Interview with Daniel Major, President and CEO of GoviEx Uranium Inc. (CSE: GXU): Three Large Advance-Stage Uranium Projects in Africa with Resources Totaling over 200 Million Pounds of Uranium, Projecting Cash Cost of Under $25 per Lbs.

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/8/2016

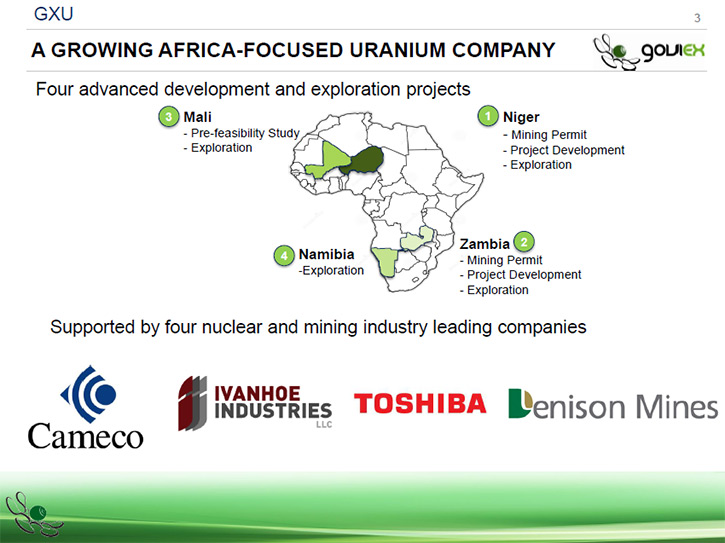

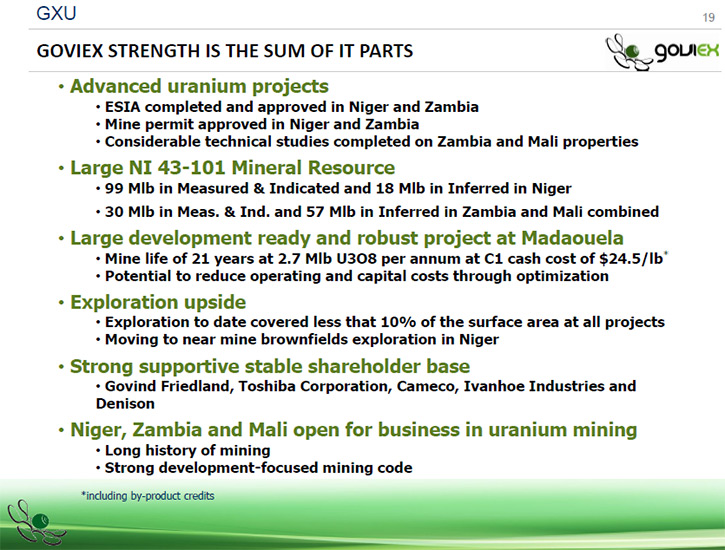

GoviEx Uranium Inc. (CSE: GXU) is a mineral exploration and development company that owns three large

advance-stage uranium projects in Africa with resources totaling over 200 million pounds of uranium. Two

of the three projects have mining permits and are shovel ready, which adds a lot of value to GoviEx

because it can have the mines ready for when the uranium market recovers over the next three to four

years as predicted by most analysts. According to Daniel Major, CEO of GoviEx Uranium, they are looking

at a cash cost of under $25 a pound and with the predicted uranium prices close to $60 they are going to

have a very positive return. We learned from Mr. Major that the key plan is to move forward with

development of their flagship Madaouela project in Niger that holds 100 million pounds of uranium. The

company is working on financing and optimizing the project and reducing the unit cost. At the same time

GoviEx is going through the 25 years of technical data on their second permitted project, Mutanga in

Zambia, where they have up to 50 million pounds of uranium. According to Mr. Major, operating in Africa

is relatively straight forward; obtaining permits is many times faster than in Canada.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News interviewing Daniel

Major, who is president and CEO of GoviEx Uranium Inc. I know you have a huge property in Africa. You and

your chairman have great backgrounds. You also have a huge company and great investor support from

companies. Tell me a bit about what differentiates your company from other uranium companies?

