Interview with Mr. Dev Randhawa, Interim CEO of Advantage Lithium: Award Winning Team, JV Owns Lithium Brine Deposits in Clayton Valley, Nevada with Water Rights Adjacent to Albemarle Corporation’s Lithium Production well

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/13/2016

Mr. Dev Randhawa, MBA, CEO of Advantage Lithium

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Mr. Dev Randhawa, who is the interim CEO of Advantage

Lithium. Mr. Dev Randhawa has won prestigious awards as a CEO specializing in the resource industry. He was named Northern Miner’s "Mining Person of the

Year" and Finance Monthly’s “Dealmaker of the Year” in 2013. EY awarded him "Entrepreneur of the Year, finalist" in 2014.

Mr. Randhawa has founded and grown successful junior resource companies, including Strathmore Minerals, Fission Energy and Fission Uranium. Fission

Uranium won The Mining Journal’s “Exploration of the Year” in 2015. In his time in the industry, he has gained a reputation for choosing the right people

to develop assets and grow shareholder value.

Would you like to tell our readers about yourself and Advantage Lithium?

Mr. Dev Randhawa: I'm in the resource and venture capital business and so to me, we had this bunch of cash and we felt lithium was a good

space.

In 1996 I formed a company called Strathmore Minerals, which is a uranium company. We built that from about two million up to about half a

billion, and then we spun out a company and took the outstanding shares back. We started another company Fission Energy. That we built from a few million

to $130 million. We sold that. From that we started another company called Fission Uranium. Today Fission Uranium is worth $350 million.

We have a record of aligning management and shareholder interests. If management and shareholders are on the same page you tend to have more

success. I have owned shares in some of our deals for over 20 years. We try to build things. That is the history of us and our management team. Advantage

Lithium is an exploration company, the main asset is in Clayton Valley Nevada.

We are strictly exploration. But because the way the Lithium business is, you have to move to production pretty quickly, unlike most mining projects. We

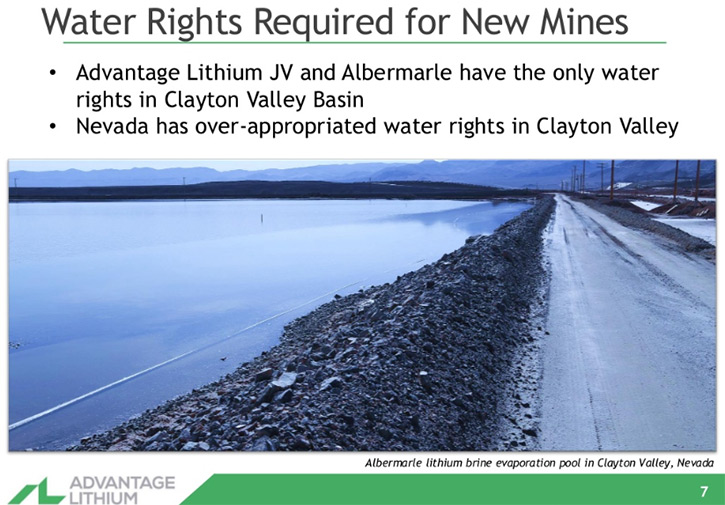

are the only exploration company down in Clayton Valley that has access to water rights.

If we find something, we have an advantage because we have access to water rights. Properties are not enough when it comes to lithium down there because

you need water.

