Interview with Michael Tamlin, COO of Neometals Ltd (ASX: NMT, OTC: RDRUY): Advanced Australian Mt. Marion Lithium Project and Patented "ELi Process" will Produce Battery Grade Lithium Hydroxide at Low Cost

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/30/2016

Neometals Ltd. (ASX: NMT, OTC: RDRUY) is an Australian mining and development company focused on developing concurrently its advanced stage Mt.

Marion lithium project and its patented "ELi Process" that will produce battery grade lithium hydroxide at low cost. With two strategic partners, -

Australia’s largest contract minerals processor as their operating partner, and China’s leading, most profitable, lithium producer as their off-take

partner for Mt. Marion project, - Neometals is uniquely positioned to capitalize on the rapidly growing demand for Lithium products. We learned from

Michael Tamlin, COO of Neometals that Mt. Marion is at a very advanced stage, where they have started mining, have commissioned the crushing

operation and are establishing some stockpiles. According to Michael Tamlin, the next stage for Neometals is to build the pilot plant to produce

lithium hydroxide. The company's goal is to build a sustainable and profitable business.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Michael Tamlin, COO of Neometals. Anyway, it's nice to

have the opportunity to talk with you again Michael.

Mr. Michael Tamlin: Yes, thanks for giving up the chance Allen. Certainly, it's been a fairly interesting journey for me. Because when

we first met, I was responsible for the marketing of the Lithium and tantalum minerals for Sons of Gwalia, and we were marketing the technical grade

spodumene. Since then I've moved on. I've spent some time in the vanadium world developing the Windimurra project that unfortunately floundered,

just before it was to be commissioned, due to funding constraints.

After that, I worked in the lithium industry, associated with both brines and hard rock operations. Then I spent a couple of years as a

consultant developing work in consulting and as a company director. I became more and more involved in the development of Neometals’ projects to the

point where they offered me a permanent position last December and I was keen to see the job through.

Dr. Allen Alper: I see you're now chief operating officer at Neometals?

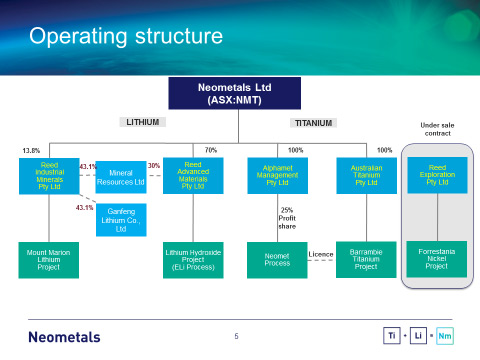

Mr. Michael Tamlin: That's right yes. We are developing lithium projects and also a titanium project, centered on 2 main deposits. One,

the Mount Marion deposit is for lithium, the mineral spodumene. The other, the Barrambie deposit is a titanium magnetite, a VTM. Whereas Windimurra

had been developed as a vanadium deposit into a vanadium world that I think is really dominated by by-product operations in China and South Africa,

the Barrambie deposit has similar, but better mineralogy and is suited to a titanium base. They are the 2 projects we're developing.

Dr. Allen Alper: It sounds great. By the way, I have a background in vanadium too. I was involved with Largo Resources in Brazil.

Mr. Michael Tamlin: Really?

Dr. Allen Alper: Yes. I was a consultant for them and was also on their board of directors.

Mr. Michael Tamlin: That explains where I had seen your name recently. I understand Largo's vanadium operation is in operation now.

Dr. Allen Alper: Yes, it is. They're producing a lot of vanadium now in Brazil. Of course stronger vanadium prices would help, but I think

that will come.

Mr. Michael Tamlin: That's the kind of vanadium resource we were developing at Windimurra, primarily as vanadium.

Dr. Allen Alper: Tell me about what differentiates Neometals from other companies?

