Dr. Alper Interviews Peter Secker, CEO Bacanora Minerals: Moves from Exploration to Development.

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/7/2016

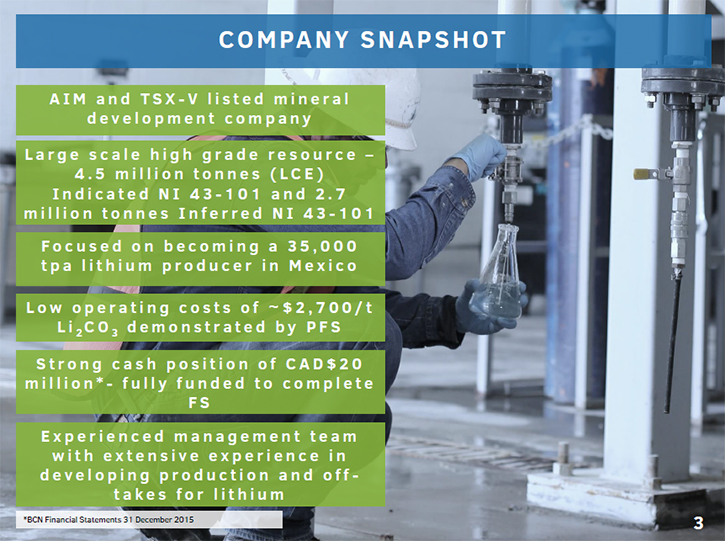

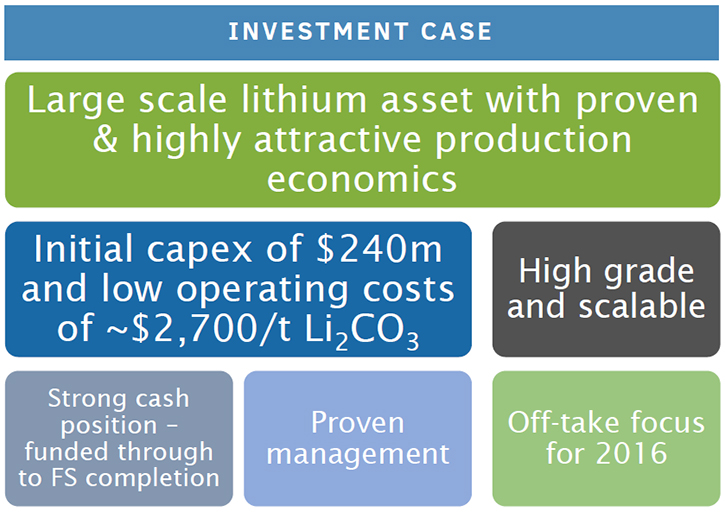

Bacanora Minerals is a development company focused on advancing their Sonora Lithium project in Northern Mexico. It is one of the world’s larger lithium resources – high grade and scalable. With low operating costs, strong cash position and experienced management team, Bacanora is aiming to become the next major lithium producer in Mexico. The Company has recently completed a Pre-Feasibility study, now available on SEDAR. According to Peter Secker, CEO of Bacanora, the company has commenced a Bankable Feasibility Study and is also operating its pilot plant in Mexico to produce samples of battery grade lithium carbonate for potential off-take partners in Asia, mainly China, Korea and Japan.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Peter Secker who is Chief Executive Officer of Bacanora Minerals. You're in an exciting area of lithium and borate, and previously you developed a lithium project in Quebec. Tell us what your company is doing now and what your plans are.