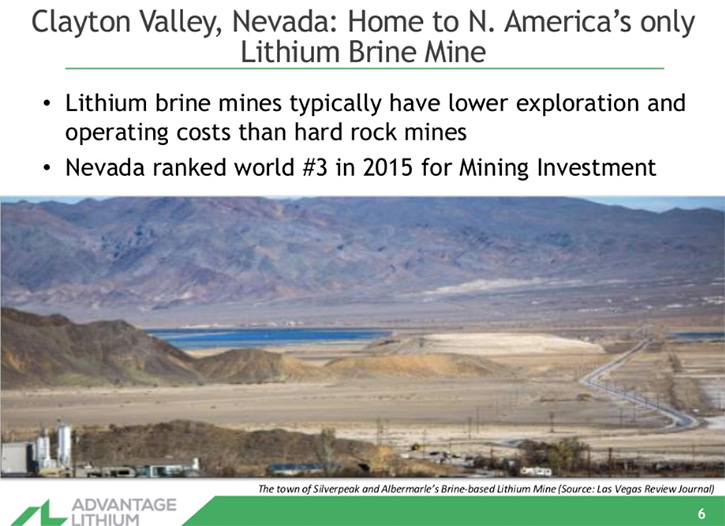

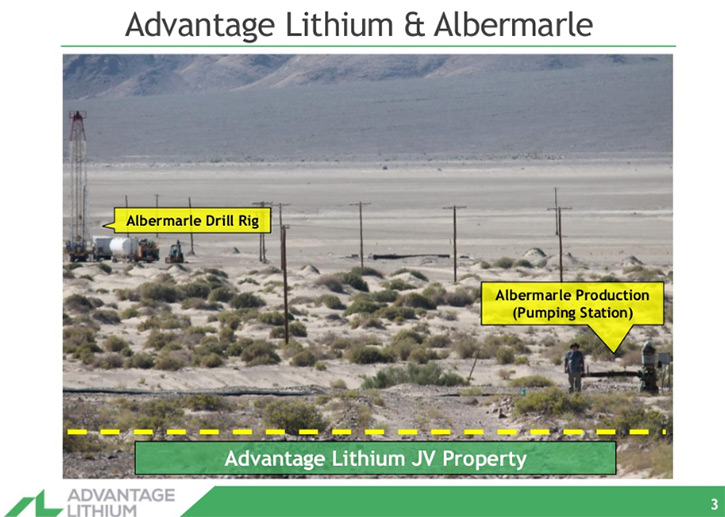

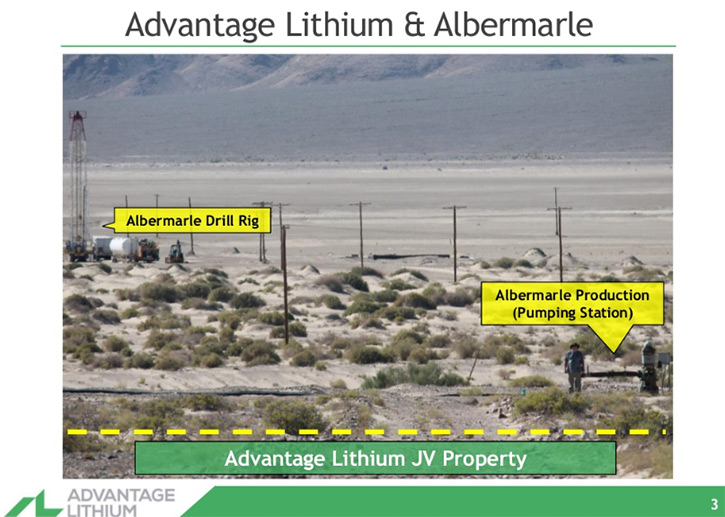

There is one producing lithium mine in North America. It is in Clayton Valley. Albemarle Corporation and their production plant is about 50 yards from our

property line. We are very confident that we can hit on some assets there, in the ground, and then put them into production if we have to.

Our joint venture with Nevada Sunrise has the water rights.

