Interview with Dr. Leon Daniels, President and CEO of Pangolin Diamonds Corp. (TSX.V: PAN) Entirely Focused on Advanced Stage Diamond Exploration in Botswana, one of the World’s Leading Diamond Producing Countries

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/12/2016

Pangolin Diamonds Corp. (TSX.V: PAN) is entirely focused on diamond exploration in Botswana, one of the world’s leading diamond

producing countries. Pangolin is currently exploring for a discovery at their flagship, advanced exploration stage, Malatswae Diamond

Project, where the leading indicator mineral in kimberlite is diamond. According to Dr. Leon Daniels, Founder, Chairman, President and

CEO of Pangolin Diamonds Corp. and a fourth generation diamond hunter, the company intends to make discoveries this year. Dr. Daniels

has an amazing background and diamond discovery record. He has 36 years of exploration and production experience. His discoveries

include the Klipfontein kimberlite in South Africa, DK4 Kimberlite in Botswana and the Mambali kimberlite field in Zimbabwe. He was

directly involved in the evaluation and development to full production of the Dokolwayo mine in Swaziland, River Ranch Kimberlite in

Zimbabwe and five Alluvial Mines in Angola. He is also Co-Founder of African Diamonds subsequently acquired by Lucara Diamond Corp in

2010 for US$100m (Karowe Diamond Mine). Dr. Daniels is proud of his team in Botswana and is committed to make the company an economical

success.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News interviewing Dr. Leon Daniels

who is president and CEO of Pangolin Diamonds Corp. Could you tell me a little bit about your company and what you're doing in Africa?

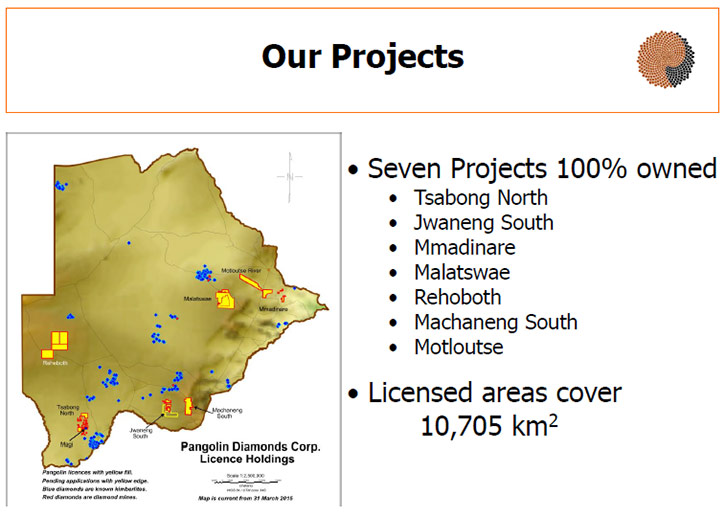

Dr. Leon Daniels: Sure, Pangolin Diamonds Corp. is listed on the TSX-V Exchange in Canada. It has 2 subsidiaries in Botswana that

are wholly owned and it has over 10,000 square kilometers covered by diamond prospecting licenses in Botswana. The company is entirely

focused on diamond exploration in Botswana, where I went in 1980 on a 2-year contract and I'm still busy there.

Dr. Allen Alper: That’s great! You have a great background in diamond exploration and in geology. I'm looking forward to

learning more about diamonds in that area. It's rare that I have an opportunity to talk with someone as knowledgeable about diamonds as

you are, with your background and expertise. So, tell me more about your deposits and what differentiates them from other companies.

