Interview with Christian Easterday, Managing Director of Hot Chili (ASX: HCH): High Grade Gold Being Added to One of the World’s Lowest Capital Intensity Large Scale New Copper Developments. Located within the Iron Oxide/Copper-Gold Belt of Chile

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/27/2016

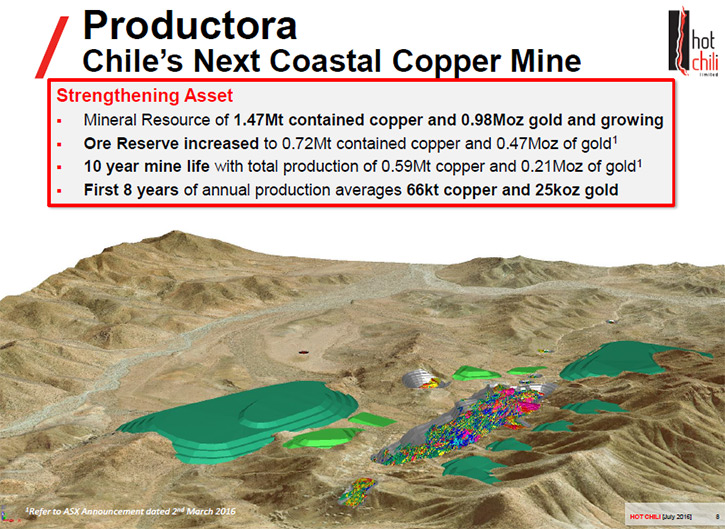

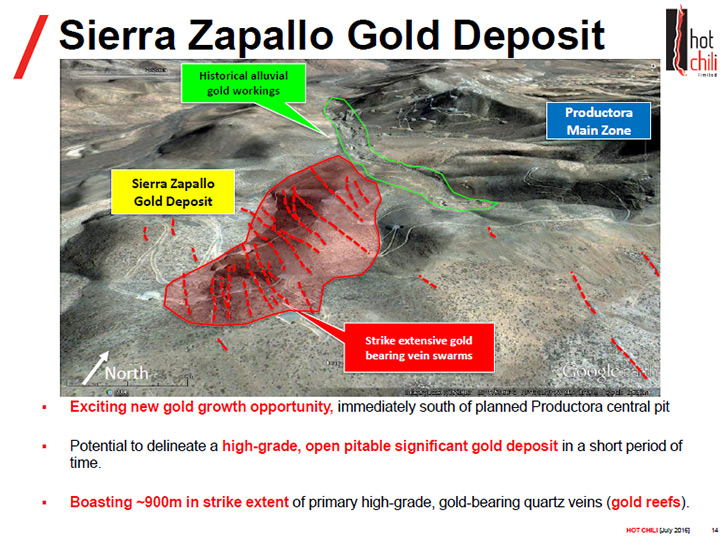

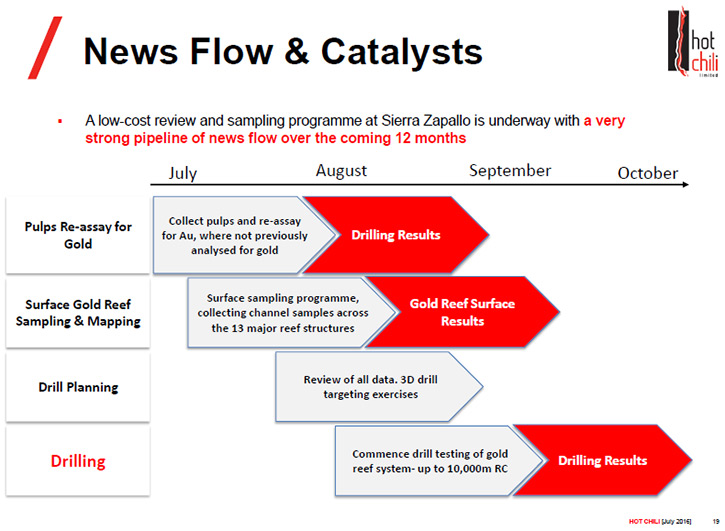

Hot Chili Ltd. (ASX: HCH) is an Australian company, focused on its very large-scale Productora copper porphyry deposit, located within the iron oxide/copper-gold belt of Chile 15km south of the town of Vallenar in Chile’s Region III. Productora is a very infrastructure-rich project, standing out as one of the lowest capital intensity large scale new copper projects to be developed. We learned from Christian Easterday, Managing Director of Hot Chili, that the company is fast-tracking a very low cost, rapid assessment of a high-grade gold deposit, recently discovered in the southern extent of Productora. Next steps for Hot Chili will be advancing Productora to a decision to mine, while in parallel, making preparations towards the first major drilling program to be directed over what appears to represent approximately 1 billion tons of additional growth potential in the main copper-gold asset. According to Mr. Easterday, Hot Chili is a very consolidated company, has very strong funding support and is partnered with CAP Mineria, one of Chile's largest resource majors. The company has a very strong news flow lined up for the coming 6 to 12 months. Productora is an asset that will be at the front of the queue of the next wave of copper price escalation. Most importantly for investors- it is the emergence of a very robust looking high grade gold deposit which looks likely to be turning heads- with the drill rods due to start turning soon also.

