Interview with Ivan Bebek, Executive Chairman of Auryn Resources: (TSX-V: AUG, OTCQX: GGTCF): Advanced High-Grade Committee Bay Gold Project and Two Scalable Oxide Gold Properties in Southern Peru

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/8/2016

Auryn Resources (TSX-V: AUG, OTCQX: GGTCF), an advanced Canadian gold discovery focused company, currently holds a 100% interest in the high-grade

Committee Bay gold project located in Nunavut, Canada. According to Ivan Bebek, Executive Chairman of Auryn Resources, who has an extremely successful

track record, Committee Bay is like a massive gold vault with really high grades across the entire 180 mile long belt. It came with great infrastructure

and equipment in place and the company is currently amid a very exciting drill program drilling really big targets. Auryn Resources also holds the rights

to two scalable oxide gold properties in Southern Peru, in an area with good infrastructure and recently announced the acquisition of Homestake Resource

Corp. (HSR). The company has a very strong management and an extensive technical team with a proven record of success no matter the market conditions.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Ivan Bebek, Executive Chairman, Auryn Resources.

Mr. Bebek has over 17 years’ experience in financing, foreign negotiations, and acquisitions in the mineral exploration industry. His understanding of the

capital markets and ability to position, structure and finance companies that he has been associated with has been instrumental in their successes. Mr.

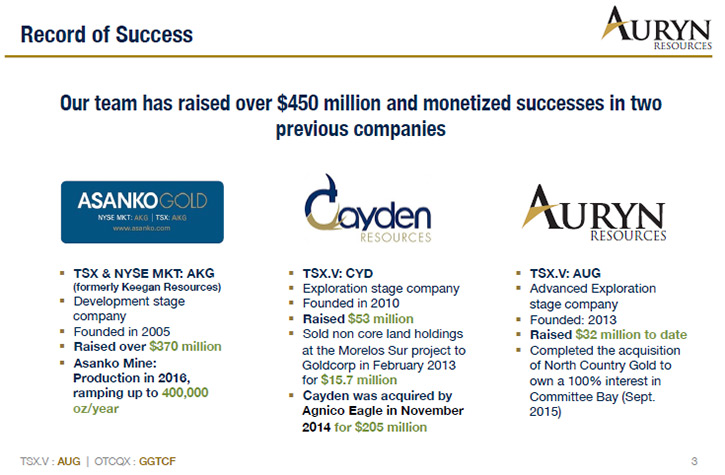

Bebek formerly was the President, CEO and co-founder of Cayden Resources Inc., which was sold to Agnico Eagle Mining Limited for $205 million in November

2014, a co-founder and a Director of Stratton Resources Inc. and a co-founder of Keegan Resources Inc. (now Asanko Gold).

Let’s start with a bit about your background, your vision and plans for your company. Update us on all the different exciting things that have been

happening for you in Canada and Peru.

Ivan Bebek: I've been in the business for about 17 years. I first started as a stockbroker, financing mining stocks during the “.com” era. I

had a strong passion and understanding of the monetization of mining assets and a strong ability to finance them. I quickly learned that I'd much rather

be building companies and running companies on the mining side than to be investing in them as a broker. I worked under one of the industry legends, Dr.

Roman Shklanka, who had found 7 major mines. He was my mentor in the mining space and taught me exactly what kind of a project would make the most money,

that being a world class discovery. I learned these rules and I met a business partner along the way, a gentleman by the name of Shawn Wallace. Shawn

worked with the Hunter Dickinson group for about 20 years at the time. We took the best of what Roman did, finding and monetizing his major discoveries,

and what Hunter Dickinson did in their pursuit and monetization of world class discoveries, and we put it into a company called Keegan Resources, which

today is called Asanko Gold Inc.

That was the start of our mining career together, where we had a couple really big successes before we started Keegan Resources. Keegan became a

producing mining company. It went from 0 to 10 million ounces of gold, and is now producing and will produce for the next 20 years or so. The share price

when we started was around 70 cents a share. It went as high as $9 a share in the last fiscal market and trades around 5 and a half to 6 dollars per share

today, but it's actually producing, and when you build these junior resource companies, obviously we want to monetize our success for shareholders. That's

how we make our money, if one can sell their company, what you tend to do is the second best thing to building a proper mining company that's producing

gold and create an insistent exit hopefully well before the risks of building a producing mine, and we've done that .