The strengths of the company are:

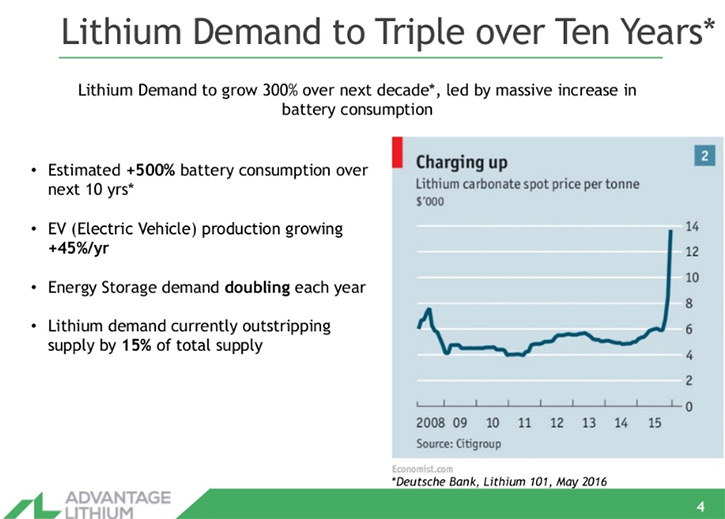

Property in lithium producing area. You know the stats speak for themselves for how the market will grow over the next ten years.

The only exploration company with water rights in the Clayton Valley.

Drilling permits and funding.

The track record of our management building value for shareholders.

Tesla is doing a great job telling that story. We are the only exploration company with water rights in the Clayton Valley. I think at the end of the day,

it always comes down to management. We have proven, over the last 20 years, how to build value for shareholders. That would be the quickest summary of the

company.

Dr. Allen Alper: That sounds excellent. You have a great track record. Could you tell me a little bit more about your plans in 2016, going into

2017?

Mr. Dev Randhawa: Well, we have the drilling permits. We are going to put together a drilling program here probably for September, October.

We have just closed a financing and have raised just over 4 million. So, we have some money. Any drilling program is not more than 150 - 350 grand so we

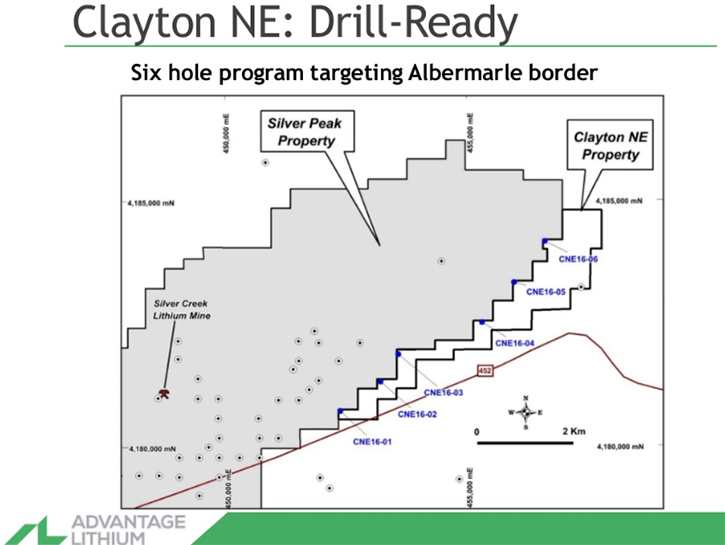

have more than enough money to drill. Our first target project will be Clayton North East.

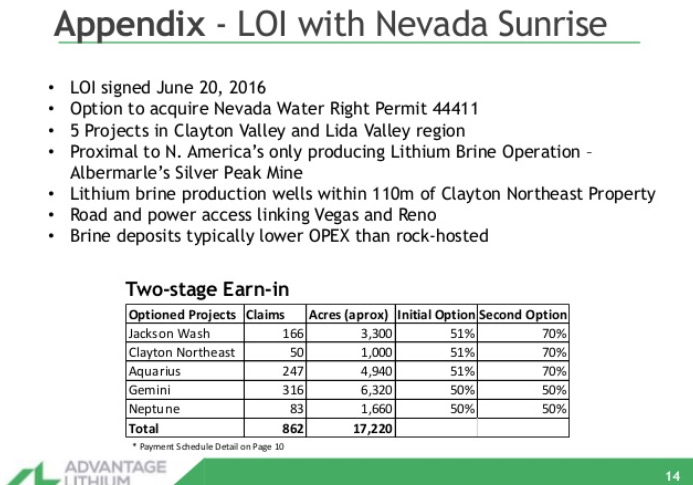

Mr. Dev Randhawa: First we will drill, see what we find, then go systematically through our properties. We have access to five properties.

