Durango Resources Inc. TSX.V: DGO Interview with Marcy Kiesman, CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/7/2016

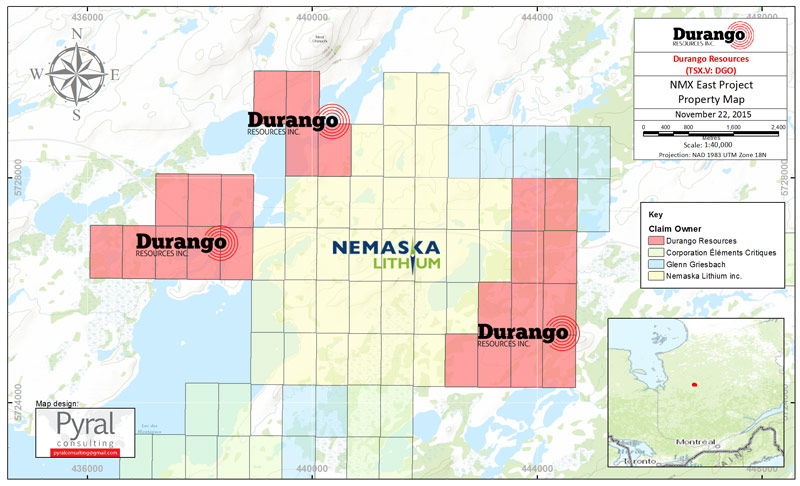

Durango Resources Inc. TSX.V: DGO is well positioned for a discovery with properties adjacent to a Nemaska Lithium and to several new gold discoveries, as well as a potential graphite property in southern Quebec. According to Marcy Kiesman, CEO of Durango, they are actively looking for a joint venture partners to help fund the exploration without diluting the company, which is being held as closely as possible until the market conditions improve. Marcy. Kiesman is hoping that, with the increasing demand for precious metals, Durango will be able to put itself on the map as a successful junior.

Dr. Allen Alper: This is Dr. Allen Alper, editor in chief of Metals News speaking to Marcy Kiesman, who is CEO of Durango Resources Inc.

Could you tell me a little bit about what is happening with your company? I know you have some interesting properties, one very close to a Nemaska Lithium property, could you elaborate?

Marcy Kiesman: Sure, I can tell you some stuff about Durango. Basically we are trying to position ourselves for discovery. We have a property that's adjacent to the world’s next lithium mine, which is Nemaska Lithium and their Whabouchi property. We are about two kilometers away from the open pit mine site. We're actually in discussions right now, on a joint venture for the eastern property, with a group.

We also have property adjacent to new gold discoveries which were made in areas that nobody thought was possible, so I find those quite exciting. Just based on those three projects alone, Durango is a wild card and anything is possible due to our proximity to and shared geology with these projects.

We have a project, we've just acquired from a geologist, which is located north west of Lake Shore Gold and Goldcorp's Whitney property in Ontario.

We're on strike and adjoining onto the property that's showing the fifty-fifty ownership of Lake Shore Gold and Goldcorp claims. We also have something on ground next to another discovery, from earlier this year, which is Metanor Resources. Metanor has discovered gold under their tailings pond, so they're actively working on drilling 60,000 metres on that project now this spring.

We also have, and have held for a few years, our Trove gold property, which is in Quebec as well. It's an active area called the Windfall Lake. Eagle Hill used to own a lot of the ground in the area but has been acquired by Oban Mining. Our Trove property is completely surrounded by Oban, and they're actively working on acquiring the whole Greenstone belt there and are also drilling 60,000 metres this spring.

We have a lot of very interesting properties in areas where there is a lot of exploration, so we're very excited and focused to get things moving ahead.

Dr. Allen Alper: That sounds promising.

Could you tell me more about your team, and your background?

Marcy Kiesman: Ironically, my background is actually as a management accountant, which is kind of interesting for the mining business, but I quite like the geology and I work with geologists who are located in different areas so they can work on all of our different claims.

We work closely with a few geologists and we have a prospector and his group situated in Quebec, which is part of the reason we do a lot of work and exploration in Quebec. Another reason to work there is because it's so under explored and the government is responsive to mining and so are the locals in the area. The Cree first nations have been exceptionally helpful to work with in the area, so we've spent a lot time working there.