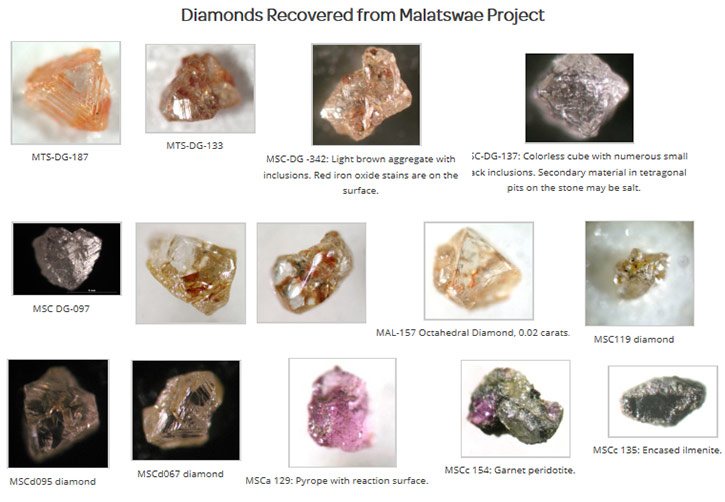

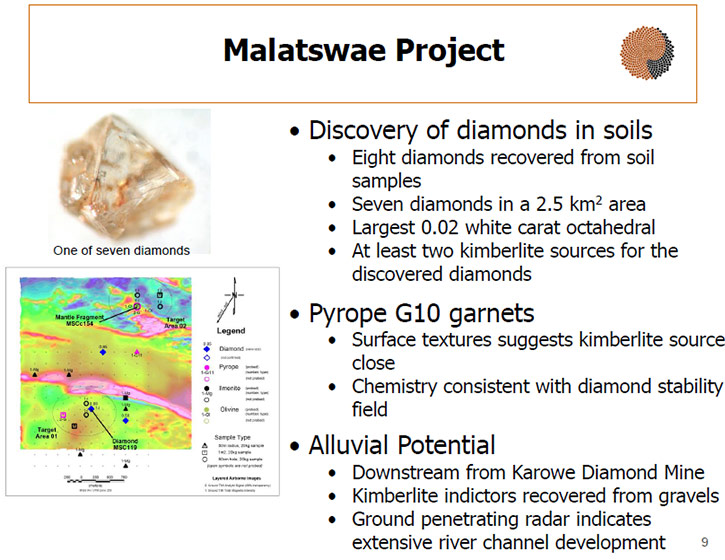

Dr. Leon Daniels: Well, we don't actually have a deposit in terms of formal definitions as yet. We are exploring towards

discovery, and we are quite well-advanced. What makes our particular project, one project, the Malatswae Diamond Project particularly

exceptional is that we are picking up in our soil samples an unusual number of diamonds. It's quite rare that people report diamonds in

soil samples in Botswana.

For example, I have personal communications with the two geologists that did most of the work on, probably the greatest diamond deposit

ever discovered, the Jwaneng Mine, which is mined by the De Beers. They told me that they never recovered a single diamond while

sampling over the deposit. So, our MSC Grid in Malatswae Project is unusual in the sense that while we're picking up all the indicator

minerals that one gets from a kimberlite over there, the leading indicator is diamond, and that's very unusual.

To my knowledge, there's only been one significant discovery where diamond was the leading indicator, and that was the Argyle

Deposit in Australia. The advantage of finding diamonds in our soil samples is that once we discover the kimberlite we have a virtual

guarantee that it will be diamondiferous, and that's quite unusual compared to most kimberlite discoveries around the world.

Dr. Allen Alper: That's excellent. Could you tell me, do you have any feel for what might be the potential for the size of the

diamonds in the kimberlites you're exploring?

Dr. Leon Daniels: No, and I can't predict whether we'll find another stone like Lucara Diamonds recently found in the Karowe

Mine. I've been asked that particular question twice in the past week. I explained it this way; the largest gemstone found so far is

the 3,106-carat Cullinan. It was found in 1905. The second-largest is the diamond that Lucara found in Karowe, 1,111 in 2015, so 110

years later. There have been billions and billions of diamonds found in between, so statistically it's impossible to predict.

But certainly, when we make a viable discovery and we start mining, if there is a big stone like that at least we won't crush

it. So, I can't predict the size range that we will be finding, but what I can state is that although people don't like to use the

definitions of micro diamonds and macro diamonds, a few years ago the difference between the two was half a millimeter size. And all

our diamonds that we are recovering out of our soil samples are well over the half millimeter size. So in terms of the old definitions

that people know about and have used in the past, our diamonds that we're recovering out of our soil samples are all macro diamonds.

But they are limited in size to 2 millimeters because our screen size that we use in the field for collecting our samples cuts off at 2

millimeters, so we discard the plus 2 millimeter material, so we can't recover stones bigger than 2 millimeters. I expect there will be

some because some of our stones that we have recovered are getting very close to the 2 millimeter range.

Dr. Allen Alper: That's great. You definitely have commercial-size diamonds in the kimberlites with which you're working. It’s

interesting and really amazing that the diamonds are indicator minerals. So wonderful! Could you tell our readers a bit about how

diamonds are formed, the kimberlites et cetera, a kind of synopsis of the geology?