Subsequently, we started a company called Cayden Resources Inc., where I was the CEO and Shawn was the Chairman however Shawn was continuing with

conversion of Keegan into a producing mining company, I took the lead on the exploration efforts of Cayden to go find another world class gold deposit,

something that could be 3-5 million ounces of gold in a very good jurisdiction this time. It was Mexico, and this company started at the peak of last

market, and it went through the 5 years of a downturn that the mining cycle has endured. However, we performed really well for that whole downturn, and

there are some great technical people, and some great projects, we were able to sell the actual company, Cayden Resources, for $205 million in 2015 to

Agnico Eagle Mining Limited after we had drilled about 100 holes, which was great not just because our price had gone up from 70 cents the year before to

a sale of around $4 per share.

If you own shares of Cayden today, which were converted to Agnico Eagle Mining Limited shares, you'd be around $6 or $7 a share, but the fact that

we were able to sell the actual company in the bear market prior to an actual resource or a mine being officially found, that was a great success for us

and our shareholders, and the timing was incredible to get to do that in a tough market, so if you look back at both Keegan, which is now Asanko and

Cayden, which has been purchased by another company, we've been able to deliver successes in both positive and difficult market conditions, and so Shawn

and I took the best of what we did between those 2 companies, and we channeled it into Auryn , and it's the best company we've built so far.

Auryn Resources is a well-financed and technically driven exploration company comprised of an experienced management and technical team with a proven

track record of success.

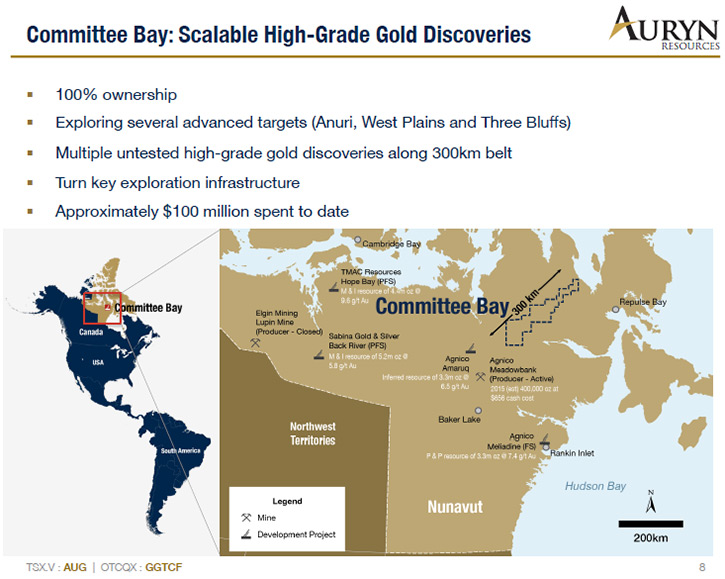

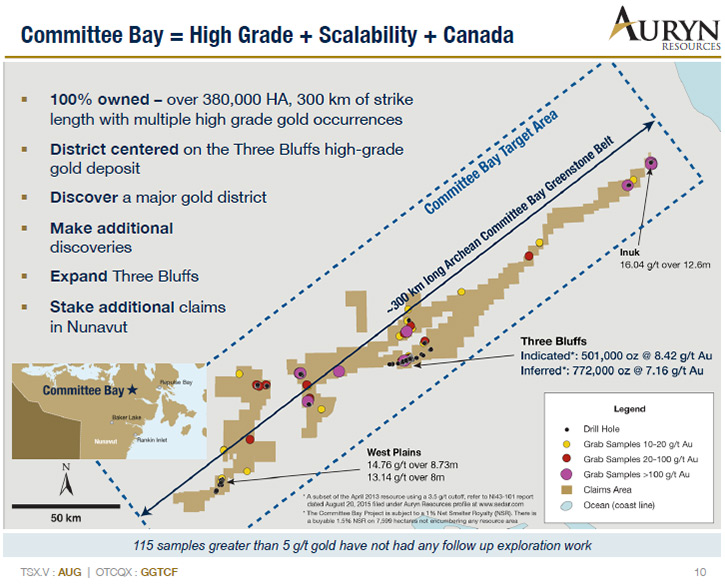

The Company is primarily focused on developing its Committee Bay gold project, which encompasses greater than 380,000 hectares situated along the

Committee Bay Greenstone Belt in Nunavut, Canada.