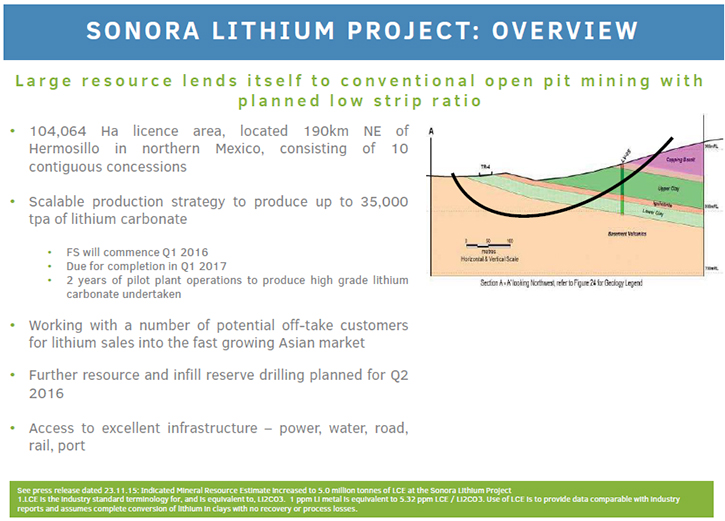

Peter Secker: Bacanora Minerals is transitioning from an exploration company into a development company based on its Sonora Lithium project in Northern Mexico. The company has been working on the project for the last five years and has delineated a significant lithium resource. We've only drilled about a third of the area so far and have delineated an indicated resource of approximately 4.5 million tons of contained lithium carbonate and an indicated resource of another 2.7 million tons. The lithium mineralization is hosted within a polylithionite, clay style deposit, which stretches for approximately five kilometers. The resource itself is located 190 kilometers to the east of Hermosillo, the capital of Sonora State.

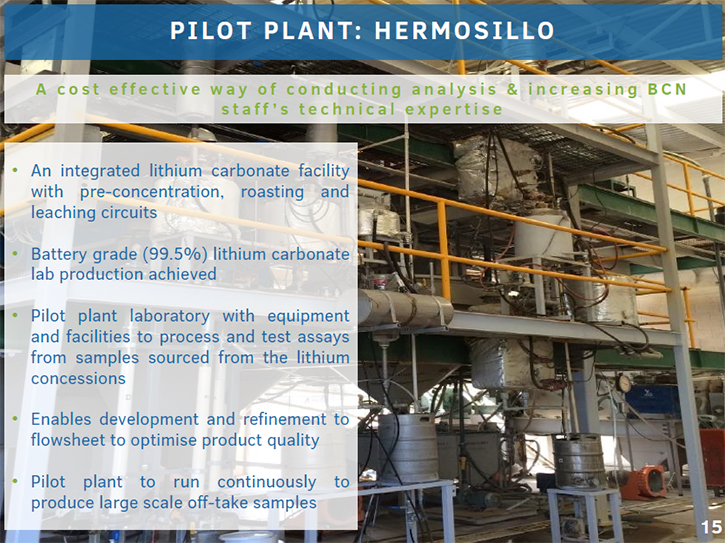

Over the last five years Bacanora has completed a number of tasks including detailed exploration, a 43-101 pre-feasibility study, plus building and operating our own pilot plant in Hermosillo to confirm metallurgical flowsheets and produce lithium carbonate samples. As part of the project pre-feasibility study, a number of international consulting groups were engaged to ensure project viability. Bulk ore samples from the site and the pilot plant were sent to SGS Lakefield in Ontario to confirm the lithium flow sheet. SRK Consultants in the UK developed the 43-101 resource estimate. International Mining Consultants, out of Tucson, developed the mine reserves. Ausenco Engineers in Perth, Australia developed process engineering designs, infrastructure designs, plus operating and capital costs.

Our strategy is to develop a first stage 17,500 tons per year lithium carbonate project with an estimated capital cost of $240 million. Our strategy is to operate at this scale for a couple of years, grow our cash flows, and then expand from 17,500 tons per year to 35,000 tons per year of lithium carbonate, with operating costs of approximately $2,700 per ton of lithium carbonate. We will be supplying off-take partners in Asia with battery grade lithium carbonate for use in electronics, renewable energy storage batteries, electric vehicles, and other applications.

With all that work completed, we have been upgrading the pilot plant in Hermosillo which is now operating to produce samples for potential off-takers. We will start to distribute samples to off-takers in China, Korea, and Japan in the third quarter of 2016 and based on those samples we would like to start working with a couple of off-takers towards the end of the year. In conjunction with the pilot plant and off-take work, we're also completing a definitive feasibility study and that is scheduled to be completed by Q1 2017, about 10 months from now.

