Interview with Jason Paltrowitz, Executive Vice President - Corporate Services of OTC Markets Group

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/26/2016

OTC Markets Group, Inc. is a SEC regulated, FINRA registered, electronic market connecting over 110 broker-dealers. This is a 3-tier system. The Best Market is called OTCQX and includes companies that meet certain financial criteria and choose to be transparent. The second market is called OTCQB. It is a Venture Market and includes early stage entrepreneurial companies that choose to be transparent. The third market is called Pink Market. It is not transparent, there is no company involvement but broker-dealers come together and trade. We learned from Jason Paltrowitz, Executive Vice President - Corporate Services of OTC Markets Group, that since 1997 they have transformed from a phone-based pool of thousands of securities with no standards, to a fully electronic market that allows companies to be open and transparent and decrease reputational risk by meeting certain standards. We learned from Mr. Paltrowitz that under the Regulation A+ introduced in 2012, companies are now allowed to raise up to $50 million capital from the general public. And we learned what steps the companies need to take to do that with OTC.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News interviewing Jason Paltrowitz, Executive Vice President - Corporate Services of OTC Markets Group Inc. Tell us a bit about OTC Markets. I see you're doing great things, you're growing, you're having a great year and you had a good year last year. We mainly have readers/investors who are interested in mining, manufacturing metals and related areas. We report on startups and on large companies like Newmont Mining. I know you have three different groups. Would you fill our readers in on what OTC Markets group is all about?

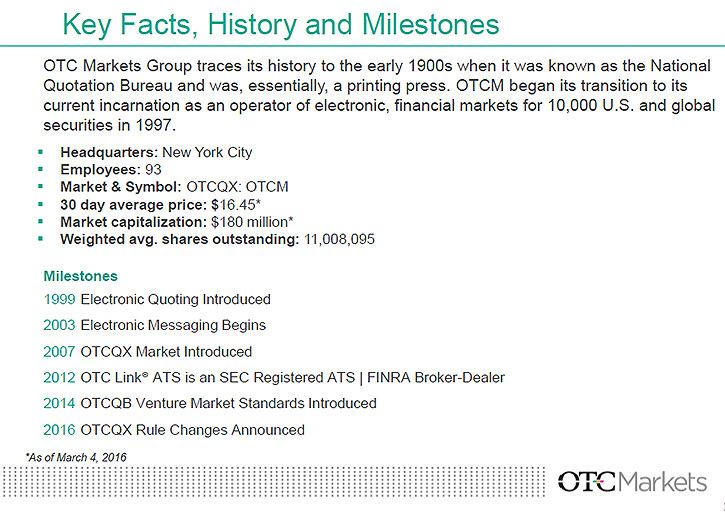

Mr. Jason Paltrowitz: Sure. OTC Markets Group dates back over 100 years to something that was called The National Quotation Bureau. The company then became Pink Sheets and is now what is called OTC Markets Group. Our CEO and some other investors bought what was the Pink Sheets in 1997, with a vision to do a couple of things. The first was to transform what was a not very transparent phone-based trading model. We were called the Pink Sheets then because we were actually publishing a book of stock quotes that was printed on pink paper. So the goal was to take that market from something that was phone-based and not transparent, and to turn it fully electronic.

Between the years of 1997 to 2003, our markets became fully electronic, - what is called an ATS, Alternative Trading System. We are now a SEC regulated, FINRA registered, alternative trading system, connecting over 110 broker-dealers electronically to create what, in essence, is the market infrastructure model that NASDAQ was before it became a stock exchange. An inter-dealer quotation system, linking dealers electronically to make markets. That process continues, as we continue to develop our technology to create an electronic market for broker-dealers.

Over that time period, we endeavored to create some transparency in the market; rather than having all 10,000 securities trade in the same way, we created market tiers and allowed engaged companies to choose to be more transparent, to be more open, to provide more disclosure, so that we could give investors the ability to use data, use market information, use market intelligence to better discern what was an investable security versus what was not.

We took all of those securities and we created three tiers. The first tier being our Best Market, what we call OTCQX. That market requires that companies meet certain financial criteria, financial criteria that are very similar to those of NASDAQ or the NYSEMKT. So you have to hit those financial standards. These are companies that are fully-formed. We have some of the largest international companies in the world that choose not to be on a national exchange or that aren't yet ready to be on a national exchange. They can be trading, they can have a public trading market, while being open and transparent.

