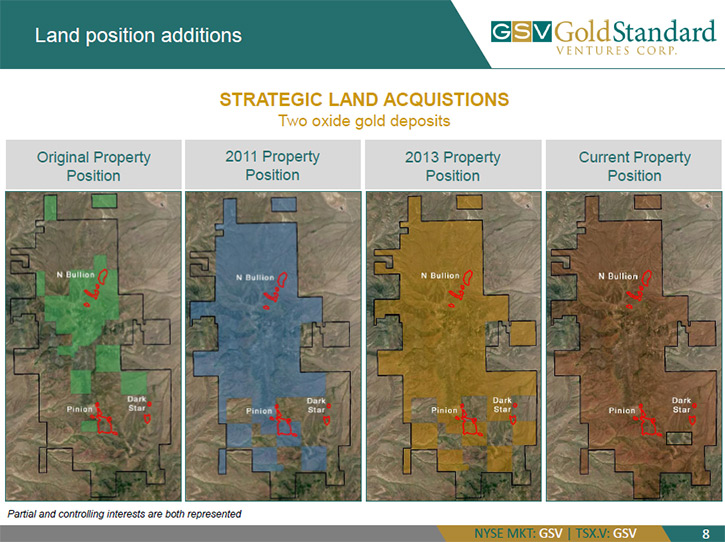

Jon Awde, President and CEO of Gold Standard Ventures (TSXV: GSV; NYSE MKT:GSV), used the downturn to consolidate Gold Standard’s land package in the

Carlin Trend, Nevada. These efforts directly led to a significant discovery of shallow 3.95 grams per ton oxide on their North Dark Star property. They

have raised $30M and budgeted 13.5 million dollars in 2016 for drilling, metallurgy and permitting. Look for a preliminary economic assessment, PEA early

in 2017. Gold Standard Ventures leveraged the poor market to position themselves for a major advantage going into 2016, 2017 and beyond.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Jonathan Awde, President and CEO of Gold Standard Ventures

Corp. I see you're having a good year drilling and getting excellent results. Could you tell me what you've achieved this year and a bit about your

property in the Carlin Trend, Nevada? Also, more specifically what you're doing with the North Dark Star deposit?

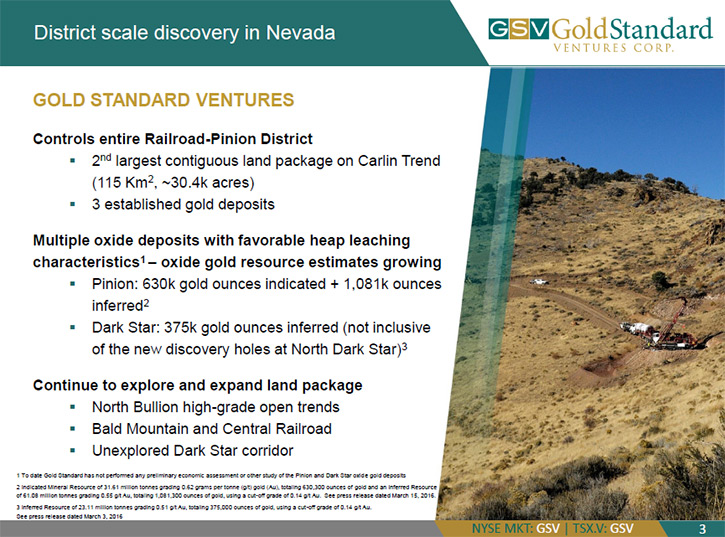

Mr. Jon Awde: Sure. What Gold Standard has is a large, contiguous, district-scale land package in the southern portion of the Carlin Trend. Over

the last five years we've consolidated the entire southern portion of the Carlin Trend, everything just to the south of Newmont's Rain and Emigrant Mines.

We decided to be opportunistic in the downturn, and finish the consolidation of the second largest land package in the Carlin behind Newmont. What the

