Interview with Steve Mallyon Managing Director of Riversdale Resources Limited: Australian-Canadian Hard Coking Coal Exploration and Development Company

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/27/2016

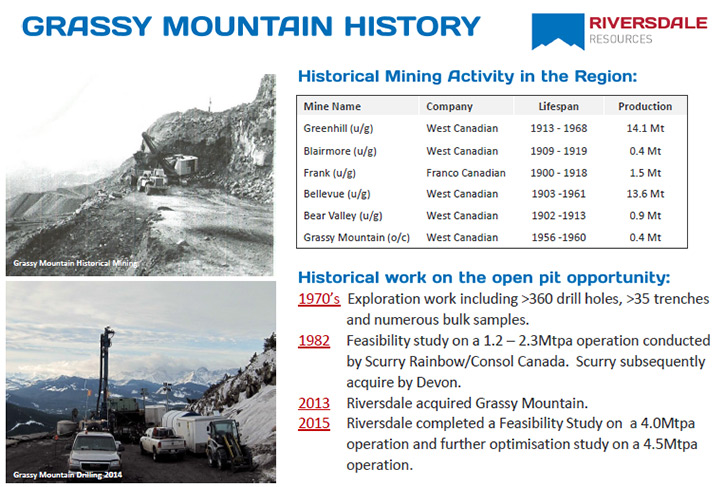

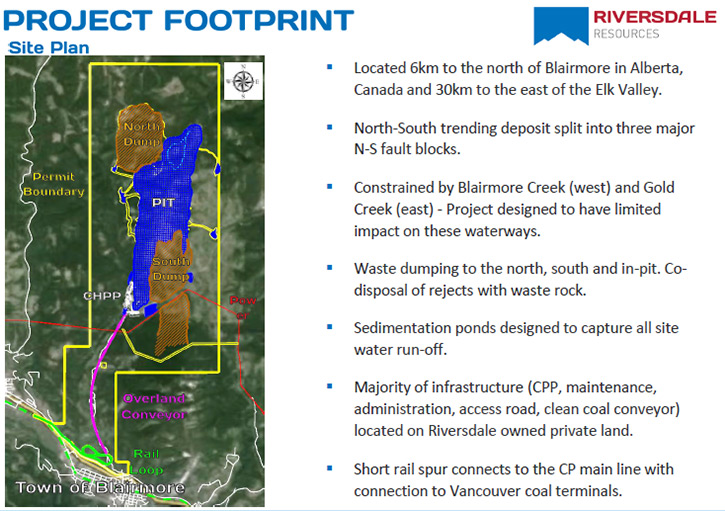

Riversdale Resources Limited is an Australian-Canadian hard coking coal exploration and development company that owns the Grassy Mountain project in Southern Alberta, Canada. Grassy Mountain is a large, very long-life, and low-cost project that came with the package of excellent work on exploration, coal quality assessment and infrastructure. Riversdale is run by an experienced crew of people that all came from majors, which enables the company to move quickly and efficiently. We learned from Steve Mallyon, Managing Director of Riversdale, that they started the permitting process last November, and hope to start building Grassy Mountain in early 2018 and to commission the project in mid-2019, producing 4.5 million Metric tonnes within the first 20 months. The company has recently concluded the Optimization Study of the Grassy Mountain project, that was largely focused on lowering further the cost of the project, reducing its environmental footprint, as well as a quicker ramp up to full production. Riversdale has had a long good relationship with the Piikani First Nation and the other First Nations and with the community. According to Mr. Mallyon, Riversdale Resources is the only independent mid-vol hard-coking coal company that can offer the steelmakers a large long term supply alternative to the majors.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News interviewing Steve Mallyon, who is managing director of Riversdale Resources. Could you tell me a bit about your company? I know it's an Australian coal and coking company.

Mr. Steve Mallyon: It's a hybrid Australian-Canadian company, started about five years ago. A number of us, including my chairman, CFO, and some of the management team, were involved in several projects in South Africa and Mozambique with a company also called Riversdale Mining in those days. It was acquired by a major in 2010, after we built a large project in Mozambique. We decided to get together again and look at opportunities in steel making coal. We felt Canada had some great quality coal and good infrastructure. That led us to the Crowsnest Pass area of Alberta, and the Grassy Mountain project.

We're strictly a development operating company. We don't tend to be too far out of the steel making coals. We don't tend to do early stage exploration either. We look at existing resources, improve them and get them into development. That's the business rationale for Riversdale.

