Discussion with Nigel Lees, President and CEO Sage Gold, Inc. (TSX: SGX): An Overlooked, Undervalued Gold Deposit Amongst Timmins Industry Majors about to go back into Production

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/15/2016

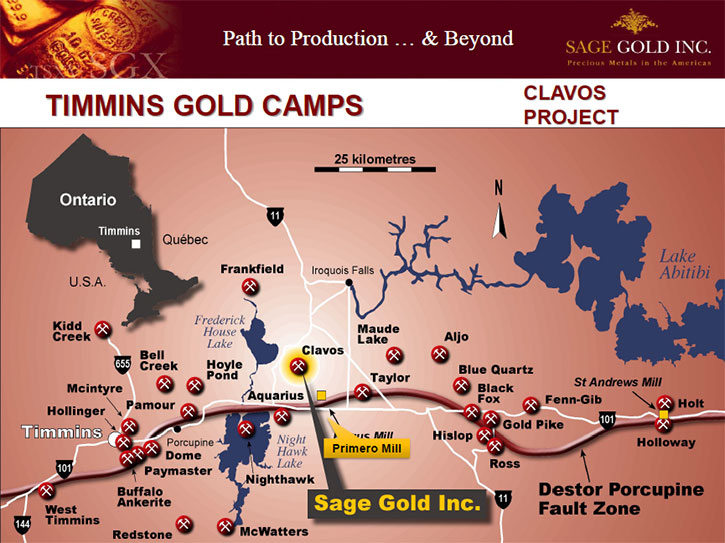

Sage Gold, Inc. (TSX: SGX) is a small Canadian exploration and development company with advanced

properties in the province of Ontario. Their flagship asset is Clavos gold deposit located in the

prolific Timmins Mining Camp. As far as mining companies go, it has the right address. It’s adjacent to

the well-known Canadian producer, Primero Mining and close to other producers, such as Goldcorp and

Kirkland Lake. The Clavos deposit is fully permitted and the previous owners spent $50 million on

underground and surface infrastructure. According to Nigel Lees, President and CEO of Sage Gold, they

have been approached recently by potential financiers with the purpose of putting Clavos back into

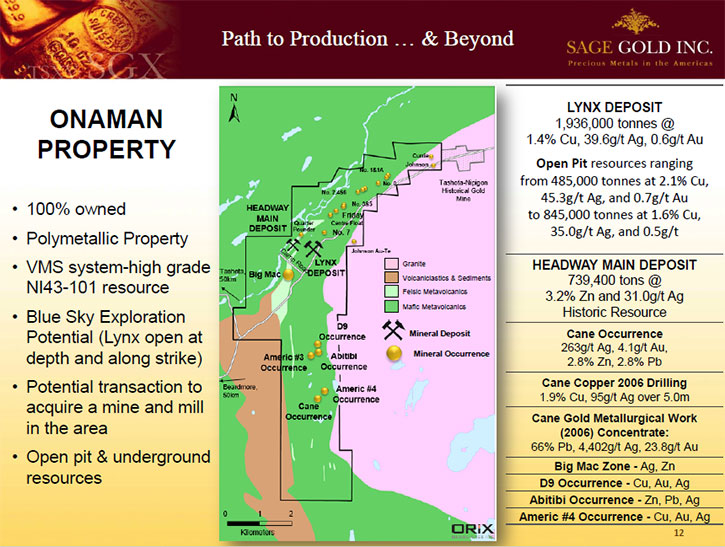

production. Secondly, Sage Gold's Onaman Property is a polymetallic deposit of copper, gold, and silver,

with some very attractive characteristics that suggest tremendous geological potential.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News interviewing Nigel Lees,

President and CEO of Sage Gold. Nigel, could you tell us a bit about your company, Sage Gold, Inc., with

properties in Northern Ontario?

Mr. Nigel Lees: We are a small exploration and development company, based in Ontario Canada.

Personally, I have been involved in mining in a variety of different countries, particularly in the US

and several countries in South America. I find Canada a very good mining jurisdiction to deal with. The

lower Canadian dollar makes mining pretty attractive especially since the gold price is quoted in US

dollars and costs are in Canadian.