Dr. Leon Daniels: Sure. There are essentially 2 classes of diamonds; they are the eclogitic diamonds and the peridotite diamonds.

There are a few other smaller components, but people recognize the 2 predominant populations as eclogitic and peridotite. The eclogitic

diamonds are as a result of the ocean floor being subducted underneath the older cratons of the earth, and with that subduction,

carbonates are taken down to depth where the pressures and temperatures are of such a nature that diamonds are formed in that subducted

material.

The peridotite diamonds form in the deeper cooler parts of the mantle where the earth has old, stable cratons, and that is

from degassing from the core of methane, which then breaks down into carbon and hydrogen when it gets to the right pressure and

temperature within the mantle and crystallizes diamonds. So, those are the two basic populations of diamonds. In terms of color,

diamonds generally crystallize as white stones, but if you have nitrogen in the environment, because in the periodic table nitrogen

sits just to the right of carbon, nitrogen can fit into the structure for diamond with carbon.

And then because you have longer bond lengths between nitrogen and carbon than carbon to carbon, the light diffracts though the

diamond and comes out as yellow. So, it's nitrogen that provides yellow stones. On the other side of carbon you have boron, very much

rarer than nitrogen and shorter bond length, the light diffracts blue, and we know what blue diamond prices have gone for recently.

The browns are from mechanical distortion of the white stones, whereby the stone is slightly deformed. The bond between carbon to

carbon is distorted, the light comes out brown.

Dr. Allen Alper: That's excellent. I appreciate that, and I know our readers and investors will appreciate getting a synopsis

like that. Could you tell me a little bit more about what your plans are this year?

Dr. Leon Daniels: Well, we've just closed a financing which in current market conditions I think went very well. All the funds

will be directed towards progressing with the projects we have at the moment. Now, I'd like to put one thing upfront, it's not a

lifestyle company, Pangolin Diamonds, because I don't get paid out of the company's cash reserves rather by a nominal amount of shares,

and in fact, my family and I continue to contribute to the finances because we believe that there will be success.

Having said that, Dr. Chris Jennings from SouthernEra Diamonds, Inc. in the 1990s set out on a philosophy that one should

explore for kimberlites where historical diamonds have been reported. And he did that in South Africa and he found kimberlite, in an

area was point 4 of a hectare, which is 4,000 square meters. They mined that out in 29 months and produced $238 million of diamonds

from there, certainly the richest deposit probably ever mined.

Applying that philosophy, for certain until the end of the year, we are specifically going to focus on where diamonds have been

reported, in particular, where we have recovered diamonds, because we know that when you start recovering diamonds in your soil

samples, you're looking at a kimberlite that is mineralized. You can't guarantee to the degree that it's mineralized, but at least

you're increasing the probability of finding something that's economically viable by focusing on where you're finding the diamonds.

So, we are identifying very specific small target areas, and when I say small, most of the target areas that we are identifying

are less than 9 square kilometers. In fact all of them are less than 9 square kilometers, with some of them less than 2 square

kilometers. And that's where we are focusing our project development until such time that we make the discovery. By focusing our

efforts and our expenditure on such small targets, I have very little doubt that we'll be successful in making discoveries.

Dr. Allen Alper: Sounds great. Could you tell me a little bit about your background?

Dr. Leon Daniels: Yeah, well, I'm kind of genetically disposed towards hunting for diamonds. My great grandfather, we're not sure

exactly when he come out to South Africa, but he obviously came out to South Africa to seek his fortune in the 1870s diamond rush. On

the 1876 claims map on what is today the Big Hole of Kimberley which was the Kimberley Mine, he had two claims. By 1888 when the De

Beers was formed he had clearly sold out because that year he christened a child at a well-known church in the area and he is recorded

as "farmer."

So, he obviously made enough money to go farming. His sons all became what we call "diggers" which are artisanal small-scale

diamond miners, and my grandfather's sons all became diggers during various stages of their lives. In my generation I'm the only one

who has continued with diamonds. I didn't know what else to do. Well, it's not that I didn't know, I didn't want to do anything else

but look for diamonds. And actually when I went to university, they asked me, "What subjects are you studying," and I said, "Geology."