View over the Productora proposed central pit development area looking north

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News interviewing Christian Easterday, Managing Director of Hot Chili Ltd. (ASX: HCH). Christian, could you tell me a bit about your great property in Chile, your copper and gold property, what's happening, and what differentiates your company from many other companies?

Mr. Christian Easterday: Hot Chili is an Australian listed company. We listed on the Australian Stock Market in 2010. We went over to Chile acquiring and consolidating projects through partnerships with some of Chile's major mining companies. We established a portfolio of low coastal range copper projects, copper-gold projects specifically, located next to infrastructure. Shortly after listing the company in 2010, we made a major discovery at the Productora copper-gold project.

The company has deployed some US$90 million investment into a very large scale drill-out and development assessment of what is widely considered one of Chile's next emerging large scale copper mines. The company just recently completed a pre-feasibility and are working with our local joint venture partner, Compania Minera del Pacífico S.A. (CMP or CAP Mineria) of Chile, to develop the project towards its final phase of bankable feasibility study prior to a decision to mine in the coming 2 years.

One of the differentiating points is that we are partnered with CAP Mineria, one of Chile's largest resource majors. Hot Chili has always been known as a strong local partner of the Chilean resource majors. We have a very infrastructure-rich project, meaning that Productora, at pre-feasibility level, is standing out as one of the lowest capital intensity, large scale new copper projects to be developed. We've been able to advance this from discovery in a very rapid period in Chile. With our recent announcements concerning the addition of a high-grade gold deposit in the southern extent of Productora, which the company is now working on, I guess we have quite a bright future in this market to look forward to over the short to medium term.

Dr. Allen Alper: Well, that sounds excellent. It sounds like you really have an amazing property.

Mr. Christian Easterday: Yes. Recently the company has focused just on Productora. We have a large deal there with our partners and that is very much where the lion's share of Hot Chili's focus is going at this stage.

Dr. Allen Alper: Could you tell me a bit more about the nature of the deposit? I know it's a massive project.

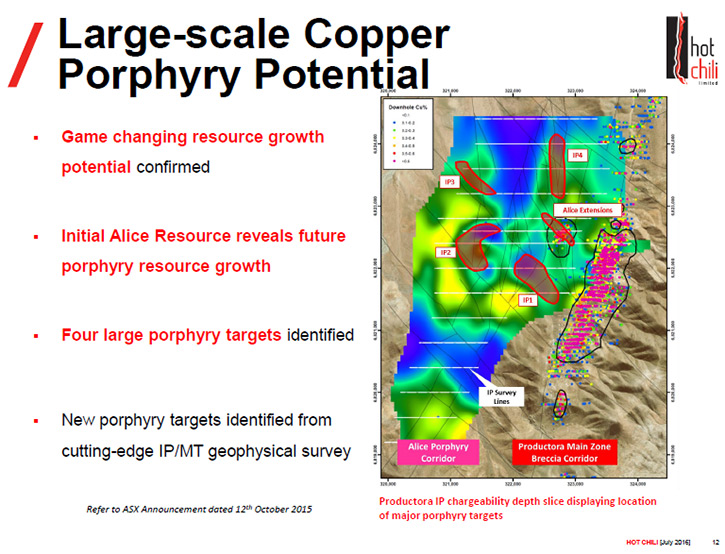

Mr. Christian Easterday: Yes. Productora was always a little different. It lies within the iron oxide/copper-gold belt of Chile, at about 800 meters altitude. It has, I guess, one of the best locations to build a new mine. It was a deposit we discovered that was widely considered a hybrid deposit until quite recently when we discovered porphyry mineralization immediately adjacent to the Main Zone- a 9 kilometer long breccia hosted deposit which contains the majority of Productora’s 240 million ton resource base grading about half a percent copper and 0.1 grams per ton gold.

We've only recently been expanding our knowledge of the larger mineral system. What we're actually sitting on at Productora, following 2 years of focus on new porphyry mineralization in the center of the project, is a very large-scale copper porphyry deposit, a Cretaceous Age deposit. The main zone seems to have bled some 1 1/2 million tons of copper and 1 million ounces of gold into resources along the Main Zone, sourcing a very large-scale copper porphyry system, which the company has only recently begun exploring. We are preparing to assess what looks likely to be a significant game changer in the scale and mine life of the current project.

