Discussion with Kye Abraham, President and Co-Founder, LKA Gold Incorporated (OTCMKTS: LKAI): Golden Wonder Mine, One of America’s Richest Gold Deposits

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/25/2016

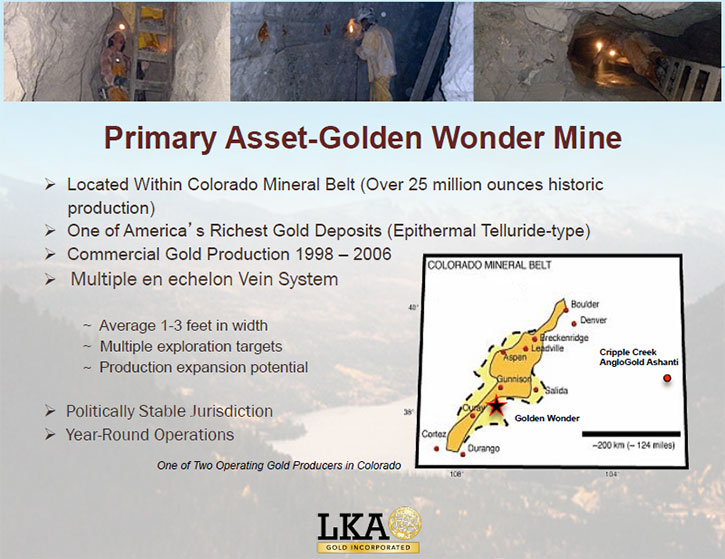

LKA Gold Incorporated (OTCMKTS: LKAI) is focused on finding and developing high-grade anomalies in North America. Their extremely high-grade Golden

Wonder Mine, located near Lake City, Colorado, is one of the richest gold producers in North America with a production history of 141,510 ounces of gold

at an average ore grade of 11.63 ounces (362 grams) gold per ton and an average production cost of less than $150 per ounce. Kye Abraham, President and

co-founder of LKA Gold Incorporated, feels that there is a huge upside potential for LKA, as the company works to re-establish the mine's reserves and

returning it to commercial production.

Dr. Allen Alper: This is Dr. Allen Alper, editor of chief talking to Kye Abraham who is the President and co-founder of LKA Gold Incorporated.

Well I can see you have an extraordinary project in Colorado. The richest gold producer in North America, Golden Wonder Mine. Could you tell me a little

bit more about your property, your company and your deposit?

Kye Abraham: Thank you for your interest Dr. Alper. I suppose if someone asked me for the “bumper sticker version” it would read LKA Gold

and Kinross are searching for extensions to the richest gold producing mine in the Americas and early indications suggest that they may have found

it.

To provide a bit more color, I’ll tell you that LKA’s Golden Wonder mine has characteristics that are, in many ways, similar to the world-famous Cripple

Creek gold deposit, also located in western Colorado, that produced over 40 million ounces. Geologists will tell you that these types of epithermal,

telluride deposits can be some of the biggest gold producers and certainly some of the richest gold deposits on the planet.

We understood the potential of this geologic setting when we picked up this property in the early 1980s; but it was confirmed in spades when the first

high-grade ore shoot was discovered in early 2000. From that point until 2006, the mine produced over 133,000 ounces, which by itself, wouldn’t have

been unusual except that it came from a single bonanza-grade ore shoot of less than ten thousand square feet AND maintained an average ore grade 16

ounces per ton. That’s over 450 grams of gold per ton over six years. This made the Golden Wonder mine the richest ore producer in either North of

South America as far as we knew…by a wide margin. Due to the exceptional grade, our operating costs were less than one hundred dollars an ounce.

