Dr. Alper Interviews Anthony Julien, President and CEO: Brazilian High Grade Manganese for the Fertilizer and Steel industries

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/9/2016

Cancana and Ferrometals’ President and CEO, Anthony Julien updates Metals News on its shift to high grade Manganese for fertilizer

and steel industries with its Brazil Manganese Corporation, and addition of multi-commodity exploration programs for tin.

Dr. Allen Alper: This is Al Alper, editor in chief of Metals News, talking with Anthony Julien, president and CEO of Cancana and

also Ferrometals. Could you tell me about your company, about Cancana Resources Corp?

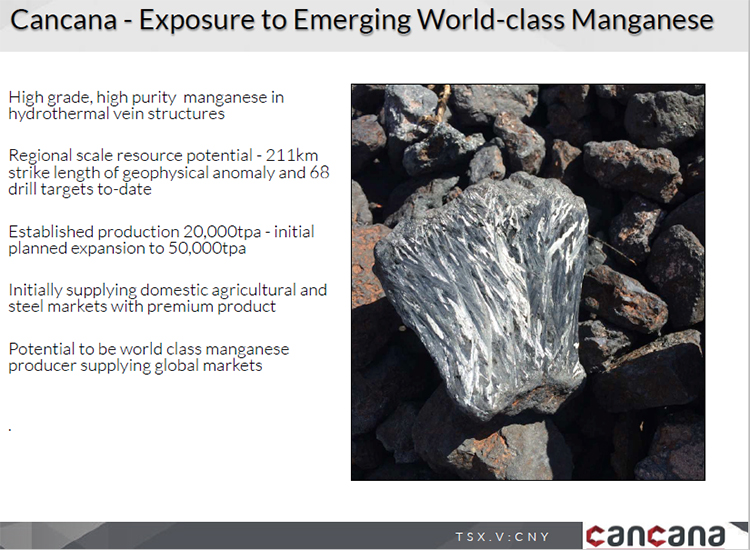

Mr. Anthony Julien: Cancana Resources Corp is a Toronto venture stock exchange listed Company. It started its life looking

for diamonds in the state of Rondonia in Brazil and around eight years ago, while looking in that area, discovered the project area was

rich in manganese. This resulted in Cancana reinventing itself from a diamond exploration company to a manganese exploration company.

Back in 2013 Cancana approached the Sentient Group, which is a private equity based commodities fund, to put forward these manganese

properties. Sentient sent their geologists to review those properties and they recommended that Sentient invest. Ferrometals was

incorporated as a special purpose investment vehicle for the Sentient Group and acquired the first of three projects in December 2013.

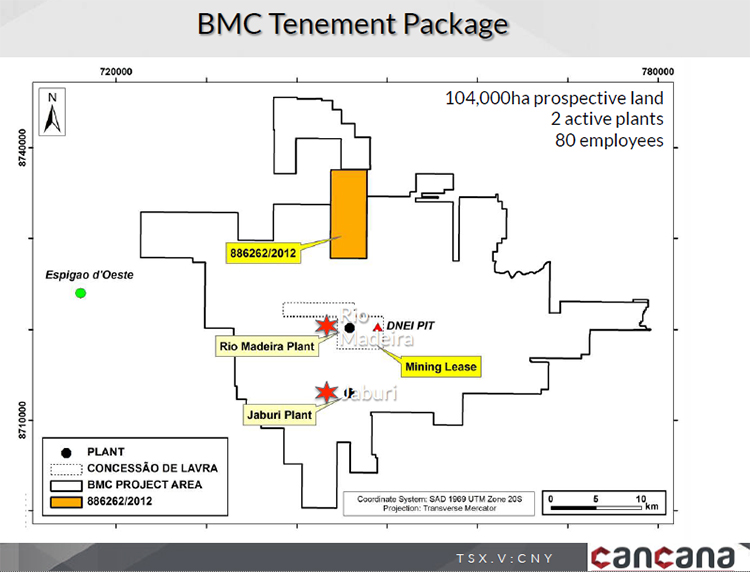

The structure of the deal is as follows: Cancana owned manganese claims adjacent to two manganese producing operations. Cancana

approached Ferrometals to enter into a joint venture. The joint venture is called Brazil Manganese Corporation. That joint venture is

made up of three key components, the tenements and operations of Rio Madeira and Eletroligas, which we renamed as “Jaburi” and the

tenements that Cancana owned, which made up a then total tenement package of one hundred and four thousand hectares.