Dr. Allen Alper: What do you see the timing going forward in exploring and developing your project?

Mr. Christian Easterday: To advance Productora toward a decision to mine in late 2018. We see three great opportunities to add value to Productora in advance of commencing the bankable study of the main copper-gold project. These include firstly; the commencement of a porphyry drilling campaign over what we consider to be “game-changing potential”, and secondly capturing a number of engineering opportunities we identified in the Pre-feasibility study to position Productora’s expected cost of production into the second quartile of the global copper cost curve for producers. The third opportunity involves the exploration of a historical gold deposit in the southern extent of Productora.

It is this third opportunity which we are moving on right now and I must say that the Company has been very impressed with the early exploration results

Dr. Allen Alper: Yes the market has seen some very impressive high grade gold results coming from Sierra Zapallo. On paper- thirteen narrow gold reefs grading over 6g/t gold from surface would suggest a high value open pit gold resource is coming together- what are your next steps at Sierra Zapallo

Mr. Christian Easterday: We have confirmed what looks to be a low strip ratio, high-grade open pit opportunity with an extensive amount of surface mapping and sampling supported by an earlier drilling campaign. The potential of the 900m long hill which hosts most of the gold reefs being assessed looks likely to be playing host to a potential open cut mining opportunity which could be brought into production quickly and generate very substantial margins should drilling continue to delineate the types of grades and widths we have seen to date. It is always very exciting to see potential for open pit gold metal profiles of up to 2,000 ounces per vertical metre with strip ratio estimates of 12 to 16. Our group has a lot of gold experience and you do not have to question the attractiveness of those numbers if you have spent any time in gold. We are very excited by the potential at Sierra Zapallo- however we also understand there is much work to do to confirm the resource potential and before we are in a position to get serious about how we integrate Sierra Zapallo into the larger development plan should we encounter continuing success in our drilling.

Dr. Allen Alper: That sounds very good. Could you tell me a little bit about your own background?

Mr. Christian Easterday: Before joining Hot Chili and founding the company along with my chairman, Murray Black, I'm originally a geologist, brought up and educated in Australia. I spent many, many years in the Australian gold sector, based in Australia with companies such as Hill 50 Gold, Harmony and Placer Dome. I also learned the business of mining and picked up an MBA and a Master's in Mineral Economics. I guess my story, coming into Hot Chili, really begins with working with my chairman, Murray Black, starting about 10 years ago.

We built a very loyal team which included some of the foremost geological talent of Placer Dome and Hill 50, a very successful company that I was fortunate to work with early in my career. As a result I was attracted to come and put something together in Chile through a very long private investment with Murray and our group. Building a company such as Hot Chili and working with some fantastic people in our team has been very rewarding.

Dr. Allen Alper: That sounds excellent. Could you tell me a little bit more of the background of your chairman?

Mr. Christian Easterday: Well, Murray's a very private man. He's a very well-known Australian mining entrepreneur. He's based out of Kalgoorlie, next to arguably one of the world's largest gold mines, so gold mining and mining in general is very much in the heritage of the group through our chairman, Murray Black. He's a bit of a fearless leader, very well-known in the drilling businesses in Australia, has a lot of diverse interests amongst his shareholdings in public companies, but also in his interests in the drilling industry with very large surface drilling fleets based in Australia and Chile. He's been very much a guiding light for Hot Chili and our endeavors over there, and very much a strong supporting shareholder.

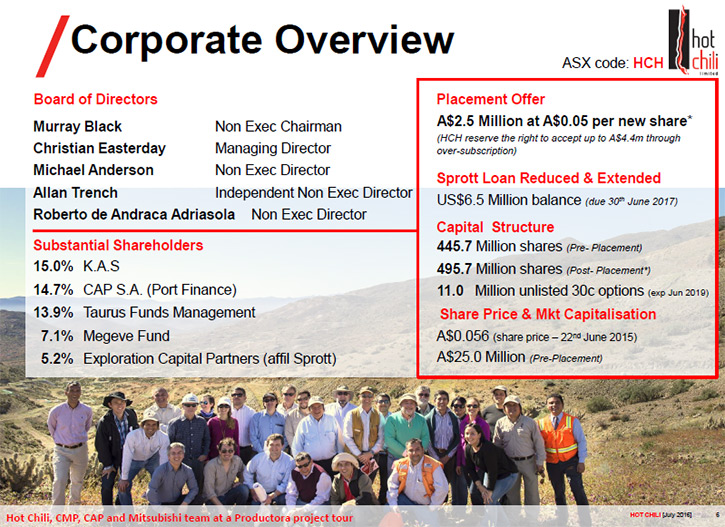

Dr. Allen Alper: That's great that you have such a great partner and team. Could you tell me a little bit about your share structure?

