Interview with Stan Bharti, Chairman and Acting CEO of Aberdeen International (TSX: AAB): a Successful Global Resource Investment Company and Merchant Bank

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/17/2016

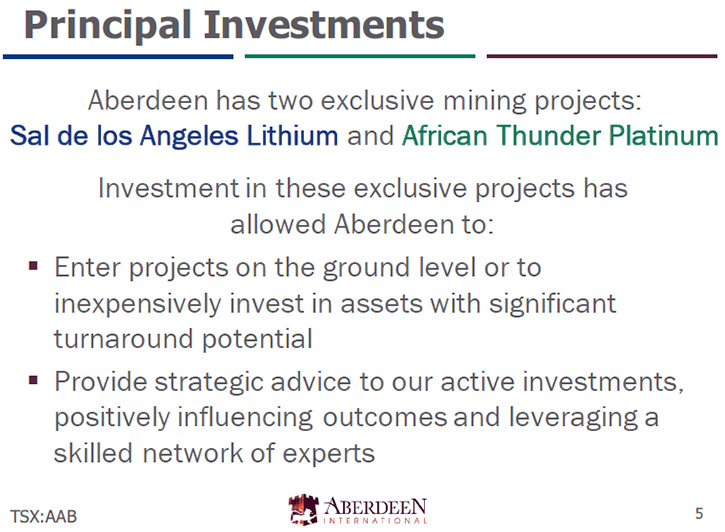

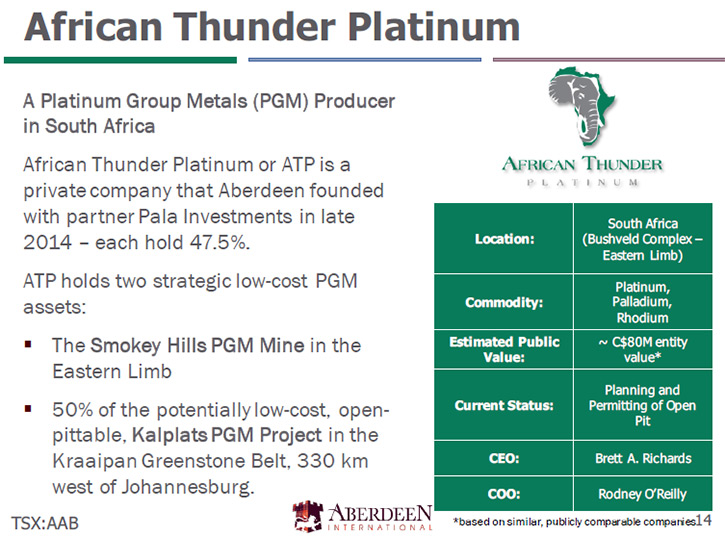

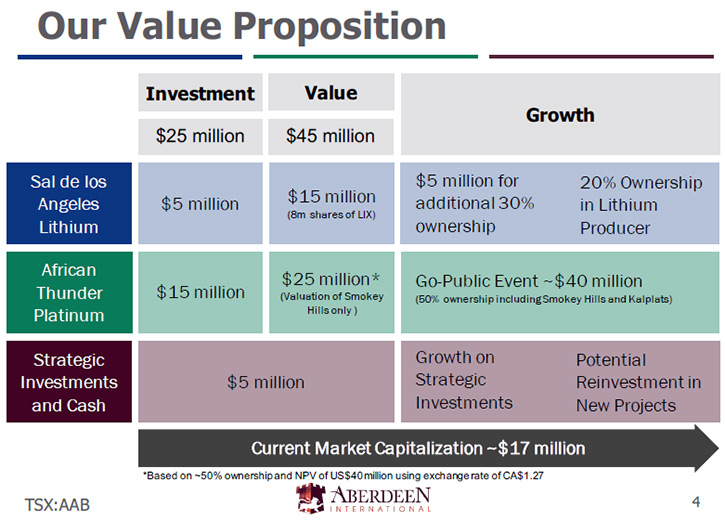

Aberdeen International (TSX: AAB) is a global resource investment company and merchant bank focused on small-cap companies in the mining and metals sector. We learned from Stan Bharti, Chairman and acting CEO of Aberdeen International, who has a very successful track record, that today the company has two major investments: one is close to a US $15 million investment in a private South-African platinum-palladium company called African Thunder, and the other is an investment in one of the largest advanced lithium resources in the world called Lithium X, located in Argentina. African Thunder is a producing mine with close to a million ounces of platinum and palladium and a huge exploration upside that was put on standby because of low prices, but there is a plan to reactivate it in the beginning of 2017. Aberdeen owns approximately 50% of African Thunder with the other 50% owned by a company in Switzerland. Lithium X is a well-developed resource that is completing its feasibility study. According to Mr. Bharti, these are both world-class assets that, over the next two or three years, in a good market, will unlock substantial value for Aberdeen. In addition, Aberdeen had several other assets, including coal and gold that have been sold to build a small resource fund that helps fund investments like the lithium project. Aberdeen manages this fund, which has already grown from about $8 million to $10 million in assets in less than a year.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News interviewing Stan Bharti, who is Chairman and acting CEO of Aberdeen International. Stan, could you tell me a bit about Aberdeen International? What makes it unusual?