Mr. Michael Tamlin: In lithium we have two fundamental economic resource types. One is hard rock and one is brine, so we're

differentiated from the producers in South America by virtue of exploiting a hard rock spodumene deposit in Western Australia. When it comes to the

difference between hard rock and brine operations they have a very similar back end, or final process stages. But at the front end, it's very

different. Hard rock is a conventional drill and blast, load and haul. Then there is a calcining operation and various extraction techniques. Hard

rock has traditionally been something that is fairly quick to market in terms of mine development and in terms of development of the downstream

chemical plant to produce carbonate or hydroxide. It is typically lower CapEx and higher OpEx than brine operations.

We've set out to get the best of both worlds. That's one point of differentiation from both the brine and the hard rock world. To obtain the point

of differentiation we're looking to have the speed to market, the lower CapEx of hard rock but also a competitive OpEx with the best of the brine

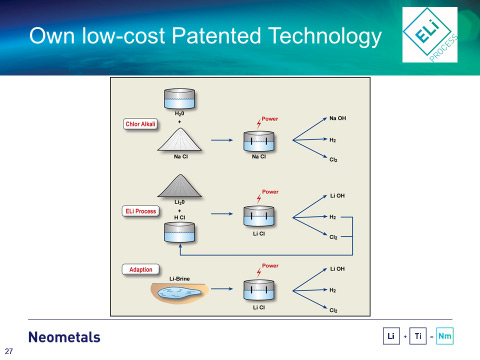

operators. I shouldn't say all of the brine operators, because they're not all low cost. The advance we’ve made is a process technology solution

that we've been developing and we have trademarked the name ELi for Electrolytic Lithium. The point of differentiation that we have for the hard

rock converters is that we're going to have an operating cost for a battery grade product in lithium hydroxide that is significantly below the

Chinese converters. It is very competitive and possibly neck and neck with the best of the brine-based producers.

We also differ from hard rock miners who are only producing concentrates. In our business, we have 2 parts. One is concentrate production

and the other is lithium hydroxide and lithium carbonate production. We have a foot in each camp in the sense that the lithium hydroxide production

operating cost is competitive with the low-cost brine producers, while still acquiring its raw materials spodumene at market price. We have 2

lithium “divisions”. One of those is the Mount Marion operation and that has a profit delivery mechanism for us. We have a 13.8% profit share with

our shareholding partners. We also have a contractual right to purchase the spodumene concentrates for feed into the proposed hydroxide plant and we

aim to have a profit center there.

In looking to get the best of both worlds, it's a fairly difficult objective, but we have feasibility studies that show that we can deliver

on it.

Finally, the differentiation between ourselves and somebody like Lithium Australia, who has been primarily a process developer, is that we have a

secure supply source from Mount Marion. We have a contractual right with our shareholder partner Mineral Resources to take 50% of production from

the Mount Marion operations to feed into the plant.

Dr. Allen Alper: It sounds excellent.

Mr. Michael Tamlin: It's pretty exciting actually.

Dr. Allen Alper: Absolutely!

Mr. Michael Tamlin: Neometals has a deposit with a lot of promise that was acquired in about 2008 at the start of the previous lithium

“boom”. Reed Resources (subsequently Neometals) then negotiated with Mineral Resources, Australia's largest contract processor of minerals.

Mineral Resources agreed to fund, design, build, own and operate the concentrator at its own capital cost to earn a 30% share of the project. That

was the first enabler. But subsequently the lithium prices in both chemical and mineral markets were pretty weak for a few years and that put the

project on hold, because the off-take situation was really very tenuous. The only pathway for chemical grade spodumene concentrate was Greenbushes

Mine in Western Australia to the customers in China and that was the market that I developed 20 years ago, when I joined Gwalia and Greenbushes

remained as the sole supplier to sole market place. Where Neometals are differentiated is that anybody developing a hard rock mine now either needs

to have some supply security through the second tier of converters or else convert to chemicals themselves. That led us into a partner search for

offtake and during the second half of last year we finalized the discussions with Ganfeng Lithium. Ganfeng is a company that I've known since the

early 2000's, when it was established by the former General Manager of the Jiangxi SOE Lithium factory.

