Stornoway Diamond Corporation (TSX: SWY): Renard Diamond Project Becoming Québec's First Producing Diamond Mine

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/14/2016

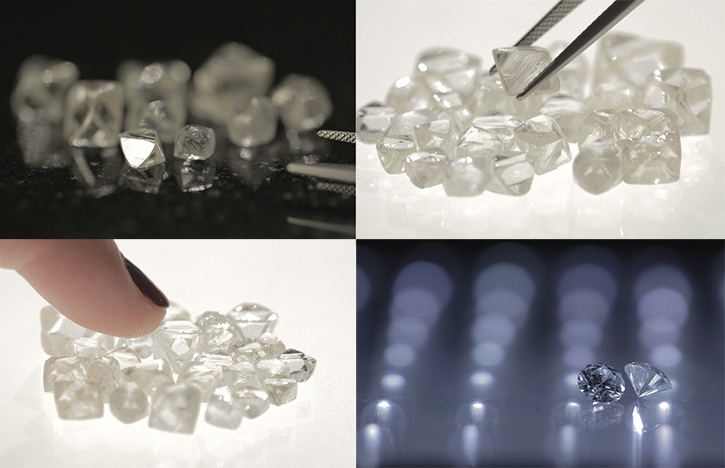

Stornoway Diamond Corporation (TSX: SWY) is a leading Canadian diamond exploration and development company advancing their 100% owned Renard Diamond

Project (nearing construction completion), located in the James Bay region of north-central Québec, to become Québec's first diamond mine. We learned from

Orin Baranowsky, Vice President of Investor Relations and Corporate Development at Stornoway, that Renard holds a little over 22 million carats in the

reserve, 14-year mine life, and will begin commercial production by the end of this year. According to Mr. Baranowsky, what sets Stornoway apart is that

they own 100% of their project, have shown the ability to deliver ahead of schedule and on original budget, have a higher quality diamond profile, and

their project is the only Canadian diamond mine with permanent year-round road access, which really plays into its cost profile.

According to a company statement; Stornoway is a leading Canadian diamond exploration and development company listed on the Toronto Stock Exchange under

the symbol SWY. Stornoway is a growth-oriented company with a world-class asset, situated in one of the world’s best mining jurisdictions.

In an era when diamonds are becoming increasingly rare, Stornoway’s vision is to build a world-class diamond mining company based on quality Canadian

diamond projects, supplying an expanding world market. Starting with Renard, our flagship development-stage asset in Québec, and building upon a pipeline

of exciting exploration projects, Stornoway is guided by the following principles: Maximizing shareholder value, respecting the interests of the

communities in which we operate, growing through exploration and mine development, and working with the best people in mining, exploration and finance.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Orin Baranowsky, who is Vice President of Investor Relations

and Corporate Development at Stornoway Diamond Corporation. Could you tell me a little bit about what's happening with Stornoway? I know it's a very

interesting time. A lot of wonderful things taking place.

Mr. Orin Baranowsky: Yes. We're on the home stretch now of the construction at Renard. We started the commissioning of the plant, wet

commissioning commenced in the spring and we started commissioning the plant with ore in July. It's been a 2-year process for us in terms of the

construction and many more years before that of drilling, sampling, bulk sampling, feasibility studies, optimization studies, and project financing. It's

been a project that's been a long time in the making but we're now seeing the light at the end of the tunnel. At the end of June, we were 97% in terms of

construction on the project. That is 12% ahead of our original construction schedule that we set out 2 years ago. We re-base-lined the schedule in

February this year and we're even ahead of that new schedule. Construction has gone really well.

Dr. Allen Alper: That sounds exciting! That's really great. You all worked very hard and are doing a wonderful job. And you have a wonderful place

where you'll be working. Québec's first diamond mine! Very impressive!

Mr. Orin Baranowsky: Yes. It's been a great success in terms of the construction. We've had a great team in place to build the project. There

aren't many other projects that are being undertaken in Eastern Canada. We've had great access to contractors and laborers so our productivity has been

much higher than we imagined when we set out the original schedule.

Dr. Allen Alper: That sounds great. Could you tell me a little bit about your profits and what you expect going forward in 2016-2017?