So, I wanted to study geology to learn how to look for diamonds professionally. And they asked, "What other subjects," and I said, "No,

I'm here to study geology," at which point they informed me I needed to do physics, chemistry, and math as well. I didn't realize that,

and I haven't really used physics, chemistry, and math since then either. Having said that, in my entire university career, I only had

1 lecture in diamonds as well so I'm not sure how much one really should go to university, or if you just have a passion. I think the

passion is far, far more important. Well, I persevered and I eventually did a PhD on the chemistry of the diamonds and the associated

minerals that came from a kimberlite in Swaziland that I assisted in evaluating and developing into a mine.

Dr. Allen Alper: That's great. It's really wonderful to talk with someone who has a tradition of mining and diamonds in their

background. It's excellent, and a passion to pursue it and learn about it and then pursue it once you graduate. That's excellent.

That's really great.

Dr. Leon Daniels: Well, I have been very fortunate in that it's quite rare for geologists to work on one project that turns into

a mine, and I've been very fortunate that I've worked on two projects where I've arrived onsite and the mineral rights owners didn't

exactly know where the kimberlite was. In both cases De Beers discovered the kimberlite but didn't progress with it, and in both cases

I took it from arriving and not knowing exactly where it is and leaving when it was in full production, and that's a rare experience to

have. The Karowe Mine, which Lucara Diamonds, is mining very successfully, was a kimberlite discovery made by De Beers in 1969, but it

took until the late 1990s for someone to recognize that actually it had potential to be developed by a junior company into a mine. And

I was actually the geologist, who recognized that and promoted that.

Dr. Allen Alper: Well, that's excellent. That's certainly something to be proud of.

Dr. Leon Daniels: My partner and I were founding members of African Diamonds that was taken over by Lucara for $100 million. My

partner has retired since then. I could have retired as well, but you know, I hadn't gotten the bug out of me yet and felt that there

were still more kimberlites to be discovered. So I started Pangolin Diamonds and continued with that. And I do believe that by focusing

on where we're finding the diamonds at the moment, hopefully before the end of the year that belief will have been proven.

Dr. Allen Alper: That's great. I think it's important to do things you enjoy, be active and follow your passion.

Dr. Leon Daniels: I have a small team in Botswana. Two of them have now worked with me for over 20 years, and as a small team

we've discovered kimberlites in Botswana and in Zimbabwe. They don't have any formal qualifications, but they're highly experienced and

they are highly motivated. Recently somebody asked me, "Well, what happens to the company if something happens to you?" And I said,

"Well, I'm replaceable." There are other people with a lot of experience in terms of managing exploration companies.

There are lots of people that have experience evaluating and then developing kimberlites into mines, so I'm replaceable. What's

less replaceable is the team that I have on the ground in terms of their experience. There are not many teams anywhere in the world

with a consistent coherent experience like they have. They are to me the most important part of the company. The success of the company

depends on their enthusiasm and their loyalty and dedication towards finding the next diamond mine in Botswana.

Dr. Leon Daniels: Incidentally, they are shareholders as well. When we formed Pangolin Diamonds we allotted quite a nice chunk of

shares to each one of them.

Dr. Allen Alper: That's very good. Could you tell me a little bit about Botswana? I guess it's the largest diamond-producing

country in the world by value.

Dr. Leon Daniels: Actually at the moment it's second. The Russians have, I think, sold more diamonds by value last year. I think

at the moment Botswana is second in volume and second in value. But in terms of reserves, they standout above anybody else because

Orapa and Jwaneng still have quite a number of years to go, and certainly I think volumetrically, the Russians would have mined out

everything they've got, and so will the Canadians and the Australians and Botswana would still happily be ticking away. The first

diamonds were discovered there by a company called CAST, Central African Selection Trust, in 1959.

And then De Beers went sampling in the same region where CAST found the first diamonds, and in 1962 found their first diamonds.

They found Orapa, a very good friend of mine, Manfred Marx was the geologist who found it. In fact on the 24th of April 1967, 49 years

ago he dug the discovery pit on what is today the Orapa Mine. Botswana is very stable. It has the highest rating in Africa, and I think

it is number 14 or 17 in the world, certainly ahead of some other Canadian provinces and countries like Sweden from a miner's point of

view.

I am not aware of any significant corruption. I don't think there's a country free of corruption, but certainly I don't have to

get involved in any corruption and never have had to in terms of applying for mineral rights et cetera or anything else. It has a very

well-established law as far as mines and minerals are concerned with automatic progression from prospecting to mining, and I think at

the moment there are probably something like 60 companies doing diamond exploration in the country at various levels.

