Brooke Macdonald, President and CEO of Cornerstone Capital Resources (TSXV: CGP, F: GWN, B: GWN, OTC-CTNXF): a Prospect Generator Following the Joint Venture Model with a Diversified Portfolio of Projects in Ecuador

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/7/2016

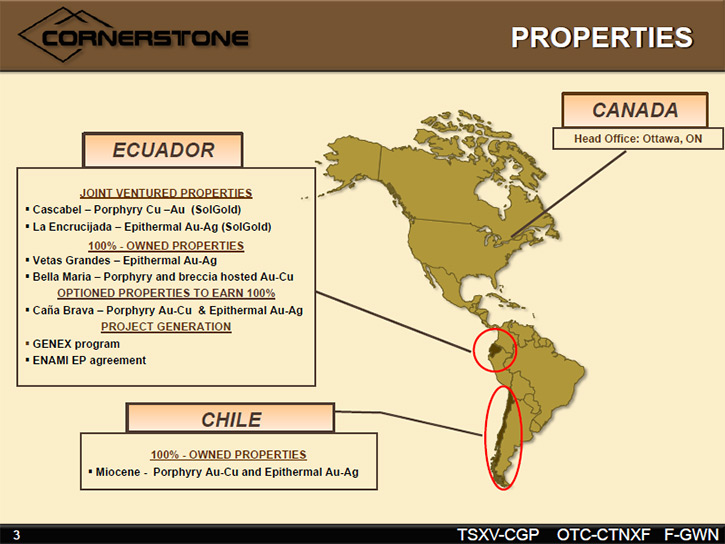

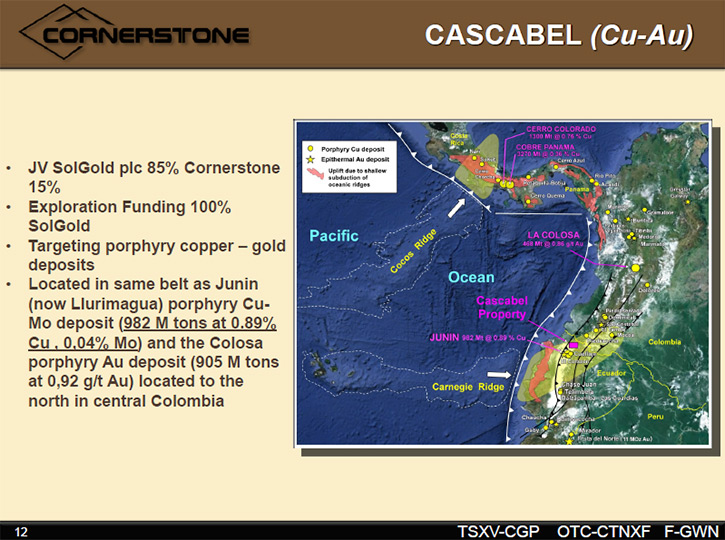

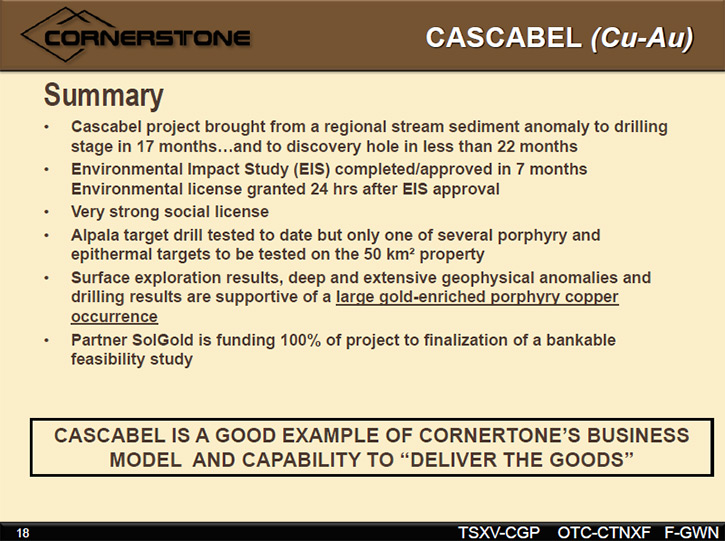

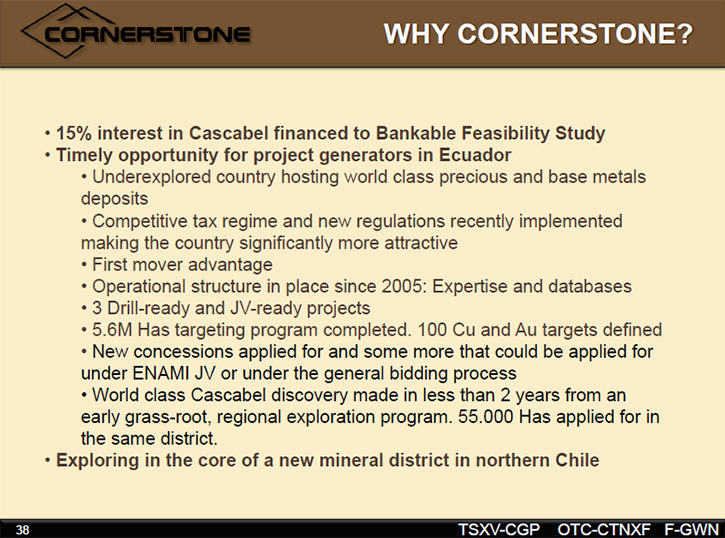

Cornerstone Capital Resources Inc. (TSXV: CGP, F: GWN, B: GWN, OTC-CTNXF) is a mineral exploration company and a prospect generator following the joint venture model with a diversified portfolio of projects in Ecuador and Chile. The anchor in the company right now is the 15% interest in a property in Ecuador called Cascabel that has the potential to become a very large gold enriched copper porphyry deposit. The operator of the project, an Australian company called SolGold, has announced it is putting together the first inferred resource toward the end of the year. According to Brooke Macdonald, President and CEO of Cornerstone, deposits like Cascabel are very hard to find, and has already attracted the interest of major mining companies. We learned from Mr. Macdonald that Ecuador is the last under-explored part of the Andes and likely to be the place where large deposits are discovered in the near future at lower cost than in other places. Cornerstone entered into a strategic alliance with ENAMI EP of Ecuador, the state mining company, in order to explore for new areas together. In addition to Cascabel, Cornerstone owns several properties in Ecuador that are drill ready, and an early stage gold-silver-copper property called Miocene in Chile. The company is well funded with enough money to last several years without going back to the market.