Discussion with David Cole, President and CEO Eurasian Minerals, Inc. (TSX: EMX, NYSE MKT: EMXX): Successfully Assembled a Large Global Portfolio of Exploration and Royalty Properties, by Executing the Prospect Generation Model

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/15/2016

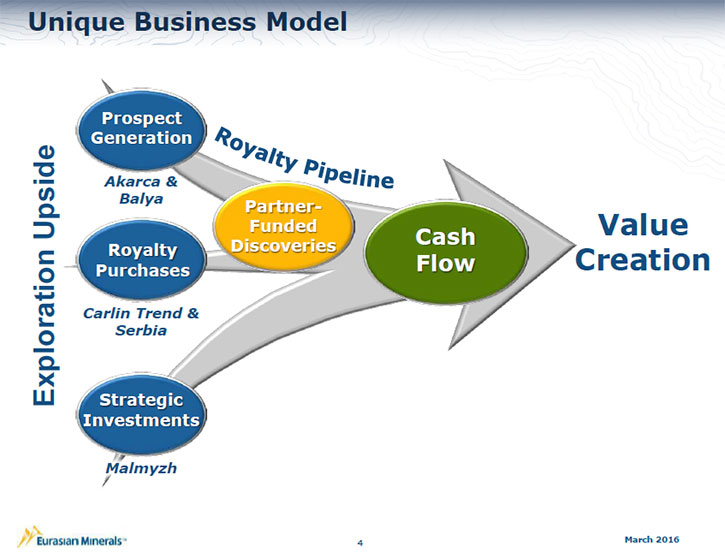

Eurasian Minerals, Inc. (TSX: EMX, NYSE MKT: EMXX) has assembled a large global portfolio of

exploration and royalty properties, by executing the prospect generation business model, royalty

purchases, and strategic investment. Mr. David Cole, President and CEO of Eurasian Minerals, is excited

about a very significant recent discovery on their copper-gold Cukaru Peki royalty property in Serbia, as

well as the beginnings of cash flow from their Balya lead-zinc-silver royalty in Turkey, the increasing

of the cash flow from their Leeville royalty in Nevada (not including Newmont's new discovery there) and

the new shaft Newmont has completed. If all goes as planned, the company should be cash positive by 2017.

What brought the company to this important juncture? That would be Eurasian’s team and their ability to

continue to grow a portfolio and manage the existing assets to the benefit of shareholders. Eurasian has

amazingly managed to accomplish this through good and bad cycles within the mining industry.

Examining and logging a fresh trench at the Akarca

gold-silver project, Turkey; from front to back: Dr. Dave Johnson, Chief Geologist, Mike Sheehan,

Exploration Manager-Turkey, Halil Aydincak, Senior Geologist & Alper Ozbek, Geologist

Mr. David Cole: Awfully nice to hear your voice.

Dr. Allen Alper: Good to talk with you too. This is Dr. Allen Alper, Editor-in-chief of Metals

News interviewing David Cole, President and CEO of Eurasian Minerals. I see your stock has nearly doubled

since we talked last. That's great news. You're being recognition again for the great things your company

is doing.

Mr. David Cole: Thank you. We're happy to see some level of sanity return to our stock price. I

think quite honestly and sincerely, there is a long way to go. There is some significant news from

Serbia, regarding the advancing huge discovery there and our royalty position on that discovery.

Dr. Allen Alper: That's excellent. Could you elaborate on your business strategy and your royalty

generation activities?

Mr. David Cole: Certainly. I'm very passionate about our business model and I'm always happy to

review it and discuss it. I have taken my peers and my own experience in this industry of seeing how

people make money in mining; and using different examples of how people have done very, very well.

Royalty holders do exceptionally well by reducing risk in this very risky industry. The folks that have

received highest return on investment and with the lowest risk are those that have grown royalties

organically. What I mean by that is the people who actually do the prospecting and the geological work.