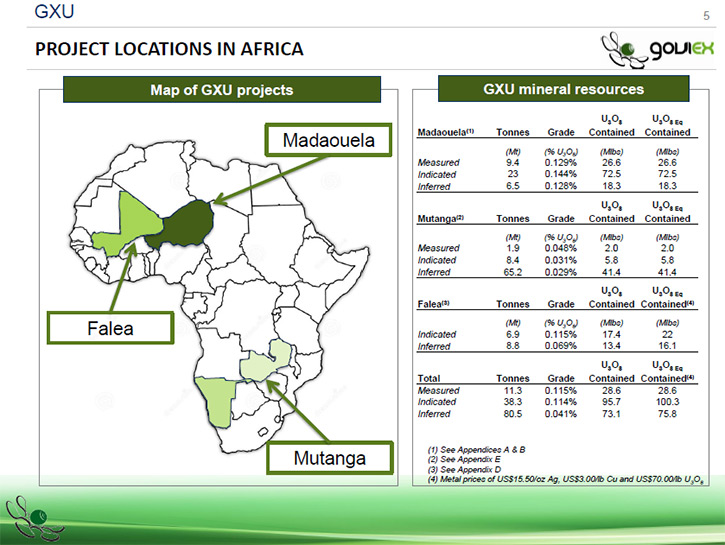

Mr. Daniel Major: I think there are a number of differentiations between GoviEx and many

others. One, the sheer scale of the resource that we have. We are now sitting with over 200 million

pounds of uranium in resource spread over three large advance projects. The Nigerian project at Madaouela

has over 100 million pounds, and then there are about 50 million pounds in either Zambia or in Mali. I

think the other key points are that they're large resources, they're relatively high grade for Africa.

The other differentiating point is we now have two projects which have mining permits. I think that adds

a lot of value where most analysts are predicting that the uranium market will recover over the next

three to four years as we see the gap in supply and demand widen as inventories are worked through and

increasing demand comes on.

I actually saw an interesting statistic the other day talking about the offtake positions,

particularly in Europe, where they're well covered at the moment. By 2018, they only have 70% coverage on

their long-term offtakes. By 2020 and onwards, less than 40% of their positions are covered already.

Where we are different is that we can actually build these mines because we're fully permitted and shovel

ready. We're looking at a cash cost at under $25 a pound with most analysts predicting uranium prices

closer to $60 at that time. Obviously we're going to have a very positive return for those projects.

Madaouela is the primary one in Niger. Mutanga, which we acquired recently from Denison, already has its

permit. It has a large resource there. It's relatively simple, open pit mineable, very low acid

consumption and we're starting to work our economic numbers on that. We certainly think that's two to

three years behind Madaouela from a development point of view, which would still be within the scope of

the next cycle. I think those are the real differentiations. When you look at our value, we did not get

any credit for that valuation and those projects and the value of the mining permit.

Dr. Allen Alper: Could you tell me a little about how it is operating in Africa?

Mr. Daniel Major: Other than really nice and warm, it's relatively easy. GoviEx started

operating in Niger in 2007 with the field work. That's the one we have the most experience in. In 2008,

we started our drilling campaign. Between 2008 and the beginning of 2013, we drilled over 600,000 meters

on the property to define the resource. We took it all the way through from initial exploration to

developing over 100 million pounds measured and indicated. We did all of our environmental work and got

our baselines sorted out and filed our ESIA at the beginning of last year.

Operationally, it's been relatively easy. We've had no issues operating in the field. In 2009, the

company took a Nigerian approach on everything. We run a full 100% Nigerian team in the field. Our

drilling contractor, who did the 600,000 meters of drilling, was a Nigerian drilling contractor. Our ESIA

team, working in the field, was another Nigerian ESIA contractor. Finding the key people to operate in

the country is relatively easy, particularly when you're working in a country that's been mining uranium

for over 50 years. You have to appreciate people like the president who used to work for AREVA and was an

NUM supervisor. They have a lot of experience. They have a geological college, a mining college. Finding

key skills in country is relatively straightforward.

As I said, you get stuff done. We filed our ESIA, full international equator standard ESIA in

March and by July, it had been signed off. For our mining code application, the permit was filed in July

and was signed in January. Those are six month windows to get things done. I did do a study of Canada,

trying to understand how that compared. There are four permits that I could find and the quickest was

Rabbit Lake, which took seven years to permit, Elliot Lake, and Key Lake took 12 years each to permit,

and this is from one of the lawyers in Canada who had written a document on it. Cigar Lake took 23 years

to permit. The ability to operate in the field, find the key people, have all our infrastructure around

us, roads, power, mining towns next door to us, and the ability for government to get things done, makes

operating in Africa relatively straightforward.