Dr. Allen Alper: Could you tell me what differentiates your company from others?

Mr. Steve Mallyon: We have a team that's worked for many of the majors including BHP Billiton, Anglo American, and Glencore. We don't have extensive experience running junior companies because no one's really ever worked for one for any length of time. We've all come from majors, we're an experienced crew and we can do things a little quicker and more efficiently than some of our competitors. That’s why Grassy Mountain has gone through drilling and full feasibility study optimization into permitting in the space of about 3 years.

It's our view that time equals money. If we can reduce the period from inception to commercialization of a project we'll provide a better return for our shareholders. That's the basis for the Riversdale operation.

Dr. Allen Alper: That sounds excellent. Could you tell me a little bit more about your properties and resources?

Mr. Steve Mallyon: Sure. We acquired the Grassy Mountain project and three other properties from two companies: Consol out of Pittsburgh and Devon out of Houston. Devon had become involved in the region of southern Alberta initially to acquire oil and gas resources. Coal just happened to occur adjacent to the oil and gas properties and Consol brought their coal development expertise to the region. Both companies, particularly Consol had maintained the properties and had done some serious work on feasibility study around the Grassy Mountain project. Consol's decision, some years ago, to transition away from coal to a pure gas company was an opportunity too good for us to miss and we started looking at Grassy in 2012, acquiring the property in mid-2013. I think it was one of those few transactions where both sides were happy. Consol and Devon had found a group, in us, that was a developer rather than just an explorer or trader of assets. I think that was important for them, in handing it over, because of all the community expectations. For Riversdale the Grassy Project is unique in that it produces a single high value steelmaking coal and there are no byproducts such as PCI, semi-soft or thermal products which makes the logistics relatively simple.

I think from our side, we acquired a property in the downturn of the market, but one where our predecessors had done excellent work on exploration, on coal quality assessment, and had put a lot of infrastructure into the site. From our perspective, a great transaction. I think if you interviewed the guys at Consol and Devon they would probably say the same thing.

Dr. Allen Alper: That sounds really good. Could you tell me a little about your plans for 2016 going into 2017?

Mr. Steve Mallyon: We started our permitting process last year, last November. We have our second stage to that which is late July where we hand over additional air, water, aquatics, biodiversity information to the provincial regulator. That will be assessed and they will then make a decision to act with the federal counterpart in Canada. C-E-A-A which is the federal environmental authority will potentially look at a joint process with their Provincial government equivalent, Alberta Energy Regulator (AER), culminating, we hope, in a review and a public hearing next year, possibly about 12months from now.

In the background we are doing a lot of work and consultation with the First Nations and the local Crowsnest Pass Community. We are very focused on entering into a long term relationship with the Treaty Seven First Nations. In August we concluded an Impact and Benefits Agreement (IBA) with the Piikani Nation. This is a long term partnership with capacity building, training and contracting opportunities for Piikani and tremendous support offered to Riversdale from a group of traditional landholders.

Riversdale are also in the process of working with the Crowsnest Pass community on the redevelopment of a golf course along with other community projects. Some of the land of that golf course we're utilizing for our loadout, yet we are also developing a new mountain course which will be a great project for the town in terms of its ability to attract out of town visitors to a true Mountain Course development within easy access of airports in Calgary, Cranbrook and Kalispell in Montana.

We've done a major optimization exercise at Grassy Mountain to reduce the amount of material we've moved and also in reducing or eliminating the need for a wet tailings facility. We have utilized a dry tailings co-emplacement system by employing a dewatering system, which will help reduce our environmental footprint.

A lot of activity is occurring on site in terms of coal quality testing. We've also been doing significant geotechnical drilling this year, and looking at how we can optimize the project even further.

Dr. Allen Alper: That sounds very good.

Mr. Steve Mallyon: If all comes to pass and we're able to earn the support of community and government, in terms of regulation, we would be positioned to start building Grassy Mountain in, early 2018 and to commission the project in mid-2019 and with a ramp up to about 4.5 million Metric tonnes within about the first 20 months of startup. For Alberta the project has potential to not only create direct and indirect employment yet to also diversify the energy sector from oil sands, gas and thermal coal into a high value steelmaking coal for export.

Dr. Allen Alper: That sounds excellent. Could you tell me a little bit more about yourself and your team?

