Interview with Meghan Brown, Director of Investor Relations of Endeavour Silver (NYSE: EXK, TSX: EDR): in 2015 Produced 7.2 Million Ounces of Silver in Mexico

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/16/2016

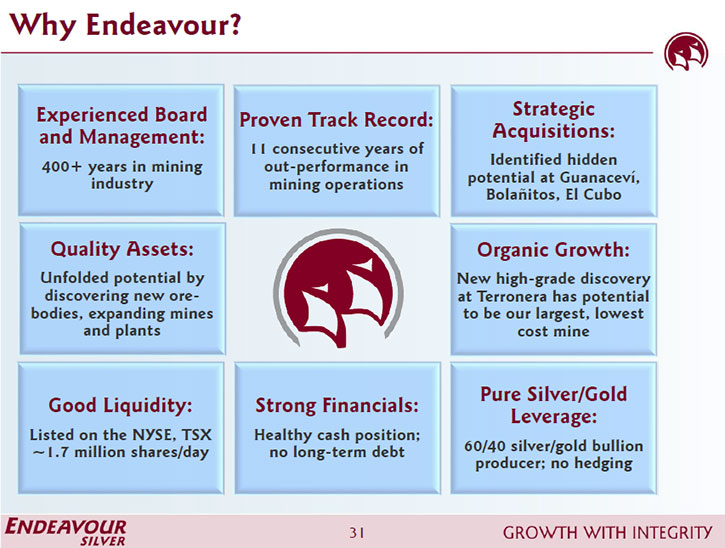

Endeavour Silver (NYSE: EXK, TSX: EDR) is a mid-tier precious metals producer with three high-grade underground silver mines in Mexico that in 2015 collectively produced 7.2 million ounces of silver. The company is focused on organic growth through strategic acquisitions and new discoveries. The new high-grade Terronera silver-gold discovery and El Compas mine acquisition both have the potential to become new mines for Endeavour, near term. According to Meghan Brown, Director of Investor Relations of Endeavour Silver, this is a good time to be in silver as its price is strengthening, and the company's stock is rebounding quite nicely.

Guanacevi

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Meghan Brown, Director of Investor Relations, Endeavour Silver Corp.

A lot of exciting things are happening with Endeavour Silver and the market seems to appreciate what you are doing. I know recently you raised 16 million dollars US.

Meghan Brown: Yes.

Dr. Allen Alper: Could you tell me a bit about what Endeavour is doing and what your focus is. I know you are a silver, gold company doing well in Mexico, but could you elaborate on Endeavour?

Meghan Brown: Sure, I would be happy to. We are based in Vancouver. All of our mines are in Mexico. We have three operating mines. All three of them are primary silver mines. All three of them do have gold as a byproduct, but we don't have any base metal by products at all. So Endeavour is truly a pure play on precious metals. We are the only primary silver producer that is purely precious metals. We have great leverage to the silver price and we have seen in recent weeks, with the strengthening in the silver price that our stock is rebounding quite nicely.

It is a good time to be in silver. Obviously you and your readers have all observed the improvement in the silver price. Silver is out-performing gold at the moment, which it often does on the way back up after it hits the bottom of the bear cycle. So it is a good time to be in the silver mining business.

