Discussion with the Management of Scheelite Metals LLC. Looking for Financing to Create a World Class Tungsten Mine in the United States

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/2/2016

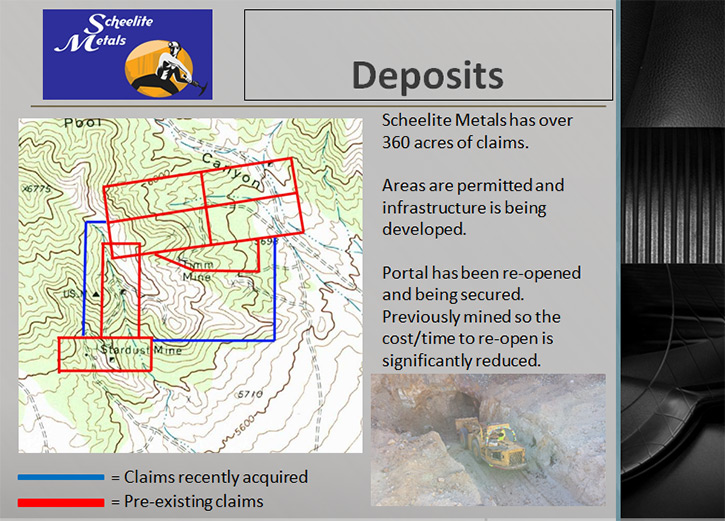

We interviewed the management team of Scheelite Metals LLC., who is positioned to create a world class tungsten mine in the United States. They have a huge orebody with over 44 miles of tungsten outcroppings. Scheelite Metals, with minimal investment, has progressed the mine to the point where a relatively small investment of 12.5 million dollars will bring the mine to a 500 ton per day production capacity. This is a golden opportunity for investors to get in on the ground floor, where in 1-2 years, this mine can be virtually untouchable from any external market. Scheelite Metals is positioned to be a highly profitable operation with minimal operational cost and it will be a serious market player here in the United States.

Scheelite Metals Mine and Mill

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing the management of Scheelite Metals. Please describe your company's focus, plans and why it makes sense for high-net-worth investors to invest in Scheelite Metals.

Christopher W. Kolb: Scheelite Metals is a golden opportunity. The concentrates found in this mine are such high grade that it almost makes it immune to market shake up. Even if the Chinese wanted to push this mine out of the market, it'd be very difficult for them without hurting themselves as well. The concentration of Scheelite ore in this body has such a huge potential. From our perspective, it is limitless.

At the entrance level of where someone could invest in something like this, based on comparisons that have been done on a global basis, it's extraordinarily cheap. I believe the value has been bounced around at about 25 million dollars, which is virtually nothing compared to what the likes of HC Stark, Sandvik, Kennametal and Osram have spent on investments in mine operations. It is the only operating mine in North America. Its potential is limitless. For the first time in my personal experience, there are customers lined up, while we're still struggling to get product to the street because of a lack of capital. This is despite the fact that the people at Scheelite have done a phenomenal job of getting to where they are on virtually a shoestring budget. I think anyone, who has knowledge of mines and operations, would be extremely impressed with what these people have accomplished with so little funds.

I think it's a golden opportunity to get in on the ground floor, properly capitalized, this mine will be virtually untouchable from any external market position whatsoever. Scheelite Metals will be a very, very profitable operation at a minimal cost per MTU and it will be a serious market player here in the United States. It's a golden opportunity. Yes, it's rough right now. There's no question about that, but this is a diamond that will be polished very quickly, very inexpensively compared to other operations. It can make an immediate impact. That's pretty much it in a nutshell.

Harold Frederick: Very well put, Chris.

Dr. Allen Alper: Chris could you give your full name and your position in the company?

Christopher W. Kolb: My name is Christopher W. Kolb. I am the managing member of Carbide Concepts, which has signed a contract to be the sales and distribution branch of Scheelite Metals. Neither I personally, nor is Carbide Concepts, a shareholder. We're nothing but the sales division of Scheelite Metals.