Mr. Steve Mallyon: Sure. I've been in the industry, the mining industry, for more than 30 years, starting out in running quarries and construction material plants in Australia and then moved onto some larger companies including MIM Holdings in Australia and then Billiton, the big British/South African Company which later merged with BHP. I did do a stint in investment banking for a period and my current CFO, Anthony Martin, and I started RBC’s investment banking operation in Australia. I came back to mining with the original Riversdale Mining, which was a small company when it started in 2004 and by the end in late 2010 it was an ASX 100 company. Many of the rest of the team have worked with me in the original Riversdale Mining, including Michael O'Keeffe our Chairman, Tony Redman who's one of our non-executive Directors and a former Chairman of Anglo-American Coal, and Gary Lawler, who was a senior partner with one of the big legal firms in Sydney.

In terms of our operation team, we have some excellent people including our CFO Anthony, who worked with me at RBC and also in Africa, Mike Youl, the former project director for BHP Billiton's coal division, BMA, has also come to join us. We've been fortunate to get talented people in Canada, who have been involved in project development and operations for many years in the coal and oil sands sectors and we think in this business, experience pays. It enables us to move quickly, but also to make informed decisions on how to get projects up and how to do it efficiently and safely.

Dr. Allen Alper: That sounds excellent! A very experienced team! What are your thoughts on the coal industry, where it's going and what experts say about it?

Mr. Steve Mallyon: I think the coal industry has gone through a horrific time. As a group, we've never been involved in thermal coal for the power industry and I think that's one sector that has taken some massive hits, particularly in the United States where the development of the gas industry has been at the detriment, to some extent, of the coal sector. We've been in this business a long time, we're focused on steel making coal, yet we have previously operated Anthracite mines in South Africa.

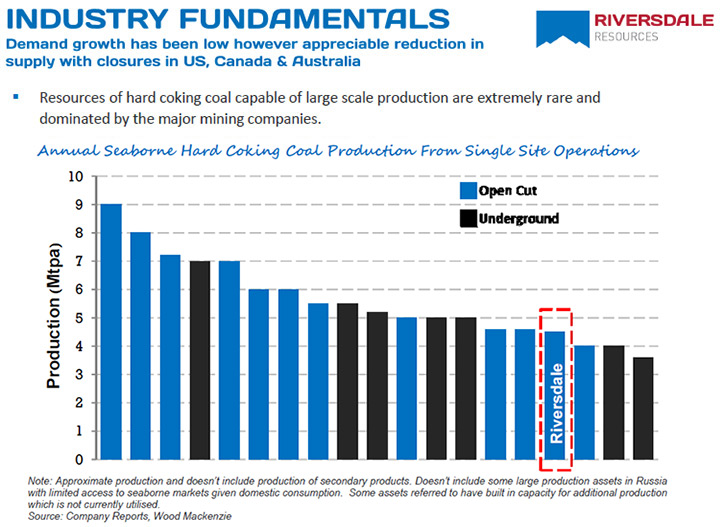

However out of adversity often comes opportunity and with the demise of some of the US, Canadian and Australian producers, the industry has become incredibly concentrated with the two largest players in the Seaborne coking coal trade at least, being BMA from Australia which dominates the industry and Teck Resources from Canada. Out of the top leading hard coking coal mines and projects in the world, there's just one, still to be developed, which is owned by an independent, and that is Riversdale. Teck, BMA, Rio Tinto, Vale, Glencore, and Anglo-American, are essentially large often diversified majors, some now managed by banks following well publicized financial challenges. Riversdale has the potential to offer Steelmakers an alternative supply over a very long project mine life. Having said that Riversdale is not reliant on a surge in demand for hard coking coal. Grassy is essentially a replacement/displacement product for some existing production in Australia and the US which is at or near the end of mine life due to cost structure, changing quality issues or indeed exhaustion of economic reserves.

For us this is the exciting part of the market cycle, because we recently marketed to many of the Asian and Brazilian steel makers, and they're always welcoming. Yet recently we felt even more of a welcome, because clearly if you're a steel maker you want some choice and diversity of supply to offset any potential supply disruptions whether they be related to weather, infrastructure, government and labour impacts. Provided the product meets their spec, and provided it comes from a first-world country, and provided there's good infrastructure in place (rail and port), procurement people get enthusiastic about a new source of supply.

Steelmaking coal has endured a debilitating industry restructure over the period from late 2012 to today. A significant amount of productions has disappeared in Australia, China, Canada, United States, and New Zealand with about 45 million tons of capacity over the last two years of steel making coal being closed. In parallel the industry level of ownership has become more concentrated among a few large, diversified majors. Riversdale will potentially be the first of a small group of developers offering new high quality mid-vol hard coking products to steel makers with the ability to ramp up to 4.5 million tonnes reasonably quickly. As a result, we see a great opportunity for our project and our product going forward.