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News interviewing Brooke Macdonald, president and CEO or Cornerstone Capital Resources Inc. (TSX VENTURE:CGP)(FRANKFURT:GWN)(BERLIN:GWN)(OTCBB:CTNXF). Brooke, could you tell me a little bit about your company and what differentiates it from other companies?

Mr. Brooke Macdonald: Sure. Thank you, Allen, for interviewing me. Cornerstone is a prospect generator following the joint venture model. It started in Newfoundland back in 1999. In the last 4 or 5 years, we've gotten out of Newfoundland and re-focused the company on gold and copper deposits in Ecuador where we have been since 2005 and, to a lesser extent, Chile. The anchor in the company right now is a 15% interest in what we think will become a very large gold enriched copper porphyry deposit in northern Ecuador, called Cascabel.

The operator of the project is an Australian company called SolGold Plc. They're listed on AIM in London. Cascabel has had 18 holes drilled on it, five returning assays of over one kilometer of over 1% copper equivalent, with much higher grades on included intercepts. And this is just on the first prospect or target drilled called Alpala. Cascabel has, to date, 14 targets on it, most of them porphyry targets. There is at least one epithermal target on it. It's a very exciting deposit. We're hoping this really puts Ecuador on the mining map.

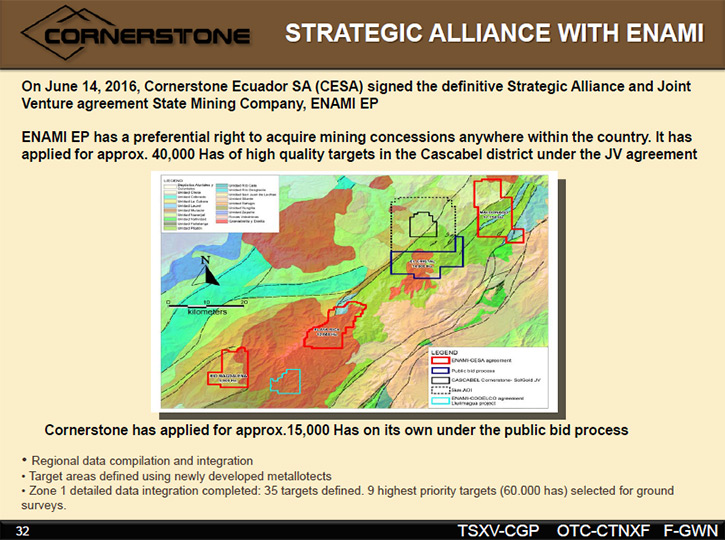

Also, we have a strategic alliance with ENAMI of Ecuador, which is the state mining company, in order to explore for new areas together.