We are going to see which one does the best for us.

Dr. Allen Alper: That is very good. Could you tell me a little bit more about your team?

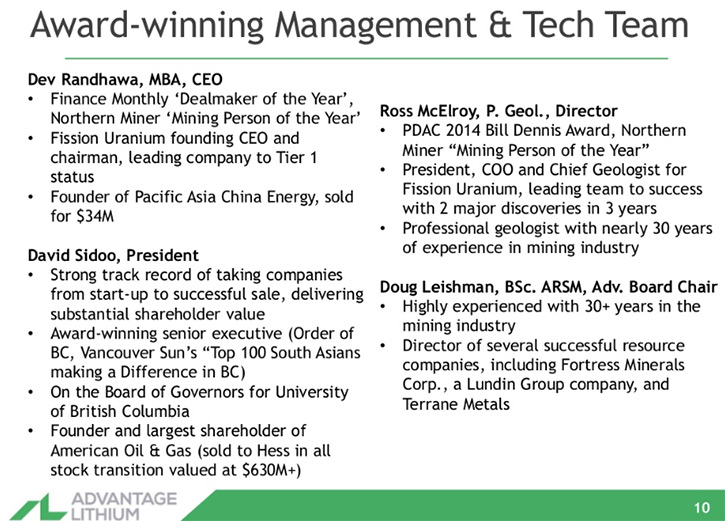

Mr. Dev Randhawa: Sure. We have been able to build a lot of shareholder value. Some say we are the most awarded team in the last ten years

of any mining teams. Mr. Ross McElroy and I, won the Northern Miner’s Mining People of the Year in 2013. The most prestigious award for geologists is at

the PDAC - the Bill Dennis Award for a Canadian Discovery and Prospecting Success. Ross won that award in 2014. I won deal maker of the year by Finance

Monthly magazine for 2013, we were joint finalists with Ernest Young’s entrepreneur of the year. We have won a few times. We are fairly well awarded.

However, at the end of the day it is, “What have you done for me lately?” The Chinese bought 20% of our uranium company, Fission Uranium, in January this

year for $82 million. That was CGN, which is one of the world’s largest utilities.

Unfortunately, uranium is out of favor. I am a contrarian right, I think this is the bottom of the uranium market and probably a great buy. Unfortunately,

not everybody is a contrarian, right?

But the Chinese think 5, 10 years ahead, not the next quarter. They just gave us a lot of money. So our management team has a great track record.

I brought Sumitomo Corporation into a project. I also brought in a utility from Korea, called Korean Electric Power Company to do a project, now the

Chinese government. We have been able to source international funds from Korea, Japan and China and large amounts, over 50 million each.

Dr. Allen Alper: That is great. That is a great track record. It shows not only can your team find properties but you can find investors too, who

appreciate what you are doing.

Mr. Dev Randhawa: Thank you. One needs a bit of luck and team work. We had to make some changes along the way, refining the process, but we

have been very fortunate. The first thing is structural management, management can assess whether a project is good, bad or ugly and then they have to

have a track record to raise the money. It all starts with management and ends with management.

I have seen my own pocket book shrink when I invested in projects, not people. End of the day it is all about management. They can find other

projects because they can assess a good project from a bad project. Especially in lithium, there is a tremendous amount of promotion and hype and very

little substance. That was the main reason I did not want to go into it initially. The space was crowded and all I could see was a lot of people wanting

to promote their stocks and not worry about building a company.

