Dr. Alper Interviews Mr. John Pearson, Vice President of Investor Relations of Centerra Gold Inc. (TSX: CG): Internationally Diversified Gold Producer

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/17/2016

Dr. Alper interviewed Mr. John Pearson, Vice President of Investor Relations of Centerra Gold, an internationally diversified gold producer.

Centerra just put in place a US$150 million project financing facility for the Öksüt project in Turkey, and looks forward to construction this summer,

and anticipates first gold production in the third quarter of 2017. With a stock dividend and strong balance sheet, now Centerra is focused on

optimizing the business and maintaining low cost operations.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News interviewing Mr. John Pearson, Vice President of Investor

Relations of Centerra Gold Inc. You have great news that was just announced. Centerra Gold’s project in Turkey sounds excellent, with an amazingly low

cost. That's really great! Could you tell me a bit about your company and more detail on your project in Turkey? I'd also like our readers to know more

about all of your different mining operations. I know Centerra Gold has them all over the world.

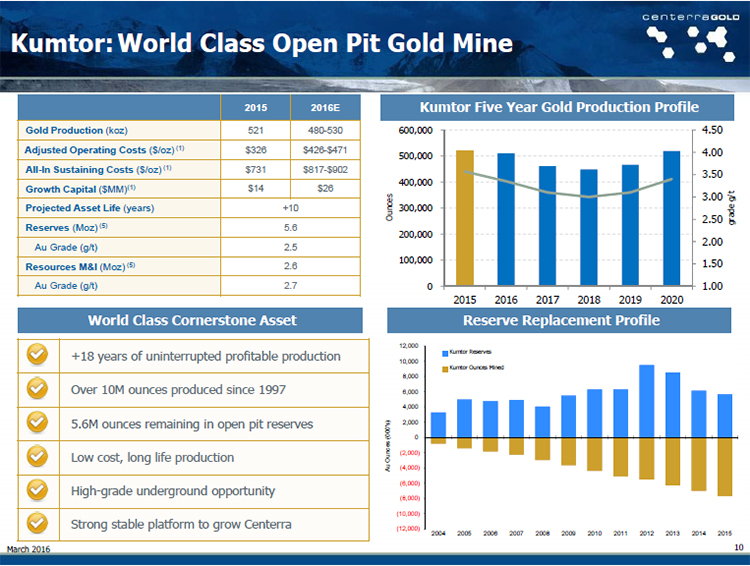

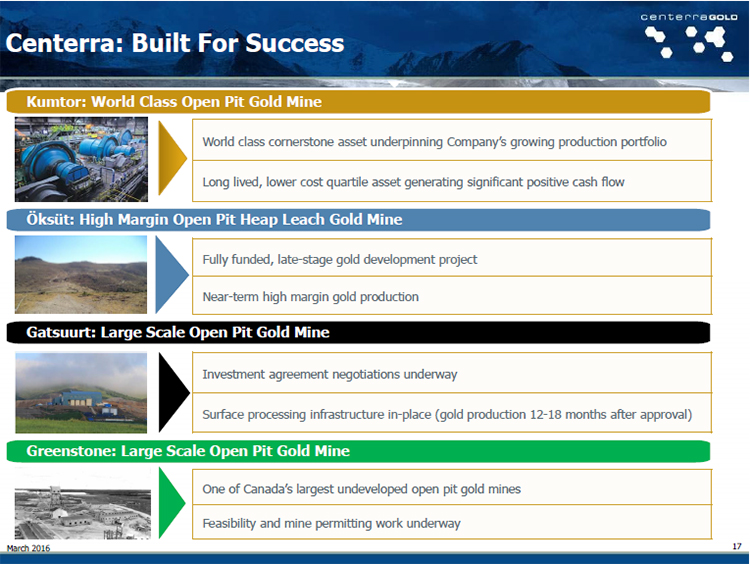

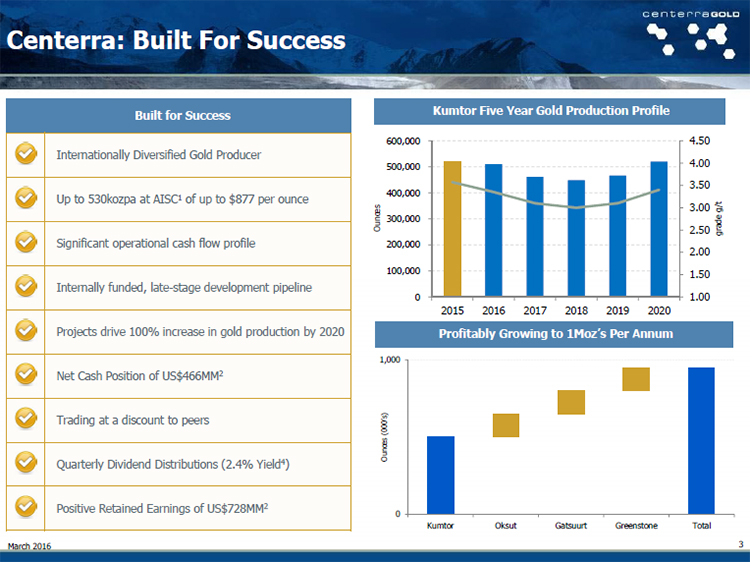

Mr. John Pearson: Centerra Gold Inc. is an internationally diversified gold producer, and we have a solid production platform based on our

world class Kumtor Mine that's located in the Kyrgyz Republic. Kumtor produces, on average, about five hundred and twenty thousand ounces of gold a

year, and this year, we're looking at all-in sustaining costs of somewhere around eight hundred and six dollars $860 per ounce, which is the mid-point

of our guidance range.