Dr. Allen Alper: Well, that sounds great. A cash cost of under $25 a pound, how does that compare

to other major companies and other uranium producers?

Mr. Daniel Major: It's about in the middle of the cost scale. Obviously, the very low cost

operator is coming out of Kazakhstan and you have Cigar Lake. If you compare it to projects in Africa,

Langer Heinrich, which is owned by Paladin, operates an average grade of .05%, those cash cost is under

$24 a pound at the moment. Our average grade is .14%, so it's right there in the middle of the cost

scale. It's a fully loaded cost and it's full of PFS cost as well. There are some projects out that I've

seen with not fully loaded and non-PSF, which are lower, but ours has already gone through full PSF as a

fully loaded cost. It's right in the middle of the cost scale. We're looking at a break even for the

project at $48 a pound. The initial work that we've been doing on offtake is indicating that floor price

contracts are achievable at $50 up. On that basis, based on our economic models, based on a debt finance

structure for 2/3 of the capital, this project is a go.

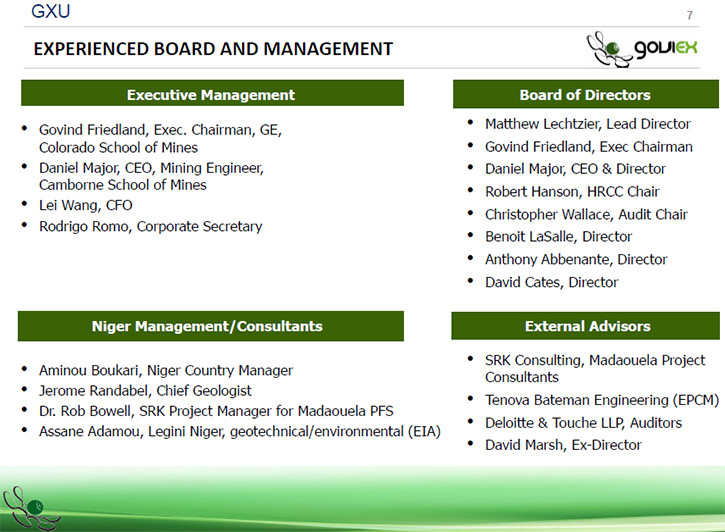

Dr. Allen Alper: It sounds very good. Could you tell me a little bit about your background, your

executive chairman's background and the rest of the team.

Mr. Daniel Major: Yeah, absolutely. Let me start with myself. I have some background as a

mining engineer. I went to the Camborne School of Mines here in the UK. I started operating in what was

then Southwest Africa a long time ago for Rössing, Rio Tinto’s uranium open field operations. I worked

there four years until the uranium price went to $8 a pound. My last job there as a senior planning

engineer was to redesign Rössing work at $8 a pound and survive for a number of years, which it did.

I then went into the platinum industry, operated in the platinum industry in South Africa, opened

a platinum mine. Did that for a few years. Then I had my own consultancy company for a while. I went to

work for one of the big gold mining houses for a company that was called JCI, Johannesburg Consolidated

Investments, which was in chrome, coal, base metals. It doesn't exist anymore. I was doing mergers and

acquisition work for them and project work. I was an equity analyst for a while, a rated equity analyst

in the UK and South Africa, part of a number one global team. I then worked in Russia, working for Oleg

Deripaska, who owns RUSAL. I was operating his molybdenum operations for him in Russia. I was producing

about 8% of the world's ferro moly and then I ran his timber businesses as well. From there, South

America exploration, gold and gold production in Canada and Peru, and now I'm back in Africa. That's me.

Dr. Allen Alper: That's a great career and background.

Mr. Daniel Major: Yeah. I've been to most of the world at some point and I've done a lot of

commodities as well. Looking at different jobs, different projects, different commodities, what you do

learn is that most commodities are very similar and most metals are the same. In fact, I've realized that

timber and mining are actually pretty similar as well. You process in very similar ways. The whole

process route is pretty analogous one to the other. You're just processing different things.