Dr. Allen Alper: Thank you. Who would like to talk about the grade, the type of mineral, the resource, and the area it's in, in Utah? Also someone should explain about tungsten and its strategic importance, for our readers who aren’t familiar with it.

Harold Frederick: Jon, I think you should probably give Al a little bit of the history on this project. Why you selected the mill site that you did. Give the history of this mining area.

Jon Rush: Sure. My name's Jon Rush. They call me Mucker. I've been mining lead, silver, zinc, copper, gold and coal for around 30 years. I have been in the industry for a long time and I ended up out here on Gold Hill. I was mining gold and ended my gold mining days after finding a deposit of 800 ounces to 1,200 ounces. Owner dies and I get into tungsten. Gold Hill's an unusual place, because it's a land of everything. It's like Mother Nature stirred it all up with an egg beater and just dropped it in this one basin. There is a current gold operation happening over there.

Thus far, we have found powellite in our tungsten vein. Myself and my geologist, Burt Thomas Clark, whose been with me for 25 years, and worked for Kennecott and several other companies and for me as my manager at Deer Trail mine for 20 years. He has done all of my geology work there. He's a dang good geologist. Newmont is also on our mountain right now looking for gold. They've been quick claiming back all of the tungsten property to us. We have about 40 miles of exfoliated contact quartz, granite contact of the seam of the ore. We have been core drilling down below, ahead of where we are drilling. We just started mining and we're going through a fault right now, moving back on to the Timm's ore body. The grades have shot 48.2% W, per crystal down to 22.89% W per crystal. The assay over all runs from 16 percent down to 1.44 percent WO3.

Dr. Allen Alper: Could you tell me a little about your mill and flotation facilities, also your concentrate.

Jon Rush: We crush the ore down with a primary cone crusher. We crush it to about an inch and then we crush it again, down to 30 mesh. It has to pass the 30 mesh classification to get up to the six shooter. We call it the six shooter, because that delivers the ore to the six tables. Then it's cut three ways: waste, mids and highs. Mids go to regrind. Highs go to a secondary table, a triple deck, where it goes through three more layers of cleaning.

All the waste and mids go back to flotation to the rougheners and so on. Therefore, nothing is lost. There's one way in and one way out. Our grade should be right around 65% right now. Rosa, from Cantung, Canada, works as a consultant in our lab. She is running more tests and we're trying to refine it down even more, using some new 845 frothers that were being used at Cantung. We have their metallurgists as consultants, as well. Since Cantung failed, we've used experienced personnel as consultants and we will eventually hire them permanently.

Dr. Allen Alper: Sounds very good. Harold, could you tell our readers why tungsten is important, how it's used and why it's a strategic and critical element?

Harold Frederick: This is Harold Frederick. I'm now one of the owners of Scheelite Metals. Jon and I originally collaborated on another project and recently I decided to invest in the company.

I was in the business for 35 years. Chris has been in the business ever since I've known Vennie and I’ve known Vennie for over 20 years. He hasn't spoken yet, but we all know Vennie is one of the owners and he certainly is a long time metallurgist, in the tungsten carbide plants. As you know, the largest use for tungsten at the current time is Tungsten carbide (WC). Without WC the infrastructure is in trouble. It's used for cutting tools and a hundred other uses that we all know: penetrators, parts for copy machines, mining tools, etc. It's not an end product in many cases, but it is used in making a lot of other products. The tungsten market in the past, as we've all gone through it, goes up and goes down. The Chinese are the biggest reason why it goes up and goes down. The Chinese, with their pricing policy, are trying to put everybody else in the world out of business. Most mines can't exist at these levels. Eventually the only mines left will be the mines that can survive with very low costs. The strategic need for tungsten, because of its use in an infrastructure and down hole drilling, is significant. Eventually those requirements, the end markets will come back. We all know that. Even coal, I think, some day has a chance of coming back.