Dr. Allen Alper: Well that sounds very good. It sounds like your focus is on using manganese for fertilizer, is that correct?

Mr. Anthony Julien: Yes. Rio Madeira, for the past eight years of their corporate life, were mining colluvium. This is the

loose manganese rock that is dispersed at surface. That colluvium is extremely high grade, fifty percent plus grade, but more

importantly met key trace element requirements for fertilizer use. So traditionally they would mine somewhere between eight to ten

thousand tons per annum and sell the majority of those rocks to the fertilizer producers. When we took over the operations the

fertilizer market in Brazil took a bit of a turn, mainly due to the political and economic downturn. This has delayed state funding to

the farmers, resulting in lower orders for fertilizer as they delayed planting their crops.

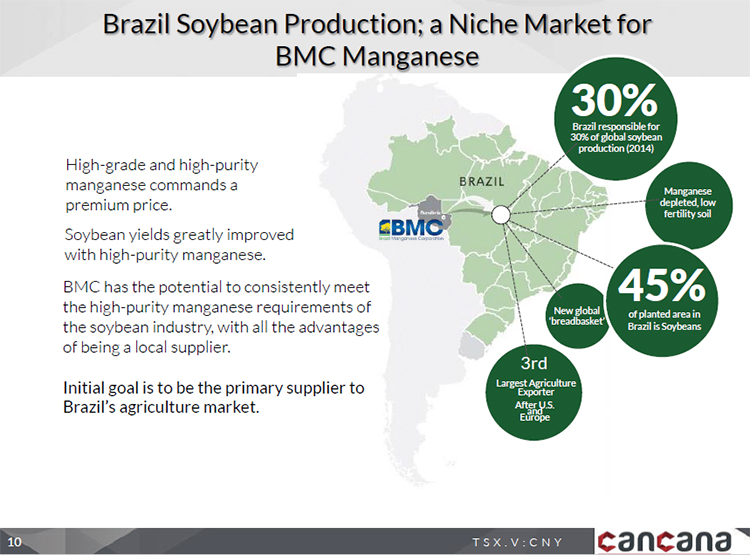

So the fertilizer market in Brazil is fairly weak even though agriculture is still growing in Brazil. So we've diversified our

sales from fertilizer into the ferromanganese space. However, we still have been able to maintain our margins similar to the fertilizer

space. Fertilizer will pay somewhere between 30% to 40% margins on China CIF prices and the ferromanganese industry is paying around

about 15% to 20% margins on CIF China prices. During 2015, 60% of sales were to the ferromanganese space and for 2016 our forward

contracts are pointing to around 80% sales in that space.

We hope that the fertilizer market will turn around as things stabilize in Brazil over the next 12 to 18 months.

Dr. Allen Alper: Now ferromanganese will be used in the steel industry is that correct?

Mr. Anthony Julien: Correct and the reason why they purchase our material is this; they blend our high grade, low

phosphorous product material with the lower grade sedimentary ores to get an optimal mix. What our customers are telling us is that

using our high grade material causes less slag, which results in a lower energy usage. The benefit is lower production costs by using

our high grade manganese. We’re very confident that once we publish this customer case study, in the next few months, it will allow us

to grow our presence in that market beyond Brazil. The strategy that we’ve been talking about to date has always been to target the

niche markets, which are fertilizer, animal feed and batteries because they do pay a premium. We were saying we would not necessarily

target the steel markets because they weren’t prepared to pay the premium.

What’s happened in the past three months is that the steel markets will pay a premium as they can see that they make energy

savings by using our products. What does that mean? Well out of the 50 million tons of manganese oxide only 2.4% are in the niche areas

of batteries and fertilizer. This opens up a much larger market for our products at a premium based price which is a very good problem

to have if you’re a manganese producer.

Dr. Allen Alper: Well that sounds very promising. Will you just focus on China or will you broaden out to Europe and other

places for the ferromanganese alloy material?