They become the landlords and acquire exploration licenses or claims. They then sell those off while

holding back royalties and when they eventually become producing mines, they enjoy that handsome cash

flow. The leverage there can be huge. We've seen a number of individuals and companies doing incredibly

well with their royalty portfolios.

Eurasian’s focus is really on the organic growth of our royalty portfolio worldwide and we do

this by executing the prospect generation business model. We acquire large tracts of mineral real estate

and add value by performing basic, inexpensive exploration. We then sell those assets, keep royalties,

carried positions and other payment structures associated with the advancement of our properties. That's

a very powerful long-term way to build wealth.

Another way is to purchase royalties that are attractively priced. The process of purchasing

royalties at favorable levels is a very tough, competitive business. They are normally very richly

valued. But occasionally, with enough hard work and digging, you can find a solid royalty at a sensible

price. This helps leapfrog the time horizons to obtain production royalties sooner within the portfolio.

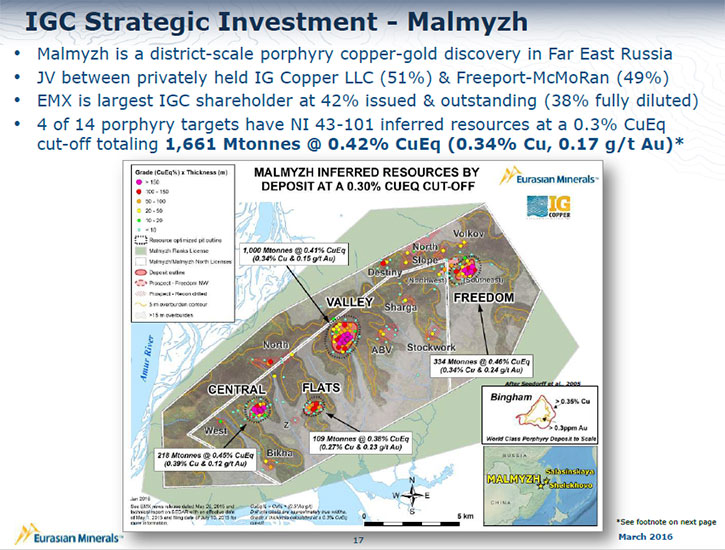

Then the third prong of our business approach, Dr. Alper, is strategic investment. We utilize our

geologists with well-honed business skills and instincts, to scour the globe for assets and partners to

place strategic investments with. We've done quite well with our strategic investments. One of our key

strategic investments is the advancing huge discovery in far southeastern Russia called Malmyzh. This

example fleshes out the last prong of our 3-pronged approach. We spend considerable time in the

calculation and execution of these investments.

Dr. Allen Alper: Could you elaborate a little bit more on some of your key projects and why they

are so important?

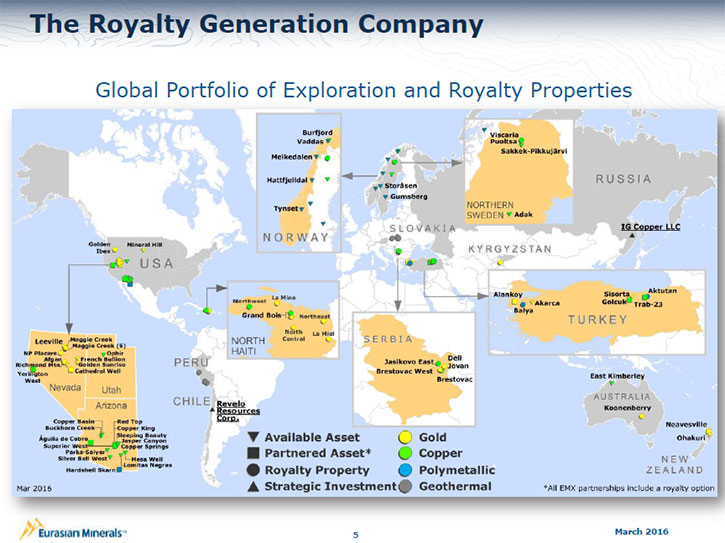

Mr. David Cole: I'd be happy to. We have 1.6 million acres of mineral property worldwide,

including projects we own 100%, royalty properties and projects that are in joint venture. This provides

us with a lot of exposure. Within that portfolio, which spans a dozen countries or so, there are 5 big

value drivers. Interestingly enough, 2 of those came to us through our organic process of prospect

generation. 2 came from royalty purchases and 1 is a strategic investment. This once again illustrates

all 3 prongs of our approach.