Mr. Stan Bharti: Let me tell you about Aberdeen. It's a company we started in 2006 or 2007 and I think we raised about $80 million in the beginning. The original idea of Aberdeen was that we would invest only in companies that Forbes and Manhattan, the merchant bank that I control, managed or operated. Often, when we start new deals, we put two, three, five, ten million dollars into the deal through Forbes and Manhattan. A lot of the funds and a lot of the investors feel that they have missed-out on the first round because it's too early. It's too slow. So we proposed to them, let's create a company, Aberdeen, which would automatically invest in every deal that Forbes and Manhattan invests in.

That was the original model in 06, 07, quite successful, but of course then we had the financial crisis. Things changed a lot. The funds that invested all rechecked their positions. So, today Aberdeen is a company that really has two major investments. One is a big investment in African Thunder. African Thunder is a private platinum-palladium company in South Africa. It owns an operating mine. The mine was operating until a couple of months ago. We put it on standby because prices have been low. We own approximately 50% of African Thunder, the other 50% is owned by Pala. Pala is a fund out of Switzerland. Our plan is to build the company and then IPO it, but it's a very good asset. We already have close to a million ounces of platinum and palladium, and we have several acquisitions in sight that could extend the resource tenfold. So we have huge potential there. Plus, African Thunder owns a huge undeveloped project called Kalplats, which we think will be the next big platinum mine in South Africa.

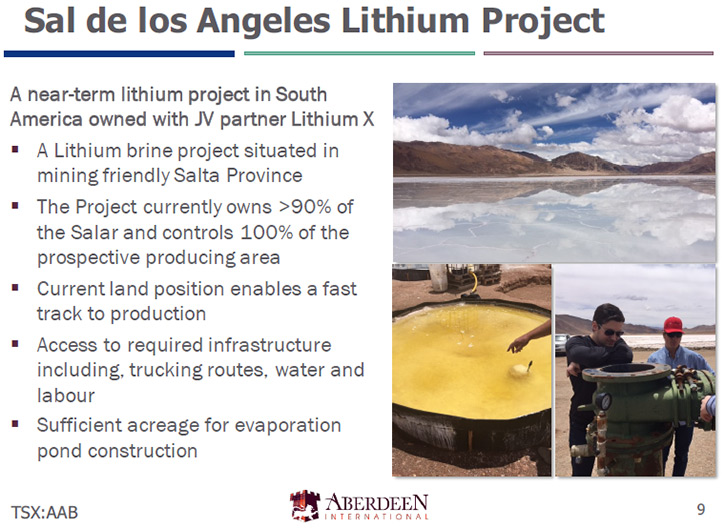

The other main asset we have is our investment in Lithium X. Lithium X is a lithium company that built one of the largest, advanced resources in Argentina. This resource was drilled by other companies. It's developed. It's permanent. There's a feasibility going on right now, and we rolled this asset into a company called Lithium X for 8 million shares. So we are one of the largest shareholders of Lithium X. Our stocks getting in over two bucks, so it's got an implied value of $16 million, and we still own 50% of the asset.

