Interview with Joseph Hebert, CEO of Miranda Gold Corp. (TSX-V: MAD): Three very Strong Projects in Colombia and Advanced Production Stage JV in Alaska

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/1/2016

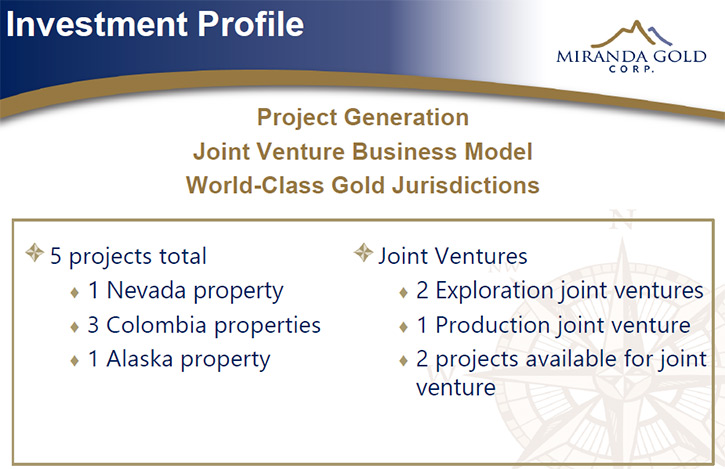

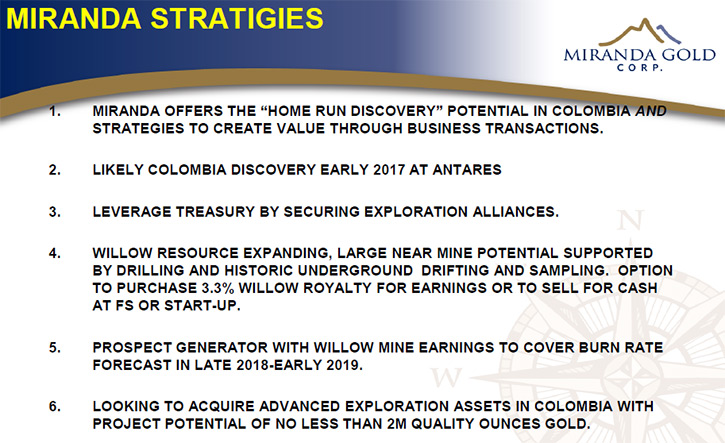

Miranda Gold Corp. (TSX-V: MAD) is a gold exploration company with a high degree of expertise focused on Colombia and Alaska. The company employs the prospect generator and joint venture model whereby it finds a good project and a joint venture operator partner that carries the project to a production decision. We learned from Joseph Hebert, CEO of Miranda Gold that the company has three really strong projects in Colombia - Cerro Oro, Antares and Oribella, with Cerro Oro about to be drilled by Prism Resources and with near-term discovery possibility at Antares. In Alaska, the company has an advanced production stage project called Willow Creek, which is a joint venture with Gold Torrent and a near-term production and cash flow opportunity. According to Mr. Hebert, Colombia holds a lot of gold and copper and with the situation in the country normalizing Miranda Gold is best positioned to acquire the best Colombian gold projects.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News interviewing Joseph Hebert, CEO of Miranda Gold. Could you tell me a little about Miranda Gold? What differentiates your company from others?

