Interview with Lance D'Ambrosio, President and CEO of Crystal Peak Minerals (TSXV: CPM, OTCQX: CPMMF): Planning on Becoming One of the Highest Margin SOP Operations Globally and Evaluating the Production of Associated Lithium and Magnesium Compounds Using

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/22/2016

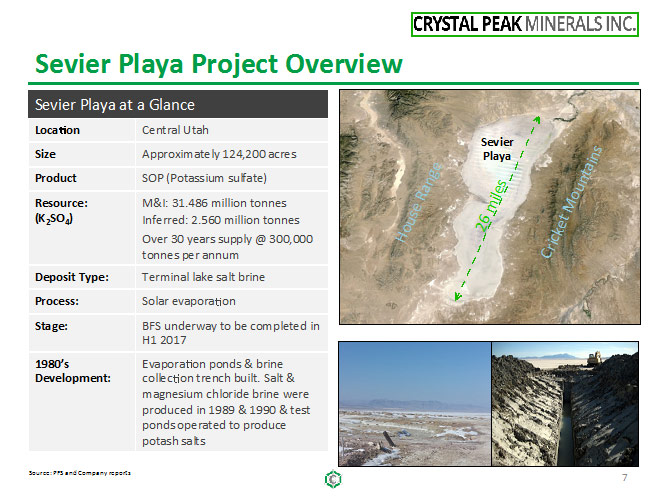

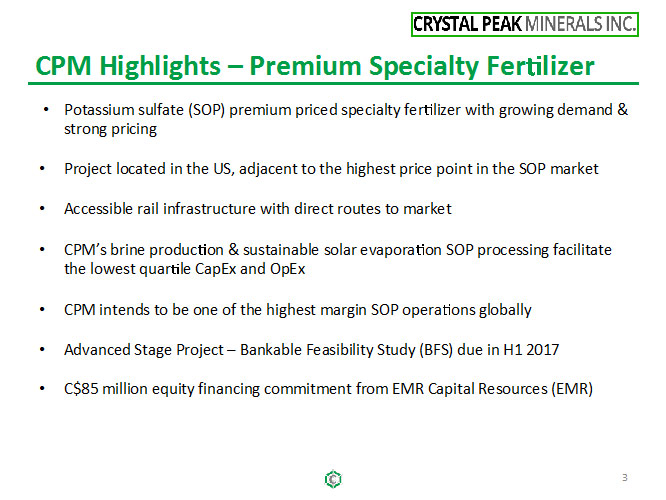

Crystal Peak Minerals Inc. (TSXV: CPM, OTCQX: CPMMF) is developing its world-class potash project on the Sevier Playa in southwestern Utah. This is

an advanced-stage, pre-revenue project that will produce sulfate of potash (SOP), a high-value fertilizer that's used on sensitive crops, employing an

environmentally-friendly solar evaporation process. According to Lance D'Ambrosio, President and CEO of Crystal Peak Minerals, this is a very low CAPEX

project. The company intends to be one of the highest margin SOP operations globally.

Al Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Lance D'Ambrosio, who is President and CEO of Crystal Peak

Minerals. I know you have a large potassium sulfate project going on in Utah and plan to develop it for fertilizer. Could you tell our readers a little

bit about your property and your plans?

Lance: Of course. The development is known as the Sevier Playa Project in south-central Utah. The company, of course, is Crystal Peak Minerals,

and it's a project that has had quite a history. We have been working on the deposit and the opportunity for the last several years. It's unique in the

world from a geologic perspective, as it is a brine deposit, and there are only three producing potassium sulfate deposits in the world right now that

produce from a brine.

It’s a very positive opportunity. If you can produce subsurface brine deposit, like ours, you have a very good chance to have a low capital

expense project with very low operating expenses too. We are blessed with both of these opportunities, based on our work to date. Our 43-101 technical

report and pre-feasibility study numbers suggest that we're in the bottom quartile on the operation cost side, and one of the lowest capital expense

projects of any potassium deposit project development in the world. Most of those are well north of a billion dollars while ours is sub- 400 million

dollars all-in to develop.

We have a fantastic suite of minerals and the economic profile from a project through to production looks extremely robust. We're within

striking distance, now, on the final two big milestones before we get into the construction and the production phase. So within the next 12 months, we

will be looking to complete the feasibility study, and complete our final permitting, and go into construction.

Al Alper: That sounds excellent. That sounds like you're in the right place, have the right materials, your potash, and you're in a great

area to do it. Do you have any problems getting all the permits? I know Utah is a mine-friendly state.