In African Thunder, we invested close to 15 million US, so if you put the combined value of just these two assets at $30 to $40 million. The company has 90 million shares outstanding, trading at 16 cents, so clearly it's very undervalued. And if lithium and platinum prices go much higher as many expect, then our gain is far greater.

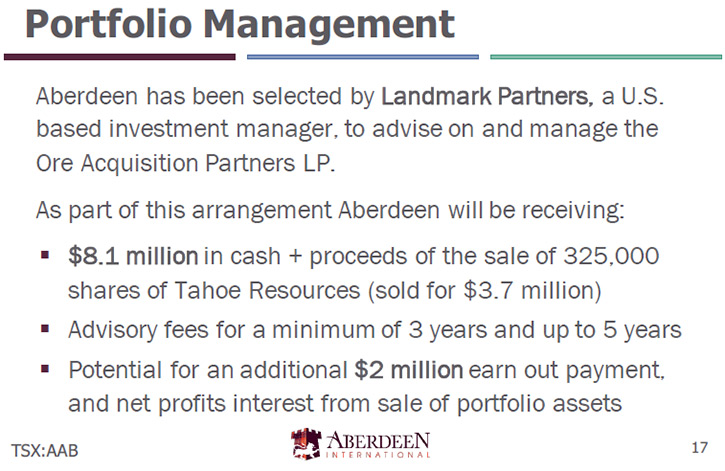

The third thing we have in Aberdeen, is two years ago if you remember, we talked to a company called Landmark, a fund out of Connecticut, and agreed to create a new fund with a lot of the Aberdeen assets going into it. So we put a lot of the assets into this fund, and essentially Landmark bought them from us for cash, but allowed us to manage the assets. So we have in there some coal assets, some gold and several other companies. We're slowly liquidating them and building a track record that could help us raise similar funds in the future.

One of the reasons, if you saw the recent change we made with the acting CEO, was because we felt that David Stein is well qualified to run this small fund. The fund assets sit at about $10 million now, but we think that over the next two years we could take it to a much higher value. So those are the three main assets within Aberdeen.

Dr. Allen Alper: Wow! That sounds great. Could you elaborate on the two major projects you have. Why is it so important, and what your plans are for them?

Mr. Stan Bharti: The main asset, African Thunder, is in South Africa. It's platinum-palladium. It's in the East end of the main platinum belt. We think this asset has significant upside potential. It's reinforced by the fact that Pala, one of the largest resource funds in the world out of Europe, came in and invested with us and took 50% of the project.

The main mine is called Smokey Hills. The mine was in operation until April of this year. With metal prices falling we decided to put it on standby. We're now coming up with a new plan to reactivate it in the beginning of 2017. We also brought in a new CEO, Brett Richards, who used to be CEO of Avocet. A knowledgeable impressive guy, he's running the company. Pala and Aberdeen are willing to put more finds behind it with the objective of taking it public by the end of this year.

The lithium space is hot, as you know. There are two things we see with lithium. One is that we have the largest resource and the most advanced resource of any company in the world. It's similar to solution mining. The infrastructure is easy to access. Everything is ready to go. The new team is run by Paul Matysek, a geologist with big successes over the last ten years in many companies. A very knowledgeable guy, he's running the company as the chairman. He believes that lithium is going to grow. Companies like Lithium X are on this path. The market cap on Lithium X, I think, is already well over $100 million.

We're very positive on that. Next they’ll do the maximum feasibility study. They're very close to announcing a deal for all the capital that's required to put it into production. Then they're going to put the mine into production. We feel lithium is exciting for obvious reasons. The world is moving away from fossil fuels into safer, more secure, renewable energy and using batteries. We've already had discussions with several major car manufacturers about this asset, and we will continue to do so.

We think they are both world-class assets that over the next two or three years, in a good market, will unlock substantial value for Aberdeen.

Dr. Allen Alper: That sounds great. It sounds like you are very well positioned with a growing lithium market, and well positioned with platinum and palladium in South Africa.

