Discussion with Mr. Keith Neumeyer, Founder, President and CEO of First Majestic Silver (TSX: FR, NYSE: AG, Frankfurt: FMV): Purest Silver Mining Company and Strong Production Growth

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/4/2016

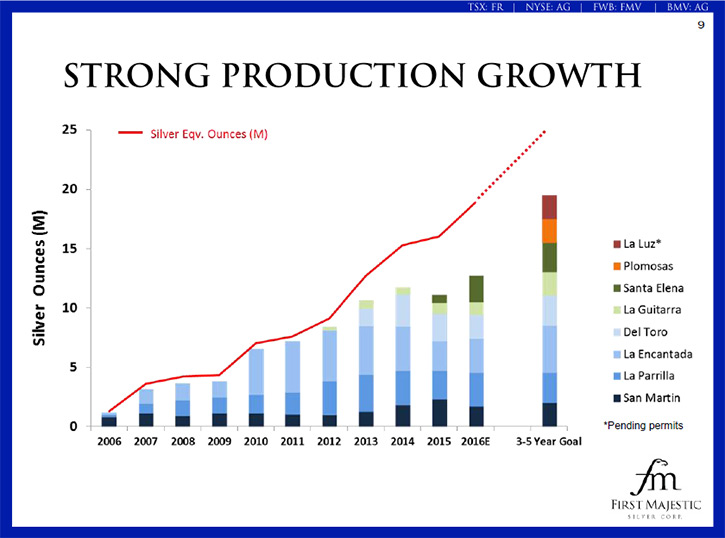

According to Mr. Keith Neumeyer, Founder, President and CEO of First Majestic Silver (TSX: FR, NYSE:

AG, Frankfurt: FMV), his company is the purest silver company in the world producing primarily silver

with all of their six mines located in mining-friendly Mexico. They have $100 million dollars U.S. in

the bank and recently raised another $50 million dollars Canadian to top the treasury. Mr. Neumeyer is

bullish on silver, and with the metals market cycle changing, the company is planning to expand their

current operations and advance some of their development exploration projects. According to Mr.

Neumeyer, First Majestic was the top-performing stock from all industries on the Toronto Stock Exchange

in the first quarter of this year.

La Encantada Mine

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News interviewing Keith

Neumeyer, president and CEO of First Majestic Silver Corp. Could you tell me what differentiates First

Majestic Silver from other companies?

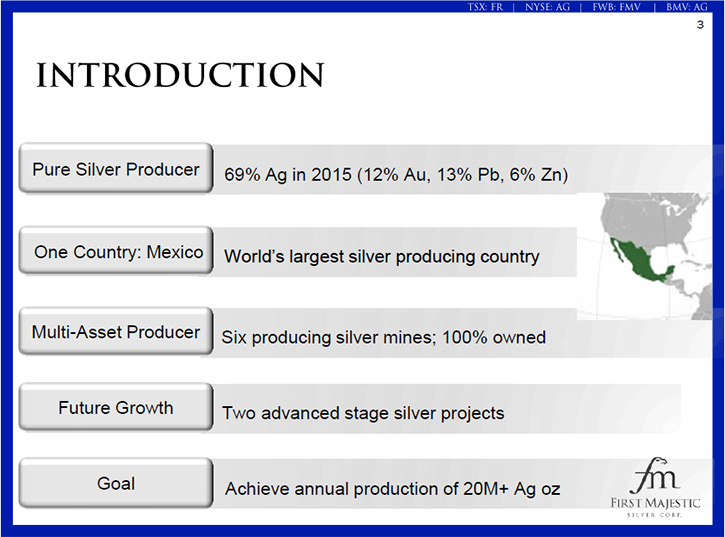

Mr. Keith Neumeyer: In the silver space, interestingly enough, First Majestic is the purest silver

company in the world, which I think may surprise a few people. But over the last three or four years, a

lot of what people would consider silver companies have been buying gold assets. First Majestic is the

sole pure silver company left in the space. It's a unique position to be in. We have six producing

mines in Mexico. We're all in one country and we're the second-largest silver producer in Mexico as

well.

Dr. Allen Alper: Could you tell me a little bit more about your properties in Mexico?

Mr. Keith Neumeyer: Yeah. We're active in eight different states. We have nine projects spread over

eight states. We have a very large footprint in Mexico. We employ over four thousand people in the

country. This year we'll produce somewhere around twenty million silver equivalent ounces, of which

somewhere between thirteen to fourteen million are silver. The rest is in the form of gold primarily,

and a little bit of lead and zinc. Santa Elena is the largest mine in our portfolio and then La

Encantada, La Parrilla, San Martin, La Guitarra, and Del Toro are the six producing silver mines spread

around the country.

