Interview with Jonathan Awde, President and CEO Gold Standard Ventures (TSXV: GSV; NYSE MKT: GSV): Advanced-Stage Gold Exploration Company, Owns Just Over 20% of Nevada’s Carlin Trend

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/26/2016

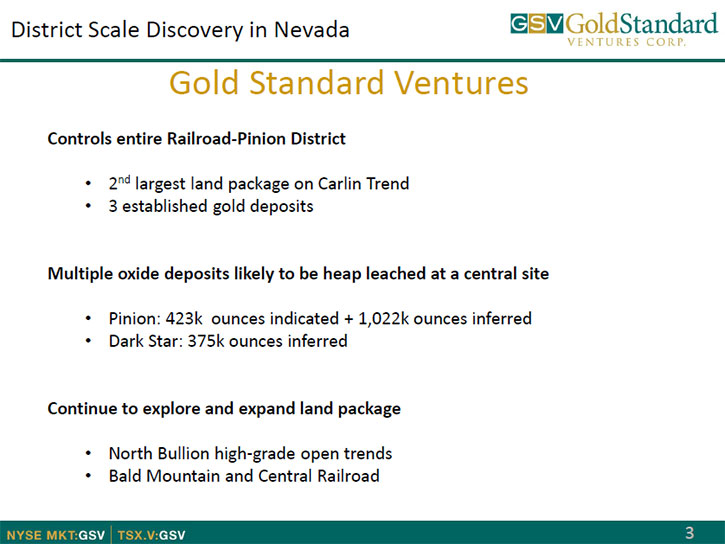

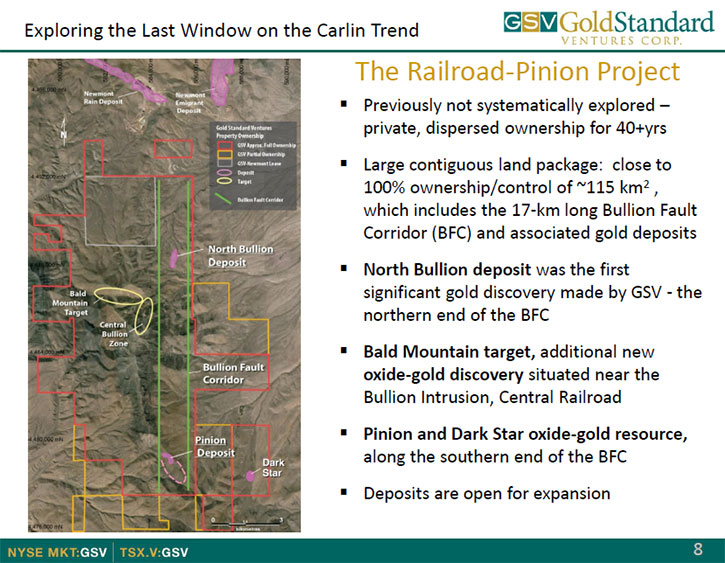

Gold Standard Ventures (TSXV: GSV; NYSE MKT:GSV), an advanced-stage gold exploration company, owns just over 20% of Nevada’s Carlin Trend, the most prolific gold mining trend in the Western Hemisphere. Gold Standard's Railroad Project is the last significantly underexplored district on the Carlin Trend. Jonathan Awde, President and CEO of Gold Standard Ventures, feels that it is the phenomenal exploration team and the land package they were able to consolidate over 6 years, that make the company stand out from its peers. The Pinion and Dark Star, two oxide-gold deposits in the southern portion of the project, represent a potential near-term development option with characteristics that suggest low capital and operating costs.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News interviewing Jonathan Awde, President and CEO of Gold Standard Ventures Corp. I see you have a great land position in Nevada and you are doing advanced exploration work in Nevada. Could you tell our readers a bit about your company, what you're doing and what makes it different from other companies?

Mr. Jonathan Awde: Sure, Gold Standard has, over the last six years, consolidated about 20% of the Carlin Trend. We now have the second largest contiguous land package in the Carlin Trend. The Carlin Trend is one of the largest, well-endowed gold trends in the world. It's actually the second largest gold trend in the world behind the famous Witwatersrand Trend in South Africa. And we've used this market downturn as an opportunity to consolidate this whole land package and put it all together under one roof for the first time.