Dr. Allen Alper: Do you expect to get funding from the off-takers and also maybe from debt and equity? What are your plans on that?

Peter Secker: Yes, it will be a combination of all of the above. Subject to working with two off-take partners, we think there is the possibility to get pre-off-take finance. And then there is the combination of debt and equity on top of that so we would do a combination of all three.

Dr. Allen Alper: That sounds like a very good approach. Have you produced satisfactory product on the Laboratory scale? Where are you on that?

Peter Secker: Yes, as part of the pre-feasibility we produced lithium carbonate in Lakefield with SGS. We've also produced lithium carbonate at our pilot plant in Hermosillo, and obviously that is forming the basis of this pilot plant run we're doing at the moment to supply material to potential off-takers in the third quarter.

Dr. Allen Alper: That sounds good. Could you tell me what differentiates your company from other companies?

Peter Secker: One of the key differences is that the management of the company has previously developed a number of new mines, including lithium projects, over the past 25 years. Martin Vidal, our President in Mexico used to be with Rio Tinto’s Industrial Minerals group and has worked with industrial minerals for the past 25 years. Eric Carter has over 23 years lithium operating experience and has built and operated lithium projects.

We are slowly growing a lithium operations team at Hermosillo in Mexico. All the operational staff will be based in Mexico. We are currently recruiting personnel with lithium operations experience - people who have built and operated lithium plants before. So, we're getting a team ready to complete the feasibility study and then move into detailed design, construction and operations. We have a project development time-table showing that, post completion of the feasibility in Q1 next year, and assuming funding within a reasonable time, we could potentially start commissioning the 17,500tpa plant at the end of 2018 and delivering lithium carbonate into the market in 2019.

Dr. Allen Alper: Now how does that satisfy the demand and developing markets? What about the auto battery market and why it's so important?

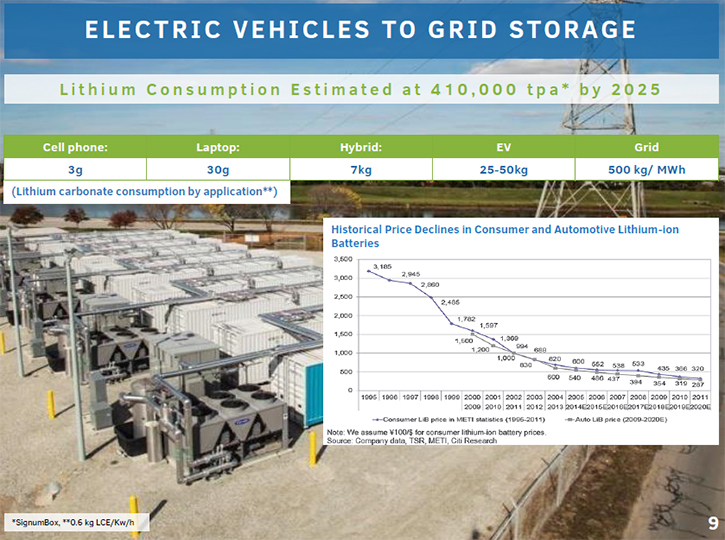

Peter Secker: The global lithium market is expressed in a unit called lithium carbonate equivalent, LCE. Current demand is approximately 175,000 to 180,000 tons per year of LCE. The market is growing somewhere around 10% year on year, and as you pointed out, predominantly on batteries. I'll talk a bit about that in a minute, but if you assume that demand is 15 to 20,000 tons per year of new production, then the world needs to start bringing on new projects rather quickly.

There are currently four main producers of lithium products. There are two in Chile, one in Argentina, and one in Australia. There is one new entrant in the market at the moment, they are currently commissioning a project in Argentina and that should be at full production towards the end of this year. That will bring on somewhere around 10,000 to 15,000 tonnes of lithium carbonate. So, if the market is growing at 15,000 - 20,000 tonnes annually, and only 15,000 tonnes of new mine production is coming on stream, the world needs at least another two large scale projects to be in development for production start-up in 2018 to 2020, just to meet current demand forecast.