In the near term, we have a growth pipeline, which will grow our production from five hundred thousand ounces, annually, to about a million ounces over

the next five years. The first one of those projects in that growth pipeline is our Öksüt project in Turkey. The Öksüt Project is a fully funded, high

margin gold project, just waiting on final permits, to get into construction on that property. At Öksüt, we announced just yesterday, putting in place a

US$150 million project financing facility for the Öksüt project. We hope to get in construction this summer on that project, with anticipated first gold

production in the third quarter of 2017. We received the EIA approval for Öksüt in November of 2015, and we are just waiting for the final land use

permits to get under way. Öksüt is an open pit heap leach project, and it's high margin. The first four years of the project life we expect to be

producing, on average, about 155,000 ounces of gold.

The second project in our property pipeline or growth pipeline is our Gatsuurt development project in Mongolia. Gatsuurt is an adjacent deposit

to our former Boroo mine in Mongolia. It's located some 55 kilometers away, by road. This year, the important development on the Gatsuurt property is

that the Parliament in Mongolia approved the ownership structure on Gatsuurt. In 2015, Gatsuurt was declared strategic by the government and passed by

the Parliament. That allows us to move it forward. We are currently in discussions with the government of Mongolia to finalize the deposit development

agreement, investment agreement on the Gatsuurt project.

Gatsuurt is essentially already to go. What we're going to do there is mine the ore at Gatsuurt and truck it over to our Boroo milling facility.

All the facilities are essentially built and ready to go. In fact, we have built the road that connects the two sites. We have the mining fleet and the

trucking fleet already purchased, we have the mill, at Boroo, which is currently on care and maintenance, and just waiting for Gatsuurt to move forward.

Then, last in the growth pipeline is our Greenstone Gold property, the Hard Rock Project in Northern Ontario, Canada. We are completing a

feasibility study on that property, and the Hard Rock open pit project. That should be out mid-year, this year. That will be the third piece of the

growth pipeline. That would take our gold production up to the million ounce range in 2020.

Dr. Allen Alper: That sounds great. It sounds like you have great projects going right now, and you have a pipeline of new projects coming right

on, so that sounds extremely excellent.

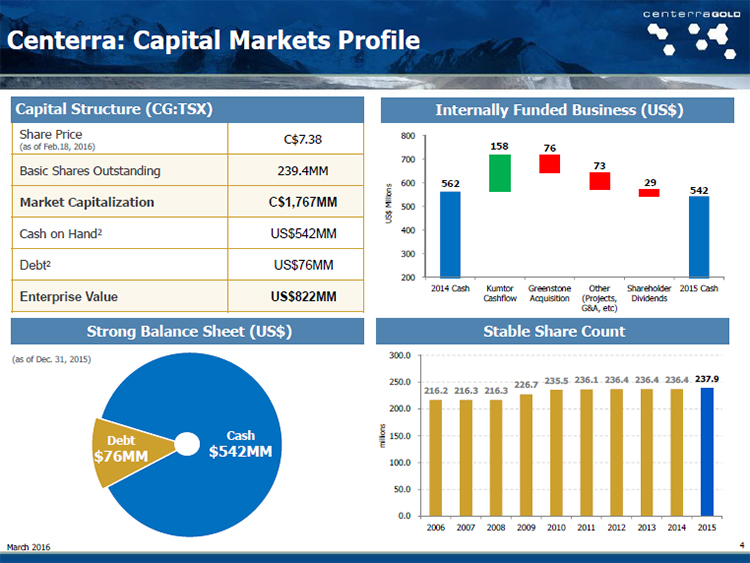

Mr. John Pearson: Centerra is in very good financial shape. We had a very solid balance sheet at the end of 2015. We ended the year with

$542 million in cash and cash equivalents on the balance sheet, very little debt, we had drawn down about $76 million on our existing revolving credit

facility, so we have just a small amount of debt outstanding, $76 million. We certainly have the cash reserves available to us to fund our growth

pipeline, and in addition, adding this credit facility for Öksüt just improves and maintains our financial flexibility and maintains our balance sheet

strength to enable us to deliver on our growth pipeline.

Dr. Allen Alper: Could you tell me a bit about how it is operating in Kyrgyz Republic, Turkey and Mongolia and some of your other locations?