Mr. Anthony Julien: The focus for the next two years will be Brazil, predominately. That is because we will be building a

pilot plant, which should be operational by the end of this year or very early next year. It will have a 50,000 ton capacity. The

demand for high-grade product similar to ours in Brazil right now is around 100,000 tons. I think for the foreseeable future the

majority of our sales will be in Brazil and we will start to develop the export markets as an interim step to the larger production

volumes. The markets we would be targeting would be batteries and fertilizers to the export market, because I don’t believe that China

will be as receptive to the energy saving as countries, which have higher energy costs, such as Brazil. That’s my feeling but we’ll see

how that plays out.

Dr. Allen Alper: That sounds good, it’s good that you’re positioned close to your market both in feed and also in alloy

products. What kind of pilot facility will you have?

Mr. Anthony Julien: The two plants that came with the acquisitions were setup to wash colluvium. They basically could only

crush down to about 10cm. Now in order for us to process the primary material, we will need to crush down to a finer size to liberate

the manganese from silicate breccia fragments - and that’s what the pilot plant will do. Once it’s gone through the primary and

secondary crushing circuits, it will then go into jigs and those jigs will make two to three different product sizes.

Today we have lumpy grade, we have a medium grade and we have fines which come out of the process. In the current domestic

market there is a high demand for the lumpy grade and for the fines, but not much of a demand for the medium. They like the lumpy grade

because a lot of these guys have their own milling operations to mill it down into fines, before they put it through their sintering

process. We may consider putting in a ball mill to produce a consistent fine product for that market.

The pilot plant will crush it down and liberate the primary ore. This year we plan to release a 43-101 compliant PEA that will

put together the economic business case for the primary product that we want to bring to market.

Dr. Allen Alper: That’s sounds very good! It sounds like an excellent plan, well thought out. You’re going to make different

grades of manganese, powered manganese both for animal feed and fertilizer and also for the steel uses, is that correct?

Mr. Anthony Julien: That’s correct. The animal feed guys need somewhere between 49% to 51% grade and compliant levels of

heavy metals. The ferromanganese guys could actually use as high a grade as you want to produce because there is direct savings on

energy costs. The current contracts that we have with our domestic customers are asking for 51%. However if you look at the global

markets most steel producers are happy to receive 42%.

Our average production grade in 2015 was 50.7% One of the wonderful things about this project is when you compare our product

grade against the top ten mines in the world. The highest grade Mn oxide producer that we know of is the ERAMET’s Moanda Mine in Gabon

where they produce an average grade of 48%. We’re averaging 50.7%, if we can scale that up, we are well on our way to getting wonderful

value for this project.

Dr. Allen Alper: That’s a high grade!

Mr. Anthony Julien: Yes … we’ve got confirmation from a global trading house that we are the highest grade manganese oxide

producer in the world today.

Dr. Allen Alper: That’s excellent. That’s very important. Tell us a little bit more about your team and yourself, your

backgrounds.

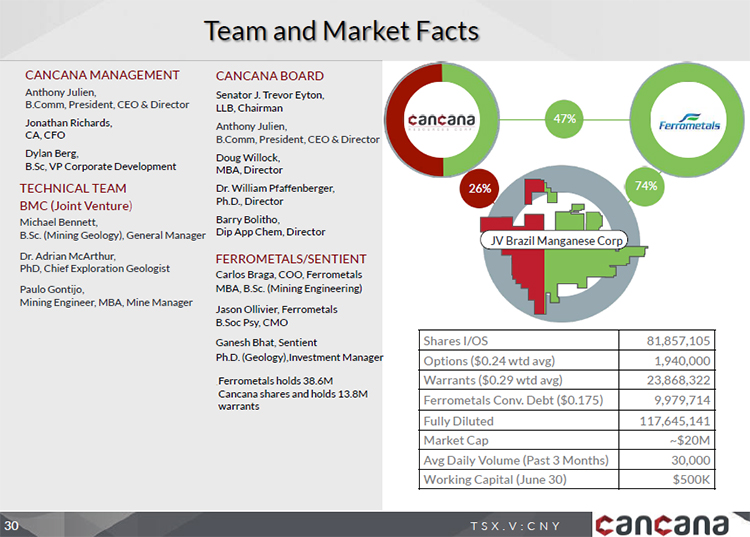

Mr. Anthony Julien: Let’s first start with my team. The project is called the Brazil Manganese Corporation and 98% of the

team on the ground are Brazilians. The chief operations officer is Carlos Braga who is a mining engineer, and has spent most of his

career in the phosphate industry. He’s responsible for the operations. The general manager of the project is an ex-pat but now a

Brazilian national by the name of Mike Bennett and he’s a geologist by trade. He is based on site in Espigão do Oeste. Our chief

geologist is Dr. Adrian McArthur, from Australia.

