Interview with Bob Evans, CFO and Director of Ascot Resources (TSX-V: AOT): High-Grade Premier Gold Project, Located in British Columbia

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/25/2016

We interviewed Bob Evans, CFO and Director of Ascot Resources (TSX-V: AOT), who is very excited that their high-grade Premier Gold Project, located in British Columbia, was recognized by one of the Canadian precious metals gurus, Eric Sprott, who made a $20 million personal investment in the company. Currently Ascot is conducting exploration and definition drilling on the project. Results continue to demonstrate good continuity and grades of the mineralization. Excellent existing infrastructure and close proximity to the town of Stewart make this a relatively low-cost project.

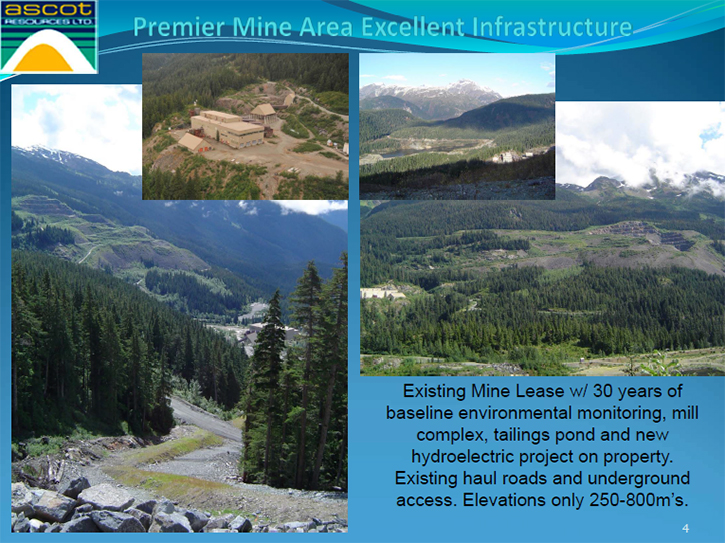

Premier Pit and Mill

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Bob Evans, CFO and Director of Ascot Resources, Ltd. (TSX-V: AOT). I could see a lot of exciting things going on with your company. Could you tell me a bit about what's happening in Canada with your company, your recent results and why your deposits are important?

Mr. Bob Evans: Eric Sprott, an important guru of precious metals in Canada, just made a $20 million personal investment in Ascot Resources, Ltd. That’s exciting for us, having our project recognized by Eric Sprott is a game changer that has brought Ascot Resources a lot of activity.

Dr. Allen Alper: That's terrific! Fantastic news! That's really great recognition! We recently promoted the Sprott Natural Resource Symposium 2016. We also did an interview with Rick Rule.

Mr. Bob Evans: That recognition was what we have been looking for.

Dr. Allen Alper: That's fantastic to be recognized by Eric Sprott. Tell me a bit more. Why did he invest $20 million? You must have something very important there.

Mr. Bob Evans: We believe we do. What really influenced Eric was we were consistently coming up with a lot of high-grade numbers. He was attracted by the high-grade gold. He believes where there is enough consistency in the high-grade results that they are not anomalous.

Our property is just to the south of the Pretium property. This is up in northwestern BC. We have been working there since 2007. Our Premier property covers more than one hundred square kilometres near the town of Stewart in northwest BC, and includes the old Premier Mine, a past producer of 2.1 MOz Au and 44.9 MOz Ag.

Dr. Allen Alper: That's great.

Mr. Bob Evans: Eric's money has enabled us to expand our horizons totally. We can now explore the whole prospective area of our property. We have five drills going now. We own our own drills. Our drill costs are under $100 a meter, Canadian. That’s "All in", I'm talking all of the costs that we incur up there including the analysis and dividing it by the footage drilled.

Our drilling costs are about 1/3 of the industry average. One of the main reasons for that is the excellent infrastructure there already in place. We are within driving distance of Stewart. It's only about a 20 or 30 minute drive. There are existing roads. We are not at a high elevation. We have existing infrastructure on the property. It's like a dream property. If we were to go into production on a small scale, say 3,000 tons per day, we could probably put this into production for under $200 million.

At the moment though, we are focused on finding out what more we have there. There's historic mining on this property from the early part of the last century on what they called the glory hole area. From 1922 to 1928 the glory hole produced 1.2 million tons grading approximately 28.6 grams gold and 600 grams silver. The glory hole area is relatively small. We have no end of targets to test and if we find another glory hole it would be fantastic news for our shareholders.

Dr. Allen Alper: That sounds great. That's excellent. Could you tell me a little more about your background, John Toffan and the rest of your team and board?