The first 2 were organically developed in Turkey. They're the result of 13 years of prospect

generation we've performed in the country. We've found Turkey to have geologically well-endowed

properties; lots of opportunities there to carry out good geologic investigations and advance assets to

the benefit of shareholders. One of those is a significant gold-silver discovery called Akarca. This

project has had $13 million of our partners' money spent on it and 245 drill holes punched in it that

represent a very nice discovery and a material asset within our portfolio.

Another illustration would be our Balya lead-zinc-silver discovery. That is a holding we

originally acquired early in our history in Turkey while prospecting the district for copper. We

uncovered these lead-zinc-silver horizons that were quite interesting. We later sold the property to a

Turkish company that has drilled 36 kilometers of holes into the system. Almost every hole has hit high-

grade lead-zinc-silver mineralized bodies. They have advanced that into production where, not

coincidentally, we held back a 4% uncapped, un-buyable royalty. Those are fabulous commercial terms for

the shareholders. Just to give you an idea of the leverage we're talking about, we bought that license at

auction from the Turkish Mining Department for approximately $17,000. Now it represents a juicy revenue

center for us. This example makes an excellent case for the bang you get from your buck on the generative

side of the business.

Dr. Allen Alper: That's fantastic work. That's great!

Mr. David Cole: Yes, thank you. It does take time, though, and as I said, we've been in Turkey

for 13 years. This is a wonderfully accretive business. It works very well, but it does take time and

patience. It takes time to make discoveries, to advance them to production; simply it takes time for the

assets to mature. The other two projects that I'll highlight are royalties that we've purchased. They are

particularly interesting.

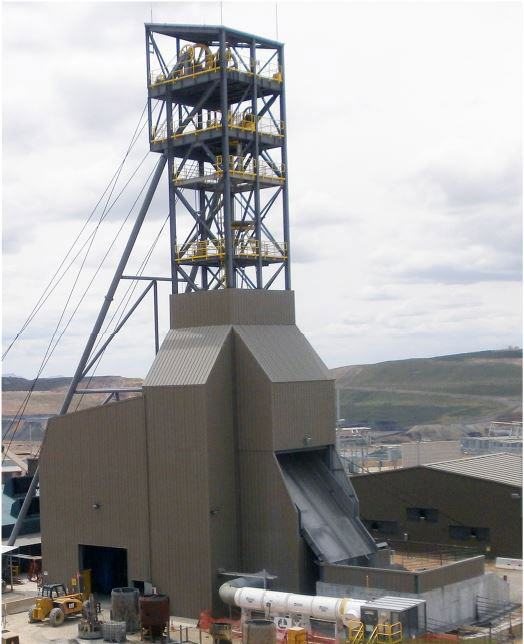

One is the royalty on the Carlin Trend. For a small company, we're really proud of the fact that

we have a piece of the Carlin Trend. As you well know, it is one of the most prolific gold belts in North

America and is situated northern Nevada. The Carlin Trend is a major center of activity for Barrick and

Newmont. Newmont Mining operates gold mines within the area where we have a 1% gross royalty. We receive

royalty checks from Newmont on a monthly basis. Previously, Newmont had two shafts to service our primary

revenue source, now they have three. They've announced in their 10-Q, quarterly reports and annual

reports, the plans to increase production now that they have completed the third shaft. This portends

well for Eurasian Mineral’s royalty there.