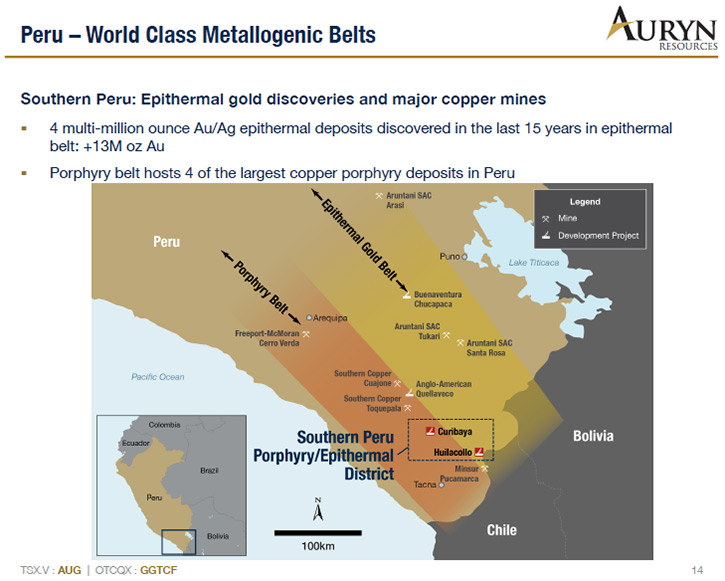

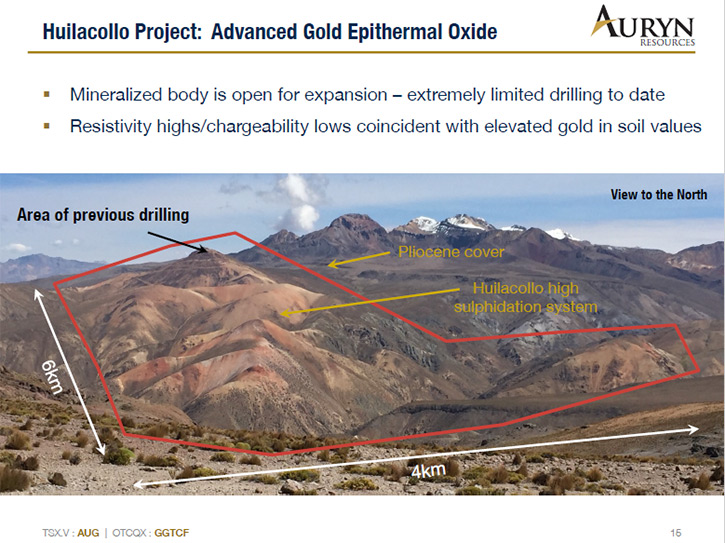

Auryn Resources also holds the rights to two gold properties in the Tacna province of Southern Peru, the Huilacollo and Curibaya properties. Together

these projects encompass a total of 33,600 hectares within the prolific Pliocene Au/Ag epithermal and Miocene Cu/Au porphyry belts respectively.

Ivan Bebek: When you have the success it's not “what did I do wrong that I could improve on”, it's what can I do better. With Auryn we've

expanded our technical team dramatically. Auryn’s COO Michael Henrichsen introduced to us by Dan McCoy is a brilliant structural geologist, who was at

Newmont Mining Corp. We've hired (in the downturn) predominantly a lot of nuanced global experts that were a big part of Newmont Mining’s global

exploration team, to lead our charge technically, and we've gone after some of the best outlets we could find in the entire business and market, and so if

you think about an analogy being real estate for example, we all remember the 2008 crash that we saw in US real estate and worldwide, and if you went and

bought several houses or buildings at that time, 2 years later, you would have been rewarded dramatically from how far they've recovered and how well

they've done.