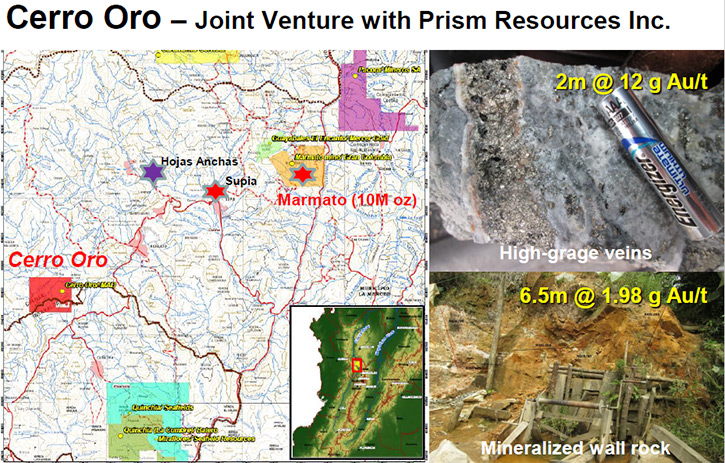

Mr. Joseph Hebert: What we're trying to deliver in a big way to the shareholders is discovery, big discovery, world-class discovery in Colombia. We've been here long enough to develop expertise in the country. We have a couple of the best Colombian geologists on board with us. We have three really strong projects in Colombia, one of which is a joint venture and about to be drilled by Prism Resources [Comment [J1]: Received last Monday. Should start within 2 weeks.].

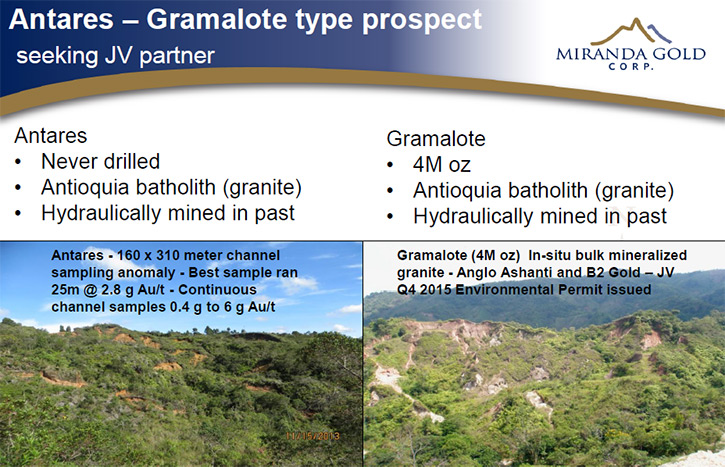

Then we have substantial interest in another property called Antares, and another property called Oribella. The attraction of Antares is that it's close to, and very much like Gramalote. We have consistent surface sampling on the order of a 300 meter by 160 meter area that suggests we have an outcropping deposit. We hope, as soon as we get a drill program on that, we will have a good chance of discovery as long as that mineralization expands and is confirmed in the vertical or third dimension. Oribella is interesting because it is on probably the most active trend being worked by Anglo Ashanti. That work has been prompted by their Quebradona discovery. The discovery hole was essentially 800 meters 1.65 percent copper and almost 0.8 grams gold, which is just a phenomenal hole. I mean, that's more than world-class. That's an elephant.

The interesting thing is that we're right on that trend. Anglo has surrounded us. We're talking actively with another company that's done quite well with copper in Colombia. Outside of that, now we've done a financing of about 2.6 million and it's topped off our treasury at about 4.3 million, which is a three year burn at the budget we would like to have. It would be a small increase from what it is now or more if we are able to bring in an alliance similar to what we had previous with Agnico Eagle, where they were providing 70 percent of our budget for the right to acquire projects. We demonstrated with that Agnico alliance that we are a go to company with the mid-tiers and the majors. Agnico provided $1.4M to our exploration efforts over 3 years.