Govind Friedland’s background, he's obviously the son of Robert Friedland, he is a geologist by

background, geologist engineer from the Colorado School of Mines. He's worked for a number of exploration

companies before joining Ivanhoe where he was business development for the company and worked with them

until 2006, which is when this opportunity came up. The government in Niger at the time was trying to

diversify its land ownership away from Areva. An opportunity came up to acquire these licenses and he

realized that the source of all the uranium in Niger and this area was the mountains in the east. Areva’s

mines were in the west, and the properties for sale were between Areva and the mountains. Therefore,

unless the uranium had just jumped across the property, it had to flow through the land that we had to

get there.

He saw that as a great opportunity and acquired the assets. He then subsequently brought Cameco

on board. He presented the story of the assets to the Cameco board early in 2008 and what he had there.

They had experienced all of that area and said, "Yes, we want to come on board." He gradually built the

company up. He was the CEO for a very long period of time, and then the company was going to IPO in March

of 2011. Unfortunately, the filing date for the draft IPO document was the Monday after Fukushima

occurred. So the draft document wasn't filed and the company subsequently didn't IPO. He then got Toshiba

to join us as an investor. Initially, they were a debt investor. They came on board because they own

Westinghouse and they were looking to secure long-term offtake, so we have an offtake contract as part of

our structure with them on the project. We did convert that debt when we IPOed the company on the CSE in

June of 2014. Toshiba is now one of our largest shareholders.

On our board, we have Benoit La Salle most of your readers will know, the guy who founded SEMAFO,

the chairman of Algold as well with a long history in the mining industry, a company creator in West

Africa. Tony Abbenante comes from Ivanhoe Industries. He's President of Ivanhoe Industries, LLC, a U.S.-

based, privately held company actively engaged in supporting technology, energy and natural resource

companies worldwide. We had David Cates join the board now. Matthew Lechtzier, a lawyer by background and

corporate financier, worked in the industry for a long time. Robert Hanson comes from a wealthy family.

Transport, a lot of contact particularly across the Asian market as well. Chris Wallace joined the board

after becoming an investor. The head of our audit committee stepped down and we asked him to join. His

background is corporate finance, started Capital Corporation, a US$100 million private equity and

mezzanine loan fund. Very strong from an audit point of view, very strong from a corporate investor point

of view as well. We have a very strong constructive board, a small management team, but we all have been

around the block and know what they're doing.

Dr. Allen Alper: You have a great management team, a strong board and great support from corporate

investors. That's a great position to be in. It sounds like your property is very extensive with great

potential. Could you tell me a bit about your plans going forward?

Mr. Daniel Major: Yeah, absolutely. Absolutely. Because of the structure of the property,

the key plan really is to keep moving forward on the development stage for Madaouela. That is our primary

target. We're working on the debt structuring and the finance structuring for that. At the same time,

we're working on optimizing that project. I'm one of these engineers who is never satisfied that I have

the right project and I' have to keep working on the costs, seeing where we can optimize further. There

are a lot of things that I've left that I can go back through, currency adjustments, for example, that

need to be made. We could help reduce the unit cost. There are optimizations on the design side that

still have to be worked through further. That is going to be done in parallel with work that we're doing

on the debt side because I want the debt people to be involved and see the fruition on the technical. At

the same time, we're starting to work on the equity side, but tying that to the offtake as well,

preliminary the offtake contracts.

Actually, all four of those components, the debt, the technical, the offtake, and the equity all tie

together. For example, when you talk to the Chinese ECAs, they very quickly point out that they would

like to talk to certain Chinese operating companies. That then brings you round to the offtake side, and

if you're in the offtake, then you end up on the technical, so they all very much interrelate. We're

running them all parallel. That is going to be our process with Madaouela. On Mutanga we're currently

going through all the data we've acquired from Denison. They've done a great job of scaling the resource

up to 50 million pounds. There's a lot of technical data because there was a mining permit already on it.

We want to revisit that technical data and see how it compares now that the resource is bigger than when

it was last done.

I think there are a lot of opportunities on that one. It's a very low acid consuming project.

It's in a country that produces quite a lot of acid. It's in Zambia, it's open-pittable, it's heap leach

with good recovery, low CapEx. That looks really interesting. We're going to see what we can do about

advancing that project and then probably slightly further down the track for us, less work to be done

until we see an improvement in the market will be the very exciting project Falea in Mali which needs

more drilling. It's got a great silver and copper credit. For example, the indicated resources have a

70kg a ton silver grade and a .2% copper credit that goes with it. That one's not as advanced. A lot of

technical work. I mean, over $200 million has been spent on these three projects in the ground

investment. There's a lot of investment here and that's not being credited into the market value. We're

trading it ten cents a pound in the ground. Our peers are trading at a dollar a pound in the ground.