We have two main projects;

The first one is Clavos, a gold project in the Timmins camp. As you and your readers would

undoubtedly know, Timmins is one of the great historical gold camps in Canada having produced well over

100 million ounces of gold in more than a century of active mining.

Dr. Allen Alper: That is a great location to be in.

Mr. Nigel Lees: I think it is a great location for several reasons. First of all, our neighbors

are some of the industry’s best-known producers, such as Primero and Goldcorp. Secondly, the underground

infrastructure is largely developed and Sage has invested in a compilation of the historic data and hence

the company has an evolved understanding of the mining and exploration potential of the property. . Right

now we are seeing mergers and acquisitions in the area. Our 40% partner in the Clavos gold deposit is

Kirkland Lake Gold the successor company to St Andrew Goldfields. Thirdly, most gold mines in Timmins

have a long life. The Dome Mine was in business for over 100 years. I don't think they ever declared that

they had any more than four or five years’ resources. They were able to go on replacing their resources

as they mined. Very often, as you go deeper in the camp, the grade goes up. There are a lot of real

pluses being in Timmins.

Mr. Nigel Lees: Clavos was in production between 2005 and 2007 by St Andrew Goldfields, now

Kirkland Lake Gold, before Sage earned its 60% interest. St Andrew had an aggressive management team and

a very buoyant gold equities market at that time. I am guessing all the brokers were bugging them about

doing financing and putting it into production. They decided to go underground, built a ramp with the

idea of taking a bulk sample and ended up, almost by mistake, mining. Frankly, they did not do their

homework and did not model the project. While they successfully mined in one sense, they had not properly

planned their operations, resulting in too much dilution. When the gold market turned down, the company

was involved in two other projects, one in Alaska and the other in New Zealand, which were not working

out either. As a result, they closed all of their operations and management changed.

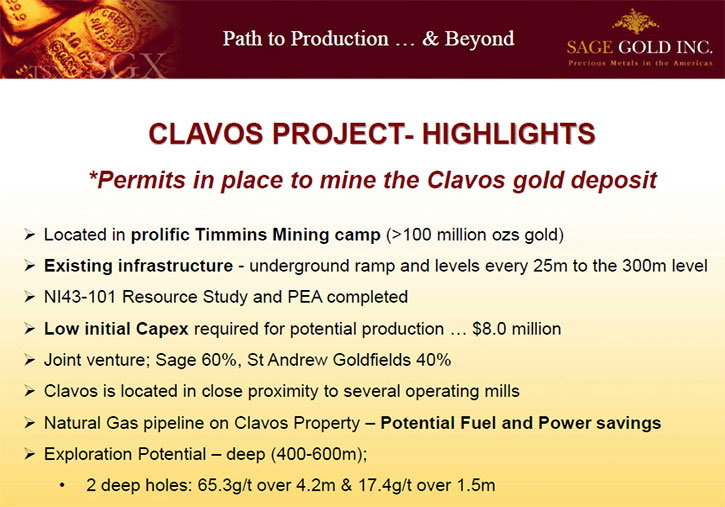

Sage entered into an option agreement with St Andrew in 2010 to earn into a 60% interest in the

Clavos property by expending $3 million in exploration and development. Additionally, we paid shares and

other cash to St Andrew, close to half a million dollars. Subsequently, we have spent approximately $2

million upgrading the property. St Andrew closed the mine in a hurry, after having spent about $50

million on underground and surface infrastructure. We were aware of the problems they experienced and

viewed it as a great opportunity. That is why the estimated Capex to put Clavos into production is only

about CDN$8 million.

Dr. Allen Alper; That is great! What are your plans for 2016?

