Interview with Paul Kuhn, CEO of Avrupa Minerals Ltd. (TSX VENTURE: AVU): An Excellent Junior Canadian Prospect Generator Focused on Politically Stable Regions of Europe

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/18/2016

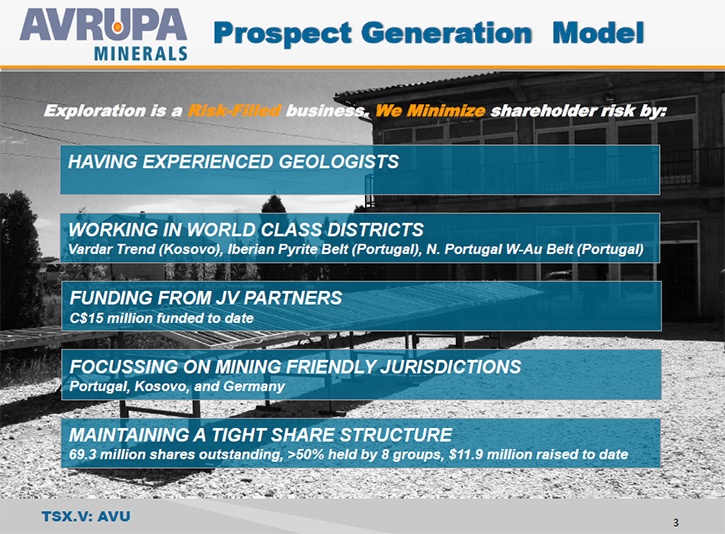

Avrupa Minerals, Ltd. (TSX VENTURE: AVU) is an excellent junior Canadian Prospect Generator, focused on building a diversified portfolio of mineral

exploration projects in politically stable regions of Europe such as Portugal, Kosovo and Germany. The properties are located in areas with existing mines

and have strong geological potential for discovery. We learned from Paul Kuhn, CEO of Avrupa Minerals, that there are a number of projects that are in the

pipeline that offer great return prospects including Oelsnitz in Germany, Alvalade in Portugal and Slivovo in Kosovo. According to Mr. Kuhn, the latest

drill results from Slivovo, coupled with a far better understanding of the geology and mineralization parameters, increase the possibility of finding gold

in more areas of the project.

Avrupa Minerals: An Introduction

Avrupa Minerals is a fledgling company, in the growth phase, focused on exploration and production of precious and base metals. The company has a team of

experienced geologists, having extensive on-sight experience. To minimize the exploration risks, the company uses a prospector generation model. It

focuses on historic mining districts in central and western parts of Europe.

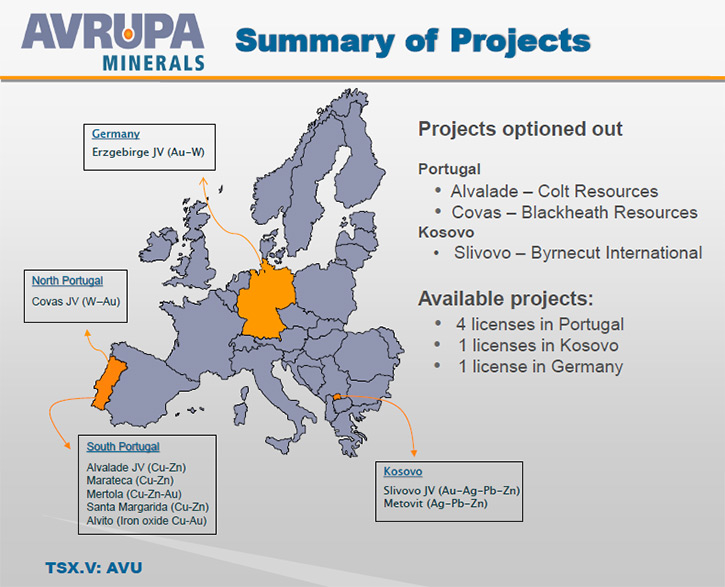

Currently, Avrupa has exploration operations in Kosovo, Germany, and Portugal. The exploration portfolio of the company, at the present, includes the

following.

• Tungsten in northern Portugal at the Covas JV project area;

• Zinc and Copper deposits and targets in southern Portugal, and in the Iberian Pyrite Belt, which is the location of one of the richest copper

mines in Europe;

• Tin and Gold in the eastern part of Germany;

• Zinc, Silver, and Lead assets in Kosovo on the Kamenica (Metovit) area that is the most prolific location for zinc and lead;

• Iron oxide copper-gold (IOCG), polymetallic massive sulfide, epithermal precious metal potential, and copper-gold porphyry in southern Portugal

that is located within the Alvito project area; and

• A Gold-bearing gossan zone target on the Slivovo JV, also located in the Trepça Mineral Belt, just 15 km southeast of Prishtine, the capital city

of Kosovo.