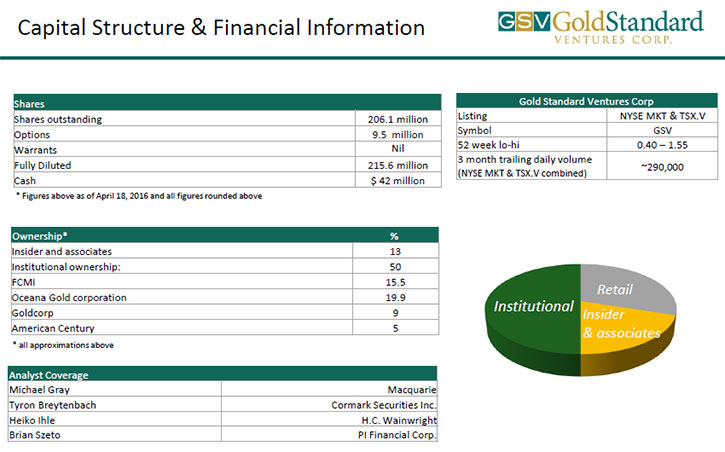

What makes Gold Standard different? For a junior to have a land package like we have in the Carlin Trend separates us from our peers. We have a really successful exploration team that's made a number of discoveries that are now producing mines in Nevada. We have a number of really supportive shareholders, we have 2 corporate shareholders, Gold Corp that owns 9.9% of the company and OceanaGold that owns 19.9% of the company. We also have the legendary investor Albert Friedberg, who owns about 17% of the company. So we have a great catalogue of shareholders, a great composition of shareholders, and we have about 40 million dollars Canadian in cash. Despite the uptake in the market in the last two months, there's still a lot of uncertainty with where the gold market is going to go, and I think having a strong balance sheet acts as a bit of a de-risking event.

Dr. Allen Alper: That's excellent, that shows that major companies and investors have faith in what you're doing and think you're doing the right thing, that's excellent.

Mr. Jonathan Awde: Yes, exactly. Their validation of us in the context of this market, deploying capital in a time where the gold market was in a lot of trouble, with depressed gold prices, it's still coming out of this 4 year bear market, speaks volumes for the assets, the project, and the team.

Dr. Allen Alper: It sounds like you and your team are doing all the right things. Could you tell me a little bit about your background and your team's background?

Mr. Jonathan Awde: My background is capital markets. I've been in the business for 17 years, I Co- founded Gold Standard Ventures in 2009, took it public in 2010, and we've raised about 125 million dollars, for the acquisition, exploration and development of this project. We feel quite strongly that for any junior exploration company to have one Geologist, who has found a deposit that's in production, is rare. But we have a team, we have 3 Senior Geologist, who have all been a part of major discoveries, or have led programs for major discoveries in Nevada. There are four producing mines in the state of Nevada that were discovered by our team. I think it’s a great collection of talent. They’ve really mentored and brought along two phenomenal young Junior Geologists, who were really helpful, and responsible for a new discovery at Dark Star. We have a great team concept. I think it’s very rare to have a junior company of our size to have 3 Senior Geologists that have been as successful as they've been.

Dr. Allen Alper: That's excellent. What are your plans for this coming year?

Mr. Jonathan Awde: The plans for this year, we have a 13 and 1/2 million dollar program outlined for 2016, which will encompass about 9 and 1/2 million dollars’ worth of drilling. That’s focused on 3 areas, Dark Star, Dark Star's new shallow oxide discovery that we've made late last year. I cannot emphasize enough the importance of having a shallow oxide deposit. What the market wants, what the market’s willing to pay for, is shallow oxide, low CapEx, good IRR, using a lower gold price. I think that Pinion and Dark Star, two oxide deposits we have in the southern portion of our project, collectively represent all of those things. Dark Star is just starting. We have 3 holes into it. They're very exciting holes. Holes that typically, when you see that kind of mineralization, A 157 meters of almost 1.6 grams oxide, close to the surface, those are big intercepts. Those intercepts are what attracted Gold Corp to put money into our deal and what attracted Oceana to our deal as well. They clearly like our assets, the project, and the team.

Dr. Allen Alper: I agree. You and your team are doing an excellent job. It shows that people who know what they're doing are investing in you at a time when it's an extremely tough market.

Mr. Jonathan Awde: Yup.

Dr. Allen Alper: It gives you cash to work with, while many companies still are very tight on cash for exploration.

Mr. Jonathan Awde: Yeah, that’s right. Despite the challenge in the market, there has been a silver lining to come out of this 4 year downturn. You can get a lot more work done for a lot less. Our exploration costs are probably 50% below where they were 3 years ago. You're able to acquire, consolidate, merge and buy assets for pennies on the dollar. If you look at the leaders of the mining industry, the Frank Giustras, the Ross Beatys, the Lucas Lundins, they've all been deploying capital in the last 6 to 9 months. Not with a view that gold prices were going to be higher in 3 months or 6 months, but with a view that gold was going to be higher in 3 to 5 years. We've taken that same view, we've decided to be active.

We just did a small strategic private placement through a company called Battle Mountain Gold, which is also in Nevada and has a really exciting project immediately contiguous with the Phoenix 42 mine that belongs to Newmont. It was both strategic in district and scale. It was the first project that we looked at, outside of our own, which was absolutely, unanimously accepted by our team as having checked off all our boxes. For us, that's really important.

Dr. Allen Alper: That sounds very good. Could you tell me a little bit more about your capital structure?