When those markets rebound and the requirements for tungsten increase, there won't be enough raw materials coming out of the ground. That's one of the reasons why this mine is, as Chris pointed out, one of the gems in the world because of its low cost. We think that this mine could help fill this shortcoming and since Jon got his permits in two and a half years, anybody else tries to permit through the BLM process and through the state process, it will take them at least three to four years to get the permits. We're well ahead of everybody else, strategically, in the United States.

Dr. Allen Alper: That sounds excellent. Could you tell me a little bit about the costs and the pricing, the possible cash flows or margins the mine might get?

Harold Frederick: Even though we've run the mill, we haven't run it full blast 24 hours a day, because frankly we don't have the water yet. Currently Jon's adding infrastructure to the mill plant. He's adding some ponds so that we will have sufficient water to run 24 hours a day. He's getting his plant ready so that by September we should be able to produce. We don't have a mining crew yet, but once we do put on a mining crew, correct me if I'm wrong, Jon, every 12 hours we will produce about 200 tons of ore in a 12 hour period. Typically this mine, if you look at the information that was written many, many years ago, averaged 1.67% WO3, but they had no flotation to recover the mids, so they lost a lot of tungsten. I think assuming a 2% return, is not out of the question.

If you mine 200 tons a day, and you only run 25 days of 30 a month, because of down time, et cetera, you can produce about 5,000 MTU’s in a month. If you take the price and again, as far as pricing goes, if you look at APT today and then discount it by 20%, you're probably in the $142/MTU range. This mine can survive below $142, but it has to be capitalized properly; adding the infrastructure items that Scheelite Metals would like in order to make this a world class mine. Assuming we could do that someday and assuming we can get at least one percent out of the ore, at $170, they’re going to make a profit of $250,000, $300,000 a month. If you jump up to two percent, with the same amount of mining, then you could make about 1.1 or 1.2 million dollars a month profit. I think fully loaded, running 24 hours a day, three shifts at the mine, three shifts at the mill plant, with a geologist and mining engineer and some mechanics and truck drivers, I think I have the plant at about 42 people. Maybe 43 or 44 if you needed more than what I anticipate right now.

The cost to run this operation, per month, and again I just picked the number $3.11/gallon for diesel, it's not there yet, it's down in the$2.70. Assuming $3.11, I think the cost to run this operation is a little bit under $600,000 a month. Let's just call it $600,000. Even if I'm really wrong, and it's $700,000 a month, this operation is still profitable, even at low prices, assuming we capitalize properly. As far as cash flow, once Jon starts to produce in September, it depends on how fast we can accumulate working capital as to how many people we can hire. That's the key. We have to start hiring people so Jon can start running the mining shifts 12 hours a day and a new mill crew 12 hours a day. Then the people that we currently have, can start doing other jobs to improve the mill plant until we get it where it needs to be. Is that the kind of answer you're looking for, Al?

Dr. Allen Alper: Sounds good, Harold.

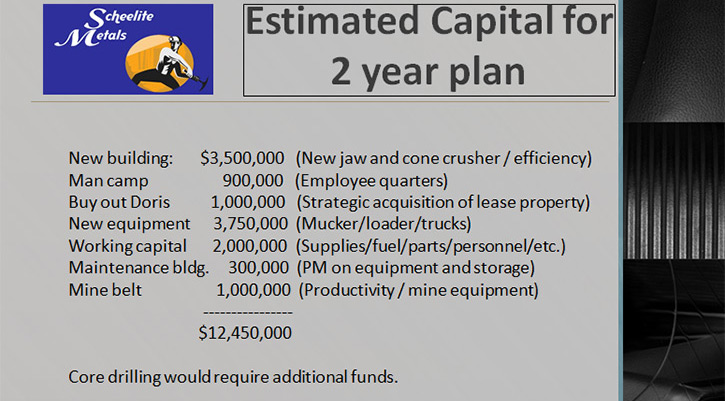

Dr. Allen Alper: Could you tell me a little bit about the funds and then I'll use your slide as well. Broadly about what funds are needed to make this a first class operation.