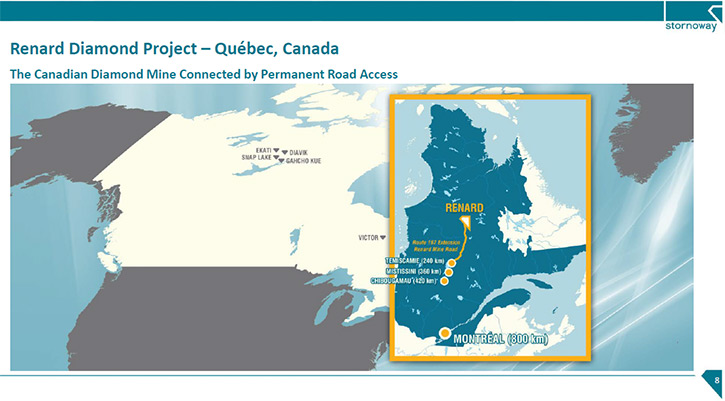

Mr. Orin Baranowsky: The Renard project will be Québec's first diamond mine. There are 2 diamond mines being built in Canada right now and

we're on very similar schedules. There are currently 3 others in operation in Canada, but no others in Québec. The Renard project is about 800 km north of

Montreal and approximately 250 km north of the Cree community of Mistissini and 350 km north of Chibougamau in the James Bay region of north-central

Québec. It’s a remote location, but what differentiates Stornoway from the other diamond projects, and even many other northern Canadian projects, is that

we are connected to the Provincial Highway Network, so there's a permanent road that connects our site to the provincial road network. That has certainly

been a big factor in allowing the project to progress as it has in terms of construction and being ahead of schedule. We released the new mine plane in

March of this year.

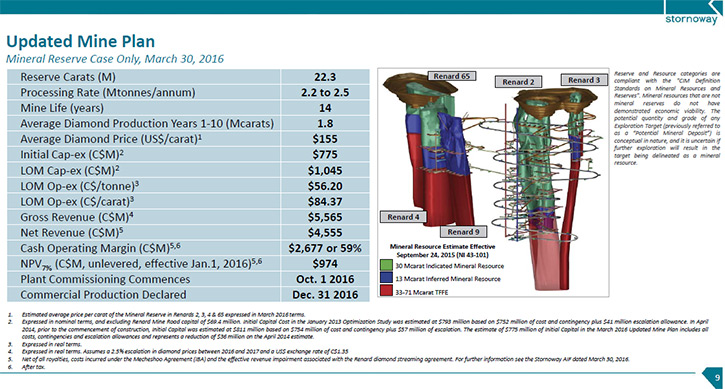

We have done 2 resource updates between our optimization study in 2013 and when we outlined our new mine plan in March 2016, a little more than 22

million carats in reserve, 14-year mine life. Average production of the life of the mine is about 1.6 million carats per year, but 1.8 million carats per

year in the first 10 years. We've done all our profitability and our costing metrics based on actual mining costs experienced over the last year, and

putting the stream in place in factoring in our financial numbers. We are forecasting a 59% cash operating margin life of mine after tax and after the

stream. It's a high margin project. We began commissioning the plant with ore in July this year, approximately 10 weeks ahead of schedule, and expect

commercial production by the end of this year.

Dr. Allen Alper: That's fantastic! Those are great margins.

Mr. Orin Baranowsky: That's the characteristic of diamond projects. They are harder to find and prove up than a typical metals project, but

they tend to be long life and high margin assets. We've gone through the stages of permitting and all the other things along the way to get where we are.

Hopefully, we'll begin to see some of the fruits of all the hard work we've done over the last several years.

Dr. Allen Alper: That sounds great! Could you tell me a little bit about your team?

Mr. Orin Baranowsky: Matt Manson is our President/CEO. Matt was appointed President of Stornoway in March 2007 following the acquisition of

Ashton Mining of Canada and Contact Diamond Corporation, and subsequently President and CEO in January 2009. He was formerly with Aber, so was involved

with the financing and construction of the Diavik project. He was CEO of Contact Diamond, an Agnico-Eagle subsidiary, which was one of the catalyst

companies for the takeover and 3-way merger of Contact, Stornoway and Ashton in 2006.

Patrick Godin joined Stornoway as Chief Operating Officer in May 2010 and was appointed to the Board of Directors in October 2011. Pat’s overall

responsibility is the development of the Renard Diamond Project. He was an experienced mine builder with Cambior and G Mining, building and operating

mines in the province of Québec and Africa. Another key member is Ian Holl. Ian joined Stornoway in March 2014 as Vice-President, Processing. Prior to

joining Stornoway, Ian spent more than 20 years with De Beers in increasingly senior operating roles. He worked as plant manager/superintendent at the

Victor and Snap Lake Mines, so he is experienced working with diamond plants as they come into production, as well as in a Northern Canadian environment.