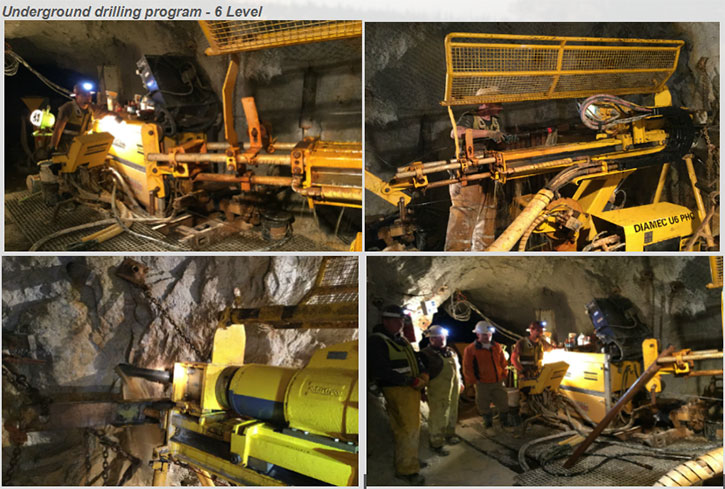

After that first ore shoot was extracted, we went back into exploration mode in 2009 looking for additional ore shoots that we believed must be

in the vicinity. In these types of deposits, typically, you find multiple ore shoots. They're not just one-off occurrences. Through a combination of

exploratory mining and drilling along the vein structure, we've extracted another 5,000 ounces, yielding over five million dollars. This covered most of

our exploration expenses. Even in exploration mode we maintained an average ore grade of 1.48 ounces per ton chewing our way around the edges of the

first ore shoot looking for another one.

Dr. Allen Alper: So, how did Kinross get involved in your project?

Kye Abraham: As part of our exploratory mining program, we shipped a considerable amount of our crushed vein material to Kinross' mill in

Republic, Washington. Our material, on average, was of much higher grade than other ores they were processing at the time…including their own. Senior

management eventually got wind of this and in the summer of 2015 visited us on the property and offered to manage and fund the hunt for additional ore

shoots.

Since then, they've conducted a detailed surface exploration program that was completed in the third quarter of last year. I think the most

significant thing to come out of that was the location of three surface anomalies that have geological characteristics remarkably similar to those we

find directly above the first bonanza-grade ore shoot. Needless to say we’re extremely enthused about our three new prospects. Drilling to test those

three anomalies is going to happen in late June, or early July this year.

Dr. Allen Alper: That's amazing. It's nice to have a partner like Kinross Gold to help you with geology and the drilling. That's really

fantastic. You obviously have something that's very interesting for Kinross to be willing to put their money and time into. That's very, very good.

Kye Abraham: We think it is. They're the 5th largest gold producer in the world and we’re very impressed with their operating style and

philosophy. We’ve worked with their people for a couple of years now. I guess the thing we most appreciate about Kinross, out of all the major

producers, is their view that some of these smaller, richer deposits can be more profitable than some of the industry-typical, low-grade deposits that

require tens of millions, if not hundreds of millions, to put into production…and take 8 to 10 years to get started.

Dr. Allen Alper: We're doing an article on Klondex also. Also Kirkland Lake, which is very similar.

Kye Abraham: I don't know much about Kirkland Lake other than a few pieces I’ve read, but I do know something about Klondex's operations

simply because we’ve also shipped them some of our exploration grade material over the past two years, to their Midas Mill in Nevada. We have a high

regard for their senior management. They too are focused on higher grade projects bypassed by the majors. They’re very much aware of the Golden Wonder’s

potential.

Dr. Allen Alper: You have a very excellent project. It reminds me of a featured article I did on Lucara Diamonds. They're in Africa and they have

a smallish diamond operation, but they have diamonds the size of a fist.

Kye Abraham: Wow. Having some experience with previous LKA diamond and emerald exploration projects in Indonesia and Africa, I can appreciate

just what an extraordinary find that is.

Dr. Allen Alper: They're like you. You have such low costs and such concentrated gold. That makes your company so very, very interesting and

worthwhile. It's really amazing.