If you look at the demand dynamics, the majority of new demand is intended for energy storage application, generally electronics, vehicles and grid storage. In terms of demand, a portable device like a cell phone consumes about 3 grams of lithium carbonate, a laptop around 30 grams (one ounce) of lithium carbonate. Once you start moving into the electric vehicles space, then a hybrid, anything from five to ten kilograms, (10 to 20 pounds). A high performance EV sports car, 50 to 60 kilograms (100 to 120 pounds). And then for grid storage and renewable storage, (usually energy stored from wind farms or solar installations), then lithium consumption increases significantly to about half a tonne of lithium carbonate per megawatt of installed power.

So, lithium consumption is growing based on the migration of demand from portable electronics to electric vehicles, and then onto grid storage. Over the next decade, as we move more into the renewable energy space and more and more renewable energy demand, specifically in Asia, there is going to be an increased focus on lithium carbonate as the storage solution for renewable energy. A wind farm may be only 60% to 70% efficient. A solar farm, let's assume sunlight for from five to eight hours a day. As the world is going to rely on an ever increasing supply of renewable energy and is still going to demand energy on a 24/7 basis, there has to be a very cost effective solution for storing energy from renewables that can then supply the grid on a 24/7 basis. Lithium battery technology is now able to provide a storage solution to meet the 24/7 demand cycle.

Dr. Allen Alper: That sounds like an excellent description of the market. Could you tell us about the properties of lithium carbonate that allow for it to be so important in these electronic applications?

Peter Secker: If I go back to the basic chemistry and look at the periodic table, focusing on the first 3 elements: hydrogen is a gas, helium is a gas, lithium is a metal. So the third lightest element in the periodic table is lithium. In order to ensure a portable battery, lithium combines an energy density with extreme lightness. Take the conventional batteries currently used in internal combustion engines in motor vehicles, generally using lead-acid chemistry. Lead is one of the heavier metals, so therefore if you try to put a lead-acid battery into a portable application such as a cell phone, laptop or an electric vehicle, then lead acid would make it both extremely heavy and inefficient. If you want a light, portable application that has a high energy density and a high efficiency, then that obviously moves you into the lithium space.

There are a number of lithium chemistries, with lithium carbonate currently comprising somewhere around 70%-80% of lithium battery chemistries. Lithium battery technology has been around for a long time, the first large scale commercial applications appearing in the late 1980’s. Lithium battery use increased significantly with the requirements for portability for cell phones and laptops in the late nineties and early 2000’s. From a pricing point of view, the cost of developing these batteries has decreased significantly over the past 20 years. In the early 2000’s costs were around $2,000 to $3,000 per kilowatt hour for a lithium battery. Pricing today has decreased significantly to around $180 to $200 per kilowatt hour. By 2020, anticipated prices for lithium batteries will continue to fall to around $130 to $140 a kilowatt hour, which will allow them to be cost competitive with lead-acid and other applications. I believe there will continue be a significant movement from current battery chemistries to lithium technologies over the coming decades.

Dr. Allen Alper: Well, I'm very impressed with your knowledge of the industry, of the marketplace, of the application. That gives me great confidence and I'm sure that will give our readers/investors great confidence. It sounds like you have excellent projects, and also that the plan from the pilot plant and then further on to production is very sound and rational, so that's great.

Could you tell me a little bit about your team?

Peter Secker: My background is that I'm a mining engineer and I've been in the industry around 35 years in Australia, South Africa, China, Canada, and have built a number of Greenfield projects over that time. Martin Vidal, our President in Mexico, worked for 25 years with Rio Tinto and has headed our team in Mexico for the last five years. Eric Carter brings 23 years of lithium experience with him, from FMC’s lithium operations in North Carolina. We're starting to build a technical operations team in Mexico, a team that is capable of both project development and operations over the next 5 years.

Dr. Allen Alper: That sounds excellent, sounds like you have an excellent team, and that you're strengthening it, and you have great knowledge and background about the group. Could you tell me how it is operating in Mexico and what your thoughts are there?