All of the company’s existing projects have a strong potential for the discovery of metals that can be mined economically. The company intends to build a

portfolio of projects that can be developed through forming a joint venture or can be sold to large mining companies with the end goal of enhancing value

for shareholders.

Management Background

Avrupa has a dedicated management team, having extensive experience in exploration and development. Management of the company consists of a board of

directors, having broad experience in finance, exploration, and other fields.

Mr. Paul Kuhn is the CEO & Director of the company. Before joining the company in 2010, Mr.

Kuhn had been working for Metallica Mining Company based in Norway. He has over 35 years’ experience in the exploration of minerals in Europe, North

America, and Central Asia. He earned an A.B. degree from Dartmouth College in 1978 and an MS Degree from the University of Montana in 1983. Mr. Paul Kuhn is the CEO & Director of the company. Before joining the company in 2010, Mr.

Kuhn had been working for Metallica Mining Company based in Norway. He has over 35 years’ experience in the exploration of minerals in Europe, North

America, and Central Asia. He earned an A.B. degree from Dartmouth College in 1978 and an MS Degree from the University of Montana in 1983.

He has working experience in different geological terrains, exploring precious and base metals such as gold, silver, uranium, and phosphate. He has been

involved in the Coeur d`Alene Mining District, which is considered one of the most important silver districts in the world.

Mr. Kuhn has been associated with the initial mapping and description of the Çöpler porphyry Au deposit (a 10 million ounce gold deposit now being mined

by Alacer Gold). Additionally, he has been involved in a number of successful exploration programs in Turkey, North America, and Europe, including the

Cerattepe Cu-Au volcanogenic massive sulfide deposit, the Taç and Çorak polymetallic deposits, the Diyadın Carlin-style Au deposit, the Altıntepe

epithermal Au deposit, and the Karakartal porphyry Cu-Au deposit.

Another top name in Avrupa’s management is Mr. Mark Brown, who is the lead director of the

company. Mr. Brown is also the President of Pacific Opportunity Capital Ltd. His company is a merchant banking and financial consulting firm that is

active in venture capital markets across North America. Another top name in Avrupa’s management is Mr. Mark Brown, who is the lead director of the

company. Mr. Brown is also the President of Pacific Opportunity Capital Ltd. His company is a merchant banking and financial consulting firm that is

active in venture capital markets across North America.

He has helped various private and public companies maintain a strong presence in the corporate sector. Mr. Brown has played an important role in the

success of different companies in the mining and exploration sector. Well-renowned companies that have benefited from his expertise include: Sutter Gold

Mining Ltd., Portal Resources Ltd., Pitchstone Exploration Ltd., Rare Element Resources Ltd., and Animas Resources. His corporate activities range from

merger and acquisitions, strategic corporate planning, financing, and corporate development. He obtained a B.Com degree from the University of British

Columbia and qualified as a Chartered Accountant in 1993.

Other directors of the company include Mr. Ross Stringer, who is a qualified Chartered Accountant and former senior partner of a Canadian based firm. He

has broad experience in the real estate industry; Mr. Paul Dircksen, who has more than 40 years of management experience in the exploration and mining

industry; Mr. Frank Högel who is currently the CEO of the German-based Peter Beck Performance Funds GbR; and Dr. Paul Nelles who is currently a non-

executive director of IEK and was one of the founders of the wholly owned subsidiary of the company in Kosovo named Innomatik Exploration Kosovo LLC.

Description of Operations

Mr. Kuhn told us that Avrupa holds nine exploration licenses. These licenses are held through the company’s subsidiaries in Kosovo, Portugal, and Germany.

He stressed that the company conducts self-funded generative exploration work in Portugal. He told us that Avrupa holds the Alvalade license in the

Iberian Pyrite Belt of Portugal, which represents a Joint Venture with Colt Resources. The Covas license, also in the country, is held in Joint Venture

with Blackheath Resources.

According to Mr. Kuhn, Avrupa also operated a joint venture license until the end of last year at the Slivovo property in Central Kosovo. The operation

continues to be fully funded by Byrnecut International Limited that is based in Australia, and now operated by the Joint Venture entity Peshter Mining JSC

(25% Avrupa and 75% Byrnecut). He told us that Avrupa continues to conduct mineral exploration activities in all the three mentioned countries.