Dr. Allen Alper: Well, now that you've raised another fifty-million Canadian dollars, which you

plan to use for expansion and exploration, could you tell me a bit more about your plans for 2016/2017?

Mr. Keith Neumeyer: Yeah. We've got about a hundred million dollars U.S. in the bank currently and

you're right, we did do financing recently in Canada for about a little over fifty-million Canadian

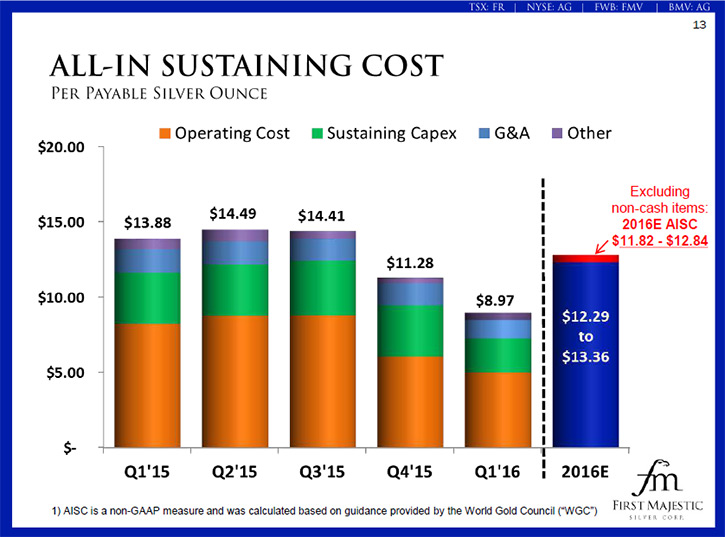

dollars just to top the treasury up a little bit. The mining sector's been under a lot of stress over

the last four years, as investors know, and we've been cutting back investment in all our assets and

really not focused on growing the business. We've been focused on reducing costs and just staying

alive, quite frankly, and I think we did a heck of a job reducing costs and turning a profit in this

low metal price environment.

I'd like to start reinvesting capital again. I think the cycle is changing, the market's changing. I

think it's time to start investing and expanding the business again, and that's why we decided to do a

financing just to top the treasury just a little bit. That allows us to advance some of our development

and exploration projects. It also allows us to look at expanding some of our current operations.

Dr. Allen Alper: That sounds very good. Could you tell me a bit about yourself and your team?

Mr. Keith Neumeyer: Well, sure. I've been in the mining business for thirty-four years. I've

founded three companies of size, or predominantly three companies in the space that I'm known for. The

first one was First Quantum Minerals, which was a copper company I put together between '92 and '94. I

left that company in 2000. Today it's one of the largest copper producers in the world and I put

together the initial team and some of the early assets. I’m proud to look back at that company and how

it succeeded over the last fifteen years.

I put together First Majestic Silver in 2002 because I wanted to focus on silver; because I

think the supply-demand fundamentals of silver are extremely unique. I'm a bull on silver and I wanted

to create the purest silver company in the world, which we've done. I'm quite proud of our team. We

have an excellent team in Mexico. We have a great team in Canada. I think it’s this team working

together that has built this company to where it is. We're all working together, being very focused on

what our objectives are.

I formed a third company, called First Mining Finance, about a year ago. It's predominantly

focused on acquiring gold assets in Canada. It has bought eight other companies in the last thirteen

months to build out its asset base to somewhere around fifteen million ounces of gold combined in all

categories. Between those three companies I think I've made quite a career for myself. I’m proud of my

achievements and I'm looking to continually build First Majestic and First Mining as this new cycle

starts. I think we're entering a new bull market for gold and silver over the next several years.

Dr. Allen Alper: Excellent accomplishments! Really, really great!

Mr. Keith Neumeyer: Well, thank you.

Dr. Allen Alper: Could you tell me a bit more about some of the members of your team?

Mr. Keith Neumeyer: Yeah. The operating team, which obviously is quite significant, plays a big

role in the day-to-day activities of the company. I think the top six executives in the company are all

ex-Goldcorp executives. We're happy to have them on board. Over the last three or four years our

business changed from a very high-growth business to a business that needed to look inwards and really

learn to cut costs and be more efficient.