Also, they have announced two new discoveries which fall on our royalty ground to all or some

degree. Additionally, they have announced an increase in resources at Leeville, Four Corners and Turf,

all of which we have a royalty on or a portion thereof. We are very excited about this and our

shareholders should be too. All of this collectively represents a significant asset for the Company. It's

a big risk reducer for us, as it provides us with cash flow every month. We expect royalty cash flow to

significantly increase within the next year per Newmont's announcement of planned production increases on

that property.

Leeville/Turf Production Shaft

Dr. Allen Alper: That's really great. That's terrific!

Mr. David Cole: Yes, It is an impressive asset to have. We're fortunate to have been able to buy

that royalty. We obtained it through the purchase of Bullion Monarch in 2011. That take-over was made

specifically to obtain that royalty because we believed in the exploration potential on that property.

Early in my career, I was involved in discoveries working for Newmont on the Carlin Trend. As a result, I

have intimate knowledge of the geology there and I believe there is still substantial exploration

potential there. We are seeing that belief bearing fruit now.

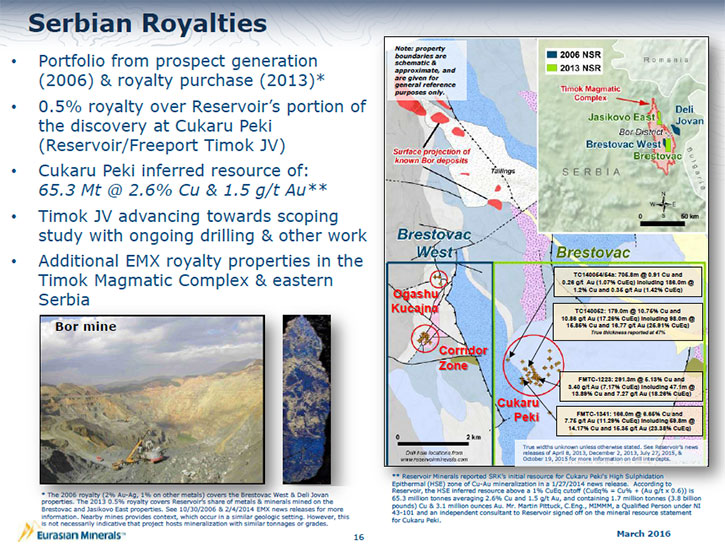

Another significant royalty that we have purchased is in Serbia. You have likely followed the

amazing discovery that has occurred in Serbia called Cukaru Peki, made by Reservoir Minerals and joint

venture partner Freeport McMoRan. It's a fascinating story and it's been very interesting to observe the

commercial developments that are entirely advantageous to Eurasian Minerals shareholders. Let me explain.

Just a bit of history to start off with. Eurasian Minerals was the first company to go into Serbia and

acquire exploration licenses after the Balkan War. We helped the Serbian government rewrite their mining

code. We became the first foreign company to acquire a minerals exploration permit there in a long time.

After a period of exploration, we ultimately sold the business unit to Miles Thompson, who started

Reservoir Capital Corporation. He went on to form a joint venture with Freeport and acquired some

additional licenses, in addition to the ones that we had sold them. We sold the business unit to them for

cash, shares and a royalty. Of course we all know now that they made a fantastic discovery with Freeport.

Kudos to Miles and their team for doing that.

As luck would have it, that discovery was not within our original licenses and was slightly off

on another license that we had not sold to them. I didn't let that stop me. I went out and found a small

royalty on the discovery ground and bought it before the significance of the discovery was realized. The

royalty is a 0.5% NSR on Reservoir Minerals' portion. I was able to buy that royalty for a mere 200,000

Canadian dollars. As time has gone on, that has proved to be a world class discovery. Freeport, who has

had some financial troubles as we all know, has sold that asset and now Reservoir is being taken over by

Nevsun.