But our goal is to build something here. We have just closed our financing. We got our permits last month. Within 8 weeks we are going to be

drilling. That is what you are supposed to do. You are supposed to put holes in the ground, build value. Not spend your time promoting.

Dr. Allen Alper: It sounds like a great approach. Could you tell me a little bit about the ownership of your company?

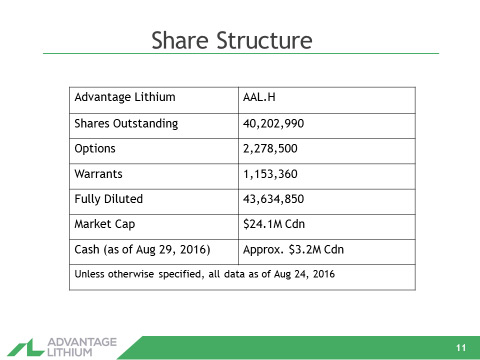

Mr. Dev Randhawa: Absolutely. Prior to the financing, Management probably had about 20 to 25% of the company. We just did a $4 million

financing so numbers have changed and we have dropped down a bit, but management still has lots of money in the deal. When people don't have money in

their own deal, investors should always be wary.

Dr. Allen Alper: True. I talk with Rod McEwen and that is one thing he stresses. Look for people who put their own money into the company and they

have a stake in the company.

Mr. Dev Randhawa: Yeah. You have to because we are all human beings. If I have a couple of 100 thousand dollars in the deal or half a

million, I am motivated to make sure it works.

Dr. Allen Alper: That is great. What are the primary reasons institutions and our high-net-worth readers/investors should consider investing in

your company?

Mr. Dev Randhawa: Well it is twofold. I think management and the Board have a track record of building value, being able to identify good

projects and raising the money. Drill it, find something and sell it. We have a history of it. That is the number one reason. The second thing is, we are

the only exploration project in the Clayton Valley that has water rights and is also so close to production. As they say the best place to find a mine is

where there are mines already. The lithium production pumps of Albemarle’s mine are around 100 yards or so from our property.

Dr. Allen Alper: That is great. Could you tell me a bit about your thoughts on the lithium market or lithium applications? Why lithium is so

important.

Mr. Dev Randhawa: The Tesla Gigafactory 1 is a lithium-ion battery factory under construction, and in production, primarily for Tesla Motors

at the Tahoe Reno Industrial Center in Storey County, Nevada, US. That gets a lot of people's attention. They are estimating that over the next 10 years,

we are going to have a five-fold increase in battery consumption. Right now, it is about the electrical market in general it is growing about 50% a year,

I am told. Energy storage is another huge business that continues to grow. Already demand outstrips supply by 15%. Then they say that even VW wants to

become an electric vehicle manufacturer. So you have VW, Tesla and others coming up. We could double the world production of lithium ion batteries by

2018. It is really demand for clean energy.

What do we need? We need lithium for it. We need graphite for it. The fact that there is lithium in Clayton Valley, near the Tesla plant, a potential

buyer for it. Right there. Shipping costs would be less, if you can find something in Nevada. I think the grades are good in Argentina and we are looking

there, we are looking all over the world to add to our quality assets at the right price of course. I think in Nevada there is a better chance of selling

to Tesla or to somebody in between. It is going to be a little easier I think to be able to find partners right where we are.

Dr. Allen Alper: That sounds good. Is there anything else you would like to add?

Mr. Dev Randhawa: Our management and Board have a history of adding value and we have money in the deal. We are the only exploration company

with water rights. Access to water rights matters because they have over-allotted the water rights in the Clayton Valley already.

Dr. Allen Alper: It’s extremely important to have water. That is a great advantage.

Mr. Dev Randhawa: Absolutely.

http://advantagelithium.com/

#1305 – 1090 W. Georgia Street

Vancouver, BC

V6E 3V7

604-685-9316

604-683-1585

|

|