Our second market is a venture market, OTCQB. That market has very light touch regulatory standards. It's really for very early stage entrepreneurial companies that again, want to be open and transparent and be seen as investable by investors and that don't want to trade on the Pink market, but perhaps aren't yet ready to be on our OTCQX or even on a national exchange.

The third market is the Pink Market, which is what we call the Open Market. That's a market where broker-dealers with really no company involvement can come together to trade anything. Within Pink, you have securities that are dark, not open and not transparent. When companies go bankrupt, that's where they go, they go to Pink. So American Airlines, Radio Shack, General Motors went to Pink, as well as a number of good companies, but because of all of the company types and because of no company involvement, broker-dealers put a lot of restrictions in place around trading Pink securities.

If you look at our market from what it was in 1997 to what it is now, it's really changed from a phone-based pool of multiple securities, thousands of securities with no standards, to a fully electronic market that allows companies to be open and transparent and decrease that reputational risk by meeting certain standards.

Dr. Allen Alper: All that sounds very good. Could you tell me a little bit about criteria and the process companies go through to become listed on the tiers?

Mr. Jason Paltrowitz: Sure. On OTCQX, we follow the SEC penny stock rule as kind of the guiding principle, so at the very least, the company needs to trade above $5, or if they are not $5, they need to meet one of the other tests as defined by the SEC. Most notably, either more than $2 million in net tangible assets, or average of $6 million in revenue over the last 3 years. Those are the key guiding financial principles there.

From a corporate governance perspective, we take a little bit of a lighter touch than the national exchanges. We require that companies have 2 independent directors and an audit committee; we don't require a lot of the other corporate governance committees that a national exchange would require. We then require that companies are making their financials available, are up to date in their filings, whether those are filings with the U.S. Regulator, or for our international companies, that they're up to date on their filings with their home market regulator. We do checks on auditors, who their directors are, who their lawyers are and all of those things.

Additionally, as part of OTCQX, we require a third party introduction or verification. Companies need to be sponsored by a third party, which we call an advisor. That advisor is basically writing a letter on behalf of the company saying that they actually, from a third party perspective, meet all of the criteria that we set out on OTCQX. Again, with OTCQX, what you're really getting is an exchange listing, but without all that cost and complexity that would go with being on a national exchange.

For OTCQB, we don't have strict financial requirements. We require that companies trade at least above a penny. You can't have sub-pennies, you can't have bankruptcies, you can't have shell companies. We require that companies disclose all of their directors, all of their lawyers, their auditors, any promoters that they may have, and any other affiliates of the company.

We also require, and this is an important distinction, that companies make available to us, through their transfer agent, the number of shares they have outstanding on a regular basis. To be on OTCQB, you need to be an SEC reporting company, but what we found was that even though you're reporting to the SEC, a lot of companies report one number for shares outstanding and then on the next day, start running a printing press in their basement and are being dilutive to their shareholders. We wanted to clean that up by requiring companies to be open about the share outstanding number.

Lastly, as I said before on Pink, there are no requirements. It's a broker market, so any broker-dealer that wants to file with FINRA to have a ticker symbol created and create a public market for any type of security they can do so. Again, because of that, you find a lot of good securities, but also a lot of dark, distressed and disreputable securities on that market.

Dr. Allen Alper: Would you explain Regulation A+ to our readers?

Mr. Jason Paltrowitz: Regulation A+. In 2012, in one of the very few times probably in the last 20 years, Congress and the President got together and did something that everybody agreed on, President Obama signed the Jobs Act, The "Jumpstart Our Business Act.” One of the provisions of that act is something called Title IV or what we call Regulation A+, which were amendments to the old Regulation A. Under the old Reg A, companies could raise up to $5 million in capital and there were a lot of rules and regulations around it, making it difficult for companies to raise capital.

Under Regulation A+, companies that are not SEC reporting can now raise up to $50 million, so the limit was taken from $5 to $50 million, but more importantly, those shares or that money can be raised from anybody. It allows for general solicitation to the public, so the investors no longer have to be QIBs or accredited. Additionally, it allows that those shares be freely tradable immediately upon issue. There's no longer, like you would see in a Reg D fundraising, that one year lockup or restricting period. What you have now for small companies is the ability to raise capital, allow them to raise capital online, from anybody, and allow those shares to have a public marketplace immediately thereafter.

So that, from our perspective, well from most people's perspective, is revolutionary, because it's probably the last thing you couldn't do online - a capital raising. You can now do that. It allows you to do it with the general public. There's been a lot of talk about how the IPO market is broken. One of the reasons that the market is broken is because it was designed for rich people and their friends. The large institutions are the ones that get into the IPOs and they're not really there to help build companies, they're there to quickly dump those shares and make a buck quarter over quarter.