Mr Li built that operation, into the largest producer of lithium metal in the world, who tolls for people like FMC and Albemarle (formerly Rockwood

and Chemetall) and others. They are a very strong company, listed in Shenzhen and have a huge market capitalization. Something like 3 or 4 billion

and at the time they were the second largest producer in China by volume. I think by now, with their expansions, they're probably the largest and

certainly financially the most successful. Mt Marion entered into an off-take contract with Ganfeng that obliges us to supply and them to buy for

the life of mine all of production, other than the production that we elect to take from the fourth year of operation.

Dr. Allen Alper: That's a great, excellent position to be in.

Mr. Michael Tamlin: My experience in China goes back to the second half of the 90's with Greenbushes, then owned by Gwalia, and we

developed the market in tiny steps. One of the keys to that was the financial aspect of selling in China and being paid for the product that you've

delivered. The way we used to do it was to only load a ship after we'd received a confirmed letter of credit for payment, even though the tenor was

usually 90, 120, sometimes a 180 days. Whereas now what we've managed to do is to get a revolving letter of credit to cover one-quarter's shipments

so we've always got money in the bank ready for payment.

Mt Marion paid market price and we've got a floor price that covers us for cost of production plus a margin in the worst times. We have

payment terms that effectively pay us as the ship leaves port, so the tenure of the letter of credit is on the side of documents.

Dr. Allen Alper: That's a great position to be in.

Mr. Michael Tamlin: Without those 2 partners it would have been very difficult to get an operation into production with stable finances.

We've gained an awful lot and we've also been paid well for selling down our shareholding. We're comfortable that we have money in the bank now to

continue development of the chemical plant and also, we have returned money to shareholders. We've made a maiden dividends payment in the last

couple of months. We have a capital share buyback scheme that is in the market at the moment.

We look at Neometals as a proper business where we're both earning money, returning money to shareholders and reinvesting the money in the

business. It has enabled us to look to the future where the added value of the lithium hydroxide and lithium carbonate in the battery industry

consistently outweighs the profits that can be made from minerals other than in the very best of times. We will be happy to be in the lithium

hydroxide market, where the margins that we can capture with our new process are far greater.

Dr. Allen Alper: That sounds very good. Could you elaborate a bit more on the status of the Mount Marion lithium operation and the Eli

process?

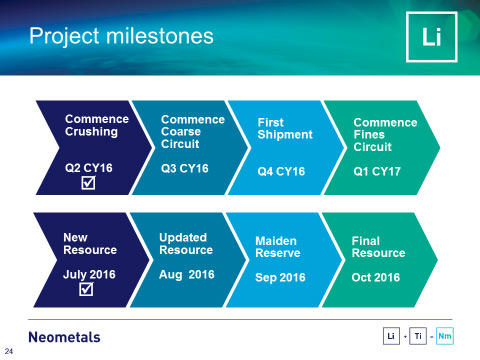

Mr. Michael Tamlin: Certainly, Mount Marion is really at a very advanced stage now to the point where we've commissioned the crushing

operation. We're in a construction phase that has seen the start of mining and the start of crushing and the establishment of some stockpiles. The

rest of the concentrator is in various stages of completion but the beneficiation plant is due for completion in the next quarter before

commissioning and commencing production of a 6% lithium oxide (Li2O) chemical grade spodumene. It's a higher iron coarse product that is ideal for

putting into a calcining kiln where the iron impurity levels really aren't the issue. It's more associated with how the lithium is extracted than

anything else.