We're hoping to find another Cascabel and then find a JV partner to drill that one. We also have 3 other properties in Ecuador that are drill ready, Vetas Grandes, Bella Maria, and Caña Brava. They're on our website, but I won't go into to detail about them because really the thing that all the investors are interested in these days is Cascabel, where we've got the 15% interest that's financed through the completion of a bankable feasibility study.

SolGold is putting together a maiden inferred resource toward the end of the year. If Cascabel is eventually drilled off and built, it will likely end up a block cave mine operation, because much of the deposit is deep. There may be some areas closer to surface that might be open-pittable but it's still too early to tell.

Dr. Allen Alper: That sounds very good. Could you tell me a little bit more about what's happening in Chile?

Mr. Brooke Macdonald: Yes. In Chile, we have an early stage property called Miocene. It's located in the Atacama region and we're targeting epithermal gold, silver and porphyry gold copper deposits. It is north of the Maricunga belt and it is quite close to some exploration being done by Yamana Gold and Mirasol Resources. This is early stage work, and we're looking for a partner to bring that one forward.

Most of the action today is in Ecuador. That's really the center of gravity of the company right now.

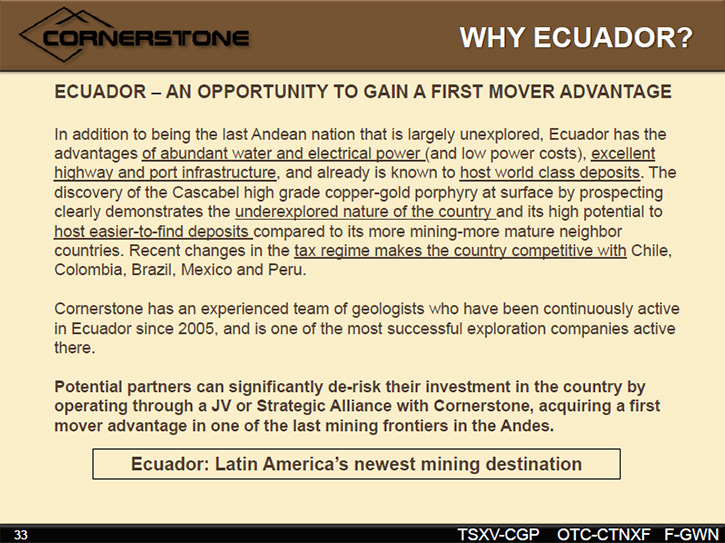

I'll just add for people that aren't familiar with Ecuador. Ecuador is the last under-explored part of the Andes. There are a string of large deposits that begin in Panama and go down through Colombia and then start up again in Peru and into Chile. There have been some major discoveries. There's the Mirador copper project that is under construction in southern Ecuador. There's Lundin Gold's Fruta Del Norte gold project in southeastern Ecuador and they have completed a positive feasibility study on that. There is INV Metals Llurimagua project which was formerly called Quimsacocha and was formerly a project of IAMGOLD. INV has recently come out with a positive pre-feasibility study.

There are a lot of things happening in Ecuador. A lot of companies are looking around again for projects. We think that Ecuador's going to be the place where large deposits are discovered in the near future at lower cost than in other places.

Dr. Allen Alper: That sounds excellent. Could you tell me a bit how it is operating in Ecuador? I know there have been changes there, improvements.

Mr. Brooke Macdonald: Ecuador got a bad name because of the 2008 moratorium on mining when there was some speculation going on in the country and the new government at the time of President Rafael Correa decided it was going to suspend all of the exploration work. While they eventually adopted a new and fairly clear mining law regulations, the process took a lot longer than mining companies had hoped it would, and it was only at the PDAC Convention in March 2016 in Toronto that the government announced the re-opening of many new areas to application for concessions.

A couple of years ago, the government hired the international consulting firm Wood Mackenzie to advise it on how to lower the tax burden to make Ecuador a more competitive destination. The government, together with Wood Mackenzie, also rolled all this out at the last PDAC.

They basically showed that Ecuador has a comparable tax burden for mining projects with Mexico, Colombia, Brazil, Chile and Peru. It's not the lowest, but it's not the highest. There are some operating advantages there. The power is cheaper in Ecuador and they're building a number of run of river power projects. They're going to be exporting power in a few years. There's excellent highway infrastructure and in the case of the Cascabel project, there's a 2 lane highway that goes right up to the project and an old railway line that crosses the project and could be rehabilitated to take concentrates to a port on the Pacific.