Mr. Bob Evans: John Toffan was the president of a company called Stikine Resources. Stikine back in 1990 was one of the companies that discovered the Eskay Creek deposit. John took that Stikine stock from 30 cents to about $75. I was the junior director of Stikine so John and I have been working together for the past 27 years. John is the CEO of Ascot and I'm the CFO of Ascot. We have two independent board members John Swann and Ken Carter. Rick Kasum is another director, he is our operations manager and he lives up in Stewart. He is the person that runs our drill programs there. Finally, we are happy to have Greg Gibson join us. When Eric Sprott put in his $20 million he got the right to nominate a director to the board and he chose Greg Gibson with whom he has been working for many, many years.

Dr. Allen Alper: That sounds very good.

Mr. Bob Evans: That's it for our board. We have our consultant geologist, Graeme Evans, who is a person you may want to talk with later on. He's actually up on the property at the moment but if you wanted to talk with him in detail about the geology you could do that at a later date.

Dr. Allen Alper: Okay. I could do that.

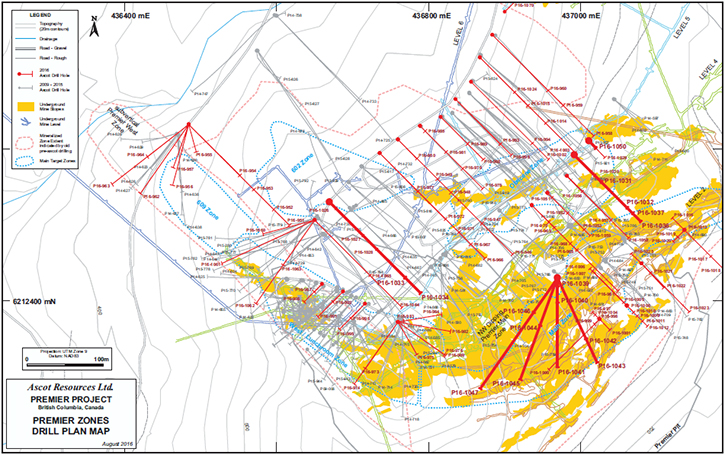

Mr. Bob Evans: The early drilling we did up on the north part of this property enabled Graeme to come up with a good understanding of the geology of the area, which previously wasn't recognized. He is now very confident, when he is drilling, where he will find the zone. The continuity is really quite remarkable. The unknown question is the grade within the zone. There is high-grade within a low-grade shell. We are trying to look for the really rich spots in it. Graeme is very confident on finding those zones.

Dr. Allen Alper: That sounds very good. Could you tell me a bit more about your share structure, your capital structure, your finances?

Mr. Bob Evans: Yes. We have 134,935,982 shares outstanding, fully diluted we have about 165 million. We only have the one class of shares, the common shares. They all have the same voting rights. We have about $24 million in the treasury, which should be enough to carry us right through to the end of next year. When you look at our website you will see that we have one final payment to make on our property, which is just under $7 million, due next June. We now have the money to do that. That final payment was a huge overhang on our share price, at the start of the year, when the market was very different from what it is now. Gold has since made a remarkable recovery and now, with our recent financing, the market can be confident we can make our final option payment.

Dr. Allen Alper: That's a great position to be in. Nice that the market finally turned around after 5 lean years.

Mr. Bob Evans: It is indeed. We have had majors looking at our property for the last 4 or 5 years. We have had offers in the past, but none we wanted to accept. Traditionally an exploration company would identify the resources and then a major would come along and take them out. That liquidity from the majors in the market has been missing for the last few years. We have been very fortunate to have a very loyal band of shareholders that we went back to each year, to ask for more money, to do more drilling and each year they came up with it.

Dr. Allen Alper: That's great. That's really important. They had a lot of confidence in the team in the management of the property. Could you tell me the primary reasons high-net-worth readers/investors should invest in your company?

Mr. Bob Evans: It's a gold exploration company with excellent prospects for identifying a high grade resource. Like all gold exploration, it's high risk, high rewards, but we believe we have done a fair amount of de-risking already on this property. If you look at the company right next to us, we are in very similar geological setting. They are presently going into production. I think you will find that before long the majors will have to start replacing their resources, their reserves. The best way to do that is to take out a junior company that has substantial reserves. I think we would be one of the top picks for any major company that was coming along and looking to buy reserves.

Dr. Allen Alper: That sounds very good. Is there anything else you would like to mention at this time?

Mr. Bob Evans: Here’s what I think. There are not many properties like ours around. We are fairly advanced because we were able to operate though lean years because of the support of our shareholders. The property has a lot of existing infrastructure. We could put it into production at a relatively low cost compared to most operations. All we really needed was the gold market to turn around and this has happened. Things are really going to start happening fast now.

Dr. Allen Alper: That sounds great.

http://www.ascotresources.ca/

Ascot Resources Ltd.

#202 - 15388 24 Ave

Surrey, BC

V4A 2J2

Phone: 604-379-1170

Fax: 604-535-9946

Email: bobevans55@gmail.com

|

|