Our team has been able to bring in a lot of automation and improvements, which really assisted

in bringing down cost. Here in Vancouver, we have our senior officers, our CFO, our CTO and all the

other individuals here that are involved in, the finance side, the investor relations side and the

high-level accounting and reporting side of the business. All together we have a very dedicated group

of individuals who are about four thousand people company-wide.

Dr. Allen Alper: That sounds like a great team. Could you tell me a bit about your capital

structure?

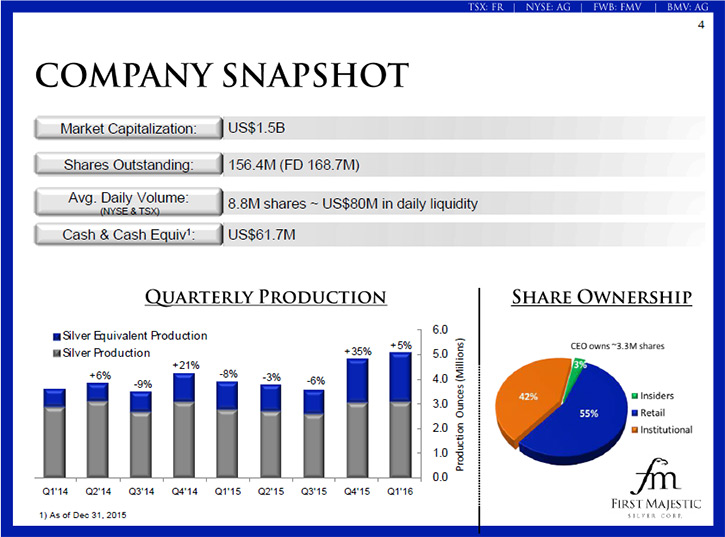

Mr. Keith Neumeyer: Yeah. We have around a hundred and fifty million shares outstanding. All of

those are in the float. We're approximately forty-five percent institutionally held, the other fifty-

five percent's obviously retail. A good chunk of that stock is in the United States, probably fifty to

sixty percent of that number. The rest is spread around Canada and Europe and elsewhere. We have some

pretty significant shareholders.

GDX and GDXJ are significant shareholders as well including a variety of other large and small

institutional investors. I'm the largest single private shareholder. I'm around three percent and the

rest of the board would be about one percent on top of that. An interesting thing about my share

position is, it’s never gone backwards since I put this company together over fourteen year ago.

Dr. Allen Alper: That's great. That shows you have confidence in your company and you're really

invested and your faith is being rewarded.

Mr. Keith Neumeyer: Yes, that's right, and I'm a bull on silver. So I'm looking for triple-digit

silver, and at that point I think the stock will be considerably higher than where it's currently

trading.

Dr. Allen Alper: Could you tell me the primary reasons why our high-net worth

readers/.investors, should invest in your company?

Mr. Keith Neumeyer: First of all, they have to like silver. If they don't like silver, then don't

buy First Majestic obviously. I think they also have to like Mexico. I coined the phrase a few years

ago, "One country, one metal". Being the purest silver company in the world, we add a ton of leverage

to the price of silver, so if silver moves, we move. It works both ways. If silver's going down, our

stock is hurt quite badly because the companies with other metals, like gold or what have you, tend to

outperform us because silver is much more volatile than gold.

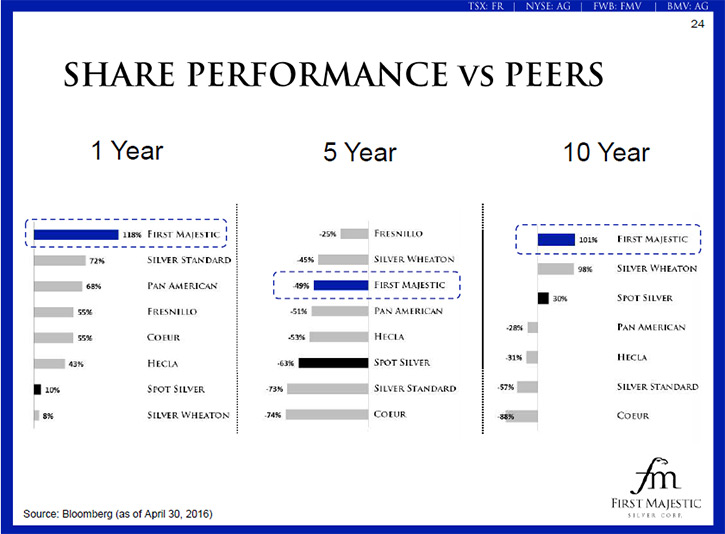

When silver's moving, our stock becomes gold on steroids. You can look at First Majestic. We're

the top-performing company of all industries on the Toronto Stock Exchange in the first quarter of this

year, which is quite an achievement, considering there's a couple thousand public companies trading on

the Toronto Stock Exchange, which is Canada's largest market, and it was the top-performing stock on

the entire exchange.