Whereas, now you have small companies who tend to have, as their investment base, retail and high-net-worth anyway, these are companies that typically don't or won't have institutional investors. Now they’re able to sell shares to their stakeholders. People that know the company, people that buy the products or are interested in whatever it is that company is doing. They can get into this IPO, they can hold those shares, they can see a public valuation immediately and they can be part of that IPO process. Again, because those shares are freely tradable, from an OTC Markets perspective, we become the natural trading venue for those securities because these are companies that don't want the cost and complexity of being listed on a national exchange. So we can make being public painless or less painful by having these companies look to our OTCQX or OTCQB markets as the venue where these shares will naturally reside.

Dr. Allen Alper: What would be the procedure for companies to do that with you?

Mr. Jason Paltrowitz: In essence there is a lighter touch SEC process where a company needs to complete something called a Form 1-A. Regulation A+ allows a company to do something called "testing the waters". A company can go out and see what the appetite is, and whether or not they can raise the money they want. They can then file this Form 1-A; they can go through the process of raising the money. If they raise the money and they decide to go through, very much like a traditional IPO, someone's collecting the cash. When the cash is collected, they deliver off the shares through the transfer agent and the escrow agent.

Then from an OTCQX perspective, we have an application process. They would need to meet our standards, they would need to have that third party advisor vouch for them and the most important piece is that there then needs to be a broker-dealer that files what's called the Form 15c2-11 to get that ticker symbol. Once that ticker symbol is created through the regulator, then those shares are immediately available for secondary trading and those companies would then be, if they opted to be on our OTCQX market, would then be eligible to trade on OTCQX.

As of now, although this was signed into law in 2012, it didn't actually go into effect until a year ago. As of today, there's only been 1 deal. There have been about 80-90 that are currently filed with the SEC. There's only been 1 that has closed that is Elio Motors, which does trade on OTCQX (OTCQX: ELIO)

Dr. Allen Alper: Very good. Could you tell me a little bit about your team and organization?

Mr. Jason Paltrowitz: Sure. First of all, we're a public company, so we trade on OTCQX ourselves. Our ticker symbol is OTCM. Our CEO is a gentleman named Cromwell Coulson. Again, he bought, with some investors, the Pink Sheets back in 1997. As a company, we're small, so we are sub-90 people. We're hiring now, so those numbers are fluctuating. I run what we call our corporate services business, so I report to the CEO and I'm on the management team. My team is responsible for new business development and relationship management.

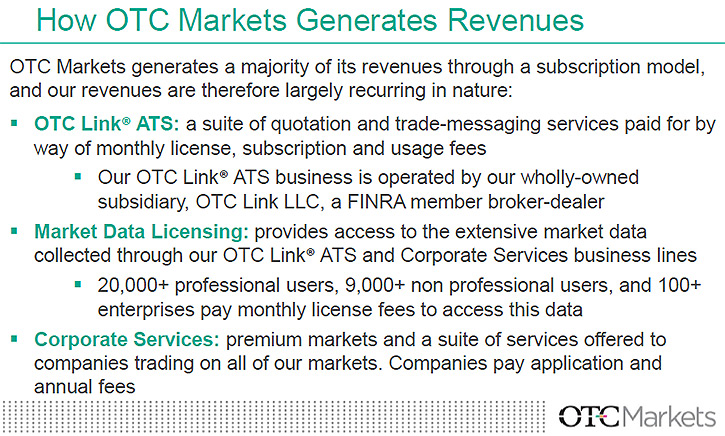

I have a colleague who works out of D.C. with our compliance team. We're based in New York, but we have a compliance team that's based in D.C. She and her team are responsible for making sure that all of our OTCQX and OTCQB companies are doing all the things they're supposed to do. We are basically split into three primary businesses. The ones that I just described we'll call our issuer services or corporate services business. The second business that we operate, and really the key to the whole thing, is our trading services business. That is the ATS, the platform on which all of these shares trade and all the brokers link into to electronically message and quote securities

The third business is market data. Like every other exchange in the world, we have companies that list, we have trading that goes on, and all of that information creates data. We then sell that data. So the market data team is selling that data to the same audience as all the exchanges - Reuters and Bloomberg, the trading firms, the broker-dealers. What's important in our market that's a little different from the exchanges is that we're selling data that is really helping investors and broker-dealers understand the nature of the securities that they're trading. In off-exchange trading, there's a lot more due diligence that needs to be done for these securities not being on a national exchange.