I think Pangolin and De Beers are probably doing more aggressive exploration that anybody else in the country at this present

time. But it's politically stable, it has elections every 5 years, multi-party elections. The police don't carry arms. If you are

caught in a speed drive they stop you and they're extremely polite, almost apologizing that they caught you. It's a safe country

generally. Certainly when I'm out there and out in the bush I literally just sleep out in the bush out in the open, and completely

safe. So, it has good access, good infrastructure. It's not called the Switzerland of Africa for nothing I can assure you.

Dr. Allen Alper: That's terrific. I'm glad to hear that

Dr. Leon Daniels: I'm very excited about the results in Pangolin. I'm convinced and believe that we will be making discoveries

still this year, because we're focusing on specific targets that will generate the diamonds. I firmly believe we'll find diamondiferous

kimberlites, end of the day. Then, it's just quite frankly up to nature to turn it into a mine.

Dr. Allen Alper: That's great. Could you tell our readers and investors the primary reasons why they should invest in your

company?

Dr. Leon Daniels: We are totally undervalued. Our current market cap is about $6 million. We don't have any deposit yet. But I

believe that by having the diamonds we have at the moment, the indicators we have at the moment that we will be making a discovery in

the very near future, I believe this year. Hopefully the market will reward us by reevaluation.

And considering where our share price is at the moment, when you look at diamond companies that have made discoveries, that are

diamondiferous and where their market caps are, I think that we should see a significant reevaluation. Diamond exploration is highly

speculative. So any investor who wants to go into Pangolin has to recognize that it's a speculative investment, but I believe a

potential for multiple appreciation with discovery is significant.

Dr. Allen Alper: It sounds excellent. Well, it sounds like you know what you're doing. You've been around for some time, you

have diamonds in your blood, and I would think that our readers should give your company great consideration.

Dr. Leon Daniels: I continue to reinvest in the company.

Dr. Allen Alper: Is there anything else you would like to add?

Dr. Leon Daniels: Your readers might like to look at the company carefully, consider the results we have at the moment, consider

that we intend making discoveries this year, and I'd like to see people think about buying into this quite frankly because the one

guarantee I always give people is, "I'm not going to give up until I make the company an economical success."

Dr. Allen Alper: That's excellent. That's truly great. It shows that you and your people are so committed to the company and

have so much faith in it that you've invested your own funds and continue to do so. It shows your commitment and shows how much you

believe in what you're doing and the results you've been getting.

Dr. Leon Daniels: It's not a lifestyle company, I can assure you. I don't draw salary from it, I put money into it. I work on

reducing the cost as much as possible at every opportunity in terms of maximizing the results that we get out of the cash we have

available. I think if people look at the progress from financing to financing, we do small financings as we go along, and critically

assess what we've done, one can see the progress. We not sitting on our hands and waiting for better days.

Dr. Allen Alper: That sounds like a very excellent approach. When the money is tight, the funds are tight, it sounds like you

are managing your exploration very wisely and betting on the future.

Dr. Leon Daniels: One of our other big assets is we have our own mini DMS plant where we process our own soil samples. We

generate the concentrate from that, the sorting of the concentrate and the analyzing of the indicators, et cetera. That all is

independent, and for example we use Chuck Fipke’s Laboratory for analyzing all our indicator minerals, and they go via Dr. Tom

McCandless to assess the surface textures, et cetera before they go to Chuck Fipke. So, we use well-established experts to take that

process further. But the point I want to make is that we estimate that our samples cost from collection to the point where the selected

concentrate goes to Tom McCandless in Canada, our samples cost us about $20, Canadian dollars each, whereas apparently in Canada the

cost to collect samples to get to that point about $1000 a sample. So, we're working in a jurisdiction and in an environment where

dollar per dollar we certainly get a lot more value for our money.

Dr. Allen Alper: That's great. That allows you to do much more sampling and get so many more results. That's excellent.

Dr. Leon Daniels: We've had to move the plant onto two shifts in order to cope with the processing of the samples, and we do

daily tracer tests with a plant, and it's not running a plant and putting the traces through, we actually run the traces with samples.

Currently, we have four sampling teams that collect samples on a daily basis, because at the end of the day it's the boots on the

ground that end up making a discovery.

Dr. Allen Alper: Well, that sounds like an excellent approach.

https://pangolindiamonds.com/

Pangolin Diamonds Corp.

25 Adelaide Street East, Suite 1614

Toronto, ON

Canada

M5C 3A1

|

|