Mount Marion is in a phase where, before we've started first production, we've agreed to expand the operation and we're managing the addition of

another piece of the plant there at the moment. Expansion is going to be through retreating the tailing's from the original operation (a dense media

circuit) and putting it through a flotation process to make a secondary concentrate. Mt Marion will also contract that production to Ganfeng. We'll

press on with the commissioning schedule of the beneficiation plant for the 6% that would be third quarter and I'd expect we'd have shipments ready

to go before the end of the year. I think we could finish the plant by the end of the year, for the lower grade production from flotation and plan

to commence production in the New Year, which is pretty much the schedule Ganfeng, our co-shareholder and customer was seeking, because they have a

plant under construction designed to process that concentrate.

Our production should be pretty straight forward because we have a straight forward type of concentrator. It doesn't have any exotic

technology. The flow sheet has been tailored to the mineralogy of Mount Marion but we're also cognizant of the problems that people like Mount

Cattlin have had with mica and we're addressing those before they occur so that we don't have the same sort of problems of starting and then having

to shut the mine down. The drilling program that we've had at Mount Marion has been pretty extensive over the last 6 months. We're on the verge of

announcing a maiden reserve and a new resource. My gut feel is there’s going to be an increase in resource that will underpin the operation we have

and possibly extend the life, but I'd reserve a comment on that until that's announced.

When it comes to the shipments. We're going to build some stockpiles both at the mine and at the port just to provide ourselves with some

supply chain for Ganfeng that's not going to be interrupted by the transport to the port issues or production stoppages for maintenance. They will

probably build up a bit stock in China as well. We will have a very robust supply chain for Mount Marion through to Ganfeng operations in China

established, by the end of this year.

Concurrently, we're in the development of the ELi process. Ganfeng has no financial interest and no involvement in that operation. They're

comfortable with their own process.

For Neometals, we wouldn't be as content to be operating a process that's similar to Ganfeng either in China or in Australia because it

would put us at the mid to high end of the cost curve. So we are getting ELi ready. We've been through semi plant operation. We've completed an

engineering cost study and we'll probably release the feasibility study, based on that cost study, in the next week or so.

The feasibility study has confirmed the results of the pre-feasibility study of about 4 years ago and to a greater accuracy. It's given us

enough confidence that we're on the right track to have a viable operation. The operation itself would be about 20,000 tons per year lithium

carbonate equivalent, focused on battery grade production. It will be lithium hydroxide primarily with a smaller amount of lithium carbonate. We

have a feasibility study to plus minus 15% now. Our next phase is to move into a full pilot operation, in which we’ll integrate all the pieces of

the process into the pilot operation and prove up the process to our satisfaction for a scale up into commercial operation.

Dr. Allen Alper: That sounds excellent. That's very good.

Mr. Michael Tamlin: We're engaging some pretty competent people to work through any potential flaws or difficulties. Even though the ELi

process is new, we've taken a lot of tried and tested commercially available unit operations such as a chloralkali cell for the electrolysis. The

art is all in the combination of the way we've put these together and the operating conditions we're using for those operations. For any

electrolysis, solution purity is key, otherwise you waste all of your energy and your money in current efficiency. We're getting very good current

efficiencies out of the cell. Membrane maintenance is very low, with which we're very happy.

We believe chloride ion media are inherently more efficient than the sulfate media and easier on the membranes. Using the chloralkali process, we're

converting pure lithium chloride solution into lithium hydroxide solution that goes to a crystallizer. The incentive for us is the purer we produce

the solution, the better the current efficiency and the product.

Dr. Allen Alper: That excellent. That's really great! Could you tell me a bit about your electricity, how you getting your energy?

Mr. Michael Tamlin: That's very key for us although, electricity cost is lower than our raw material cost because we're modeling the

process on raw materials bought at market price. That gives us a portable process, so if we can't make enough from Mount Marion we can buy at market

and still make a profit.

We have two considerations. One is the source of the electricity, how it's generated and the other is the cost to us.