The mining market kind of did the same thing, but over a 5 year period, and we bought some of the best exploration real estate in the world, being

major gold projects that could become world class discoveries that would make shareholders a lot of money. We hired a team that is the quality of a major

exploration team, and that's so critical for us on our path for gold, not just for efficiency of time, but efficiency of cost making these major

discoveries.

Dr. Allen Alper: That's a fantastic record of accomplishments for you and your partner, and now you feel you're on your way to do it again.

Ivan Bebek: Yes, and you've touched on that point, which is what gets us excited. We've put together this great portfolio, and I'll talk a

little bit about the projects in it. But the one thing that you have to think about, Dr. Alper, is everything we're doing is what would move the needle

for a major, because our technical team is predominantly from majors, right?

Their whole entire careers they've been challenged to move the needle for Newmont (Majors), so that doesn't change when you become part of a

junior. Shawn and I have been able to monetize some good successes. But the target and the prize at the end of the rainbow, or the end of the road, was

not nearly as big as the projects we have now.

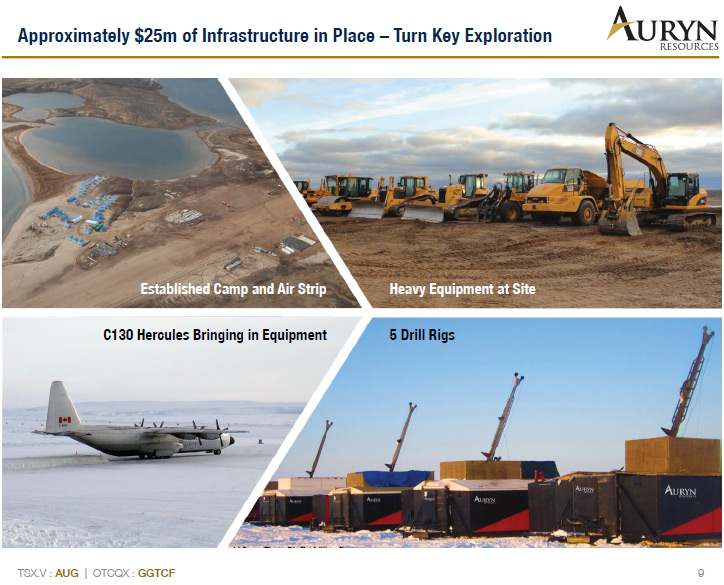

I'm going to talk a little bit about our flagship Committee Bay, which is about a 220 mile long belt in northern Canada and has high grade gold from one

end of it to the other, with several discoveries prior to us acquiring it. The gentleman before us had actually spent about $30 million in infrastructure

up there. It has camps, heavy equipment, and drills, all in place. They also spent about $60 million dollars over the last 20 years exploring this 220

mile long belt.

When looking at Committee Bay, it is important to know that only 5% of the belt was outcropping, meaning that you could see and sample the rocks. The rest

is covered by something called glacial till. If you imagine a glacier moving over the Earth's surface, it’s going to drag a lot of dirt over top of the

rocks. So you don't have full exposure, but what we've been able to do successfully is find a way to explore through that cover and get into these

targets, and we're amid a very exciting drill program. We're drilling 14,000 meters this summer, which is one of the larger exploration programs going on,

and the targets are really big, and there’re multiple targets that are really big. For me and Shawn, and Keegan, what's really big is we got to 10 million

ounces of gold through discovery of 5 and acquisition of 5 more.

For us, this would have to be much bigger than that for us to consider it big. “What can we do better?” That’s because of what we've done in the

past, and if you look at what's happening up in that part of the world, there are major deposits there in the 5 million ounce range of 6-9 grams per ton

gold. They're being made nearby us and in the same territory, in these big belts. We strongly believe we have the start of one at Three Bluffs. There are

approximately 1.2 million ounces of over 8 grams per ton, but there're some very large targets that we've found, and I keep commenting on how large it is

and using the word big, that's going to be what makes our shareholders a lot of money when we get into discovery.