Mr. Christian Easterday: One of the outcomes, of Hot Chili’s very early success upon public listing, was we were able to deploy a very significant amount of capital in a very short period of time, most of that being directed towards the Productora copper-gold discovery. Hot Chili sought strategic backing from some very well-known large institutions in Australia, also in North America, and indeed in Chile through our partners, CMP's parent company, CAP. Amongst Hot Chili's top 5 shareholders, Murray Black and our group, including myself, (Kalgoorlie Group) are the largest shareholders. We've continued to maintain our investment in the company and have supported it very significantly.

The Kalgoorlie Group control around 21 percent through various holdings associated with Murray Black. Our second largest shareholder is CAP, the parent company of Chilean resource major CMP, holds approximately 12 percent of Hot Chili. Taurus Funds Management, a very large private equity based group of Australia, they control a similar amount to CAP, around 1 percent. Also we've been very fortunate to attract some other large institutions and individuals within the industry, such as Rick Rule from Sprott, who personally holds approximately 5 percent. We are very consolidated and that has meant that we've had very strong funding support throughout the company's history.

Dr. Allen Alper: That sounds excellent. Sounds like you have very significant, important investors and you and Black are committed to the company and have invested your own funds in it, so that's really great. You have a big position in the company.

Mr. Christian Easterday: True. Last year we won the Emerging Company of the Year award at, probably the most well-known and prestigious Australian mining conference, Diggers and Dealers out in Kalgoorlie. It was a very proud moment for Hot Chili.

During the last 3 years of down-turn in the resource sector, the pull-back in the investment sector and market capitalizations, the valuations of all companies have been significantly affected- Hot Chili is not alone in this regard. I'm a CEO and mortal just like every other CEO in the mining industry. So, I'm very proud to still lead Hot Chili through that very, very challenging period. I'm very optimistic about what we're seeing in the market, particularly catalyzing around the recent interest not only in Australia, but also in Canada, on gold, and in the lithium space. It's great to finally see a breath of enthusiasm in the industry.

Dr. Allen Alper: Yeah, Things are moving in the right direction. People are coming back and investment in the resource industries. Funding is now moving.

Mr. Christian Easterday: Yeah. We're seeing almost a grass-roots led recovery in the Australian equity capital markets. We have seen the return of the retail investor, particularly in the last 6 months. That has been sorely missed for well over 3 years in the Australian market, and it has really breathed some life into small capital raisings and further exploration starting to advance again. As an Australian at a North American resource conference, I'm very pleased to tell you that the other side of the world is starting to heat up.

Dr. Allen Alper: That's great. Could you tell me the primary reasons why our investors should invest in your company?

Mr. Christian Easterday: Look, I think first and foremost, our valuation for the resource based, reserve based scale and the asset in general right now represents an extremely low entry point through the company's history. We've recently closed a project level funding transactions, which values the company at some 3 times its current market capitalization, just on the project alone. We have significantly strengthened our balance sheet. We are delivering some extremely exciting high-grade gold exploration results into the market and investors are about to work out what Sierra Zapallo could actually generate for the Company- given drilling confirmation in the coming weeks. I think in terms of a short-term proposition, we have a very strong news flow pipeline, which we have lined up for the coming 6 to 12 months.

And on an underlying fundamental basis, Productora is an asset that will be at the front of the queue of the next wave of copper price escalation. That is more of a medium-term proposition. But we have been able to manage the asset prudently and secure the asset to be a development decision in the coming 2 years. We have an underlying asset value in which a rising copper market leverages our market capitalization at multiples and multiples of where we are. That is the primary investment case. The immediate investment case is what Hot Chili is looking to do in terms of adding near-term, exciting growth in high-grade gold to its underlying asset base. I guess that is the investment proposition that Hot Chili is offering the market right now.

We expect that real value does not go unnoticed for long. Large assets like Productora will always be prized in the large-scale copper space. Hot Chili has been leveraged downwards in value to 10cents in the dollar with US$1/lb. coming off the copper price over that past few years- so we know what upside that represents to the company once copper price starts moving north again. When you also consider adding near-term, large, high-grade gold resource development upside to the project right now- that is when things start to get very interesting for all of our shareholders.

Dr. Allen Alper: Those are very strong reasons for investors to consider investing in Hot Chili. You've done a very good job, during very bad times guiding your company, positioning Hot Chili for success. You've done a great job describing your company, explaining it to investors. You and your team deserve to be very, very proud.

http://www.hotchili.net.au/

First Floor, 768 Canning Highway,

Applecross, Western Australia 6153

Phone: +61 8 9315 9009

Phone: +61 8 9315 9005

Fax: +61 89315 5004

PO Box 1725, Applecross

Western Australia 6953

Email: admin@hotchili.net.au

|

|