Mr. John Pearson: Certainly, we've been operating in the Kyrgyz Republic for over 20 years now. The Kumtor Mine went into production in

1997 and has operated and produced gold now for over 19 years, continuously. Similarly in Mongolia, we built the Boroo mine in 2003, 2004, and it went

into production in 2004. We mined that deposit and completed milling in 2014. In 2015, we were just doing secondary bleaching on the heap leach pad.

This year, we are rinsing the heap leach pad and recovering the residual gold. We've been operating in these regions a long time, and we find that we've

had an excellent experience there.

Turkey, again, is a very attractive jurisdiction to develop a mine and operate there. As you see, from our growth pipeline, we're actually

moving and adding other properties, especially outside of these regions. The Greenstone Gold project in Northern Ontario is a good example of that,

which adds to our geographic diversification.

Dr. Allen Alper: That sounds great! Could you tell me a little bit about Scott Perry, your CEO, and the rest of your management team?

Mr. John Pearson: Scott Perry recently joined us last November as Chief Executive Officer. That was on the retirement of our former

president and CEO, Ian Atkinson. Scott joined the company as CEO, and is very excited about the different opportunities we have in front of us. At the

same time, Frank Herbert was promoted to President in November of last year. Frank has been with the company for over 12 year. He joined the company

in 2004, and has been our Chief Legal Counsel of Government Affairs person. Gordon Reed, who is our Chief Operating Officer also joined Centerra in

2004, and is in charge of the operations. Our CFO is Darren Millman who had been our VP Finance and Treasurer. He was recently appointed CFO on April 1

of this year, upon the retirement of Jeff Parr, our former CFO. Jeff had been with the company since 2006, and just retired this year. Darren, who is

the current CFO, joined the company in 2013, and was our Vice President of Finance and Treasurer. He was promoted to the CFO role upon Jeff's

retirement.

So as you can see, we have a well-experienced management team in place to deliver on our growth projects.

Dr. Allen Alper: It sounds like you have a very, very strong management team, a diversified team, one that can handle the job very well. Could

you tell me a about your capital structure?

Mr. John Pearson: Centerra Gold Inc. has just a little over 240 million shares outstanding. We are listed on the Toronto Stock Exchange,

and one of our top ten shareholders is Kyrgyzaltyn, that is the state-owned enterprise in the Kyrgyz Republic. They own about 32% of the outstanding

shares, and the remainder of our shares are held between institutions and retail, so about 45% of the shares are held by major institutions in both

North America and Europe, the typical names that would hold various gold companies. You know, the Paulson, Van Eck, Black Rocks of the world etc.

Dr. Allen Alper: That sounds great; a very strong bunch. Could you tell me about several reasons why shareholders and investors should invest in

your company?

Mr. John Pearson: Centerra has created a lot of shareholder value over the years. We do pay a peer leading dividend. Currently, our

dividend yield is, I believe around 2.6%. We pay a four cent Canadian quarterly dividend. Since we instituted paying the dividend in 2010, we have paid

out approximately $248 million U.S. to shareholders. We have a very strong balance sheet, with the cash reserves that we have in place. Also, we have

retained earnings at the end of 2015 of some, seven hundred and twenty-eight million dollars. The company generates significant free cash flow. For

example, in 2015, our Kumtor operation generated $158 million dollars of free cash that came back to the company. The operations really generate

significant cash flow.

Dr. Allen Alper: That sounds fantastic. That's really, really great. That's with gold being up and down for the past few years. Now it looks like

it's firming up. Do you have any thoughts on what gurus are saying about the gold market?

Mr. John Pearson: No. What we focus on is optimizing the operations. We put in place at Kumtor continuous improvement programs to optimize

the business process to maintain our costs in the lowest quartile, if possible. We certainly have had some favorable tail winds for those cost

improvements, like the lower diesel fuel prices and favorable currency exchange rates in the countries we operate in. That does help our costs, but, you

know, not relying on that, we have to be continually improving the operations by workforce optimizations, looking at maintaining our mill throughputs at

the highest rates, and looking at the open pits to increase availability and productivity of the mining fleets.

Dr. Allen Alper: That sounds excellent. It sounds like you're focusing on being profitable, highly profitable, no matter what happens with the

gold price that sounds great. If gold improves, your profit margin will even become greater. Is there anything else that you'd like to add?

Mr. John Pearson: The one thing we didn't touch on was - We also have an active exploration team and exploration program. We have

properties, and these are more Greenfield or early stage exploration properties, but we have exploration joint ventures in Canada, Mexico, Nicaragua,

Portugal, Turkey and Mongolia, where our exploration teams are looking for the next opportunity.

Dr. Allen Alper: That sounds great.

Mr. John Pearson: We're spending about $11 million on exploration in 2016.

Dr. Allen Alper: That's really great! Having the money to do that in a tough time for mining companies, but a great time for exploration and

acquisition, with more talent available, costs down for properties and much more, shows what an excellent, well-managed company Centerra Gold Inc. is.

http://www.centerragold.com/

1 University Avenue, Suite 1500

Toronto, ON

M5J 2P1

Tel: +1 (416) 204-1953

Fax: +1 (416) 204-1954

Email: info@centerragold.com

|

|