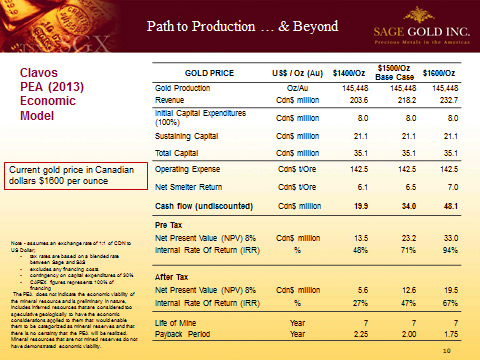

Mr. Nigel Lees: First, we did a huge amount of compilation. Then we conducted a $1 million

drilling program and had a fair amount of success. We believe the ore body can be extended along strike,

down dip and down plunge. We completed another resource study, the fourth by RPA (Roscoe Postle

Associates) related to Clavos over the past several years, followed by a Preliminary Economic Analysis

(PEA) study that showed the project to be quite economical. This was in 2013 when the gold price was US

$1,500. Even though the gold price has come down since then, in Canadian funds it is about $1,600 right

now, which makes it quite profitable. Labor rates and other costs have moderated particularly in Canadian

dollar terms.

There is a gas pipeline that transects the property. We are studying the economics of using

natural gas as a diesel fuel replacement, for mine air heating and for power generation. The price of

electricity in Ontario is high and natural gas pricing on a diesel liter equivalent is very inexpensive

relative to diesel.

The deposit is permitted for production and thus we avoid a very long, lengthy and expensive permitting

cycle. Clavos is one of the few permitted gold projects in Canada. The gold resource is approximately

320,000 ounces. We engaged an outside group to do a further geological compilation on the property which

may add data to the existing resource. We have been approached by several outside project financing

groups and potential new partners to put Clavos back into production. My goodness, we have been in a bear

market for so long I can't remember. To be approached by potential financiers is a delightful and

wonderful thing.

We are very hopeful that we will complete a project financing this year. The first step is to

dewater, rehab, and conduct definition drilling with the objective to be producing gold early in 2017.

Dr. Allen Alper: That sounds very good. Very promising. Could you tell me more about your team and

yourself?

Mr. Nigel Lees: My career started in the merchant banking business in London, England after which

I was a research analyst at RBC Dominion Securities. Actually I was not a mining analyst. I was a special

situations analyst, but I happened to be sitting very close to somebody who was very knowledgeable on

mining and kept on telling me about gold and how wonderful it was. I guess I was infected a little bit.

When somebody came with an opportunity for a project in Brazil, of all places, I realized that in the

Amazon you could mine gold from rivers. You could actually see gold as opposed to all the other regions

where people drill in areas where very often you visibly can't see any gold.

I started a company focusing on gold exploration in Brazil and it grew into one of the largest

gold mining companies in Brazil and South America. We then expanded our operations to Chile. We listed

originally in Toronto and then also on the New York Stock Exchange and eventually merged with Kinross

Gold. Some time ago, I made a significant investment in a small company called Sage Gold and decided I

would like to grow the exploration company into a North American producer and joined the company full

time. I am also on the Board of Yamana Gold, which is a significant gold producer in South America and

North America.

Sage has a very competent team of industry experts including several highly experienced

geologists and mining engineers: Our key team member, Bill Love is a geologist with an MBA and was a

geologist in the field when the famous Hemlo gold discovery was made in 1982. Bob Ritchie who is the

author of the PEA has worked around the world with companies such as Goldcorp and Noranda and has built

mills and operated mines. Avrom Howard and Peter Hubacheck, both highly accomplished and experienced

geologists round out the technical consulting team.

Dr. Allen Alper: Yeah. It sounds like things are brightening up, after a rather lean long period

and it looks like gold is going to find its footing right now.

Mr. Nigel Lees: I think so. I was amazed how poorly it did for quite a period, with all the

monetary creation. I think the event of negative rates and other things have had a significant impact.

Some Central Banks have been buying gold for the first time in years including China, India and Russia.

When it pulls back the gold price and the gold shares tend to find bids. There appears to be a fair

amount of interest and investment going into the area. I am obviously very much hoping and believe that

we have had a turn.