Harold Frederick: Ideally, in order to make this a world class operation, we first have to start hiring people. So we need some working capital. Typically, if you assumed three months of working capital and you assume you're going to spend about $600,000 a month, then we need around $1.8 or $2 million dollars in working capital. We really don't need quite that much, because our labor is probably going to be about 60% or 65% of the total cost every month. We could probably get away for $1.2 million for working capital.

We're going to need some kind of a man camp to house the people. Capital equipment, we ideally need about seven pieces of equipment. We got quotes for new equipment at $2.7 million dollars. If we only had a million or $1.2 million, we could probably get good used equipment.

Jon Rush: Good equipment with service contract.

Harold Frederick: Right.

We need a small maintenance building. I've got $300,000 in the capital plan, but we might be able to do it for less. We need a mine belt. I have a million dollars in for that. I honestly don't know what that costs. I know there are a lot of belts available today with the situation with coal mines, but then there is the undefined cost for labor and the iron stanchions to run the belt over.

Also we want to add more capacity, put a second building in the project, add about five or six triple decks tables and some more flotation tanks and another 500 ton rod mill. Jon has access to the flotation units and the rod mill. We would have to buy the triple decks, but for very little additional capital, the capacity, the ability to process concentrates would probably go from two or three hundred tons a day up to theoretical 800 tons a day. We would never need to run that much unless the markets were there and the customers needed the material. We would actually like to process 3-400 tons/day and be able to process 500 tons/day if absolutely necessary. We could easily do that and this is included in the capital plan.

Jon Rush: I agree with that, very much. I've been wanting to get that 500 ton mill moved up immediately. I think it's very important that that gets up and set very soon, because the mine is capable of running 400 tons on an average with one heading, I can pull a 400 tons a day, mining 24 hours/day. This mine can grow really fast by branching left, dropping decline and come back under contact. Then you go from 400 to 800 tons per day. You can shoot forward and backwards on contact and double or triple the amount. This is one ungodly big ore body, Al. I wish you could see on the map how big it is. Newmont was pretty dang impressed when they saw how big the contact is.

Right now I think we have a little over 44 miles of proven reserves, done by the geologist, but we have a map with lots of little blue pins. The geologist’s job is to go up and take a look at the area where those little blue pins are and find those big hot spots. We do have hot spots that are running ungodly high. Like Harold said, with the average from the old base, from the Timms, it's just a great ore body. We did our first 400 pound round and everybody got to see the ore in the ceiling and in the wall and in the roof and it's just dang exciting. You know what I mean? I'm really excited to put this material into our plant. It will be running by September for sure.

Dr. Allen Alper: That sounds very great. Really great!

Harold Frederick: Jon leased the land where the mill plant is located, it is private land with plenty of water, three wells. We should buy it. If you look at my cost to become a world class operation, I estimate 12 and a half million; we could probably get that down to nine and a half or ten million.

If we could get 15 or 20 million then we could get new equipment, build everything first class. We could do a core-drill program on the mountain, put two and half to three million into core drilling and we still wouldn't be much over 15 million dollars.

What Chris said is absolutely true, this mine is a gem. We're into the powellite right now, but this mine has, like Jon said, all kinds of scheelite. There are probably three or four different kinds of scheelite there. Once you get past the powellite and the moly runs out then you're basically into the clean blue and white Scheelite, which has no sulfur. This powellite doesn't have sulfur or arsenic either, so there's no environmental issues with this, but as you go deeper, and in other sections of skarn, we've found the material has no moly whatsoever. It's a very diverse scheelite deposit. It's an unusual scheelite deposit, easy to process.

Jon Rush: Once you get into the blue Scheelite, the iron goes away. We do have a contact, a trend that's running a 100% blue Scheelite that's a good trend too. It's found on both sides of the mine.