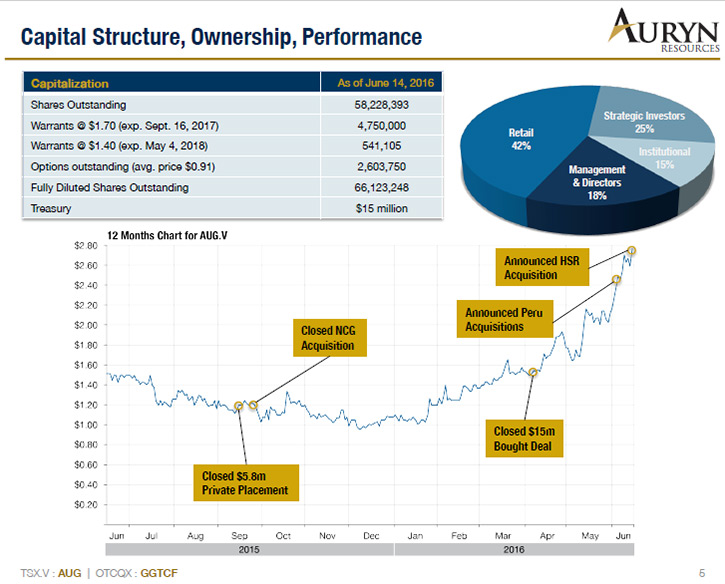

Our share price has performed quite well in the last year. I think last summer, at this time, we traded around $1.25 per share Canadian. Right

now, we're around $3.75 Canadian. A lot of investors say well, has the stock already moved? Is it too late? Did I miss out on it? We know you're going

after these really big things. My comment to those investors and to anyone looking at the stock is, this movement that people have seen has been purely

from what we have now. There's not been one discovery drill hole announced yet out of our projects. People have to look at us and say what happens if they

start finding these major discoveries? That's going to be where the real fun starts for shareholders.

Being up north in Committee Bay and having this massive vault, this gold vault, and really high grade across the entire belt. That's our flagship. That's

plenty for our company to be a major success, but we did find some really big things in Peru, albeit a little bit earlier stage. The earlier stage

projects give you a lot of upside for discovery, and that's very appealing to us.

In Peru, Newmont has one of the biggest goldmines discovered in the world, being Yanacocha. Over 60 million ounces of gold have been discovered

there. Peru originally was discovered as a silver deposit. The gentleman, who figured out it was a gold deposit versus a silver, 60 million ounces later,

that same gentleman is the guy who introduced us to our portfolio in Peru. In Peru we're not looking for the same type of deposit as in Canada. We're

looking for oxide, and oxide in the mining world generally means very profitable, easy mineable rock. You don't need 6 grams per ton grade in oxide,

although that's extremely profitable if you find it. You need stuff around 1 gram that has good infrastructure, and our projects in Peru are currently 1

gram plus oxide and they're right next to a producing mine where there's water, power, and roads. Everything’s there, so whatever we find in Peru is going

to be extremely profitable.

The 2 most profitable things you can find in terms of the mining world, in terms of gold, is either really high grade gold, an abundance of that, or oxide

gold. There's a saying amongst our mineral geologists that “grade is king and oxide is queen, and if you get them both, you've hit it out of the park”,

and so our portfolio of both Committee Bay and Peru, they give us that. They give us grade in the north. They give us oxide in the south.

The projects in Peru, they are scalable. They can get very big, and the stuff in the north - Committee Bay gets very big along the entire belt. This

brings me to our third acquisition, which we're in the middle of completing, just waiting on the shareholder vote, of a company called Homestake

Resources. Again, you're going to see grade. It's approximately 1 million ounces of about 8 grams gold equivalent, 80% of that being gold and the balance

being silver.

This project is something that can easily get a lot bigger and has the potential to be a very profitable deposit, we think it could double at the

very least, but it's something that makes a lot of money because of the richness of what it is today, and we plan to demonstrating that in the fall, after

the completion of the takeover to show everyone how valuable this could really be to us going forward.

There's certainly some more work to be done, however we're confident that we will be able to bring a really good level of exploration into the

project, and to add more ounces to that million ounces and 8 grams. As a company, we've picked some of the best jurisdictions, Canada being #1 in the

world, if you're in the right address in Canada you'll get a premium on what you find, because geo-politically, there isn’t risk in Canada of governments

nationalizing mining. Canada has no risk of anything significant that you'd worry about in the second or third world countries.