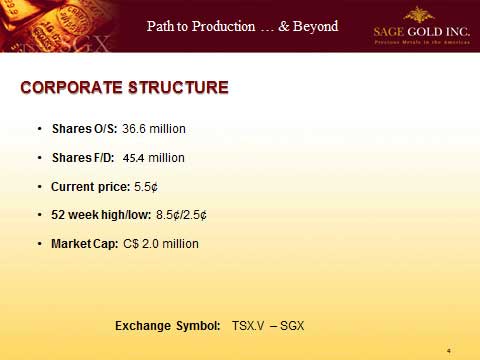

Dr. Allen Alper: Yeah. It definitely looks that way. Could you tell me your capital structure?

Mr. Nigel Lees: Yes. We have about 36 million shares outstanding. We have a tiny market cap about

CDN $2 million. At the height of the exploration market, when we did not have any resources, our market

cap was $40 million. I guess that is an illustration of how the market has changed values in a bear

market. We have about $2 million in project debt from supportive shareholders. These funds were

primarily used to advance the Clavos project. Rather than diluting the shares, we went the debt route

which will be eliminated on a project financing. I believe in time, that will prove to be a good

decision. I own on a diluted base about 15% of the company, other directors and management another 10%

plus and other friendly parties another 20%. So well over 40% of the company is owned by management,

directors and closely held. It does not trade a lot. It is mainly a retail stock. We have one or two

small institutional holdings, but I believe that is going to change with this new market environment and

our rising market cap.

Dr. Allen Alper: Sounds good that you and your team are invested in it and have confidence in it.

That sounds great.

Mr. Nigel Lees: I tell people one day I am going to be right. I buy just about every issue we do.

The law of averages suggests that I am going to be right one day.

Dr. Allen Alper: That sounds great. Is there anything that you would like to add?

Mr. Nigel Lees We have another project, the Onaman Property in Northern Ontario. It is

an area near Beardmore about an hour and a half flight north of Toronto and is a potentially very big VMS

system. We have a small compliant poly-metallic resource, the Lynx deposit, with copper, gold, silver

with a surface and underground resource. The surface resource, even though it is small, has a good grade.

It is 2.1% copper with credits for gold and silver. The Onaman Property has not been fully explored, but

geologists are very fascinated with the potential because of the different metals it has − silver, zinc,

gold, copper. We are going to be conducting an extensive program this summer, including mapping potential

drilling targets on the property.

Our goal is to expand the Lynx Deposit resource. We have only drilled down to approximately 300

metres. It is open on strike and at depth. The permitting process for production will take a year and a

half.

Dr. Allen Alper: That sounds very good. Could you tell me the primary reasons why our high-net-

worth readers/investors should invest in your company?

Mr. Nigel Lees: Sage has a tight share structure, a very small market cap and two excellent

projects located in some of the most sought after mining regions in Canada. Our objective is to finance

Clavos into production by early 2017 and further explore the Onaman property with the goal of obtaining

permits for production within two years. The timing we believe will be excellent, as we see the beginning

of a bull market in precious metals, as well as, an improving market for base metals market.

In the last several months, there has been tremendous leadership in the big market cap shares. Many of

them have doubled and tripled. The new bull gold market is now moving into the mid-size precious metals

companies. It’s important for your readers to understand that during this time, junior mining stocks

generally outperform the seniors. I think the ones with good prospects, good assets, strong management

with previous success, have favourable odds of doing extremely well. We fit into that group. As a micro-

cap company, we have managed to survive the worst of the bear market, assets intact. We have improved our

assets and economics significantly. We have a great opportunity for a major re-valuation of assets and

share values.

I think we have made a major turn in the gold market here. I am a firm believer that we are in a

new bull market and someone said to me the other day, "Nigel if you have taken the pain, you should stay

for the gain."

With the support of our experience Board, loyal shareholders and financiers, I’m confident Sage is going

to perform very well over the period.

Dr. Allen Alper: That sounds very good.

http://www.sagegoldinc.com/

Sage Gold Inc.

36 Toronto Street

Suite 1000

Toronto, Ontario

M5C 2C5

Tel.: 416 204-3170

Fax: 416 260-2243

info@sagegoldinc.com

Investor Relations:

Karen Levy

Tel.: (416) 204-3170 Ext. 228

klevy@sagegoldinc.com

|

|