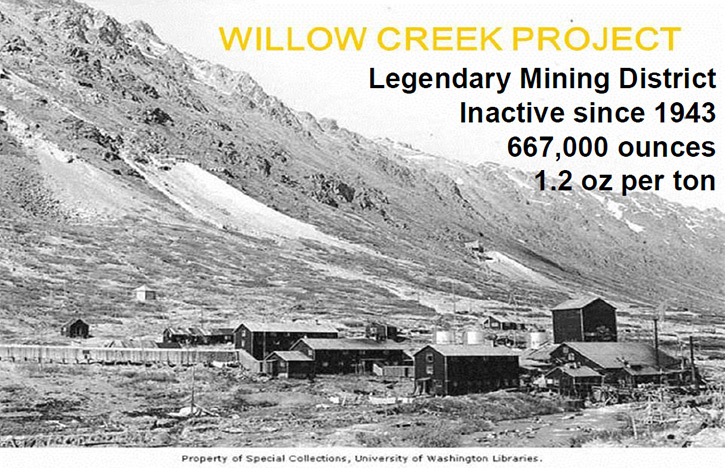

Outside of that Columbia focus, we're also in Alaska. It's a fairly restricted program, but it's an advanced production stage JV with a company called Gold Torrent. We think that most of the obstacles with that, including looking to financing for the CapEx is underway. We expect production quite possibly in late 2018. That would make us a prospect generator, but fully funded from a production JV. It would provide funding well in excess of our burn, probably multiple of two or three times.

Columbia is frankly not easy to work. My personal opinion is that it's probably the most well-endowed country in the Andean chain of South America. The advantage is, because of the insurgency, there's been almost no systematic exploration, only recently in the last three to four years. In contrast to Nevada, where we used to have our focus, which is quite mature, expensive and with deposits getting rarer and rarer. In Colombia, if we don't have surface mineralization that looks pretty substantial, we don't even bother. In Columbia we have compressed the time frame for potential discovery. We're hoping that our Antares provides discovery by 2017.

Dr. Allen Alper: It sounds like you have some excellent properties and partners to work with. Do you want to elaborate any more on your partners and also your plans for the year?

Mr. Joseph Hebert: Prism Resources is run by Bob Baxter, who is another 30-35 year guy like me. He is active in South America. He is putting together some more advanced near-term production acquisitions. He is fully funding our Cerro Oro project because it's a large epithermal system with high grade veins within broader disseminated gold. I believe they're just closing financing. They'll have the money and have a $250,000 commitment that will go into the drill program on Cerro Oro.

We had some delays on it because of the environment agency. Not because they're concerned, it's just hard to get them out of the office. We think we have a commitment from them to begin drilling in early August. That will be a five or six hole program. We're really hoping we can pull some good holes out of that with enough encouragement for Prism to proceed.

We don't have partners yet on Antares. If you're familiar with Gramalote, you can guess who is looking at it. We think both Antares and Oribella will be joint-ventured this year. On Antares we've had three data reviews, a field visit and two field visits coming up. It's an easy property to show because if the mineralization in extensive channel samples in a large hydraulically mined excavation extends in drilling we will have a discovery. Now that we have active interest again increasing in Colombia, we think we're going to have all our projects JV’ed.

Our partner at Willow, Gold Torrent, has Dan Kuntz as chairman. He has a longtime experience with Robert Friedland. He's well connected. He's struggled like everyone else in the capital drought. I think he's getting some traction now. Also because of the nature of Willow. Willow is a fantastic deposit, but it just doesn't have the size to really pique the interest except for a very small segment of the market. Again, the attraction for both of our companies is short term cash flow at very low all-in sustaining cost. Gold Torrent are good operators. We don't want to operate at least for the foreseeable future. Our expertise is exploration so we're comfortable with them bringing the project forward. It looks like they still have a 2018 timeline for production. Permitting will be on private land and very straightforward.

Dr. Allen Alper: It sounds like you have excellent properties and partners to help you explore them.

Mr. Joseph Hebert: I think so too, Allen.

Dr. Allen Alper: Can you tell me a bit more about the prospect generator concept model of your company?

Mr. Joseph Hebert: Our specialty is generating good projects that interest ideally majors or mid tiers that are more aggressive on their spending. We may advance to drill phase and do some drilling on our own to attract a partner. It is our intent, once we make a property attractive to a well-funded company and particularly larger company, to joint venture that project at about a 30 percent, typically as high as 30-70 maybe or 40-60 basis and be fully carried to ideally a production decision. In our negotiations, we try to get as close as we can to that so the project is fully funded by a third party. So we have, relatively speaking, a very low burn rate, which allows us to sustain our efforts towards discovery. Even though we have a reduced equity position, instead of having one or two opportunities for investors for discovery, we might maintain ideally six to eight active joint ventures, any of which could deliver a discovery.