Dr. Allen Alper: That sounds very good. I know you have an extensive and strong legal background, a mining background. Could you tell us more about your background and your team?

Mr. Brooke Macdonald: Yes. My background is with mining- option joint venture agreements in Latin America. I went to law school in Ontario, got admitted to practice in British Columbia, and then worked as a foreign investment lawyer with Baker McKenzie in Caracas, Venezuela in the 1980s for several years, before joining the Placer Dome legal department in Vancouver in 1989. I worked on Placer Dome’s first projects in Chile, including the financing for the La Coipa gold silver mine. Later I became the in-house lawyer for Latin America Exploration at a time when Placer was spending about $100 million a year in the world on exploration, 60% of it in Latin America. We had lots of deals going on in lots of different countries.

Our VP Exploration and Qualified Person is Yvan Crepeau, P.Geo. Yvan has been with us based in Ecuador since 2006 and before that worked with Cambior in Chile and Peru. Yvan has two senior Ecuadorean geologists reporting to him currently.

Our CFO, Sabino Di Paola is in Ottawa. There's not a lot of overhead. We're pretty nimble when it comes to doing deals. We acquired Cascabel in March 2011 from a company that had given up on Ecuador at the time and was leaving. Yvan identified the opportunity, the Board agreed, and so we acquired it for a nominal $20,000 cash plus about $60,000 worth of legal due diligence because we bought shares instead of the concession. By buying shares we were not required to get separate approvals to transfer the mineral rights or each individual permit. So for $80,000 we got, what we think could end up being one of the top top 20 gold enriched copper porphyries in the world. Yvan and his team then took the project from a stream sediment anomaly to permitted for drilling in just under two years.

Dr. Allen Alper: That's fantastic. That's amazing. It's really great. You really used your background in that negotiation and purchase and your geological team to pick the right property. Could you tell me a little bit about your share structure and financing?

Mr. Brooke Macdonald: We have about $3.5 million Canadian in the bank, about 285 million shares, 12 million options and 137 million warrants outstanding. We have sufficient funds to acquire and do basic early stage work under the ENAMI JV and on our own.

We want to try and replicate our success at Cascabel, finding some new areas. We think Ecuador is going to be hot again. Probably in 2017, when more mid-sized companies are able to raise more money on the markets, they will come looking for drill-ready properties. I think that we are well positioned going forward. We have enough money to last us several years now without going back to the market.

I think we're in a position now to get back to our regular model of finding the prospects, taking 12 to 18 months with them to identify the coincident anomalies defining the drill targets and then interesting a partner to come in, reimburse us for some of that cost, and then take over and hire us to do the work at a cost plus arrangement. That's what we're hoping to get back to in 2017. We're hoping to replicate the success at Cascabel.

Dr. Allen Alper: That sounds excellent. Could you tell me the primary reasons high-net-worth investors should invest in your company?

Mr. Brooke Macdonald: At our share price levels now, 5 or 6 cents a share, there is a lot of upside in Cornerstone. The share price should go up just when the market comes back because the company has Cascabel that at some point is going to catch the attention of corporate development people at the major mining companies. As you know, Allen, many companies are producing more gold and copper than they are replacing through new acquisitions and exploration. Deposits like Cascabel are very hard to find. Cascabel may have so many targets on it once it's all drilled off that the economies of scale of producing there may just be very attractive to a large company.

Dr. Allen Alper: That sounds very good.

Mr. Brooke Macdonald: No, I think that's it. We've applied for 3 new areas under the strategic alliance with ENAMI and we're hoping that in the next several months, ENAMI is able to obtain the concessions for that from the Ministry of Mining. We're looking forward to finding some new, interesting deposits in this last and most under-explored country in the Andes.

Dr. Allen Alper: That sounds very good and very promising. You have done a brilliant job, using your background, picking a great geological team and the right property. It looks like you're well positioned to go forward with your plan.

Cornerstone Capital Resources Inc.

5460 Canotek Road, Unit 99

Ottawa, ON

Canada K1J 9G9

Email: ir@cornerstoneresources.ca

Website: http://cornerstoneresources.com

You should not place undue reliance on forward-looking statements in this article. There are always risks and uncertainties in any business venture. Words such as "will," "anticipates," "believes," "plans," "goal," "expects," "future," "intends," and similar expressions may be used to identify these forward-looking statements. There are always important factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. This article does not constitute an offer to sell, or the solicitation of an offer to buy, any securities.

|

|