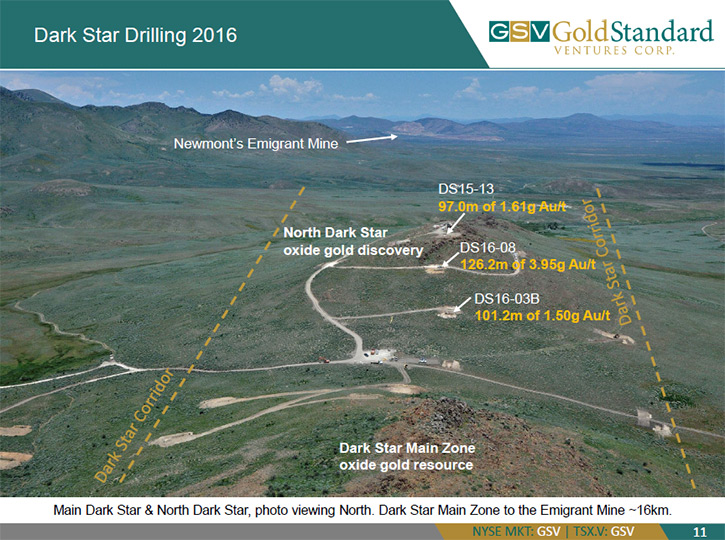

market has gravitated towards, in the last few months with Gold Standard, is a shallow oxide discovery that we made on the project called North Dark Star.

This discovery was made possible because of the consolidation effort that we've gone through in the last five years. We had some really big intercepts

that were shallow and higher grade oxide. When you look, bigger picture, at what's being mined in Nevada for an open pit heap leach project that's oxide,

you probably have point eight to point nine grams per ton. But I think more importantly, that's being replaced with point five to point six grams per ton,

so lower grade. I think that's where there's an opportunity, these companies that are exploring, that are making legitimate discoveries. Because

exploration budgets have been declining for years. There are not a lot of new discoveries being made. So something new, with these kinds of oxide grades

being hit, is very significant.

The biggest hole that we hit was a hundred and twenty-six meters of three point nine five grams per ton oxide. That's caused the stock to have a

lot of activity and to have a good few weeks, and we have five rigs on the project right now. Three of them are in and around the discovery of North Dark

Star. We have two rigs drilling some other interesting targets on the project. One of them is called North Bullion and we came out with a hole on Tuesday

that was sixty-six meters of three point two grams. That was six miles to the north of the oxide discovery. We have a rig over at Pinion which has one

point seven million ounces of gold. That's oxide, and we're looking for the northern extension there.

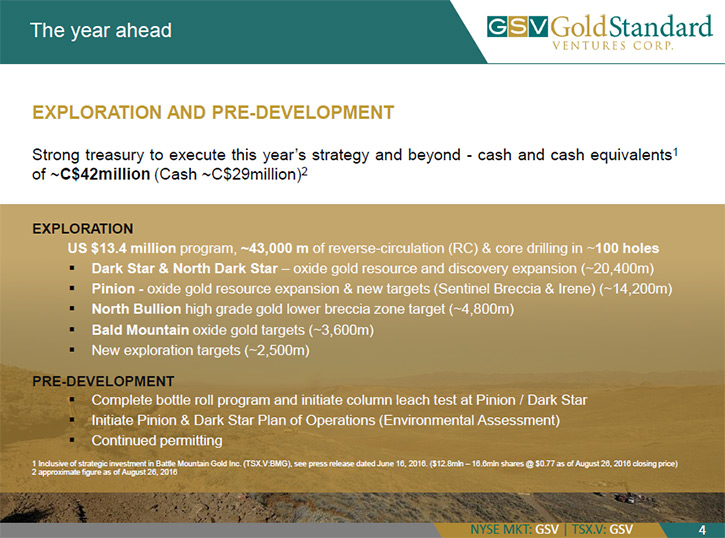

We have thirty million dollars in cash, and another twelve million dollars in marketable securities, and we're active and busy with this program. We are

going to spend thirteen and a half million dollars in 2016 with nine point five going into the ground, and another four million bucks going into

metallurgy and permitting.

Dr. Allen Alper: That sounds excellent. I guess in the industry they say that grade is king, and oxide is queen, and it sounds like you have both

on your properties.

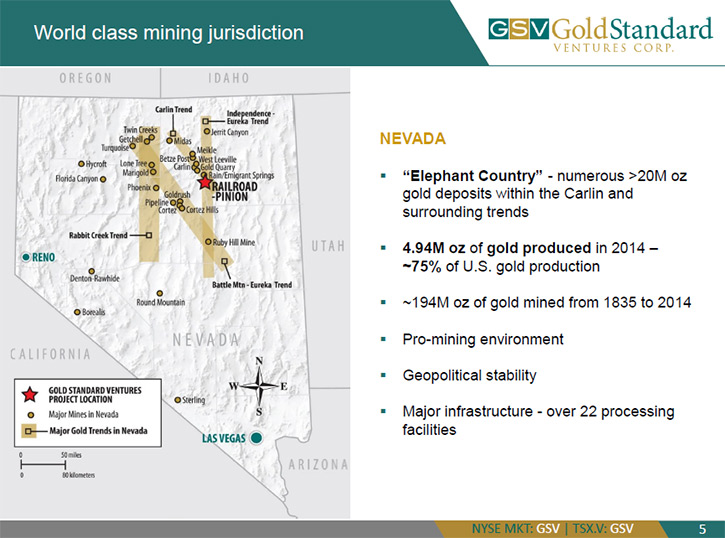

Mr. Jon Awde: The oxide discoveries being made in politically stable parts of the world, are just non-existent because of years and years of