Dr. McArthur is ultimately responsible for developing this resource. He is FIFO ( fly in , fly out) so he spends six weeks on

the ground and three weeks at home. Reporting to those three are about 140 employees in various roles: geologists, environmental

engineers, technicians, plant managers and all sorts of different people. What’s unique and interesting about our project, unlike your

usual exploration plays that you hear about especially from Canadian Juniors, is that we’re also running a production operation.

One of the constraints we have running this operation is, because Cancana is a publicly listed company and we haven’t published

our 43-101, we can’t talk about production targets grades or anything like that. It’s an interesting problem to have because we do have

customers, they are buying production grade material and they’re prepared to reference and give us case studies on how that material is

helping their business. While we’re running an exploration play, we’re also building a business.

My background is a little bit different, I have come from the financial side of things. As I explained earlier, Ferrometals is

a 100% owned subsidiary of Sentient Fund IV. Sentient Fund IV is a 10 year closed-end fund and it’s in its sixth year of life. My job

is to build a valuation event within the next three to four years. Although, if an investment has real potential that requires time, we

can roll that investment into newer funds. At this stage there is no Fund V but that is something that Sentient will be working on over

the next 12 to 24 months.

My background with Sentient was as an entrepreneur, who had a software company that they invested in during 2005, which we

successfully exited to an American global software company called Epicor in July of 2009. I then was seconded to Epicor for two years

as part of the earn out and then I was headhunted by SAP, which is the large German software company. SAP put me on various accounts

such as BHP, Rio Tinto, Glencore, Xstrata and others. I got a bit of a grounding in business processes for the mining industry and

Sentient knew my business experience and they offered me this role as the CEO of Ferrometals, which I started in October 2013.

Dr. Allen Alper: That sounds very good, that sounds like you have the right background to do that. Could you tell me a little

about why this will be eventually of interest to investors?

Mr. Anthony Julien: Yes. Essentially, my job is to build this business to exit to a major. Sentient’s strategy for

investment success is to identify projects with potential for discovery of long-life, low-cost, world-class assets and supporting them

through to production. The geological review of the project area in 2013 recognised that the style of mineralization was analogous to

Woodie Woodie – a hydrothermal manganese mine in Western Australia. The Woodie Woodie mine began its life producing ~12,000 – 13,000 t

per annum - a similar scale to that of our project which has produced ~100,000 t of product since 2007. The resource potential of the

Woodie Woodie project was not recognized until systematic mapping, geophysics and drilling defined the presence of thick concealed

manganese veins. Their exploration program ultimately defined a multi-million ton resource which supported a 1 Mt per annum plant

expansion. The owner of the project (Consolidated Minerals) was bought by a Ukrainian investor for A$1.3 billion in 2008.

The objective of our team is to screen the potential of the project for a world-class manganese deposit based on the Woodie Woodie

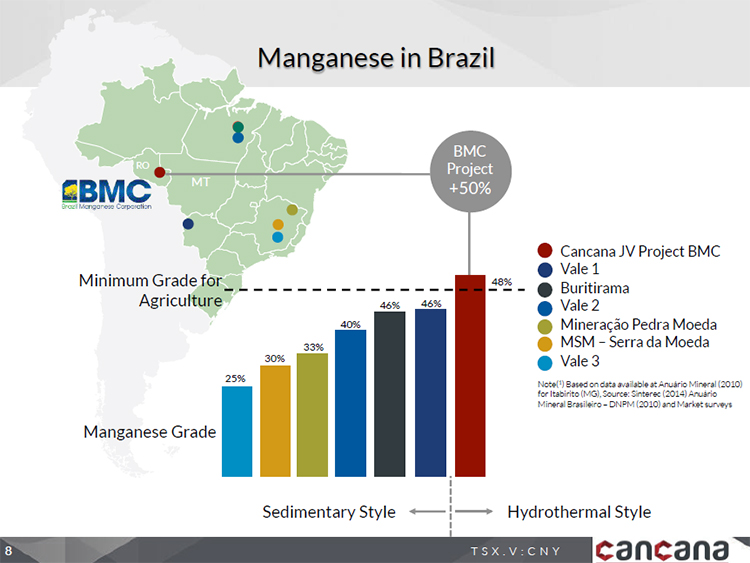

hydrothermal analogue as an exploration model. We believe strongly in the potential of manganese as a commodity. Globally there are