Dr. Allen Alper: That sounds great! Could you tell me a little bit about your finances and capital structure?

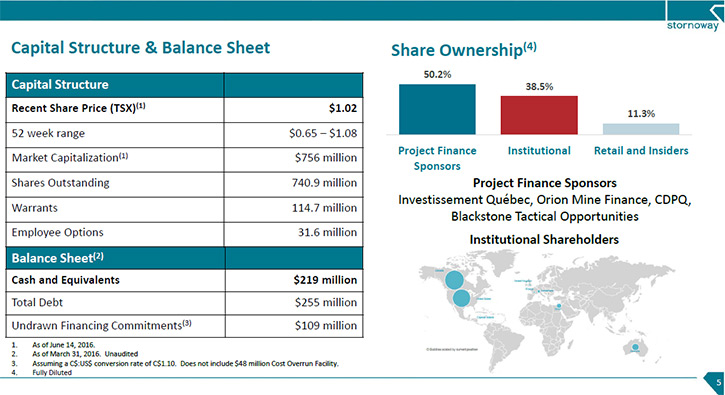

Mr. Orin Baranowsky: When we were out raising money to build the project, it was a tough market for mining and the diamond space especially. We

were a junior company, building a greenfield diamond project. We had a 120 million dollar market cap, needing to essentially raise a billion dollars to

build the Renard project. No one wanted to be the first money into the project because many of the projects over the last 5 years or so have gone over

budget and there's a history of requiring that additional fundraising to complete the project. When we started, we set out to raise all the money for the

direct/indirect cost, contingencies, escalation, head office cost, financing cost, working capital. We raised 946 million dollars. That financing closed

in July of 2014 and we've been going straight ahead since that time building the project. Approximately 50% of the financing was done in US dollars and

was raised at a time when the Canadian-US dollar exchange was a higher than normal level. Only about 15% of the CapEx on the project is in US dollars.

All of our operating costs are largely in Canadian dollars. We kept the US dollars that we needed on our balance sheet to cover our US dollar

invoices and then we began converting over some of the excess funds, late in 2014. One element of the financing that we did was a stream. That was US$250

million of funding in 3 separate tranches: March of 2015, September of 2015, and then this past March of 2016 for the final tranche. That money was not

able to be hedged because there were certain conditions around the funding being available, namely that we were on schedule and on budget. If we were to

hedge that money it would've been expensive because we couldn't guarantee that we would be able to close out that hedge. As that money funded into the

project, we converted it over at lower and lower Canadian dollars such that when we reported our quarter in March, we've been disclosing the amount of our

available funding.

At the end of March, that figure was 116 million dollars, which consisted of a 48 million dollar cost overrun facility which has been untouched

and then, 68 million of additional cash receivables and tax credits. This is what we would expect to have at the date of commercial production, 116

million dollars that we would have in terms of financial head room, when we stop capitalizing operating expenses and start expensing. We were 97%

complete on the construction at the end of June. That's the room that we have to not have to raise that additional equity. We're in a very good position

in terms of financial capacity. When we did our financing, there was 132 million dollar public equity raised and on that equity raise, there was a half

warrant.

It was a subscription receipt structure where you got a share and a half warrant. Those half warrants are at 90 cents and they expired July 8 of this

year. At the end of March, the stock went through 90 cents and we've been trading above the 90 cent range since that time. At the expiry of the warrants

on July 8th, approximately 97.5% of the warrants were exercised, resulting in the company receiving $82.7 million in proceeds. These funds will go into

the project ahead of any senior debt. In our financing, there's a 100 million dollar senior bank that has not been accessed yet. A senior debt facility is

the instrument that has the most restrictive governance in terms of what we can do with the cash flows.

With the warrant exercised, we can be in a position to come out of commercial production in end of this year/early 2017 with very little to no

senior debt. That's very little to no restrictions on what we can do with our cash flow. It just provides additional financial flexibility for the

company, so in a very good position in terms of our financial capabilities for the project.

Dr. Allen Alper: That sounds excellent! That's a great position to be in, particularly with building a mine. That's excellent work. It doesn't

sound like you've had any overruns and you didn't have to dip into your contingency. That's amazing.