We would like to have a solar or some other renewable source of electricity, but we have to balance the source and the cost with the

reliability. Companies are building solar projects and selling power in the United States at 3 or 4 cents a kilowatt hour. However, we've been

modeling power based on grid power and at prices that are between 10 and 20 cents per kilowatt hour. If we were to locate the plant in Australia we

can source renewable power through credits so it would be delivered through the grid, but it would be generated from solar or wind and there is a

lot of wind power in Australia on the grid.

The feasibility study is being modeled on a location in Malaysia and we would also be getting grid power supplied to us in Malaysia and the

price in Malaysia for power would be higher than the United Stated and Canada for hydropower but lower than grid power in Australia. The key there

would be seeking to have renewable power wherever possible and seeking the lowest possible price but we've modeled on prices that are really typical

market prices and shown feasibility under those conditions. Once we get to the construction phase, of course, it's also the negotiation of utilities

and reagents. That's where we'd be putting more effort into sharpening the pencil on the power prices.

Dr. Allen Alper: That's sounds like an excellent approach, a good way to model it, and then move forward.

Mr. Michael Tamlin: If you are too optimistic at feasibility stage you have to answer to the Board and to the investors later if you

can't get implement you planned. If we take a more conservative approach and are able to do better in implementation, we will just make more money.

Dr. Allen Alper: That's sounds great. Could you tell me a bit more about your team, the Board and the management?

Mr. Michael Tamlin: We keep a low overhead position on management and staff and we engage technical specialists in chemistry of the

lithium operations with ELi, and contract specialists in the various process operations. For example, we're using PTO Incorporated in Buffalo, New

York for the pilot testing of the chloralkali process. Doctor Bommaraju wrote the manual, about 5 volumes on chloralkali process while he was with

Occidental, a very large chloralkali producer. He was engaged in the management buyout of their R&D labs and he runs that now as a private company.

In that sense, we are blending contracted expertise with in-house expertise, maintaining enough expertise at a specialist level in the

company to support ourselves so that we have continuity of knowledge because it's very IP driven. We also engaged M&W which is a German engineering

company and they've provided the services for the feasibility study’s Engineering Cost Study. The Engineering Cost Study has been performed in

Singapore so they have a very good understanding of the situation in Malaysia and have the right sort of expertise to be able to design and build

that sort of plant. After the pilot operation and feasibility study, we’ll collect all the information necessary for the next stage and have more

detailed discussions with them on the final engineering and potentially negotiate a suitable construction contract.

Malaysia is a commonwealth country, so Australia and Malaysia have all of the appropriate treaties and so on in place for us to operate there. They

have a good skilled labor force, particularly having been a large petrochemical producing country for quite a long time so there is lot of skilled

engineers and plant operators available. The other issue is that the negotiations with various government agencies there are some very attractive

business incentive packages that have been offered to us. That I think unless we have a similar arrangement somewhere else including Australia it

would be difficult to turn away from them.

Dr. Allen Alper: It sounds very good. Could you tell me a bit about your finances and your capital structure?

Mr. Michael Tamlin: Yes, so a much prettier story now too. We've had a couple of capital injections through the selling down of our

shareholding in Mount Marion. Neometals trades on the Australian stock exchange. Share prices roughly mid 40 cents Australian. We have about $60

million in Australian dollars in cash, which is about $45 million US in cash on hand. Market capitalization is about $190 million Australian

dollars. We have about 560 million shares on issue.

Dr. Allen Alper: That's a very strong position to be in.

Mr. Michael Tamlin: The Company has focused on prudent capital management to grow, create cash flow and protect the shareholders. Now

that we have higher financial capacity we have strengthened the Board with some additional independent directors, who have corporate skills and

technical skills. We now have a good blend of legal and corporate governance and financial and technical skills on the board. We're already seeing

the benefit after just a couple of months. I think that is going to really play a major role for us.

Dr. Allen Alper: Could you elaborate a little bit on your board, who they are and their backgrounds?

