Steve Houghton, CEO of Cerro Grande Mining Corporation (CSE: CEG): (OTCQB: CEGMF) Gold and Copper Mining Company with Properties in Chile

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/3/2016

Cerro Grande Mining Corporation (CSE: CEG) (OTCQB: CEGMF) is a gold and copper mining

company with properties in Chile. It´s 100% owned, producing Pimenton mine has been operating

for the last eight years at about 110 tons per day producing up to 15,000 ounces of gold a

year. The mine has been shut down since June 2nd due to snowstorms. According to Steve

Houghton, CEO of Cerro Grande Mining, the company needs about $3 million to restart the mine

and is actively looking for funds. The mine is totally permitted and ready to start producing

within about two weeks after raising the funds. The projected free cash flow in the first year

should be close to $750,000 a month. The company has just received its updated NI 43-101

dated July 21, 2016 prepared by Watts, Griffis& McOuat, Toronto, Ontario, Canada.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News interviewing Steve Houghton, CEO of Cerro Grande Mining Corporation. Could you tell me a bit about your company, your resources, your mine in Chile and your plans for the year?

Mr. Steve Houghton: On June 2nd, 3rd and 4th, we had a snow storm that dropped about 3.14 meters or 10.5 feet of snow. We closed the mine down because of the snow. We kept the men up at the mine. During the time that the mine was shut and were in the process of opening up the road, we quickly ran out of cash flow, and working capital for the Pimenton Mine. We made the decision, because another snow storm was forecasted the following weekend, to take the men out of the mine. We took the men out of the mine on our Pistenbullies, German track machines that carries about 20 men. It has a bulldozer blade on the front so that you can cut through the snow. We evacuated the mine totally in anticipation of the additional snowstorm. The mine has remained closed since that date.

We have just completed an updated 43-101 technical report by Watts, Griffis in Toronto, Canada. The Watts, Griffis report shows 44,000 measured tons grading 15.4 grams gold per ton and 1.4% copper per ton and indicated tons of 36,000 tons grading 10 Au g/t and 1.0% Cu % per tons and 14,000 tons of inferred grading 9.7 Au g/t and 1.0% Cu per ton.

The report further states “Based on past performance, the Pimenton Mine life is likely to be prolonged. Initial continuation will be by definition of reserves from inferred resources at the Monica vein and exploration of the expected vein presence for approximately 350 m of vertical extent to surface. There is potential to expand the inferred resources considerably at this site as well as to find new veins. MMI Sampling has covered the alteration area surrounding the Pimenton Mine and outlined a gold geochemical anomaly 1,100 m by 600 m in extent. Coupled with satellite imagery, CEG has identified sixteen possible targets for trenching at surface or drilling from underground. A target of particular promise is at the western limit of a strong part of the MMI anomaly where strongly leached vein material had in the past reported 3.2 g Au/t over 2m. In WGM´s opinion, this exploration should be undertaken when funding is available ahead of any other exploration on the properties”.

The history is, I formed the company back some 20 years ago. We had our first public offering through Nesbitt Burns. In about 1995-1996, gold prices were very low, but we continued to work on Pimenton. We acquired Pimenton by virtue of an earn-in. We'd up to 53% earn-in. Then when we did the IPO with Nesbitt Burns, they insisted that we own 100% of Pimenton. We did an exchange of stock with the then two owners of Pimenton, who were David Thomson, who's our Exploration Manager, and Mario Hernandez.

We got 100% control of the Pimenton mine. We continued to develop it. We had a small pilot plant of 35 tons a day. We never declared commercial production. Then we got a loan from Overseas Private Investment Corporation, an agency of the U.S. Government in Washington D.C. in 2006 and we went into full operation at about 110 tons per day. We started to advance further on the veins at Pimenton. We encountered about seven different veins as we got farther into the mountain. Then we had a snowstorm which was the year of El Nino. We had about 7 meters of snow in about a week's time. That shut the mine down. We were just beginning to learn about how to handle really deep snow. But the mine was shut down and we lost a lot of the installation facilities at the mine. The mine remained closed down from 2006 until about 2009.

Then gold prices recovered. We got some additional financing to reopen the Pimenton mine. The mine has been operating for the last eight years at about 110 tons per day. That was giving us the equivalent of about up to 15,000 ounces of gold a year. Then about a year ago, we hit a flat fault zone in our primary Lucho vein. It had consistently been giving us about 12 to 14 grams of gold per ton and about 1% copper to 1.5% copper. It went down to a grade of about 6 grams per ton.

We kept the mine open but we were sort of living hand to mouth. We started doing more exploration in drifting and drilling. We were able to come up with the Monica vein which looks like it's a very strong vein and could replace the Lucho vein. Then we got hit with the snowstorm. At the time we got hit by the snowstorm, we had started work on the Monica vein. We decided to concentrate our efforts on the Monica vein and in preparing a pillar removal plan.