declining exploration budgets. Some of these discoveries are deeper or they're isolated or they're in countries that you really don't want to be anywhere

near. Nevada is consistently in the top three jurisdictions in the world to be exploring, developing or producing.

We're very pleased with what we have found, we think we're in the very early days of an exciting discovery, and we have some great shareholders.

We have two corporate shareholders that own percentages. Gold Corp owns about nine percent and Oceanic Gold owns about nineteen point nine

percent. A wildly successful macro investor, Albert Friedberg, owns about fifteen and a half percent. Without the support of our big important

shareholders, this discovery and a real exploration program would not be possible.

Dr. Allen Alper: That is fantastic! That's a great position to be in. You have excellent properties and great support with powerful shareholders.

Mr. Jon Awde: Yeah.

Dr. Allen Alper: Tell me a bit more about your plans.

Mr. Jon Awde: Sure. Over the next six months, we'll have the balance of our drill program for 2016 completed and those results released out into

the market. We plan to update the resources at Pinion, Main Zone Dark Star, and North Dark Star. We're currently doing our metallurgy. Metallurgy is

really important for a project like this because it's going to show what the recoveries are. The better the recoveries, the better the economics. The

lower the recoveries, the lower the economics. We're really excited about what we're seeing so far. Once we finish that metallurgy, late in the year,

early into January and February of 2017, we are going to come out with a PEA, a preliminary economic assessment. It will provide a rough idea of what the

costs will be, what the CapEx will be, and that's something the market will want to see.

That's the next six to nine months for Gold Standard. We have a lot more drilling left to do, getting into the resources, metallurgy, PEA. We're

submitting our full EA, a big exploration permit with years of work put into it. We've put some money into a little company, about an hour and twenty-five

minutes west of us, called Battle Mountain Gold that's doing some really exciting things. We now own twenty-eight and a half percent of that company.

That's Battle Mountain Gold, symbol is BMG. This year has been incredibly busy for us. The work our exploration team is doing, is first rate. It's an

honor to be associated with a group like that. I want to make sure whatever targets they want to drill they have the money for.

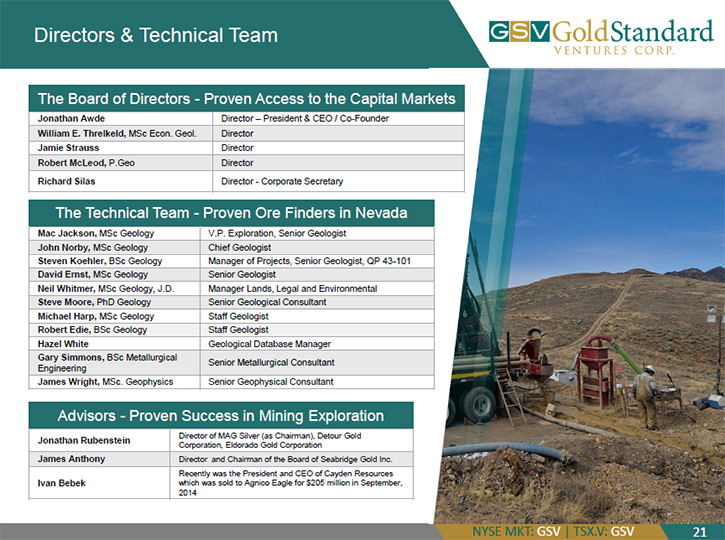

Dr. Allen Alper: That's sounds great. Could you tell me a bit more about your background, your team and your board?

Mr. Jon Awde: Yeah. The board has a good mix of capital markets expertise and technical, in mining engineering and exploration. We have a great

advisory board lead by Jonathan Rubenstein, who is active as a mentor to me and a key advisor to the company. He's had a remarkably successful career.