Kye Abraham: I'm glad you understand what we're doing here. It is really not our intention to build a big, conventional gold company with

projects all over the world. We're more interested in finding these kinds of high-grade, high-profit, anomalies and developing them. We look at

projects more from an investor’s point of view than a miner’s.

Dr. Allen Alper: That's a great approach and I think you and your team have to be complimented on being so selective and doing your homework and

getting the right properties.

Kye Abraham: Well they're pretty rare, as you know. We’ve always looked at this not so much as a conventional mining project but rather more

like a modern-day treasure hunt. If we can duplicate our past success with another high-grade discovery, it’ll be an extraordinary event for our

shareholders.

Dr. Allen Alper: I think that's an excellent approach. Could you tell me a little bit about your capital structure?

Kye Abraham: We've been pretty stingy in issuing shares over the years. We have about 19.2 million shares issued and outstanding and almost

no debt. Historically, over 60 percent of the stock was owned or controlled by the Abraham family. Recently, the Koski family of Sarasota, Florida

became LKA’s largest shareholders after providing the Company with over 2 million to fund continued exploration. The Koskis were the founders of Sun

Hydraulics Corporation, one of the world’s leading manufacturers of hydraulic valves and manifolds.

Dr. Allen Alper: What is your stock trading for right now?

Kye Abraham: I didn't look at it today but in the last six months it's been up to fifty cents and then down to twenty-eight and back up again

so basically all over the place depending on where people think we're at in the exploration process. Many investors are a little reluctant to buy until

they think we've found something. But I think they’re missing the key point. This is not like a normal mining project in the sense that once you find

something you have years of development ahead of you. Once we find another ore shoot we can turn on a dime and go back into production very quickly, I

mean like within months.

Just consider this, our current market cap is only 6.7 million. At current gold prices, that’s less than the value of a single quarter’s worth

production at our previous production levels. The real opportunity for investors is now before Kinross deploys the drills.

Dr. Allen Alper: Could you tell me the main reasons why our readers/investors, high-net-worth investors, should invest in your company?

Kye Abraham: Just last week, Tony, a good friend of mine from Florida, put it in a way that I hadn't quite thought about. He said "Kye, this

is very similar to looking for the Atocha." the big Spanish galleon that sunk off the coast of Florida that Mel Fisher and his crew ultimately found.

”We know it’s there somewhere and all the signs indicate that we’re closing in on it.”

Kye Abraham: In our case, we've found the treasure once before and now think we’re going to get two or three more shots at it, thanks to the

Kinross discoveries last summer. For those that get on board early, while our market cap is still below 10 million, we think there will be tremendous

rewards if we succeed.

Dr. Allen Alper: That’s a great analogy. Is there anything else you'd like to add?

Kye Abraham: Now with gold prices on the rise, this is a very opportune time for these kinds of investments. I don’t believe that LKA should

be a core holding in someone’s retirement portfolio, but for investors looking for big upside quickly, who can tolerate the risk, this should be

seriously considered. A 10-20 X multiple based upon LKA’s current stock prices is very possible. We’ve certainly put plenty of our own money in it and

we like our chances

Dr. Allen Alper: I think you've expressed very well why our high-net-worth readers/investors should take a very close look at investing in your

company. Is there anything else you'd like to add?

Kye Abraham: If your readers are interested in monitoring our progress I suggest they sign up for the President's Email Updates on our

website at lkagold.com. The email updates enable us to candidly discuss, with our shareholders, our thoughts about this project and its potential as

things develop. It’s difficult to convey the message in a press release written to satisfy the SEC and regulatory authorities.

Dr. Allen Alper: Okay. I'll definitely do that.

http://www.lkagold.com/

LKA Gold Incorporated

3724 47th Street Ct. N.W.

Gig Harbor, WA 98335

Phone (253) 514-6661

Email: info@lkagold.com

|

|