Right now, we're talking with the investors about the potential of coming in. We need about 3 million to open up the mine in satisfactory form. The mine is totally permitted. We have access to our own water supply which we actually get out of the mine. The plan is ready. We can have the mine and the plant and the whole operation up in about two weeks when we get financing. Now we're out in the market looking for financing. We're using Watts, Griffis again who did our first mine reserve report back in 2013. We started the updated mine report on about the 10th of June.

Dr. Allen Alper: Now, could you repeat how much funding you need to go forward with the mine?

Mr. Steve Houghton: Yes, about $3 million to be going forward comfortably. What that $3 million would be used for, it will be $1 million to pay down past due creditors which had built up and then we'd be totally out of debt. Number two, about 1million dollars would be used to pay the back wages of workers due to the mine shutdown. Then we would have a million to a million dollars for working capital which will enable us to continue to develop the mine further at a more rapid pace. The grade that we are getting consistently on Monica is between 9 and 10 grams and 1% copper.

Dr. Allen Alper: Once you have these funding, what do you expect your cash flow will be?

Mr. Steve Houghton: Our Free cash flow in the first year, because we'll be taking 50% from pillars and 50% from Monica, should be close to $750,000 a month.

At an all in mining cost of about $900 and a cash cost per ounce of near $760 per ounce.

Dr. Allen Alper: Once you do you see the funds, what is the timing on this?

Mr. Steve Houghton: Well, immediately because the mine is totally permitted, ready to go. We would be in production within 10 days. The cash flow stream would be at full strength within 10 weeks. 50% of the production is in Dore that is paid for in full within two weeks and the other 50% is in a Copper concentrate that is paid 50% within a week and the rest over two months.

Dr. Allen Alper: That sounds great.

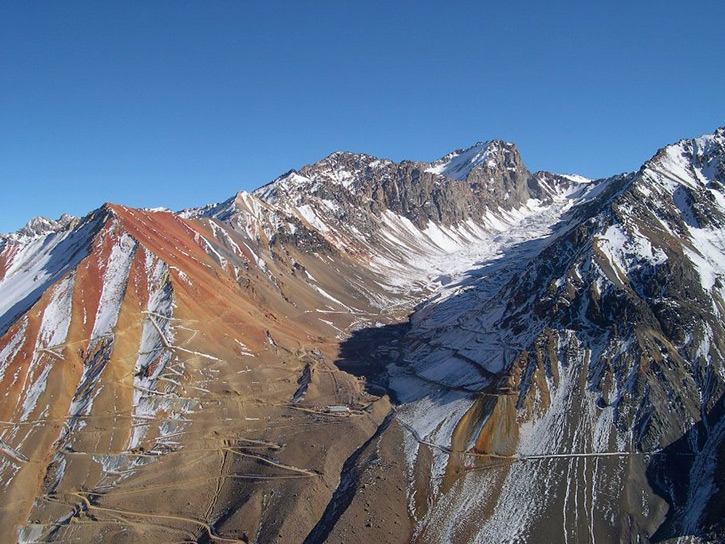

Mr. Steve Houghton: There's an 80 kilometer road into the mine, about 40 or 50 kilometers of which are in the high cordillera at 3,500 meters. We get a lot of snow up there in the winter time. We have three avalanche experts, who come from the United States down to Chile during the summer season in the United States, which is the winter season here in Chile because we're on the opposite side of the equator. We have several avalanche guns, run by nitrogen. During a snow storm, we're continually shooting down any snow drifts that build up. We have two Pistenbullies, four frontend loaders plus three tracked BV206 personnel carriers that are made in Sweden. We can do the shift changes very easily during snowstorms. We're not impacted now like we were back in 2006.

Dr. Allen Alper: By the way, I also help companies get funding. It’s all very confidential. If you’re interested let me know.

Mr. Steve Houghton: Thank you. One thing that I have not mentioned is that Pimenton is in the porphyry copper belt of Chile. We have Andina mine which is about 55 kilometers for the South and then we have Los Pelambres which is about 80 kilometers to the north of us. We have Los Bronces which is 73 kilometers to the South west of us. We're right in the heart of the porphyry copper belt. Rio Tinto put down five holes and then Anglo-American came in and they drilled only two holes, really just to reprove what Rio Tinto had proven up.

We have a geological report written by Rio Tinto on one of the Porphyry targets, which has the potential of 400 million tons, grading 0.4% copper and .43grams of gold. If you convert the gold they say is there and convert those into gold ounces, you'd get about 5 million ounces. But on a vein mine, you're never going to have more than about two or three years of reserves because you cannot afford to drill and explore for veins beyond that.