We present more opportunities than a normal company, conserve treasury, have a longer time line for sustaining our efforts, and get a smaller dilution.

Dr. Allen Alper: That sounds like a very good approach. I understand you have an excellent background, excellent experience and your partner Ken also has an excellent background. The two of you have worked together for a long time. Could you tell me about your background and his background and the rest of the team?

Mr. Joseph Hebert: My experience started with Superior Minerals back in 1982. I went on to Freeport-McMoRan and spent most of my time in the glory days of Jerritt Canyon when the expansion of the higher quality resource was going on. Then I went to work as a consultant in Mexico, Mongolia, Suriname, a couple other small jobs. Up until that point, Ken and I had come together about three times. He first hired me for a project in Saint George, Utah, Washington County. That's also called Gold Strike Utah. That was with Tenneco. Tenneco had a very aggressive, maybe not the best strategy, but a very aggressive strategy to put small mines into production and then expand them. I was put on the ground with 70,000 ounces in resource

I worked steadily for the next three years to get it up to 280,000 ounces at which point USMX bought the project. I think Ken and I went separate ways then and we came together again for Uranerz. It was Uranerz’s American Gold Program. I was the generative guy. What I like to do is prospect and put together exploration models to identify quality projects, to determine if they have merit. After that I did Consulting. I consulted for whatever Ken was doing at the time because we had a good chemistry together.

I went to work for the Cortez Joint Venture. At that time, I was basically the generative manager for the Cortez Joint Venture. I was responsible for putting in the discovery hole at what we called ET Blue. It is now on the south end of Gold Rush. So we did the first discovery holes in Gold Rush. I'm not sure what it's up to, but it's substantial. Working in well-endowed projects, really aligned my thinking on which projects are good, which are bad, and on which I should spend my time. Then also bring the projects to the drop decision, advance decision and hopefully discovery.

Ken and I tied in on the same companies, Tenneco, Uranerz. Then as soon as he took over the reins at Miranda, on the demand of a major investor for Miranda, who wanted Miranda to be a real company. They hired Ken and three months later Ken hired me away from Placer Dome and the Cortez Joint Venture. We've just been doing that ever since. I replaced him as CEO and President and he works part time as Chair.

Dr. Allen Alper: Sounds like you both have an excellent background. It's good to work people that you have experience working with. That sounds very good.

Mr. Joseph Hebert: Yeah. It's been fun. We have different styles. Since I've taken over as CEO, it's been thrilling actually because it's just nice being in charge. It's nice being in control. It's also nice prioritizing your efforts. Also, I've got an excellent team in Colombia. All of them started with Mineros S.A., which is the largest Colombian gold company. It's a listed company now in the Colombia exchange. They've all gotten their experience starting with the best and the largest Colombian company. Then they all worked during the boom, when everyone was here. They all worked for a good collection of junior groups: Grupp, Continental, Anglo Ashanti in particular and others. So they really have a good well rounded experience. Probably better than average Colombian geologists, who have a lot of knowledge, but a hard time translating that knowledge to exploration models sometimes. But I provide mentoring when I can.

Dr. Allen Alper: By the way, how is it working in Colombia?

Mr. Joseph Hebert: The biggest obstacle in Colombia is frankly bureaucratic inertia. There's corruption rampant through the business community. There's some corruption in the government, but not really corruption that we're aware of. We would certainly never considering participating in corruption with the mining agencies and the environmental agencies. It's just that they're slow. There are too many bureaucratic hurdles associated with getting anything done. It just goes slowly.

There's also a mixed political view of the government. The legislature is in favor of and wants to promote mining as an economic leg for Colombia, especially with the drop in prices of coal and oil. The Supreme Court looks at it as a need to defend the people from the potentially bad aspects of mining. It moves slowly.