Nevsun's plan, as they have announced, is to fast-track that deposit into production. That

deposit is distinctly described as 2 zones. There is the upper high grade zone, which will be mined

underground and then a very large tonnage porphyry copper-gold prospect at depth. Drill results announced

by Reservoir in April included an intercept that was 835 meters of 1.07% copper, all within our royalty

footprint. We have the 0.5% royalty on that. As you might imagine, we are very excited about this. We

also have other royalties within the district that have long-term potential. This is another win for our

shareholders and speaks to the portfolio effect of having all these properties worldwide. So that's 4 of

the 5.

Dr. Allen Alper: That's very good.

Mr. David Cole: Thank you. Then the fifth one is our strategic investment in far southeastern

Russia. This is the Malmyzh Project. The way that we found our way into our current position is

interesting. We were monitoring that belt for exploration activities. We were familiar with a claim held

by Phelps Dodge. Phelps later sold to Freeport and then Freeport ended up joint venturing that out. To

make a long story short, it landed in the hands of a private company called InterGeo Copper (IGC),

managed by the CEO, Tom Bowens. He was drilling off this amazing porphyry coppery belt and making some

significant hits. We saw the results of the holes and the potential for copper and gold. We said, "Holy

smokes! This is something special."

Tom needed money to advance that program. Eurasian Minerals had a very nice treasury at the time

and we bought in at a distinctly favorable valuation and became the largest shareholder in IGC. Along

with helping Tom financially, we also aided him technically in advancing the discovery. There are now 14

promising porphyry copper-gold systems that have been identified on that belt in addition to an in-pit NI

43-101 compliant inferred resource advanced on 4 of those porphyries. That compliant resource is 1.66

billion tons of 0.42% copper equivalent, making it one of the larger ongoing copper-gold discoveries in

the world. We are ecstatic to have significant exposure to this monster via our share ownership in IGC.

That strategic investment represents the third prong of our business approach.

Dr. Allen Alper: That's excellent!

Mr. David Cole: You can tell there is a lot of value in the portfolio. One thing I'll point out

is that the team built this astonishing portfolio. I really believe in them. We continue to acquire more

prospective mineral real estate around the world. Some of the key areas where we're focusing right now,

in this downturn, are in very favorable political jurisdictions.

We're quite active in Sweden. The country has a fantastic mining law. It's rated amongst one the

best places in the world for mining by the Fraser Institute. There are 17 major mines in production and 7

smelters in Sweden today. That's about 5 or 6 more than in the United States. We find it to be a great

jurisdiction to work in, with its clarity of mineral law and title, not to mention its distinctly

productive work force. There are also excellent databases to work from available through the Swedish

Geological Survey. We are also quite active in the western United States, which is obviously another tier

1 country and great place to work. Specifically we are active in Nevada and Arizona.

Dr. Allen Alper: That's excellent! Could you tell me a little bit more about yourself and your

team?

Mr. David Cole: Sure, I'd be happy to. I have a Bachelor's degree in geology and a Master's

degree in economic geology from Colorado State University. I went to work for Newmont Mining Corporation

and spent the first 18 years of my career working for Newmont in exploration. I did my time working in

the mine environment enough to learn how and what it's like to work in a mine. Most of the time I spent

with Newmont was performing exploration in Nevada, Peru, Southeast Asia, Turkey and Eastern Europe.

During my career at Newmont I learned so much working with those people; they really have some great

geo-scientists. My passion was always with value creation on the exploration end of the mining spectrum.

In mining, the early stage discovery is where the most leverage occurs. When I left Newmont to found

Eurasian Minerals, my focus was and still very much is value creation through discovery. To best leverage

that premise, I closely observed through my career the development of entities such as Franco-Nevada,

Royal Gold and private companies such as the Lyle Campbell Trust along with a list of very astute

individuals. I watched those companies build a lot of wealth for their shareholders over time through the

leverage of royalties and property ownership while largely de-risking their endeavors in what is

generally a pretty risky industry.

I have been very fortunate to work with some phenomenal individuals such as Eric Jensen, a Ph.D.

geologist from the University of Arizona. He currently manages all of our geologic activities outside of

the Americas. He has a very high level of experience and knowledge in porphyry copper systems as well as

a specific type of gold deposit known as alkalic gold systems. He did his Ph.D. on the Cripple Creek

mine, here in Colorado where we are primarily based.