Mr. Michael Tamlin: The Company was founded as Reed Resources about 15 years ago by a father and a son. The father is David Reed, who

was chairman from the beginning and until last year. He is now a non-executive director, with a background in mine development and in stock

brokering. In fact, he was chairman of CIBC Eyres Reed after CIBC bought the family share brokering company. Chris Reed, his son has a background in

mineral economics and has been running the company as chief executive for most of the time since it started. It's gone through several phases, from

a very small company into an operator of the gold mine and now back to development in a technology and a resource sense.

Chris Reed is the chief executive officer and is also a member of the board. Steven Cole is the Chairman of the Board. He is a corporate law

specialist and a corporate governance specialist with very strong credentials throughout the Australian Institute of Company Directors and is

providing a lot of guidance and development in the corporate governance of the company. The 2 new directors are Doug Ritchie. Doug is an Australian

who has worked for Rio Tinto for a long time in several senior management roles and has a big resources company background and skill set. Dr Natalia

Streltsova is a PhD qualified chemical engineer with over 25 years’ experience in the minerals industry, mineral processing and hydrometallurgy

relevant to Neometals. She has had senior technical and management roles at Vale (formerly CVRD), GRD Minproc, BHP Billiton and WMC Resources. Dr

Streltsova has considerable international experience in South America, Africa and the Former Soviet Union.

Dr. Allen Alper: That sounds great. Sounds like you have a very strong, smart, well-balanced board. That's great. Could you tell me the

primary reasons a high-net-worth investors should invest in your company?

Mr. Michael Tamlin: The Lithium market fundamentals are strong - strong demand growth over the next 5 plus years and relatively tight

supply fundamentals, leading towards a market that is not oversupplied. Probably, largely in balance for a lot of that time, but nonetheless growing

at double-digit compound growth per annum. The lithium market is at a fairly high unit value and relatively low volume. The market at the moment is

about 200,000 tonnes a year of lithium carbonate equivalent (LCE) and prices are currently somewhere in the $10,000 to $20,000 per tonne range.

Given those fundamentals on lithium, an investor might want to look closely at Neometals Ltd. It has good corporate governance, good

management of finances, good project implementation and execution, a strong resource in Mount Marion, downstream supply chain security with a firm

off-take contract timed to coincide with our project schedule for the ELi TM project for lithium hydroxide production of added value product.

We plan to have production going into the strongest growth sector of this high growth lithium compound market with a high added value

product. So we're capturing more than just the value of the lithium and the spodumene. We'll be capturing the value of the lithium in the hydroxide

and we'll be doing it with a low cost process. Depending on our project execution through the pilot plants, construction, and finance management,

our new project growth can support the company for several years.

Dr. Allen Alper: That sounds excellent. Those are very strong reasons why our high-net-worth investors would consider investing in Neometals.

Mr. Michael Tamlin: It is really interesting that the lithium market is really partly a speculators market. Many companies are reporting

they suddenly have lithium in one of their tenements and shareholders are, to some extent, going crazy over anything that has lithium in it. But

we're not really a speculator type stock. We have gone past the development phase, the speculation phase. We're in a position where we have

significant milestones for an investor such as first production from the mine after the commissioning, the feasibility study will be in the market

soon and, other prospects of producing a high-value product.

Dr. Allen Alper: No, that's sounds like you are progressing very rapidly.

Mr. Michael Tamlin: We hope so. We are working hard to reach the stage of first production of lithium hydroxide and to build a

profitable operating company.

Dr. Allen Alper: That's great.

Mr. Michael Tamlin: Investors should look at us closely because our goal is to build a profitable business.

Dr. Allen Alper: That's great.

http://www.neometals.com.au/

Neometals Ltd

Level 1

672 Murray St

West Perth 6005

Western Australia

T: +61 8 9322 1182

F: +61 8 9321 0556

|

|