The rest of our team with Durango, one director is a lawyer, Thea Koshman, another a management accountant, Veronica Liu, and Twila Jensen, who was just added to the company last November, she's been around in the business for quite a few years. She's on the marketing side and works with Stockhouse.

Dr. Allen Alper: All very good.

Could you tell me a little bit about your plans for 2016?

Marcy Kiesman: 2016 is going to be an interesting year, so far we have been struggling to get our share price up so we can complete a financing. We are looking to joint venture some of our projects so we can reduce the risk to Durango shareholders, take a little bit of cash and some shares of the partner so we can enjoy the upside potential. This way the projects can be explored without diluting the Company.

Currently, we have fifteen million shares outstanding, and we're trying to keep it as closely held as possible. I own over two million shares, and another director owns a half million shares. So we're trying to keep as lean as possible to keep us moving ahead until the market conditions improve. Once they improve we can actually raise money at the higher levels without diluting the stock and put our shareholders needs first.

We've been working closely with INRS, which is a group located in Quebec. We have a three-year partnership with them where they help us explore the Decouverte which is a gold exploration project located in the Abitibi Greenstone Belt right next to an Osisko property. INRS has been helping us by doing a lot of IP work and petrology for us at a very nominal cost.

We're working on advancing the properties different ways so we can keep exploration going, keep the data coming on the projects, and keep the expenses down to a bare minimum, and still get the exploration results that we need to move the properties forward.

Dr. Allen Alper: That sounds like a good approach.

What are some reasons for investors to invest in Durango?

Marcy Kiesman: Investors would probably be interested in investing in a company like Durango if they're looking for low overhead costs, and good usage of their investments on the business side of things. Having projects that are contiguous to new gold finds and deposits such as our Lithium deposit and the additional Lake Shore Gold projects and the Metanor are helpful for the potential of additional discoveries and also to keep the costs down while crews are working in the area. We have a variety of projects we're slowly working on to get things moving. Once we can get the share price up and attain the financing, we'll be working on the balance of the projects that aren't joint ventured. We'll be working on the different projects, so we can move the company forward and make a new gold, silver and lithium discovery.

We have another project too, we haven't talked about much recently. It's the Buckshot in southern Quebec, and about 70 kilometers west of Montreal. It's been an area where there is a lot of graphite potential next to the old Miller graphite mine. We're in discussions for a joint venture on that property as well.

We have crews, who have just gone up to the Nemaska property. We just got news this morning that they're up there to do a site visit for 43-101. They will also go out to our Buckshot property, which is the graphite property, so we can have a 43-101 written up on that property for a potential joint venture.

Dr. Allen Alper: Well it sounds like you have some very excellent properties in a great location next to lithium, gold, graphite. And you are working on joint ventures. When your stock firms up, you're thinking of getting some more funding. It sounds like you have a very good plan in a time that has been tough for junior miners.

It looks like things may be getting somewhat better. Some people are saying that we've reached the bottom, and I hope that's so. Hopefully this will be a good time for you.

Marcy Kiesman: I hope so too. From just the reports I've read, it seems the physical demand for the precious metals in 2015 has been increasing. Investors seem to be paying higher premiums and are having an increased buying activity for certain coins and bars.

I think all the geo-political events are also playing a big role in this equation. So we've recently been looking into the silver deposit in Saskatchewan and are actively trying to get properties that have some significant value that may not appear so on paper. But have some value for the future, and for the shareholders of Durango. Once we can appreciate our price and get things moving, we can put ourselves on the map as a successful junior that managed to hold strong through this rough bout.

Dr. Allen Alper: It's been very tough, a lot of companies couldn't keep the lights on.

Marcy Kiesman: Yes, we've been very lean for a long, long time which has served us well for these times anyways, but we're well positioned now for a discovery of some sort.

Once we get some funds to do the work that we need to do, I think things will definitely improve, not just for us, but for the whole junior market in general.

Over the last year or so, we traded over twenty million shares, so shareholders looking at Durango, also have the ability of having very liquid stock, even though it's a junior with very few shares out.

Dr. Allen Alper: That’s helpful.

Email: durangoresourcesinc@gmail.com

Web: http://www.durangoresourcesinc.com

Tel: 604-428-2900

Fax: 888-266-3983

248-515 West Pender Street

Vancouver, BC

V6B 6H5

|

|