Another great example of the intellect within the team is another Ph.D. from the University of

Arizona, Dr. David Johnson. The U of A is without a doubt, one of the top schools for economic geology in

North America. David Johnson manages the Americas for us. He has a real passion for exploration; he

really lives and breathes it. He has an uncanny understanding of geological environments and a very

strong background in porphyry copper systems as well as gold systems. He and the team he manages are some

of the best structural geologists in the United States, regarding what we call extensional tectonics.

They understand how the structural systems in the Western United States have faulted, moved rocks around

and displaced mineral systems. Their understanding of such is where our opportunity lies. They understand

how these big copper porphyry systems have been chopped up, moved around and can predict where they might

be now. That has been something that we have leveraged very nicely into property positions that we

continue to sell to other mining concerns, which is what we do.

We have a robust portfolio in Nevada and Arizona as well as other western states. Our guys employ

their geological expertise, acquire properties, do some basic exploration, sell them and move on. One of

many examples is Rio Tinto, one of the largest mining companies in the world. They have done 3 deals with

us in the recent past and we continue to work on other exploration ideas with them. It's just great to

have repeat business from top tier clients such as Rio Tinto. Our business model includes helping other

companies be successful.

On the legal side, I should mention our Chief Legal Officer, Jan Steiert. She's the immediate

past president of the Rocky Mountain Mineral Law Foundation. She has a wealth of experience in natural

resource law. We are very fortunate, for a small company, to have a top tier senior attorney in-house

helping us paper these deals and making sure they're put together correctly for the long-term benefit of

our shareholders. She's doing a fabulous job.

Dr. Allen Alper: Well, you definitely have an outstanding background and your team is outstanding.

You've really put together a great group.

Mr. David Cole: Thanks very much. I always appreciate your interest and I appreciate the fact

that you understand the work that we're doing, Dr. Alper.

Dr. Allen Alper: Yes. I do understand the excellence of both your technical work and your unique

business model. I admire what you are doing.

Could you tell me a bit more about your finances and capital

structure?

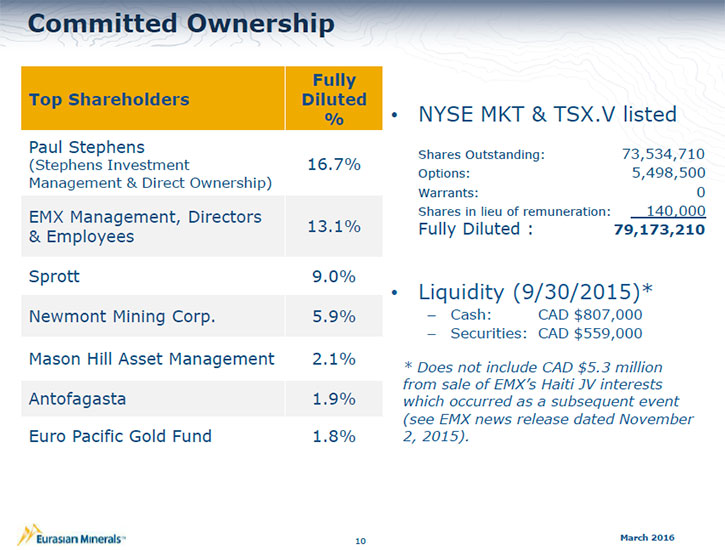

Mr. David Cole: We don't have a lot of money in the bank right now. This is one of our

challenges. But we do have a solid royalty at Leeville and are very much looking forward to receiving

increased revenue flow from there. Last year we sold our assets in Haiti to Newmont, where we had an

enormous land position and kept 0.5% royalty covering all of that land. We are happy to have done that

deal as well as having repeat business from Newmont Mining. Newmont is also one of our largest

shareholders with about 6.4% of our shares in their hands. That $4 million we received from Newmont has

been enough to keep us going without doing a financing. In fact, we have not done a financing since the

first quarter of 2011.