Peter Secker: The Sonora project is located south of the Arizona/Mexico border, about four hours’ drive from Tucson and three hours from the state capital of Hermosillo. There is a significant mining industry in Sonora, for instance Grupo Mexico operating the Cananea and associated copper projects just to the north of our project. In Hermosillo, Ford Motors has one of their largest car factories outside of the US and has been operating there for about 25 years. In fact, they are building a Ford Fusion hybrid in Hermosillo, thus a little bit of lithium synergy.

Access to the site is by a paved, sealed road. We have high voltage power just to the north of us. We have access to process water beneath the site and a mining infrastructure that will allow us to develop a skilled operations team from the local area. We also have access to a port about an hour from Hermosillo, the Port of Guaymas. So, in terms of exporting to Asia, all road, rail and port facilities are easily accessible from the mine. Compared to some of the more remote locations in the world, this is one of the easier ones.

Dr. Allen Alper: That sounds excellent, that's great. Could you tell me a little bit about your financing and your capital structure?

Peter Secker: We are dual-listed TSX venture and AIM. In terms of shares, we have approximately 97 million shares on issue, currently trading at around C$1.50. In terms of cash, at the end of 2015, we had approximately C$20 million in the bank, so we are fully funded for all of the work we are doing both on the feasibility study operating the pilot plant. So fully funded through until 2017.

Dr. Allen Alper: That's great that the market place and the industry have confidence in what you and your team are doing, your plans and your deposits. That's excellent. Could you tell me a little bit more about the type of people or groups who are invested in your company?

Peter Secker: Within the project lease, there are three main exploration areas: La Ventana, Fleur, and El Sauz. Ventana is the area where initial mining operations commence and is 100% owned by Bacanora. The other two areas are a 70/30 joint venture with Rare Earth Minerals, (REM) a UK based investment company. REM is also a 17% shareholder in Bacanora. Colin Orr-Ewing, our Chairmen, holds about 11% of Bacanora. Then Igneous Capital holds 15% and M&G Investments a further 8%.

Dr. Allen Alper: Sounds great. Sounds like you have a fine group of investors it's quite tightly held, and yet it also gives other people in retail and other institutions an opportunity to invest. Could you tell me the primary reasons why our readers should invest in your company?

Peter Secker: You just have to look at the current supply-demand dynamics of the industry, lithium demand is anticipated to grow at around 10% year on year. New lithium applications, including portable electronics, electric vehicles and grid storage are forming a greater part of everyday life, and therefore lithium is a commodity that is going to be increasingly used in the future.

We have a project that has a large resource of over 7 million tonnes of contained lithium carbonate and our production plans are to produce up to 35,000 tonnes annually. Our pre-feasibility study demonstrates a project that has a pre-tax rate of return around 29% and a project NPV of around $750 million. We have a series of milestones to be achieved over the next 18 months that will lead us towards project financing and then a construction timetable that is currently focused on plant commissioning in late 2018 and delivering product into a growing Asian market in 2019. The management team has built lithium projects before and the project has some 200 years of resources currently defined, with potential upside. Plus, a commodity that is strategically focused on the energy storage markets in Asia that continue to grow at a significant rate.

Dr. Allen Alper: Well that sounds like excellent reasons for our readers to take a very close look at your company and consider investing in your company. It sounds like it should be a very attractive opportunity in a growing market and a critical area. Is there anything else that I didn't ask you about that you'd like to mention?

Peter Secker: Our recent pre-feasibility has just been posted on SEDAR, so anyone who wants more detailed information on the project can read it there. We have a management team that's built lithium mines before and we have a long term resource that, I believe, is attractive to off-takers when considering a resource life of over 200 years. As the world moves down the renewable energy path and as the conservation of energy becomes increasingly critical, lithium will become a much more strategic commodity than it is today. So, yes, we have a series of milestones comprising off-take negotiations, bankable studies and then project construction, so some very visible milestones to be achieved over the next few years.

Dr. Allen Alper: That sounds fantastic, truly great.

http://www.bacanoraminerals.com/

info@bacanoraminerals.com

Head Office Address (Calgary)

2204 6th Ave N.W.

Calgary, AB

T2N 0W9

Phone: 403-237-6122

Fax: 403-237-6144

|

|