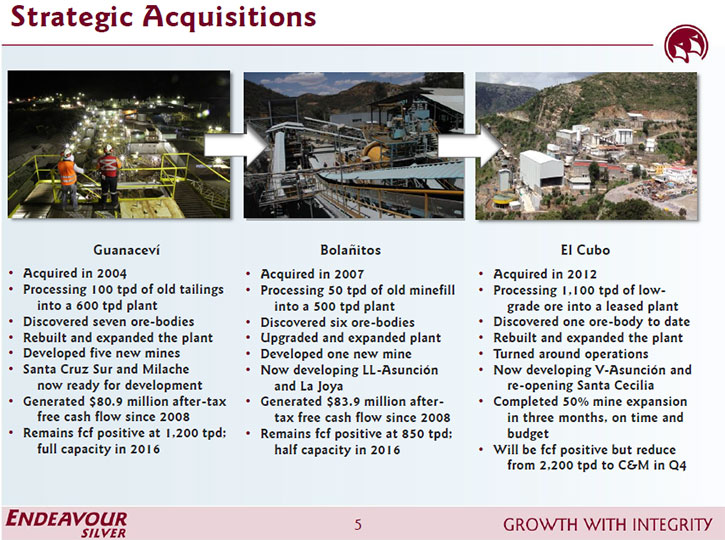

Just by way of background, the company was formed in 2003. We have been operating for 11 years in Mexico. Our first mine, which was acquired in 2004, is known as Guanacevi. It is located in Durango State. It is our highest grade silver mine, with silver grades up to 300 grams per tonne. It is a mine that operates with cash costs below 10 dollars per oz and all in, sustaining costs at around 12 or 13 dollars per oz so it makes money throughout the precious metals price cycle.

Our second mine, Bolanitos, was acquired in 2007. It is located in Guanajuato state. It is about a half and half gold/silver mine, so it has a nice, healthy gold credit. It operates at around 4 dollar per oz cash cost and around 12 dollar per oz all in sustaining cost, so again, it can make money throughout the price cycle even as low as we recently saw 14 dollars per oz late last year.

Our third mine, El Cubo was acquired in 2012 at what, we didn't realize at the time, was the top of the market. When we acquired El Cubo, one of the strategic reasons for acquiring it was that it is located just a few kilometers from our Bolanitos mine. So there were some operating synergies there. When we acquired it, silver was trading close to 40 dollars per oz and it was a high-cost mine, but we were quite confident we could get the costs down and expand production.

We modeled it from 35 dollar silver, down to 20 dollar silver and it made money at all those various price scenarios, but it never occurred to us that we would need to model it down below 15 dollar silver. So of course, silver went below 14 per oz, and El Cubo had a very hard time making money at those price levels in spite of the fact that we made significant progress getting the costs down. We actually doubled the through-put-in the past 3 years, we improved mine efficiencies, and plant recoveries. So early this year we made the difficult but right decision to ramp down production at El Cubo until it goes on care and maintenance at year-end. We do still own those ounces at El Cubo so there is upside there for when the silver price rebounds, then we will bring it back into operation.

Dr. Allen Alper: That sounds like a wise decision, to put that on care and maintenance and continue with the other two that have favorable cash flow.

Meghan Brown: Yes so this year, we will be a smaller company in terms of ounces produced, but we will make money. We have ceased all development at El Cubo and El Cubo will actually make money this year for the first time.