Another important holding that is becoming an added source of cash flow is the Balya lead-zinc-

silver royalty in Turkey. That is just now coming into production and we recently received our first

quarterly royalty statement. This is a material development in the company as this is the very positive

end result of a maturing property. We expect to see increased production from that over time and this

will be one of the properties that take us to positive cash flow in 2017, if all goes as planned. The

outlook now is quite good from a cash flow perspective. We don't have a significant amount of cash in the

bank at the moment, but I’m confident that we've got enough to get us through until we see these other

properties start to provide increasing amounts of cash flow. We have very, very strong shareholders that

will always make sure that we're properly funded, so I'm not concerned about that at all.

Dr. Allen Alper: That's very good. It's good to have strong shareholders that have confidence in

what you're doing and have stayed with you in good times and hard times.

Mr. David Cole: With respect to the comment about shareholders sticking with us in good times and

bad times, I should probably point out the rather prodigious amount of insider buying that there has been

in Eurasian Minerals over the course of last year. You and I have discussed that previously. We're up to

insider ownership exceeding 30% of the company. I bought a lot of stock myself in 2016 and our largest

shareholder; Paul Stephens is on our Advisory Board. Paul Stephens has just bought and bought and bought

stock. As an insider all of his trades are reported of course as are mine. You can see those on SEDI.ca.

That shows our innate belief in our business model, our portfolio and our team. We were buying the stock

in a significant manner during a very protracted downturn in the industry.

Dr. Allen Alper: That's great. That shows you have confidence and other shareholders do, too. It

looks like your confidence is beginning to pay off again. That's great and there's plenty of room to

grow.

Mr. David Cole: I think we have a good runway in front of us, quite honestly. The way things have

advanced recently on the Serbian royalty has been greater than we could have imagined.

Dr. Allen Alper: That's great. It reminds me that I've done a lot of interviews of Rob McEwen and

one thing he always points out is he has 20% of McEwen Mines and that he has confidence in the company.

He says that's often how he judges different companies, whether the management has put investment into

their company and have an important share of the company. I can see you and your team have done that.

Mr. David Cole: And gladly I might add.

Dr. Allen Alper: That's great. Could you tell me the primary reasons why our high-net-worth

readers/investors should invest in your company?

Mr. David Cole: The primary reason would be the team and our ability to continue to manage and

grow the portfolio to the benefit of shareholders, over time through good cycles and bad cycles. We take

advantage of downturns to acquire prospective mineral rights. We take advantage of upturns to get

projects sold, where other people's money and expertise is being employed on our properties. Moreover we

strive to manage the portfolio to maximum benefit of the owners, our shareholders.

There are some superb examples of big companies that have been built through the process of

acquiring quality mineral royalties over time. The prime example of this would be Franko-Nevada followed

by Royal Gold. Altius is a mid-tier example of a company that executes a comparable 3-pronged approach

towards the sector that Eurasian Minerals does.

From our Copper Basin, Arizona mineral exploration

project. Need we say more?

Dr. Allen Alper: That sounds excellent. Is there anything you'd like to add Dave?

Mr. David Cole: Well, I like to advise folks to exploit the downturns to take advantage of the

depressed price levels and add to their holdings or establish new quality positions. Don’t get caught up

in the latest drill plays, just stick with the top tier quality companies in the sector. Of course I

recommend that you hold royalty companies in your investment book; they represent the best combination of

low risk and high returns in the industry. People should be accumulating these now while the prices are

still quite low. That's the right way to get in.

Dr. Allen Alper: Well, I agree. That sounds like a very good approach to investing.

http://www.eurasianminerals.com

Corporate Office

Suite 501 - 543 Granville Street

Vancouver, British Columbia

Canada V6C 1X8

Phone: +1 (604) 688-6390

Fax: +1 (604) 688-1157

|

|