four or five mines with million ton capacity and there is pressure on sustaining the supply of high-grade high-purity product. In

Brazil, the exploration focus has traditionally been on the sedimentary deposits. Production grades, in these deposits, have fallen

over the years as many have enriched weathered (“superegene”) caps that have been progressively depleted by mining. Our hydrothermal

style of mineralization persists as an oxide phase below the base of oxidation, whereas many of the sedimentary deposits transition to

lower-grade carbonate phases at depth. The sedimentary deposits are generally higher in iron and phosphorus, which is why the demand

for our product is high. The opportunity has been overlooked by others as they have not recognized the style of the mineralization and

the implications it has for marketing.

Dr. Allen Alper: That’s very, very good. Is there anything else you would like to add?

Mr. Anthony Julien: The only other thing we have announced to the market place, is that the Rondonian region is a world

famous tin (cassiterite) region and we have discovered tin minerals on our tenements. We have built a tin exploration team and we will

be making future announcements over the next three to six months on the tin exploration plan.

I think people are going to take a lot of interest in the tin potential. If you do some research on Rondonian tin mines you’ll

actually see that it’s one of the better tin regions in the world. We know that we have tin minerals on our tenements and we’re going

to evaluate that in conjunction with our manganese.

Dr. Allen Alper: That would be fantastic! That course would be very competitive in the marketplace.

Mr. Anthony Julien: Yeah … One other thing I’d like to raise, I know there’s a lot of press right now on how politically

Brazil is extremely unstable and how Brazil has moved into a recession. All of that bad news is really federal problems. On the ground

itself things are relatively stable in terms of labor and prices. The thing that keeps me up at night is the lack of infrastructure in

that particular region of Rondonia. We can see that the infrastructure could support a half million ton a year operation, but to go

beyond that would require either a railway connecting Rondonia to the nearest port, or their national highway, which is currently a

single carriage way, would need to be at least a dual carriage way.

Hopefully because the soya bean exports are following that exact same route, (I believe soya beans and agriculture account for

about 25% of GDP and are the number one contributors to GDP) that will pressure the government to put in the required infrastructure

improvements in the region.

Dr. Allen Alper: Well that sounds like a very good plan and it sounds like you have a good possibility the government will

support it based on soya bean production and sales. I think at some point the Brazilian economy will turn around. I think it was robust

and I would guess it would undergo a certain cycle, is that what your thoughts are?

Mr. Anthony Julien: On the ground that’s what we hear. It’s the political turmoil that has brought the economy unstuck,

obviously the corruption involving the largest construction and oil companies has put a damper on the growth and on the economy. Once

they solve their political issues, I think you’ll find that the economy will re-bound quite rapidly. Brazil has similar economic

indicators as Australia. You can see, because it’s a commodity driven economy, the exchange rates right now don’t correctly reflect the

lack of economic strength in Brazil. I think it’s a little over valued, but we shall see. The next 12 months are going to be key to

Brazil turning around.

Dr. Allen Alper: Is there anything else you would like to add?

Mr. Anthony Julien: I think I’ve covered everything that I have. We will be making some announcements over the next month

or two and we’ll update the corporate presentation, which will then have the exploration plan for 2016 for manganese and tin. I think

that will be what everyone is looking forward to seeing, and obviously an update on the status of the pilot plant.

Dr. Allen Alper: Well that sounds very good. We look forward to publishing your announcements over the next month or two. It

sounds very exciting.

http://www.cancanacorp.com/

Phone: +1 (604) 681-0405

Email: info@cancanacorp.com

Address: 650 W.Georgia, Suite 620, Vancouver, BC V6B 4N9, Canada

|

|