In Peru, we're in southern Peru. We're in a very low populated place that's very pro-mining. People are looking for jobs to go and build mines

there. So I think when you look at our portfolio and you look at the possibility of success of finding gold, that to me is a very comfortable risk that

we're taking. I think we're going to find a lot of gold. But what's become more important to myself and Shawn is the amount of work, effort and risk that

goes into finding gold being only one aspect. But monetizing it and getting the biggest premium for what you find is the other, and that's where Canada

and Peru work really well for us as a company. I don't think we could have built a better portfolio between the 2 jurisdictions that we're in.

Dr. Allen Alper: Well, that sounds excellent. It sounds like you have great properties with excellent potential. Could you tell me a little bit

about your finances?

Ivan Bebek: Yes, so we've certainly taken on a lot in terms of some very scalable, large scale projects that are going to require funds. As we

sit right now, we have some warrants being exercised in our stock. These are warrants placed at around $1.70 a share. I own some of those. I wrote the

check. I didn't sell any shares to exercise them. So did some other members of management, but it'll bring our treasury at the end of the summer to about

$12 million, and so we're finishing a 14,000 meter program. We're going into the fall with $12 million in cash in the bank, and once the Committee Bay

14,000 meter program finishes this summer, we're going to be starting in Peru and getting ready to drill in January in Peru.

The work that gets done pre-drilling will be a lot of surface work, trenching and studies that will lead to a very aggressive drill program in

Peru in January, but our treasury right now should get around $8 million dollars as we enter January 2017, after that pre-drilling work is done, between

September and December of this year, so really good financially. We have a lot of money in the treasury. We're not looking to do any kind of financing

now, because we believe that the Committee Bay drill program will yield some pretty significant results, just based on optimism of our technical team and

the type of success that can be made up there. We plan on monetizing the success that comes out of Committee Bay, as well as incorporating the Value of

Home Stake’s acquisition once complete before we do any additional funding.

However, if our share price appreciates on the back of Committee Bay, to a very fortuitous share price, that's quite a bit higher than where we're

at right now, we've considered doing a funding with some strategic investors, primarily some larger long term gold funds and institutions that have not

had the chance to buy us yet, and that would fund us for all of next year's programs.

We've already decided to order the fuel for next year's work program in the Arctic, and we're going to do about twice the amount of drilling. So

25,000 meters of drilling is what we're planning to do next summer up North, and this is just based on our confidence in how the program's going. We don't

have results yet, but we're encouraged by the way the progress has been these last few months.

Dr. Allen Alper: That sounds exciting. How about Homestake? What are your plans for that part?

At the meeting, approximately 98.2% of the votes cast by Homestake shareholders were voted in favour of the Arrangement. A total of 27,149,419 Homestake

common shares were voted at the meeting, representing approximately 39.1%% of the votes attached to all outstanding Homestake shares. Shawn Wallace,

President and CEO stated, “We are very pleased with the strong support from the Homestake Shareholders in respect to this acquisition which allows us to

own 100% of a significant high-grade gold discovery. The Homestake Ridge project gives us the opportunity to considerably expand upon an existing resource

and exploit the numerous high-quality exploration targets that exist within the property. Homestake Ridge complements our portfolio as it is high-grade

and located in a premier jurisdiction for gold exploration and mining.”

Ivan Bebek: There is a budget that's being designed for Homestake that's included in the numbers I've given you. So once Homestake becomes

ours, we have a lot of preliminary work that we will do in the fall. We won't get to drilling Homestake in the fall, but we will start drilling it in the

spring and summer of next year as well. But the work people can expect to see will be a lot of reveal on how good the targets are at Homestake, to double

it or to make it a lot bigger. There'll be a lot of work that we do with the metallurgy, just to show people how profitable we can potentially make the

rock that's going to come out of there.

I think shareholders can look forward to a lot of news from our portfolio, Committee Bay, Peru and from Homestake in the fall. But the next big

drill programs that start are in January in Peru, which will be followed by Homestake and Committee Bay. One thing I'll point out for your readers is that

when a junior company drills, that's the best time and that's predominantly the main time where you're going to get success and have a price movement on

the back of a discovery.