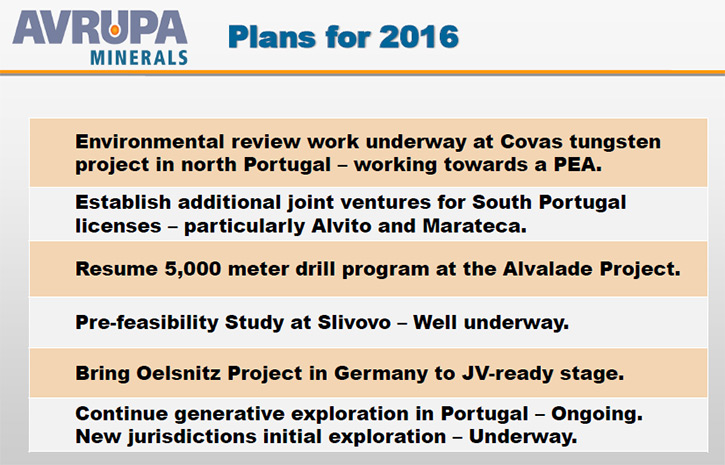

On the company’s plans for 2016, Mr. Kuhn said that there are a number of projects that are in the pipeline that offer great return prospects. He was

excited to mention some of the upcoming projects of the company for the current year that include:

• Advancement of Oelsnitz Project in Germany to JV-ready stage;• Environmental review works underway at Covas tungsten Project in north Portugal;• Resumption of a 5,000-meter drill program at the Alvalade Project;• Establishment of additional joint ventures for South Portugal licenses, mainly Alvito, Marateca, and Mertola;• Pre-feasibility Study at Slivovo;• Ongoing generative exploration in Portugal;• New jurisdictions initial exploration projects

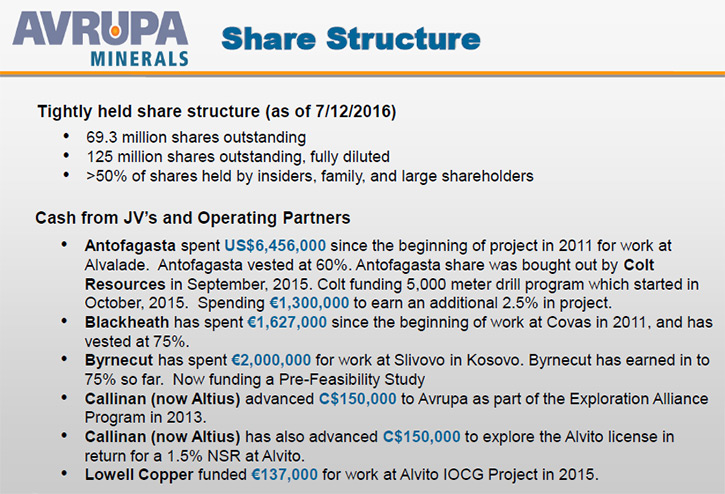

About the ownership of the company, Mr. Kuhn said that Avrupa maintains a tight share structure. At present, there are 69.3 million outstanding shares

with a share capital of approximately C$12.5 million. About 50% of the outstanding shares are held by 8 groups that include insiders, large shareholders,

and family members.

Additionally, the company receives funding for its operations from JV Partners. Up ‘till now, the company has received more than C$15 million of funding

from JV Partners. Apart from that, various other third party companies have invested in the operations of the company.

He told us that Antofagasta spent US$6,456,000 (over C$7,000,000) since the beginning of the project in 2011 for work at Alvalade. It had Antofagasta

vested at 60%. However, the company’s share was bought out by Colt Resources in September 2015. Mr. Kuhn told us that Colt has already invested over

950,000 euros in the project with plans for another 550,000 euros before the end of the year (total C$2.2 million) in the 5,000-meter drill program, which

started in October 2015, to earn an additional 2.5% share in the project. Colt will also spend a further € 1.5 million to gain an additional 2.5% in the

Project in early 2017.

Other companies that had invested in Avrupa’s projects include Blackheath that had spent €1,627,000 (over C$2,000,000) since the beginning of work at

Covas in 2011, and has vested into 75%. Another company named Callinan (now Altius) had advanced C$150,000 to Avrupa as part of the Exploration Alliance

Program in 2013. The company had also advanced C$150,000 to explore the Alvito license in return for a 1.5% NSR at Alvito.

Finally, Mr. Kuhn revealed that Lowell Copper had invested €137,000 (about C$200,000) for work at Alvito IOCG Project in 2015.