Dr. Allen Alper: Fantastic!

Mr. Keith Neumeyer: Yeah, well that's what happens to the stock, and if you look over the last ten

years and if you go to our website and look at our PowerPoint presentation, there's a slide in the

PowerPoint that actually illustrates how the stock does move against silver. Actually there are two

slides. One shows that over the last ten years we're the top performer of all silver companies in the

space and the last one year we're obviously the top performer of all the silver companies in the space.

That's really the reason why you want to own it, because it's a well-run business and the purity of

silver is key to us. If you like silver and you think silver is going hirer, you have to have First

Majestic as at least part of your portfolio in the silver space.

Dr. Allen Alper: That's great! I think those are very good reasons for investors to consider

investing in your company. Could you tell me a little bit more about operating in Mexico?

Mr. Keith Neumeyer: We're only in Mexico, so we're very familiar with Mexico. We know Mexico

probably better than most other companies do, other than maybe some of the Mexican nationals. We're the

second largest silver producer in the entire country. We achieved that after ten years of being in

business. We're already fourteen years in, so we continually grow our silver production. We're very

pleased with the country. Of course there are negatives. There are negatives in every country and it's

not all rosy all the time, but for the most part, the things we need to measure as a mining company are

good. First, can you permit your assets?

Mexico's extremely easy to permit assets. Other places, like Venezuela or Brazil, or even

Argentina to some degree, or Alaska, California or Oregon, are extremely difficult to permit. You may

have a great asset in Alaska, but you'll never get a permit. An unpermitted property really has a

limited value because you'll never get an ounce of silver or gold out of the ground. You don't have

that same problem in Mexico. From discovery to production, you can probably look at a two-year period,

and that's extremely unusual.

In most jurisdictions around the world, from discovery to production, you're looking at a

minimum of ten years and sometimes more, if permitting becomes a big issue. We're very happy to be in

Mexico. It has a great mining culture. These towns rely on these mines and these mines have been there

for decades and the people are used to working in mines. They're very familiar with mining. There's a

huge workforce available for mining activity. If we need three hundred workers tomorrow to go build a

mine, we've got them. They'll line up and they're easily assessable, so it's just a great place for a

mining company to be active in my view.

Dr. Allen Alper: That's very good. Is there anything else you'd like to mention, Keith, that we

haven't discussed?

Mr. Keith Neumeyer: We continually look at ways to build the business. We acquired the Santa Elena

mine last year, which added our sixth mine to our portfolio, which will give us a record 2016. Right

now we're in discussions with some junior companies to acquire some land packages that are

complementary to our current portfolio. So we're looking at those types of opportunities. I think the

more important thing is really the metals. We've been in a five-year bear market. We hit a peak in

silver at fifty dollars an ounce in April 2011.

First Majestic had a three-billion dollar market cap at that time. That year we produced only seven

million ounces of silver. This year we'll do twenty-million ounces of silver, and we have a one and a

half billion dollar market cap currently. I think there's a ton of room left for investors to take

advantage of and I think silver prices are going to go substantially higher. Just an interesting stat

that some of your listeners may not know, most people probably know that we're trading about seventy-

to-one gold/silver, but we're only mining nine to one, so for every one ounce of gold we're mining nine

ounces of silver.

Silver is extremely rare, way rarer than most people actually think it is, and that's why a lot

of these silver companies over the last two, three years have become gold companies because these

silver mines just aren't around. We have a great portfolio with six silver mines and two other

development projects, which are silver that we hope to bring on stream over the next three to five

years. I think the bottom is in and I think we're going to see a lot of excitement over the next three

to five years.

http://www.firstmajestic.com/

First Majestic Silver Corp.

1805 - 925 West Georgia Street

Vancouver, British Columbia

V6C3L2

Canada

Email: info@firstmajestic.com

Tel: 604.688.3033

Fax: 604.639.8873

North American Toll-Free: 1.866.529.2807

|

|