What's favorable is that it's changing. It's changing slowly, but the San Ramon mine was fully permitted and will be in production soon. We know mines can get permitted. Gramalote has its first mine permit. It requires another staged permit. Gramalote will probably go into production as the first open pit in the Colombian Andes. What's also encouraging is the armistice has finally been signed between the FARC and the Santos government. Talks are proceeding with the second largest insurgent group called the ELN. Those talks are beginning in Ecuador. Even though there's a little bit of cynicism on the part of the population, it looks like it's a real thing and that the insurgents will put down their arms on a defined schedule and join the election process as a party.

That will open up large areas of the country that people have taken a look at and ventured into and said this is just too high of a risk. We know a bunch of good districts personally. They're going to start opening up with the security. We're ready to pounce on some of those. In fact, I'm working on options on two projects that are fantastic in areas we couldn’t work previously. The people are great. It's a hospitable place to work. I think there is still probably a majority in favor of mining, but it requires a very intensive, focused and continuously consistent social program to keep the communities in support of mining.

The best thing about Colombia is that there is so much bloody gold. The copper here is ridiculous. It's like going to Chile or Peru 50 years ago.

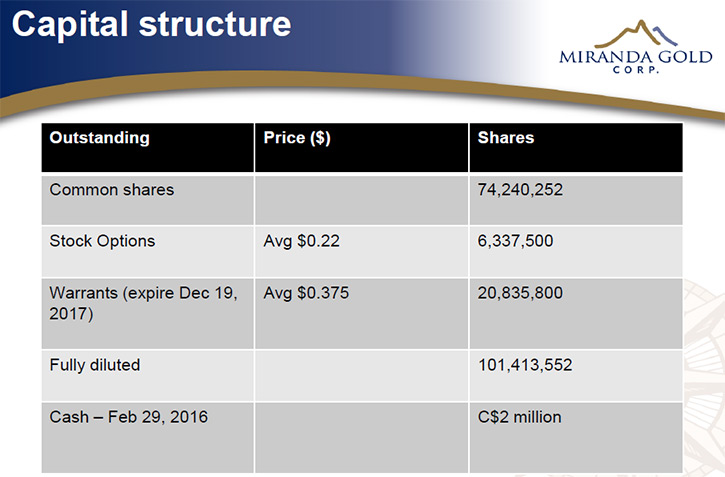

Dr. Allen Alper: That sounds good. Could you tell me a little bit about your share structure?

Mr. Joseph Hebert: Right now, subsequent to the $2.6 million financing. We have 103,000 shares outstanding. We have options and warrants that actually bring that up to 159,000.

After facing a hard first quarter of absolutely no interest in financing, we came to the market looking for 1.5 to 2. We ended up with 2.6. we just thought let's take it. Let's have a longer time frame. Let's have some cash to acquire some more advanced projects that are still available in this down market.

Dr. Allen Alper: Could you tell me the primary reasons why our high-net-worth investors should invest in your company?

Mr. Joseph Hebert: We have a management that is highly focused on exploration with a high degree of expertise. We're very frugal, because of the prospect generator model, with our treasury. We're resilient and we just keep on going. I would say that we have a good group of properties currently, one of which is Antares, which I think could be a discovery in late 2017 or before. Because of the downturn in Colombia, we are probably one of the best positioned companies to snatch up quality targets to bring to the drill-ready stage and joint venture. If things turn out with respect to the timeline on Willow, we will be a very rare prospect generator in that we will have positive cash flow. We'll basically be done with diluting the company and be building a war-chest to react to opportunities

I've come to realize that you can run exploration more like a business. The payoff is hitting the ball out of the park with a big discovery. On the way, you can do business transactions that give you things like marketable value assets and/or cash flow. I intend to keep on doing that, at some appropriate level, for the company.

Dr. Allen Alper: I like the way you think! You are doing a great job. You have good reasons why investors should consider investing in your company and you might be one of the reasons.

http://www.mirandagold.com/

Executive Office

15381 - 36th Avenue

Surrey, British Columbia

V3Z 0J5

Telephone: (604) 417-4653

Fax: (604) 648-8706

Email: info@mirandagold.com

|

|