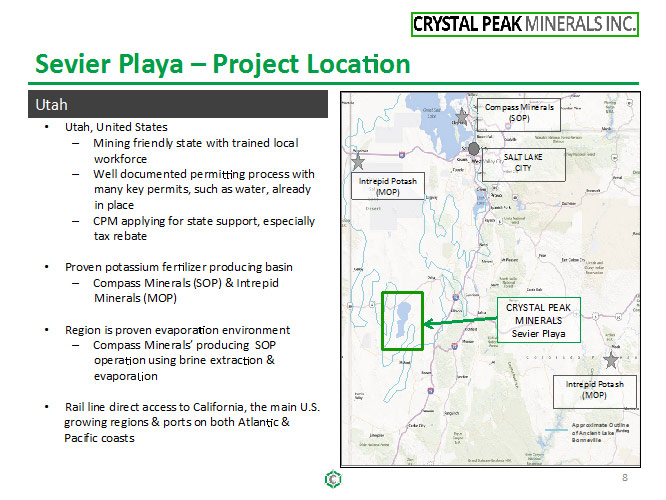

Lance: Certainly permitting is front and center on milestones to accomplish, and yes, Utah's recognized as one of the most friendly places in

the world from a resource development perspective. A third-party group, the Fraser Institute, rates Utah within the top 10 globally, for at least the

last decade. So we feel like we have a pathway forward. We have many of the major milestone permits already in-hand. We have the largest water right

ever granted in the state of Utah's history in our hands. We have the air permit for the Playa lake development. We have the corps of engineer 404

exemption for our project completed. All of the known animal and plant studies are done, and we're significantly through the environmental impact

statement at this point in time. We believe we have a great team. We think we're on target to accomplish all by about this time next year.

Al Alper: That sounds great. Could you tell me a bit about your background and your team?

Lance: My background is diverse. For the last 25 years, I've been developing projects. When interesting ideas in a variety of industries have

presented themselves, we've been able to assemble great teams of people and find very good capital partners. Then we've been able to execute and develop

these opportunities. They've ranged from cable TV to wireless technology communication services. We've raised hundreds and hundreds of millions of

dollars. We've taken more than one company public, and we've exited to larger strategies along the way.

One of the things that excites me most about the Sevier Playa Project is we've been able to balance my skillsets with a great technical team on

the project side, an excellent team on the permitting and the environmental side, and a well-rounded board of directors with a great deal of mining and

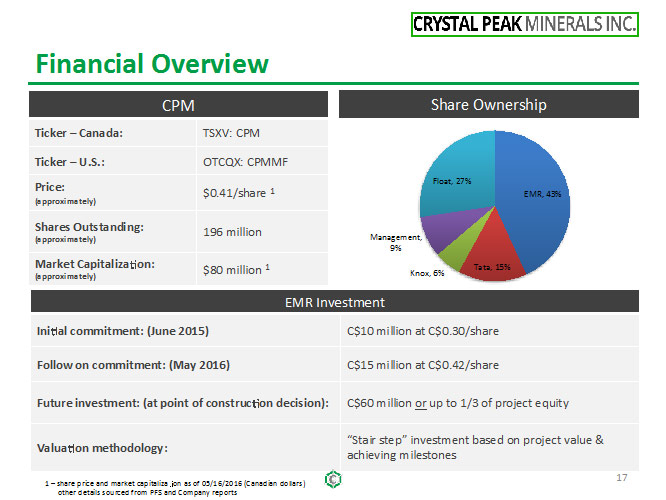

resource development experience; and most recently, the last financial investor, EMR Capital out of Australia, which is a group that all have some form

of mining experience. They've secured up to 85 million dollars of financing

for us to continue the project forward. Most recently we’ve successfully closed and drawn down our second tranch of financing with EMR Capital Partners

for a total of 20 million dollars Canadian at 42 cents per share. That relationship agreement will continue the project forward.

Al Alper: That's fantastic. That's a great position to be in.

Lance: Yes. We've been very fortunate, By investing about 60 million dollars in the project to date.

Al Alper: That's fantastic. Sounds like you have a great deposit in a great location, an excellent team, and good financial supporters.

That's a lot going for you.

Lance: Our second financing commitment from EMR Capital, the addition 20 million, will allow us to advance and conclude the feasibility study