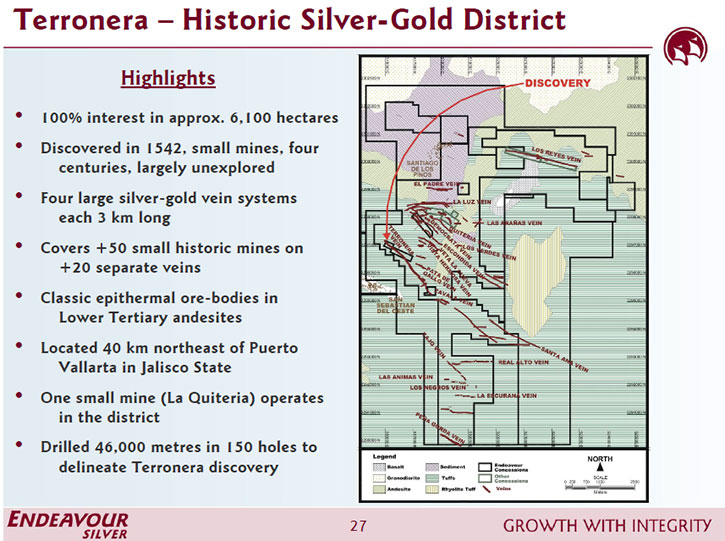

We think our shareholders would rather see us be a little smaller, but profitable this year. And there will be a time when we can grow again either by bringing El Cubo back on or through organic growth. We have additional assets in Mexico that have potential to become new mines for us. One is called the Terronera property which we acquired in 2010 and made a new discovery on in 2012. We have drilled out, so far, about 45 million ounces of silver equivalents. It is located in Jalisco state, about 40 kilometers from Puerto Vallarta, on a paved road so it is close to infrastructure. It is an epithermal vein system. It will be an underground mine. It is very similar in geology to our existing mines. So we propose to build this when we can deliver an economic mine plan. That is under way now. We are doing the advanced engineering and completing the step-out drilling with the objective of having a pre-feasibility study delivered by the end of this year.

The other development project is El Compas which we just announced this week. We have acquired nearly 4,000 hectares of property along with a five-year renewable lease on the 500 tonne per day (tpd) La Plata ore processing plant in Zacatecas, Mexico. The acquisition gives us a foothold in the Zacatecas district, which is one of the most prolific mining areas in Mexico, and it has the potential to add production and cash flow near-term. El Compas has good exploration potential to expand resources and good acquisition potential to consolidate stranded resources and exploration targets within the Zacatecas mining district to extend mine life. Our short-term goal this year will be to invest in exploration to upgrade and expand the resource, consolidate properties in the district to extend mine life, refurbish the plant, re-evaluate the economics to develop the mine, and complete an updated technical report by year-end.

Dr. Allen Alper: That sounds very good. Could you tell me a bit about your capital structure?

Meghan Brown: Up until recently, we hadn't issued any new shares since 2010. Now we have about 110 million shares outstanding, which is less issued stock than almost all of our peer companies, who are much more diluted. We have managed to do that by funding our growth through the years internally with cash flow. However, we felt, late last year, that it was prudent to do a small equity raise simply to ensure that we could maintain our existing programs and continue to have some growth capital for when the opportunity arises.

We raised 16 million dollars, which means the engineering work, the remainder of the drilling, and the pre-feasibility study for Terronera are now fully funded. We think it’s important because that is the growth part of our story.

Dr. Allen Alper: That sounds very good. Could you tell me a little bit about your management team and the board?

Meghan Brown: Sure. We have a very solid group. Most of the group has been together since the early days. Our COO, Godfrey Walton, and our CEO, Bradford Cooke, founded the company in 2003 and they are both still here. They are both geologists. Other members of the team include CFO Dan Dickson, he has been here for eight years. We have a solid team in Mexico. Most of them are local. We have very few ex-pats.

We have seven members on our board of directors. All of them are independent other than Brad and Godfrey. We have two former Placer Dome executives on the board, one of whom, Geoff Handley, is our chair. He sits on a number of other boards as well, including Eldorado Gold, which you probably know. He joined the board in 2006.

The other former Placer Dome executive is Rex McLennan. He joined the board in 2007. He was CFO of Placer Dome and he is the chair of our audit committee. We are very pleased to have him in that capacity.

We have a number of other directors with very strong mining backgrounds, including Ken Pickering, who is an engineer. He has about 45 years’ experience in mining. He was formerly with BHP Billiton and he joined our board in 2012. He is the chair of our sustainability committee. We also have Mario Szotlender. He is a business man from Venezuela. He has been involved in a number of mining ventures including Fortuna Silver Mines, Focus Ventures, Radius Gold, and others. He joined our board very early on, in 2003.

Finally we have Ricardo Campoy. He is a former investment banker and has a long career in mining, and merchant and investment banking. He is a mining engineer from the Colorado School of Mines. He sits on a number of other resource company boards including General Moly. Ricardo joined our board in 2010. He chairs our compensation committee.

Dr. Allen Alper: Well it sounds like a very strong board, very experienced and competent.