Tell me a little bit more about your plans with Lithium X. I think you plan to put it into pilot production by the end of 2016. Is that correct?

Mr. Stan Bharti: I think we should talk to Paul Matysek and get the detailed plans because I'm not part of the management of Lithium X. The plan is, by the end of this year, early next year, to really take this company to the next phase. They're working hard to get the capital lined up, but most of the permits, the feasibility is getting close to being done. So a lot of things are happening in the company, but I would encourage you to have a separate story on Lithium X with Paul Matysek. But, if you look at the valuation of the company with lithium, Lithium X is still undervalued compared to most of its peers. So significant upside going forward!

Dr. Allen Alper: That sounds very good. I'll do that. I'll follow up.

I know you have a very, very impressive background. Could you update our readers, on your background, your team, and your board?

Mr. Stan Bharti: Let me back up a little bit and tell you about Forbes and Manhattan. Forbes and Manhattan is a merchant bank that I started in 2001 at the bottom of the last resource cycle, where I thought that resources are coming back and we should create a merchant bank that would not just invest in resource companies, but also manage them. Because one of the challenges that junior companies have, is being able to create big assets and big companies out of them. The reason they have difficulty doing that is they're often tight on capital, tight on management, and they outsource a lot of the work.

Our model was that we find junior companies, good projects, put capital in on the condition that we can manage and operate these mines. Because I'm a mining engineer by background, I ended up with a finance degree, and a master's in engineering from Moscow and the University of London. I worked for one of the largest mining companies in the world, Falconbridge which is now Glencore, as a senior executive. The last 20 years, I've been in mining markets. I started my own consulting company and then I started building companies in the public market.

In 2001 I thought, "There are so many good junior companies, with very good projects, but either weak management or they lack capital, or they don't have the full spectrum in the public space to operate. Because operating in the public market isn't just about having a good asset and building it. It's about dealing with the regulators. It's about having good lawyers. It's about having good PR, IR. It's about knowing how capital structure and markets work. It's learning how to bring in good funds and building an asset is just a part of it. It's not all of it. Companies expect, "We have a project and we build it, somehow the stock will go higher." It doesn't always happen.

Sometimes we see in the market place where companies that don't have good assets will outperform somebody that does have good assets. It's because of the whole package of how you market the company, how you deal with the regulators, the board composition, the securities, and also the corporate governance is very important. So we bring all that to the table to make sure that a junior company can operate like a major without the overhead by making sure, in our shop, they have access to good lawyers, good accountants, good IR/PR people, good capital markets expertise, so that the CEO of the company, who is a geologist or engineer, has this depth and can feel that he can deal with the public markets effectively. That's our background, who we are and how this model evolved.

Dr. Allen Alper: Could you highlight some of the accomplishments of Forbes and Manhattan?

Mr. Stan Bharti: We probably have more successes than most juniors. The only group that has done extremely well, that I envy, and a good friend of mine is Lukas Lundin and his Lundin Group of Companies. His group has done extremely well. But if you look at our successes, they stand on their own.

We started Desert Sun, a company with a gold mine in Brazil, with $2 million and we sold it to Yamana for $715 million, five years later. We've had several subsequent successes. Consolidated Thompson, we started with $5 million and sold for $5 billion to Cleveland-Cliffs. Avion, we bought this company which is the Tabakoto mine in Mali, for $20 million dollars from Nevsun, and sold it to Endeavor for over half a billion dollars. Sulliden, two years ago, which was a company we put $5 to $6 million dollars into, had a $20 million valuation and sold it last year to Rio Alto for $400 or $500 million, which became Tahoe. And if we held the shares of Sulliden today it would be like a $1 billion valuation. B2Gold was created on the back of Central Gold, which is our company that we started in Nicaragua and Honduras, and in Central America. That was the foundation for B2Gold. Then we had Allana, we sold two years ago, it's a potash company in Ethiopia. We started that in 05, we sold it to ICL, one of the largest potash producers in Europe, Israeli company, for $400 million.