We also have developed our in house diamond drilling capability. We have two electric drills we purchased, and later upgraded, from Ingetrol drilling, the smaller rig is used for vein exploration and can drill to 300m while the larger rig can reach 1000m. With the experience we learned from running our own rigs, we built our own drill rig, capable of drilling over 1200m. Our drill costs are far below the costs of contract drillers. The small rigs costs are below US$50/m while the larger units have a cost below US$100/m all inclusive.

Dr. Allen Alper: Could you tell me a bit more about your background and your team.

Mr. Steve Houghton: My team is made up of David Thomson, Executive Vice President, Director of Exploration and the Director of the company. David is really responsible for having discovered the Maricunga gold district here in Chile. His first really big success here in Chile with the discovery of the El Indio mine, a mine which was discovered under the leadership of Jack Duncan then Chairman and CEO of St. Joe Minerals Company. Jack had retired from St. Joe Minerals. I knew him through the oil business because St. Joe had some Canadian oil properties in Canada. Through those, I knew who he was but I actually didn't connect that he was going to be retired. But I hired Bill Breeding, a placer geologist in 1992 to come down to Chile. He knew placer deposits very, very well and had worked for St. Joe Minerals when St. Joe had one or two dredges operating in Bolivia. At any rate, he looked at the placer prospect that we were looking at the time. He liked it. If you look on the history books or on the website, Bill Breeding was really an expert in gold placer.

But at any rate, on the airplane back from Santiago to New York, he said, "Listen, there's a guy I want you to meet. I know him very well. Your personalities would get along well and that name is Jack Duncan. He's the former Chairman and CEO of the Board of Directors at St. Joe's." At any rate, he introduced me to Jack Duncan. I persuaded Jack that I was active in South America and I had hired or engaged David Thomson and his partner, Mario Hernandez. He said, "My gosh, David Thomson discovered El Indio for me. You mean you've tied up with him?" I said, "Yes, I have."

One thing lead to another and I said how much of South American Gold and Copper Company which was the name of the company at that time do you want?" He said, "I'll take 25%." I said, "Okay, I'll fund the balance of the 75%." Jack and I worked together providing exploration funds for David Thompson and Mario Hernandez. Another person that we brought on the Board was the former chairman and CEO of Newmont Mining Company, Plato Malozemoff and then we got Paul Douglas, who had been President and CEO of Freeport Minerals Company. We had a stellar Board of Directors and then we went public through Nesbitt Burns. Mario Hernandez was one of the original El Indio Mine owners at one time when it was just a prospect. David Thomson and Mario Hernandez are very well-known in the mining industry for Chile and very highly respected.

My background - I started off working for Morgan Guaranty Trust Company. Then I got involved with the oil business. I left Morgan Guaranty. I went into the investment banking business. Then eventually I formed my own firm, Houghton & Company in the investment banking business and raised money for small to medium sized companies in the oil business. In 1990, the oil price was going up $10 or $6 or $7 a barrel one day, down $10 a barrel the next day. You were just fighting that situation.

Then I went to Oklahoma City and ran a company by the name of Hadson Petroleum Corporation. When I joined Hadson, it had revenues of about $16 million. It was an OTC Company. Eventually I built it up to a company that had $970 million in revenues and diversified the company into the natural gas distribution business and then took it public, I mean, took it from the OTC market to the New York stock exchange. Then I resigned from that Company for personal reasons. I decided I would try the mining business because I made a small investment in a small mining company which was a semi-public company. I had made about a half million dollars in that deal by putting up additional working capital. I always remember that particular incidence. That's what got me involved in mining. I traveled to Bolivia, Honduras, Guatemala searching for what I thought was a good province, a good state to set up a business. I landed in Chile. That's my story.

Dr. Allen Alper: By the way, this is just a side, are you related to the Houghtons from Corning or not?

Mr. Steve Houghton: Not directly. Indirectly. Arthur Houghton caught up with my Dad. One of the things that I should have mentioned is my dad was a distributor for Caterpillar Tractor Company, in the state of Maine. When he and my mother were in Florida on vacation, he got a message from the hotel manager, "A fellow by the name of Arthur Houghton would like to meet with you." My Dad agreed to meet with him. He was working on the Houghton family tree at the time. It turned out that there were various branches of the Houghton family and mine went to the Midwest. When I graduated from the University of Pennsylvania, I decided not to apply to Corning Glass for a job.

Dr. Allen Alper: That’s interesting. I worked for Corning once. I was research manager. I knew the Houghtons very well. My wife’s great uncle lived in the Midwest and was a friend of Amery Houghton, Arthur’s brother. When he came to the Corning area to visit his sister and the family, he and Amery would always get together.

Mr. Steve Houghton: Small world. It's a great company.

Dr. Allen Alper: Yeah, it is. I really enjoyed working for it. I got a lot of patents on refractories and ceramics.

http://www.cegmining.com/

Cerro Grande Mining Corporation

Avenida Santa María 2224, Providencia

Santiago - Chile (7520426)

ceg@cegmining.com

Tel : 56 2 25696224

|

|