Our drilling is ongoing, as I talk to you now, and it will be extensive once we hit, and it probably won't stop for a few years. What is important

for shareholders is they'll have a steady opportunity to have that big reward from a new major discovery. When I say major discovery, the targets that we

have and the potential for them to be big discoveries, they're all large-scale, meaning that if we find it or when we find it, it's going to be big, and

that's something that shareholders really need to know.

The other thing that a company offers is a bit of optionality. I like this facet of the company, because when you go and take a big swing at

something to go find a major discovery, if you miss, you tend to get into a penalty box until you come out and make that discovery. Well, if we miss up

north, and then we hit it in Peru, or if we miss up north and in Peru and then we hit it in Homestake, we have 3 company-making assets in our company, so

these assets all insure each other. If one doesn't hit right away, the other one will likely hit, and if 2 don't hit, the third one will hit, but if all 3

hit at the same time, then the shareholders would enjoy a very robust share price, because theoretically we've created 3 companies in one by asset class

in one entity.

Dr. Allen Alper: That's great. It's nice to have to opportunity to explore 3 major projects. That's excellent. Could you summarize the major

reasons our high-net-worth readers/investors should consider investing in your company.

Ivan Bebek: One is the portfolio of projects that we've been able to acquire before the market started to get expensive. They're outstanding.

You have 3 companies, theoretically, in one, so the assets are certainly there. I think the quality of the technical team is unparalleled by anyone in the

business, and I say that because there're 7 or 8 world experts that are driving our technical work, which gives shareholders the possibility for success.

We have much higher possibilities than companies that have 1 or 2 world experts, when you have 7 or 8, and thirdly, I think our history and our

track record of delivering value for shareholders, the way we've structured our companies in terms of the shareholders that finance us, work with us, and

understand our business plan. I think our experience largely speaks volumes to what we'd be able to deliver when we do get successes out of these

projects. Management, technical team, and portfolio are 3 reasons that investors should consider us as one of the top tier exploration companies to own in

this space. Lastly I will say, being in Canada, it is one of the safest and the best jurisdictions to be in, and if you look at what could a Canadian

high-grade gold, or a Canadian big volume gold discovery mean, I'll point people back to a company called Detour Gold, which was very popular last bull

market. It went as high as about $36 per share on the discovery of 10 million ounces of 1 gram per ton in northern Ontario.

Today it trades around $33 per share, but it used to trade at 70 cents per share, and they found a nice, large, lower grade, relatively, deposit in

norther Canada. The value that they were able to obtain largely comes down to ease of jurisdiction, ease of place design, great spot and no political

risks. You're not worried about nationalization. You're not worried about unfair tax changes in the government, and that's something that really helped

contribute to that value.

Our goal in Canada with Committee Bay alone is to find, this year and next summer, the potential, through drilling, of 10-15 million ounces of

high grade gold or the start of deposits that could have the scope in size to reach that kind of threshold in the 6 or 7 grams per ton range. So that's

our ambition just with Committee Bay, and that's something that shareholders really have to digest. The risk of us pulling back significantly, and the

share price getting hurt, is mitigated by our portfolio, by having multiple assets. That's going to give our shareholders the chance of a greater

discovery as is our world class technical team. That's why we're such a great investment at this time.

Dr. Allen Alper: Sounds like excellent reasons to take a close look at investing in your company. Is there anything else you'd like to add, Ivan?

Ivan Bebek: I'm thrilled to be able to be part of a great team, to put together this portfolio of projects. You can hear my enthusiasm. You

would hear the same out of our head geologist, Michael Henrichsen and my partner Shawn Wallace. The opportunity that we have capitalized on in the last 18

months of coming out of the bear market, back into the bull market for gold, and where I think we're headed, is one that I'll remember for the rest of my

career. I think we've really built our best company. I'm looking forward to the drill program that we've undertaken and the ones in the coming months.

Dr. Allen Alper: Yeah, that sounds great.

http://www.aurynresources.com/

600-1199 West Hastings Street

Vancouver, British Columbia

Canada V6E 3T5

Email: info@aurynresources.com

Tel: 778.729.0600

Fax: 778.729.0650

North American Toll-Free: 1.800.863.8655

|

|