Mr. Jonathan Awde: Yeah, right now we have 206 million shares out. Roughly 1/2 of our company is owned by our top 3 shareholders. Management owns roughly 10% of the company. We have 40 million dollars in cash. We currently have 4 analysts that cover the story. We are dual listed on both the NYSE Market and on the TSX Venture Exchange. Liquidity is quite good, it trades, collectively about a 1/2 a million shares a day between the two exchanges. It has been significantly higher in the last month. It's widely and institutionally held. I think we're in a position here to really benefit from a discovery we made back in October/November at North Dark Star. And really put a lot of ounces on the table at Pinion and Dark Star – oxide, economic, low strip ounces on the table.

Dr. Allen Alper: That's excellent. Could you tell me the primary reasons why high-net-worth investors should invest in your company, Jonathan?

Mr. Jonathan Awde: Location, location, location. Gold Standard owns just over 20% of the Carlin Trend. We have a new exciting discovery. When you see those kinds of intercepts in the Carlin Trend, it typically leads to bigger and better things. This is our 3rd discovery on the project. We have a phenomenal exploration team lead by the VP Exploration, Mac Jackson. Mac discovered the Leeville mine and the Twin Creeks mine. Both are producing mines that belong to Newmont. We have 40 million dollars in cash. Nevada is consistently in the top 5, world-wide for mining jurisdictions. It's safe, there's political stability. Rule of law actually means something. All of our infrastructure, logistics, everything is there. This land package has taken us 6 years to put together. We've had to deal with 91 owners of surface minerals and water. We've gone to great lengths to be on the NYSE Market and to have that dual listing. We have over 3 thousand US shareholders, it's really important for us to have a presence in the US given where our asset is. Some of the largest resource funds in the US are shareholders of Gold Standard.

In the last 6 months Gold Corp bought 9.9% of the company, Oceana went from 14.9% of the ownership to 19.9%, and Albert Friedberg, our 3 biggest shareholders re-upped or became shareholders, in the worst market in decades. In the worst gold market in decades, for all those people to re-up or become shareholders, I think again, speaks volumes for our assets, projects, and team.

Dr. Allen Alper: That's really fantastic. Is there anything else that you'd like to mention?

Mr. Jonathan Awde: I cannot emphasize enough the importance of having shareholders like that, who invest in people and in good projects and have all done extensive due diligence. I think that having 40 million dollars in cash is an important part of the equation. Because it means that if the gold market does soften and get weak, we do not have to go back to the market, refund it, and we can take advantage of these lower costs and get more work done. I think that for a company of our size to own 20% of the Carlin Trend is a very rare unique opportunity to have exposure to arguably the most exciting gold trend in the western hemisphere.

Dr. Allen Alper: Can you share with our readers how you were able to accomplish this?

Mr. Jonathan Awde: Back in 2009 we exercised an option to acquire a portion of the project for 3 million dollars and shares in Gold Standard. Then over the ensuing 6 years, through either staking, acquiring, buying out rights, swapping; we were able to grow this project from 13 square miles to almost 55. Through just a tenacious will to complete this land acquisition and put this whole district under one roof. We do understand that a lot of these districts in Nevada never go anywhere and are never properly explored, developed or produced because there are too many owners. Let’s just say you draw a circle on a page, that circle represents a district scale opportunity, represents the whole land package. Part of the problem in Nevada has been in that circle, you'll have 5 different Juniors or 5 different families that own it. And all want way too much of the pie. We've cleaned that up where now that circle is all Gold Standard. It's all under one roof. So we can actually look at the project as a district and we've made 3 discoveries on the project.

Our team has a very systematic approach to this. We've spent a considerable amount of time, energy and money on doing the peddle work for the project and putting this whole land package together and dealing with the individual land owners. Dealing with the ranchers, some were great to deal with, others were challenging. I think everyone understands who our team is, what they're about, the integrity and the work ethic that we all have. We've had a lot of support from the community.

Dr. Allen Alper: That's great, I think you and your team have done a fantastic job and you should be complimented on that. It's really great.

Mr. Jonathan Awde: Thank you!

Dr. Allen Alper: It took a lot of time, patience, negotiation, and teamwork. You did a great job, really excellent. Is there anything else that you'd like to add?

Mr. Jonathan Awde: Also I think we have a great board, a great advisory board. We've been very fortunate to have people like Jonathan Rubenstein who has been an advisor to Gold Standard. He's been a bit of a mentor for me. He's actively involved in Gold Standard. Jim Anthony, the former chairman of Sea Bridge is an advisor of a very, very large shareholder and someone that I use as a sounding board on a weekly basis and has an absolute brilliant financial mind, when it comes to understanding capital markets, precious metals and the Fed. We have a really supportive board and team that has bought into what management is trying to do, which makes our job a little bit easier. We've had a bit of fun along the way.

Dr. Allen Alper: That's an excellent story, excellent job!

http://goldstandardv.com/

Suite 610 – 815 West Hastings St

Vancouver, BC V6C 1B4

Telephone: 1-604-669-5702

Fax: 1-604-687-3567

Please Contact: Jonathan Awde

Email: info@goldstandardv.com

|

|