Interview with Gordon Ellis, President and CEO of Lupaka Gold (TSXV: LPK, FRA: LQP): Invicta Gold, is About to go into Production in Peru

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/9/2016

Lupaka Gold Corp. (TSXV: LPK, FRA: LQP) is a mining and exploration company with three properties in Peru. Their flagship project, Invicta Gold, is about to go into production, mining its high-grade core that could be mined at a thousand tons a day. According to Gordon Ellis, President and CEO of Lupaka Gold, within the next few months, they should be operating at a rate, which will allow them cash flow in the area of ten million dollars. The company has the ability to become cash flow positive, self-supporting and has good upside potential.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Gordon Ellis who is president, CEO of Lupaka Gold. Could you tell me a little bit about your Company and what's happening in Peru with your properties?

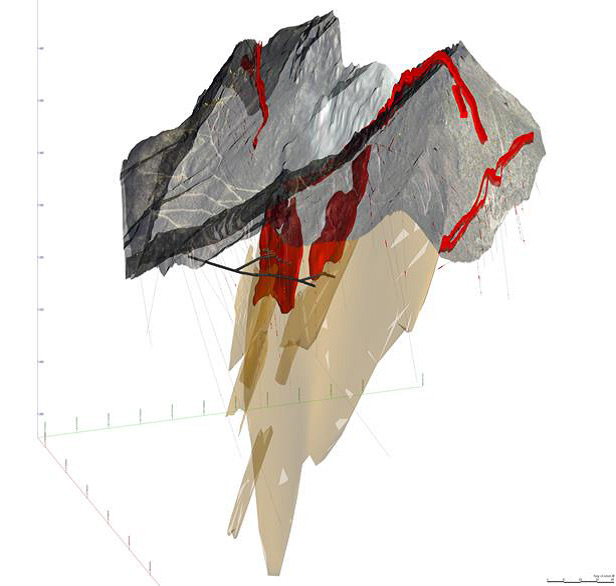

Mr. Gordon Ellis: Sure, Allen I'm happy to. We're a public company listed on the Toronto stock exchange. We have three properties in Peru, one of which we have outlined 2.1 million ounces of gold on but unfortunately it needs a higher price of gold to make it economic. One of which we are about to start drilling on shortly and the third of which, we're about to go into production with, within the next number of months. It is called the Invicta property. We have spent the last year and a half confirming previous work that was done on it. Five years to go, a previous owner had a permit to put it into production at 5,300 tons per day. At that point, the price of gold dropped considerably and it wasn't economic at that mining rate. We obtained the property. Fortunately for us, we believe that the 5,000 tons per day was a bit optimistic, but there is a high grade core that we could mine at thousand tons a day or less and make very good money. We will be putting it into production initially at 350 tons per day, which gives us good cash flow, good profitability, makes us a self-supporting company with the ability to expand the Invicta resource. Then focus on the expansion of the other two resources we have, both of which have very high potential to become multi-million dollar producers or multi-million ounce producers themselves. We are very optimistic right now. We're in the final few days of completing our financing to put the Invicta property into production and we expect within about two to three to begin the ramp up to production.

Dr. Allen Alper: That’s exciting! Really great! Tell me a bit more about the properties.

Mr. Gordon Ellis: Well, the Invicta property, the one that we're putting in production right now is about four to five hours north of Lima. You can drive up, have a look at it and drive back in a day. It's surrounded by three communities, which have been very cooperative to date in helping us put it together. We won't build our own processing plant immediately. There are other processing plants nearby and we can just truck our material to the plants and have them produce gold and copper concentrates, which we'll sell in Peru. In time, hopefully within the next year and half, we will be able to construct our own processing plant which will increase our profits considerably and improve our reliability. The growth potential for the property is very strong, with short term profitability. We can put it into production for less than ten million dollars and have it producing in a number of months. That's relatively unique and very favorable. The second property is a joint venture with a company called Hochschild. It has very high grade copper deposit in the center of it, which local miners had been mining up to a thousand tons per day. It has the potential to be a very large copper deposit. It's in the same neighborhood as some of the largest copper deposits in Peru, which makes them some of the larger copper deposits in the world. It's a good sized copper deposit with a gold halo. Large production potential. Our third project, I previously talked about, is the Crucero project, which has 2.1 million ounces defined on it today. It has good potential to increase that to at least double, with an effective drilling program. This is an exposed at surface, easily mined deposit.

Dr. Allen Alper: That sounds very good! Could you tell me a little bit more about yourself, your team and your board?

Mr. Gordon Ellis: Sure, happy to. I've been in the mining business since 1969 on and off. In the 70s and 80s I was a partner in an exploration company. We had four public companies that did exploration and a fifth public company that built the largest open pit gold mine in California at the time. Since then I've built other production plants. Two in particular which I've built up from scratch, made profitable and sold them off. I like to build things, like to make them work. I have a pretty good track record of doing so. My CFO has similarly been involved in a number of mines and some very successful ones. The last one of which was sold off for 650 million dollars, about five years ago. Our president in Peru has also been involved in mining for a long time, a very well spoken, very experienced and very well connected gentleman who's doing a great job for us down there. We have a good team.

Dr. Allen Alper: Excellent! Tell us a bit more about your capital structure and your finances?

Mr. Gordon Ellis: Well, the company is well financed right now. It has money in the bank to keep itself alive and so forth but it is just signed a financing deal which will allow us to put Invicta in production. It has been signed with a company called Pandion Mine Finance in New York State. We have 115 million shares outstanding, currently trading at about 15 cents to 20 cents, decent volume. You can get in, you can get out. I think we're doing pretty well

Dr. Allen Alper: That sounds very good. What would you say are the primary reasons why our high-net-worth readers/investors should consider investing in your company?

Mr. Gordon Ellis: The Company is currently trading at a capital value of about 15 to 20 million dollars. Within the next few months, we should be operating at a rate which will allow us annual cash flow in the area of ten million dollars. That by itself it a pretty good ratio. There are very few companies around today that can be put into production for as low a CapEx as we can. We have the CapEx arranged. We have the ability to become cash-flow positive and self-supporting. We have good upside potential and our current capital structure is such that we are grossly undervalued so there is great upside potential.

http://www.lupakagold.com/

Suite 220 - 800 West Pender Street

Vancouver, BC V6C 2V6

Phone: 604-681-5900

Fax: 604-637-8794

Email: info@lupakagold.com

|

|