Meghan Brown: Absolutely.

Dr. Allen Alper: Could you tell me a little bit about yourself, Meghan?

Meghan Brown: Oh sure. I have been working in natural resources for over 20 years. I started my career in the oil patch working initially for a company called Suncor. Later working for TransCanada Pipelines. I have an economics and political science undergrad from the University of British Columbia and I have a Masters degree in business from Queen’s. I have been working in finance and investor relations my entire career.

Since leaving the oil patch in Calgary in 1999, I have worked exclusively in Vancouver in the mining business. I spent seven years at Placer Dome, up until its takeover by Barrick in 2006. Then I worked for a number of junior mining companies with assets in South America, Asia, and Africa. I have been here with Endeavour for about three and a half years, running the investor relations program.

Dr. Allen Alper: Well that sounds great. You have a very solid background also. Could you tell me the primary reasons why our readers/investors should invest in your company?

Meghan Brown: Well, I think if you like silver it is an interesting time to be looking at the silver equities. Among all the silver producers, we are the one who has the most silver in our portfolio and pure exposure to silver and gold without any base metals. It is perhaps one of the things that hurt us in the bear market cycle because we didn't have the diversification of having any copper, or lead, or zinc production. But in a precious metals bull market, Endeavour offers more exposure to up-side in the spot metal price than perhaps any of the others, and we can see that in the charts.

If you were to chart performance, say since January 1st even, Endeavour is one of the top performing silver companies. So, if you think there is more up-side remaining in silver, there is likely more upside remaining in our stock price as well.

Dr. Allen Alper: Wow, I saw that chart. That is very impressive on recovery since January. That is very good.

Meghan Brown: Yeah.

Dr. Allen Alper: Is there anything else that you would like to add?

Meghan Brown: We have three assets that are all operating, and two compelling near term growth projects. The Terronera project is maybe one of the most interesting discoveries that has been made in Mexico in a number of years. It is an historic district and we own 6,000 hectares.

There was a lot of small scale mining going on for several hundred years, but that all stopped in the Mexican Revolution and this asset just sat and nothing was done. We took an option on it in 2010, started drilling it in 2011 and made this discovery in 2012 on what is called the Terronera vein. But Terronera is only one of about 20 veins on the property that we have traced on surface. We have not even fully delineated this one yet. We have delineated about 1.2 kilometers. It is about 350 meters deep so far. It is about 6 meters thick, on average, but the thickness ranges up to 20 meters. It is still open at depth. It is still open in both directions and we have traced it along surface 3 kilometers in each direction. So there is lots more to do at Terronera, but it is just 1 of 20 veins on our property.

I think this will be one to watch. We would like to try and double the existing resource by the time we deliver a PFS and we think it has the potential to be, not only our fourth mine, but potentially our largest mine.

Dr. Allen Alper: That is great. That shows excellent growth potential. That is really terrific. Do you have any feel for what might be the cost and how competitive it might be once it gets into production?

Meghan Brown: Yeah, we did run preliminary economic analysis, which we published about a year ago. It was done at much higher prices. I think we used 18 dollar silver and 1,260 dollar gold and a 14:1 peso exchange rate when we ran this PEA. It showed terrific economics, 20 percent after tax, IRR, 5 dollar per oz cash cost, and 9 dollar per oz all in sustaining costs, with a 65 million dollar capex. We are optimizing the numbers again for a larger mine and we will publish them at our pre-feasibility study around the end of this year.

At 2,000 tonnes per day, it would be our largest mine producing 6 million ounces per year of silver equivalents and should become our lowest cost mine.

Dr. Allen Alper: That sounds very good.

http://www.edrsilver.com/

Endeavour Silver Corp.

301-700 West Pender Street

Vancouver, BC V6C 1G8

Toll Free: 877.685.9775

Phone: 604.685.9775

Fax: 604.685.9744

Investor Relations:

Meghan Brown

mbrown@edrsilver.com

|

|