We're saying, yes, we understand people believe there's an Africa risk. We're saying it is completely

overblown, you get your permits done, you get stuff done.

People see Africa as a risk, but on the other side, when you can go out and get projects done

that’s a good thing. If you're in Australia now, for example, you must be very concerned if a federal

labor government gets in, they have an anti-mining mandate. Where does that leave not only the Australian

mining industry, but more importantly the Australian uranium mining industry? Those are some of our peers

that we have to compete with, and as I said, in Canada, it takes you ten, twenty years to permit a mine.

That I see as risk as well. I mean, you look at Strateco, who had their project in Quebec, they probably

thought they were onto a good thing, and now they have no project because the Quebec government stopped

it.

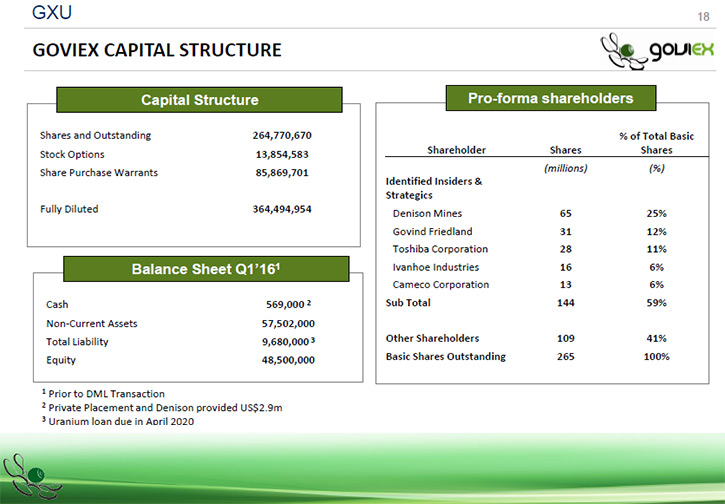

Dr. Allen Alper: It sounds like that's a great opportunity once people start recognizing and

feeling more comfortable with Africa and as uranium prices increase. There's a great opportunity for your

stock to increase in value. Could you tell me a little bit about your share structure and your capital

structure?

Mr. Daniel Major: Yeah, absolutely. Absolutely. Our current number of shares is 267

million. Cash is about $2.8 million, which is what we just raised. We have some debt on the balance sheet

still. In 2012, when we did our transaction with Toshiba, we took on a uranium loan, a structure whereby

we borrowed 200,000 pounds of uranium from them. We owe them 495,000 pounds of uranium in April of 2020.

There're no other commitments before that, and we expect that to be paid from production. That's the only

other thing that's on our balance sheet.

Dr. Allen Alper: What are the primary reasons our high-net-worth readers/investors should invest

in your company?

Mr. Daniel Major: Yeah, absolutely. We are massively undervalued to our peer group, despite

the asset base and quality of the project that's sitting there. You are looking at size. You're looking

at very positive cost structuring. You're looking at a great stable shareholder base. You're looking at a

company with two mining permits, which have considerable value. If you're looking at companies that may

potentially be taken out, surely you're a takeout target if you're a project. A Chinese or whatever

investor is going to be, "I need to be able to produce uranium from this project," and therefore those

permits have got a lot of value. We have diversity, but we also now have a portfolio of assets, so we now

have three large projects in Africa that are all very advanced, well past exploration. They all have

technical studies on them. Despite that, we're trading at ten cents pound in the ground versus a peer

average of a dollar, and then a lot of the analysts like to talk about takeout stories.

The best comp that we had for a takeout was Mkuju River. Admittedly, it was taken out in the good

times. Mkuju River had 119.4 million pounds of uranium in Tanzania. Its average grade was .04%. Our

average grade just at Madaouela is .14% uranium. Mkuju River was in Tanzania, which actually isn't a

recognized uranium mining country. It was bought for $1.2 billion. Our current market cap is under $20

million.

Dr. Allen Alper: It sounds promising.

http://www.goviex.com/

Email: info@goviex.com

Phone: 604-681-5529 (Vancouver, Canada)

Daniel Major, Chief Executive Officer

Email: DanielM@goviex.com

|

|