Mr. Orin Baranowsky: At the beginning of the project, the cost to complete that we gave was 811 million dollars. That included contingencies

and escalations. When you set your original capital budgets, you assume a certain amount of inflation. One of the biggest cost components of the project

is labor. In Québec, labor escalates by law. There has been cost escalation on that side. In terms of the direct cost, those costs have largely been

coming in line with what we had expected. In February, when we announced we expected to conclude commercial production much sooner than we had expected,

we brought the schedule forward by 5 months for commercial production. The original was going to be May of 2017 and now, we're estimating December 31,

2016 as the start of commercial production. We took the cost to complete from $811 million down to $775 million dollars. Not only have we been able to

bring the schedule forward but also the cost down for the project.

Dr. Allen Alper: That's excellent. That's excellent work by the whole team. What are the primary reasons our high-net-worth readers/investors

should consider investing in your company?

Mr. Orin Baranowsky: I think what sets Stornoway apart from the market is we own 100% of our projects so we're the owner/operator. We've shown

the ability on the construction of the Renard project to under-promise and over-deliver, building a project under the original budget and ahead of the

original schedule. We're the only Canadian diamond mine that will have, cost saving, permanent year-round road access, enabling just-in-time delivery of

products to and from our mine. Also, because of the road, we're able to use liquid natural gas as a power source as opposed to diesel generation. That has

brought our cost down by about 6-7% compared to what it would be for diesel and then also reduces our environmental footprint. At Stornoway, our average

diamond price is US$155 based on our most recent technical report for the project. I think the world average is in the US$100-US$110, so we have a higher

quality diamond profile. We'll be about 2% of the world supplies, so not someone who's going to be disrupting the market, but able to play in the market.

If you look at fundamentals for the diamond business, 2015 was a tough year. But so far, the first half of the year diamond prices have come back. We

think the longer term demand/supply fundamentals are very favorable to Stornoway. There's a bunch of mines that will be coming offline over the next 5 to

7 years or so.

There's not a lot of new supply coming on and demand remains strong, so from a pricing standpoint we think there's good long term potential for

diamond price growth. Then, finally, Stornoway has the potential to produce large stones, not thousand carat stones like Lucara does, but based on the

samples to date, there are statistical predictions, based on our diamond population, that would predict for Renard 2 (our main ore body) 3 to 6 stones

between 50 and 100 carats each and 1 to 2 stones above 100 carats every 100,000 carats of production, which is approximately every 3 weeks. Every month or

so, we'll produce this bunch of larger stones. With diamonds, as you go up in size, there is an exponential growth for the same quality for a 2 carat

stone versus a 1 carat stone. What we don't know is what the quality of those diamonds are.

If they're of low quality, it's not going to be a contributor to revenue but if they're of similar average quality to what we see in our 5 to 10, 15 carat

range, it could have a meaningful impact on our revenues and cash flows for the company. We'll be the first diamond mine that will have a large diamond

recovery circuit built into the original flow sheet. Most of the companies will see a broken larger stone and then, they'll retrofit their plant which is

done at a higher cost. We were able to get a large diamond recovery circuit into our original plant for similar amount of what our original plant without

large diamond recovery was going to be. We're sufficiently confident that we're going to be recovering these stones that could have an impact on our

revenues. We're setting up our plant in place ahead of time. But even without the large diamonds, we still see the company as generating 150 to 250

million dollars of operating cash flow on an annual basis. That works out to about 15 to 25 cents a share.

That's going to be based on what our production profile is every year and as well as our taxes paid in a given year. 15 to 25 cents per share

without the impact of any large diamonds. A diamond historically has traded at a low precious metal company multiple. Historically, that's around 8 to 10

times cash flows. We see that as the potential for a share price of a $1.50 to 2.50 within the next couple of years as we move from being a development

company to a producing company. We're in that rerating territory right now. I think, as we continue over the next 6 months, we'll see our share price

improve based on multiples going from a developer to being a producer as you see with the other mining companies as they do the same.

Dr. Allen Alper: That sounds great. That sounds excellent. Excellent reasons for our high-net-worth readers/investors to consider investing in your

company.

http://www.stornowaydiamonds.com/

1111 St-Charles Ouest, Tour Ouest, Suite 400

Longueuil, Québec J4K 5G4

Tel: +1 450.616.5555

Fax: +1 450.674.2012

|

|