So every year, two years, we've had a good success in selling assets, and the reason is simple. We find good assets. We work them. We work them for three to five years and unlock value. Because, like I've said before, anybody can buy a good asset for a billion dollars or ten billion dollars. That's not difficult. But to buy undervalued assets, to put in the engineering, the time, the effort, the operational expertise to unlock it and then sell it, gives a much bigger return to the shareholders. Like I said, the only group I know that has done extremely well in this space with the same model and a much higher level, is The Lundin Group of Companies

Dr. Allen Alper: That sounds like an excellent record that Forbes and Manhattan has had under your leadership. Could you tell me a little bit more about the capital structure of Aberdeen?

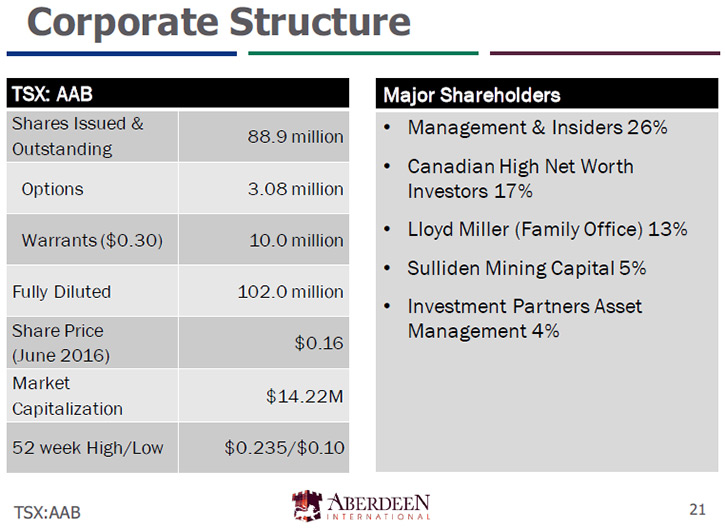

Mr. Stan Bharti: Yes. We have about 90 million shares outstanding. I'm the largest individual shareholder. Management, and some of the insiders, friends and family, have 30% to 40% of the company, and we have one or two firms that own the rest. So it's fairly tightly held. Unfortunately the weakness Aberdeen has is, in a good resource market, particularly gold, the stock outperforms the net-asset value. In a bad market, it under-performs net-asset value. We're trading at .2, .3 times net-asset value, and when the market is good companies like ours trade at two times net-asset value. So we think that in 2017, 2018 with gold coming back, Aberdeen can certainly perform much better.

Dr. Allen Alper: That sounds very good. Could you summarize the main reasons investors should invest in your company?

Mr. Stan Bharti: Listen, I mean the answer is very simple. If you believe in precious metals, and lithium, if you believe in a good management team, and if you believe that we're on the cusp of the second bull market, the first one we saw in 02, in the last decade or so, the second one is I think starting. If you believe that, then one of the cheapest stocks in the market today is Aberdeen. Because I see a 5x to 10x upside here over the next two or three years with metals performing. And don't forget, with the cash we have in the company, we can also do other deals. And we're actively looking to invest strategically in the next Belo Sun, in the next Sulliden, in the next Desert Sun. We want to find these companies, just like we found Desert Sun. Put money in, and then build them.

Aberdeen is in an enviable position. We have a good management team, we have the capital, and we have the expertise.

Dr. Allen Alper: That sounds great. Sounds like ample reason investors would invest in Aberdeen.

Stan, is there anything else that you'd like to add?

Mr. Stan Bharti: Like all junior companies, Aberdeen has gone through a tough time in the last two or three years. We've had to handhold a lot of our shareholders. We had a proxy battle about a year and half ago, that we had to deal with, which was painful and expensive. But I think we're truly through the tunnel now. We see the sun, and we're ready to go take this company to the next level. That's one of the reasons I've agreed to step up as the acting CEO in this company until we can find the right leader to take it to the next level.

Dr. Allen Alper: That's sounds very good.

http://www.aberdeeninternational.ca/

Aberdeen International Inc. Head Office:

65 Queen Street West

Suite 815, P.O. Box 75

Toronto, Ontario M5H 2M5

Investor Contacts:

David Stein

Director

416-861-5812

dstein@aberdeeninternational.ca

|

|