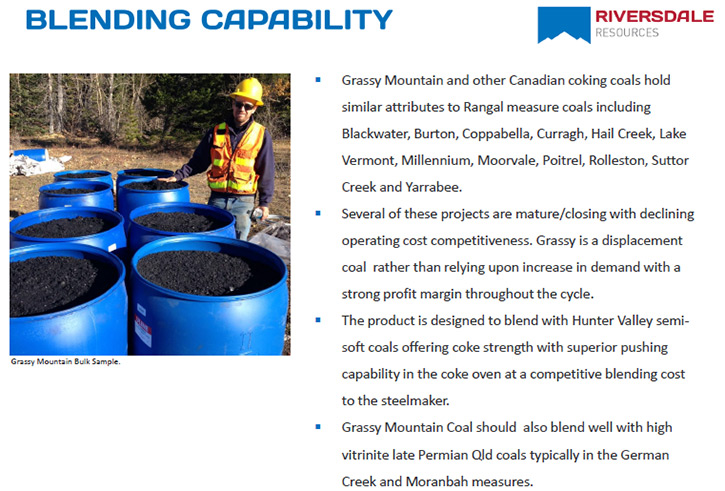

Mr. Steve Mallyon: As an independent company we are not bound to necessarily follow the market strategies of the majors, yet we offer a similar product, which is what we call a mid-vol hard-coking coal with very low impurities such as sulphur and phosphorous. What we've done, Allen, is to build upon some existing relationships with off-takers by reverting back to what BHP and the American companies did back in the '60s. We've entered into a joint Research program with 11 steel makers around the world, and we've been working with them as they test our product to ensure that our product blends well with their other coals that they utilize. To date the results have been encouraging and give off-takers the confidence to utilize a new product.

Our marketing team believes the culmination of all of that research and development work will help to build the long term relationship which has been the hallmark of previous success stories in the industry including BMA and Macarthur Coal and to a lesser extent the original Riversdale Mining some years ago.

Dr. Allen Alper: That sounds very good. Could you tell me a little bit about your finances and share structure.

Mr. Steve Mallyon: Sure. Currently the largest shareholders are management, which is myself, our CFO and chairman, and one of our directors. We have over 180 small shareholders many of whom were investors in the original Riversdale Mining some years ago. Ownership is now changing as the people who have provided the bulk of recent funding has been Macquarie Bank out of Australia and Resource Capital Funds from Denver. The bank decided that they liked the story, they liked the team, and in fact we've known them for a very long time, so they've been a great supporter. Resource Capital, is a large and very successful natural resources private equity fund based in Denver. Some of us have known them since their inception back in the late '90s, and they've had plenty of successes in bulk commodities before. But I think if you ask Resource Capital, Grassy Mountain is probably going to be one of their bigger coal stories, and probably their most exciting. We're classified as a public company under the Australian corporations’ law, yet we're not listed.

Dr. Allen Alper: That sounds very good. Is there anything else you would like to add, Steve?

Mr. Steve Mallyon: We're at Grassy because it's large, it's very long-life, and it's relatively low-cost. It's what is termed in the industry as a first-quartile producer. The optimization work at Grassy is not finite – it will continue well into the start up phase. Several members of our team and our consultants have come out of BMA. We did that because there's a lot of expertise there that helped BMA become the world's biggest and lowest cost seaborne met coal producer, which we can also deploy at Grassy Mountain. As a result the average age of the feasibility study team is at the upper end.

My Chairman and I are both from Queensland, so it's not a big job to ring around and get some of these top guys interested in working on such a large and prospective project. So we've got a great team at the moment with a mix of Canadian, Australian, American and Swedish accents that can take this project to the next level.

Dr. Allen Alper: That sounds very good. I think what you're doing is very impressive. It sounds like you have a great team and you know what you're doing, great experience, and good properties, and you are concentrating and getting the permitting, and getting it into production very rapidly.

http://www.rivresources.com/

Riversdale Resources Limited

Suite 1, Level 2

284 Victoria Avenue

Chatswood NSW 2067

Bus: +612 9419 6100

Suite 415

938 Howe Street

Vancouver V6Z 1N9

Canada

Bus: +1 604 684 6845

Cell: +1 403 563 1267

Australia Cell: +61 407 464 529

steve.mallyon@rivresources.com

|

|