Harold Frederick: The iron is predominantly in the powellite, but that's what makes the powellite really easy to process, and the fact that it's high iron, APT plants don't care about iron. Because of this, I think we can probably start with as little as three million dollars. We have a million and a half dollars of debt that we would like to pay off so that we don't have any legal issues with that debt. Clean the company and become a debt free company. With the next million and a half, we'll start to hire people and Jon will slowly hire people as we generate working capital. Jon's bought a couple of pieces of equipment, and has done very well on them. He got some great deals. The advantage, I think right now, is the fact that there are great deals out there on equipment. Al, we can make it work with probably as little as three million. If we got a million and a half, we wouldn't pay off the debts, we'd just start hiring people to generate working capital. Whatever amount of money, we would generate through this, we could put a plan together to make that work. It would be a lot easier if we got more, obviously, than less, then we could proceed with some of the options I just discussed.

Dr. Allen Alper: Could you tell me a little bit more about what would be the timing if you got different levels of funding to move forward with this?

Harold Frederick: We have customers. As Chris said, we've never been in a business where the customers are clamoring for product and we can't give it to them. We don't have the capital. We can't move fast enough. One customer wants material as fast as possible and it behooves us to deliver that qualification material. When we get some capital, I think our first step will be to put on a mining crew and a mill crew and start to mine at least 12 hours a day every day of the month and start to bring ore down and start to run the mill plant, which will be done by September.

Jon Rush: Yeah. We'll be ready to go.

Harold Frederick: Then we could start running the mill plant at least 12 hours a day. We have the people for that. We'll certainly have the water with the ponds. Then as we generate cash, we'll maybe bring some more people on, but I'll be honest with you, Al, we don't really want to waste our resources at $140/mtu unless we're well capitalized. If we get enough money to do this right, we'll ship material to this one customer and Chris will talk to them and set up a plan where maybe what we've mined and run through the mill plant one shift a day, we'll sell to them. Our goal will be to break even and defer the debt payment until next year, when hopefully the market will improve. Everything that I hear is by 2018 tungsten will be certainly higher than it is today. I honestly believe if Trump gets in we're going to see a different world by next April. We would have to talk about that. I think everybody's pretty much in agreement. Why waste the resources at $140/mtu when a year from now, it could be $200 or $220 or even higher.

We want to do this smartly and I think we have enough experience in this organization to deal with this the tungsten market forever. The other two owners, who I won't talk about because they really don't want their names published are both knowledgeable in this business. Very knowledgeable. We would decide what is the best use of the cash we get.

Dr. Allen Alper: That sounds like a good approach. Could you mention the members of the team and their backgrounds?

Harold Frederick: Vennie, you haven't spoken yet. Why don't I let you talk to your background.

Vennie Krutz: Dr. Alper, I'm Vennie Krutz. I have 44 years in the industry. I started at Carbidie in 1972, spent 25 years there. Ended up as their chief metallurgist and then later, plant manager. I then went to Teledyne Advanced Materials. I spent six years there as technical sales manager, selling tungsten carbide products. Then in 2004, started our own company and since then I've been involved with selling mostly WC to all the customers around here.

I'd like to add that my customers find it very refreshing that it's possible that we can get ore out of the ground, get it converted into WC in the United States and not from China. That right there is a real plus for a lot of my customers. They're all in favor of it.

Dr. Allen Alper: Sounds good. Sounds like you have a very seasoned group, experienced group from a variety of backgrounds to make this thing work. Could you summarize why someone should invest in this project?

Harold Frederick: Chris you want to?

Christopher W. Kolb: Dr. Alper, I don't think this opportunity's ever existed before in this fashion. I think an intelligent group of people has gone forward and has done an amazing job of putting something just on the precipice of success. All it needs is financial support for the work that has already been done to advance and succeed. A financial push and this thing is off and running.

Imagine in the United States, a mill, a mine in operation and impervious to foreign market interruption. A once in a lifetime opportunity! As Harold mentioned, the supply is being drastically diminished. As you know sir, the Chinese concentrations are dropping. What Jon found is exceptional. What they've done to get to this point, is exceptional. I haven’t seen an opportunity like this in the past and I doubt I will in the future.

Dr. Allen Alper: What your team has done to get to this point, is exceptional. The potential is very, very exciting.

Scheelite Metals LLC.

HC61 Box 190.

Wendover, Utah 84083

435-693-3225

bjrush@scinternet.net

|

|