Insights into Latest Operations

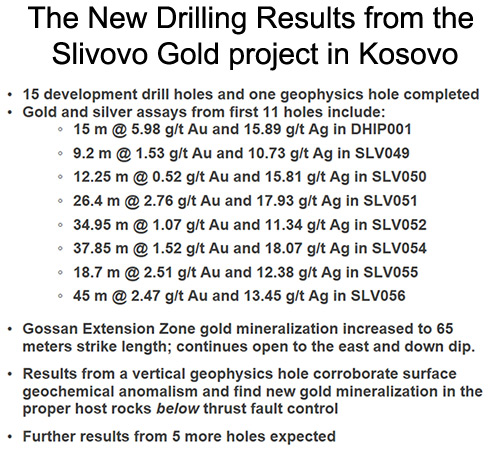

At the end of the interview, Mr. Kuhn told us about the results of the latest Slivovo Gold Project in Kosovo. He said that Peshter Mining, the joint

venture company, drilled about 15 holes as part of the Pre-Feasibility Study. These were mostly for infill and a potential increase in the size of the

indicated mineral resource in the Gossan Extension Zone.

Mr. Kuhn also said that Peshter Mining Company drilled a vertical hole into the Gossan Extension to conduct a downhole geophysical survey. It had also

drilled seven hydrological test holes and seven geotechnical holes in the potential mine area. The results of the PFS drilling have now come back from the

laboratory, and not only show good results for the Gossan Extension Zone, but also from favorable host rocks below, previously believed to be an

underlying fault boundary in the Gossan Extension. Mineralization appears to be open along strike to the east and down dip below the boundary fault.

Peshter Mining, who is carrying out the latest drilling program that is part of the Slivovo Pre-Feasibility Study, is 25% held by Avrupa while 75% is held

by Byrnecut International Ltd. Mr. Kuhn said that Avrupa has its stake in the company thought a 100%-owned subsidiary in Kosovo. The PFS will be completed

by April of 2017 as per the earn-in agreement. At that point, Byrnecut’s portion of the JV will increase to 85%.

Following are the headlines from Avrupa’s first 2016 drilling results news release, published on August 16, 2016.

On September 8, 2016, Avrupa distributed the second news release covering the PFS drilling results:

Avrupa Minerals Announces Drilling Results for Slivovo Gold Project: Confirms Gold Mineralization at Depth • Gold and silver assays from final five holes include:

- o 26 m @ 1.29 g/t Au and 7.2 g/t Ag in SLV057

- o 3 m @ 38.70 g/t Au and 33.9 g/t Ag in SLV058

- o 22.6 m @ 3.29 g/t Au and 9.7 g/t Ag in SLV058

- o 23 m @ 4.37 g/t Au and 7.2 g/t Ag in SLV060

- o SLV 060 ended in mineralization

- o 30 m @ 1.32 g/t Au and 11.9 g/t Ag in SLV061

• Gossan Extension Zone gold mineralization increased from 65 meters to 90 meters strike length from the Main Gossan Zone; open to the east and down

dip.• Results from most recent drill holes SLV058 and SLV060 confirm new gold mineralization potential below thrust fault control in the Gossan

Extension Zone.• These new assays, along with those from the previously-reported eleven drill holes (NR #14, August 16, 2016), will be used to prepare an updated

resource estimate during the fall of 2016. It is significant that the gold mineralization in the Gossan Extension Zone has been discovered below the

bottom thrust fault control which previously had been understood as the lower limit for gold mineralization in the Main Gossan Zone. Three holes cut gold

mineralization below the thrust fault with intercepts at grades up to 5.98 g/t over 15 meters. While the data from these holes may not be enough to

calculate a resource for this area, the new information does show that the mineralization continues to the east and is open down dip.

Mr. Kuhn said that other portions of the pre-feasibility study at Slivovo are continuing at a rapid space. The company met with the partners in August to

review the progress of the PFS and discuss plans for the rest of the year’s work. The partners plan to meet again at the end of January 2017 for perhaps a

final review of the PFS, if all goes well and according to schedule. He stated that the results from the 2016 drilling campaign should nicely upgrade and

expand the Gossan Extension Zone. These new drill results, coupled with a far better understanding of the geology and mineralization parameters, no doubt

increase the possibility of finding gold in more areas at Slivovo. He said that he and other members of management continue to look forward to the rapid

and positive progress of the ongoing projects.

http://www.avrupaminerals.com/

Avrupa Minerals

Head Office

410-325 Howe Street

Vancouver, BC V6C 1Z7 Canada

Phone: +1-604-687-3520

Fax: +1-888-889-4874

Email: info@avrupaminerals.com

|

|