Part of that market data business is something we call our Compliance Data File. It actually just won an award for being one of the more innovative market data products. In essence, it's a feed that goes out twice a day to broker-dealers and investors that allows them to know what the security types are on our market. What's a Pink versus a OTCQB versus a OTCQX security, what meets the penny stock rule, what share outstanding numbers, and all of those important data points that allow broker-dealers and investors to make educated investment decisions and meet compliance restrictions and criteria within the broker-dealer.

Our business is basically set-up with those three, Corporate Services, Trading Services and Market Data.

Dr. Allen Alper: That's very good. Could you tell us a little bit about your finances, your revenue, your margin, the dividends you pay? That'll give our readers/investors a more in-depth understanding?

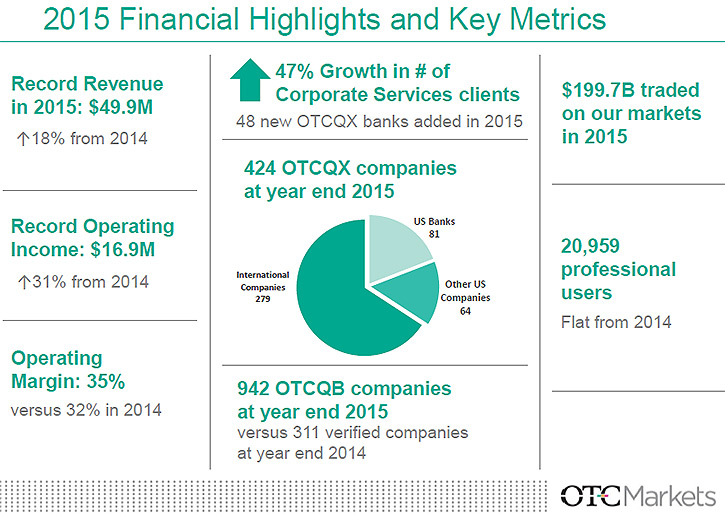

Mr. Jason Paltrowitz: We just announced our first quarter. Last year was a record year for us. We had, I believe, a 35% margin, ending last year - made about $50 million in revenue at a 35% margin. We just announced we're paying a $0.14 dividend. Last year we paid a $0.60 special dividend, so I believe our dividend yield is currently about 3.3%.

Dr. Allen Alper: That sounds very good. Tell us a bit about the mining companies you have.

Mr. Jason Paltrowitz: In our corporate services business, we have a number of products designed to meet different needs. One of our larger franchises is Canada. We have about 120 companies on our OTCQX market that are Canadian. A large number of those are mining and mineral companies. Part of our franchise is large international companies, so companies like Alumina have their secondary listing here.

I think if you look at all our securities on our markets, we're talking probably around 150-160 companies in that space. The average market cap is around $105 million. In Canada, we have a number of gold, lithium, silver companies. Those small micro and small cap producers from the Western Canadian region choose to have their secondary listing with us here in the States.

Dr. Allen Alper: Well that's very good. That's really great. By the way, I publish breaking news, interview articles with top management and analysts’ comments on a good share of the same companies - Canadians, Australians, U.S., and some South Africans, French and English, but Canadians, they're the big miners, the Canadians and Australians. Our readership is similar with almost 70% U.S. and Canada, over 20% U.K. and Australia, then India, Germany, China, Brazil, Sweden and Turkey.

Mr. Jason Paltrowitz: Alumina, the Australian company, is an interesting one because they de-registered and de-listed from the New York Stock Exchange last year to join our OTCQX market. One of the reasons they did that was because it was incredibly expensive for them to remain on the NYSE, it requires that they be duplicative in their reporting. So they would have to report in Australia as an Australian company and then they have to do the exact same thing for the SEC as if they were a U.S. company. What being on OTCQX did for them, was to allow them to use their Australian disclosure as their criteria, while still having a secondary market and publicly trading venue here. You probably saw on Monday that Western Uranium joined our OTCQX market as well. Again, a Canadian company that wants to have a U.S. listing, but doesn't want to do it with all the pain and complexity of having to be fully SEC reporting.

Dr. Allen Alper: That's a great service for them. That's terrific. You are in an amazing position.

http://www.otcmarkets.com

Corporate Headquarters

304 Hudson St

3rd Floor

New York, NY 10013

T. +1 212.896.4400

F. +1 212.868.3848

E. info@otcmarkets.com

|

|