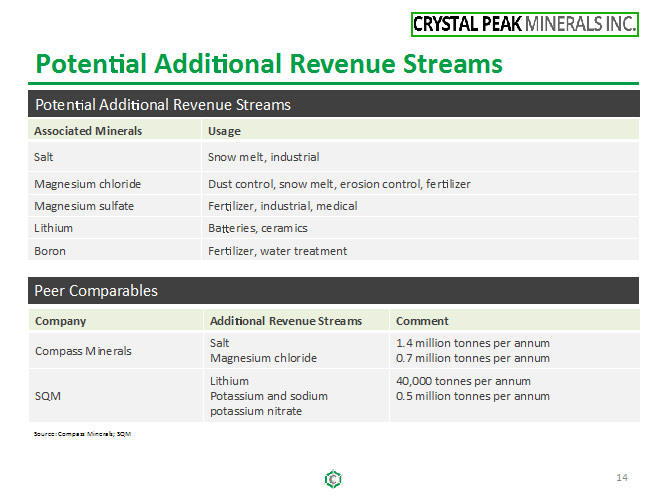

and permitting for the project. Our most recent announcement introduced the idea of starting a process on secondary minerals, like lithium. We've

initiated that effort. We just finished the fieldwork needed for the feasibility study so a process of looking at those other associated minerals has

already started. We're working through that now with the right kind of engineers and/or strategic relationships that understand these more exotic

minerals like lithium. We'll be talking to processors, producers, and end-users, and parties that are going to want the product at the end of the day.

The great news is, if we don't end up producing those minerals, it doesn't hurt our project at all, financially, based on the economics in the

PFS. It just looks to the upside, from a value-creation opportunity. We’re going to evaluate those products, and make decisions about how they

contribute to our shareholders going forward.

Al Alper: That sounds like a very wise approach. Could you tell me a bit more about your capital structure?

Lance: We have, right now we have about 196 million shares out, approximately. We've raised, and invested to date, about 60 million dollars and

have just added an additional 20 million dollars Canadian to the company’s balance sheet. When we first took the company public, we brought a strategic

partner into the equation: the Tata Group, which is India's largest company. They've invested approximately 40 million dollars in the company. They are

in a long-term restructuring -- and review process, so they've asked that we treat them as a private equity type investor at this moment in time. They

own about 14 percent of the company at this juncture. Management and friends and family of mine own about 20 percent of the company. EMR Capital

partners, the most recent investor in the company, currently owns about 41 percent of the company, and then the balance is owned by a group of Canadian

institutional investors and the public retail investor base.

Al Alper: That sounds very good. Sounds like you and your family and your friends are committed to it, and that's great. Also, you have

great support with other major investors, and you have attracted institutional and also retail investors, so that sounds very good.

Lance: We're very fortunate.

Al Alper: Yes, and you’re doing all the right things. Could you tell me the primary reasons why our readers/investors should invest in

your company?

Lance: Based on what we've demonstrated to date, we have a management team and a board of directors who have demonstrated their ability to

achieve results and deliver on key milestones, and manage to minimize dilution and maximize the capital structure of the company for the benefit of its

shareholder base. We'll continue to enhance that team going forward, as it always starts with people.

We're blessed with something that delivers a great many value opportunities to an investor: the lowest quartile on the CAPEX of any potassium

project to develop in the world; the very lowest on the operation costs, end of the curve from an operating perspective; and a product that we'll

produce right now in the PFS, for approximately

180 dollars a metric tonne that is currently selling for over 700 dollars a metric ton. The market for potassium sulfate is growing at about four to six

percent a year, on a global basis. Then, we have those ancillary minerals to look at, including the additional suite of minerals that includes lithium,

magnesium chloride, magnesium sulfate, boron, and others that are all looking like minerals that continue, as commodities, to move up in price and in

demand, even in these challenging times.

We have all those things – plus we have a pathway forward on the permitting, where Utah, again, is unbelievably supportive. Then we have all the

infrastructure at or near the site, from a development standpoint, so the risk associated with process, with infrastructure, with permitting, and with

markets for products, looks as favorable as, I believe, virtually any resource project that exists out there anywhere on the planet today.

Al Alper: It sounds like an exceptional project, and company. It sounds like you're doing everything very well, you and your people. Is

there anything else you'd like to add?

Lance: I think you've done a really nice job of covering the key aspects for anybody considering an investment in the company. We know that

investors have thousands of choices of where to put their money. We hope investors will chose us, based on what we've talked about today; the commitment

we have, the upside of our project right now, currently, significantly, that we believe is undervalued. Because if you compare Crystal Peak Minerals to

the public company Compass Minerals, and you can extrapolate numbers from our PFS into what they currently trade at, the grand prize is, Crystal Peak

Minerals, here in a few years, has the chance of being worth a billion and a half dollars or more; and we have a valuation now of approximately 75

million dollars Canadian.

We think that there's a great deal of upside in the future, yet we need to demonstrate an ability to execute. Look at our history, and then

let's see what we're going to accomplish in the next 12 months. I think it's a really exciting time and opportunity for people to be looking at us as a

potential investment opportunity.

Al Alper: It sounds like an excellent opportunity.

http://crystalpeakminerals.com/

Crystal Peak Minerals Inc.

2180 South 1300 East • Suite 200

Salt Lake City, Utah 84106

Phone: 801-485-0223

Email: info@crystalpeakminerals.com

|

|