He's a securities lawyer by training. Ivan Bebek, who sold Cayden Resources to Agnico Eagle in late 2014, is probably the best, young mining promoter,

financier on the planet, in my opinion. He's become a very meaningful shareholder and brought with him a number of his network into the deal.

Then Jim Anthony is probably the biggest individual shareholder, retail shareholder, of Gold Standard. He was the former chairman of Seabridge

Gold, and he's been fantastic with helping this company, and was also very supportive during four years of low gold prices. I think that speaks volumes,

what management does during bad times and how they allocate capital during tough times. I think that's why we have such supportive shareholders, because

we were there in the trenches with them. Management at Gold Standard owns a lot of stock and was buying shares in the downturn. I think that won some

people over. Because we had skin in the game. When you get that alignment of interests, I think that's really important.

Dr. Allen Alper: That sounds great. Could you tell me a bit more about your own background and your exploration team?

Mr. Jon Awde: Sure. My background is capital markets. I'm a finance guy. I'm not technical. I co-founded the company in 2009 and took it public

in Q3 of 2010. I've been President & CEO since day one, and my job has been largely capital markets, raising the necessary equity, strategy, leading the

whole consolidation, and doing a lot of the negotiation. Making sure that the exploration team had the capital necessary. The exploration team is led by

VP Ex, Mac Jackson, quiet, unassuming, rock star. He was one of the geologists that discovered Leeville. He's been a part of discoveries at Twin Creeks

and Fiber Line.

We have Chief Geologist, John Norby, who has been in Nevada for thirty years, very, very well thought of, part of a number of discoveries in the

state. Then Steve Koehler, who has the ability to wear a number of different hats. I was just marketing with Steve this past week and thought he did a

great job. Steve has been a part of three discoveries that are now mines. He is one of the few geologists, who can really talk to an investor, any kind of

investor. Then you have these couple of young geologists that have done a magnificent job with North Dark Star and really been brought along. We have a

great team atmosphere and concept.

Teams, not individuals, breed success. You have to have a team, and we have a great collection of people that work really well together, and

communicate well with each other. I think that's part of the reason for this success we've been having.

Dr. Allen Alper: It sounds like you have a great team there. You have a great background to keep the team going and getting good properties. It

sounds like it's a well-balanced team and board. What are the primary reasons our high-net-worth readers/investors should consider investing in your

company?

Mr. Jon Awde: Everyone should do their own due diligence as I'm not a licensed investment advisor, but I think if you're looking at the gold

market and then you're looking more specifically at gold equities, you have a couple of choices. You have, do I put some money into a senior producer? Do

I put some money into a developer, or do I put some money into an advanced stage explorer? There are different risk/reward trade-offs and scenarios for

each one of those. I think the key underlying theme for all three of those is what you're seeing investors want to gravitate towards is political

stability. Where is your asset? Does rule of law mean anything?

I think having an asset in Nevada is arguably the best jurisdiction, in my opinion, in the world to be in. I think it's really important to focus

on jurisdiction. Then you've heard this word “district” used frequently in the last couple of years. Do you have a large enough land packet that's

meaningful, that somebody could be there exploring and producing for twenty, thirty, forty years? I think absolutely, with a fifty-two square mile land

package, the second largest land package in the Carlin Trend, we have that. Very important to check that box off. Can they raise money? Has management had

any success in the past? Do they have good people?

Dr. Allen Alper: That sounds great!

Mr. Jon Awde: Yes. I think what separates Gold Standard, why people should consider Gold Standard and possibly invest is shallow oxide, high

grade oxide in the Carlin Trend, which is arguably the most prolific gold trend in the world.

Dr. Allen Alper: That sounds great. It sounds like your company is in a great position going forward. Is there anything else you'd like to add,

Jon?

Mr. Jon Awde: I think that we're always open. If there are any investors that have questions please, please feel free to call into Gold

Standard. We have myself and we have Mark McCartney in investor relations, corporate development that can absolutely walk any of you through this. Then we

have a great technical team in Nevada. I encourage everyone to do his own due diligence and feel very comfortable, but we've been doing this for a long

time. There are a lot of really good people behind the deal. I think if someone is looking for exposure in an advanced stage exploration story, Gold

Standard is worthy of a look given the reasons I've just outlined.

Dr. Allen Alper: That sounds very good!

http://goldstandardv.com/

Suite 610 – 815 West Hastings St

Vancouver, BC V6C 1B4

Telephone: 1-604-669-5702

Fax: 1-604-687-3567

Please Contact: Jonathan Awde

Email: info@goldstandardv.com

|

|