Newmont Mining Corporation (NYSE: NEM), Interview of Omar Jabara, an Executive with Corporate Communications

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/30/2016

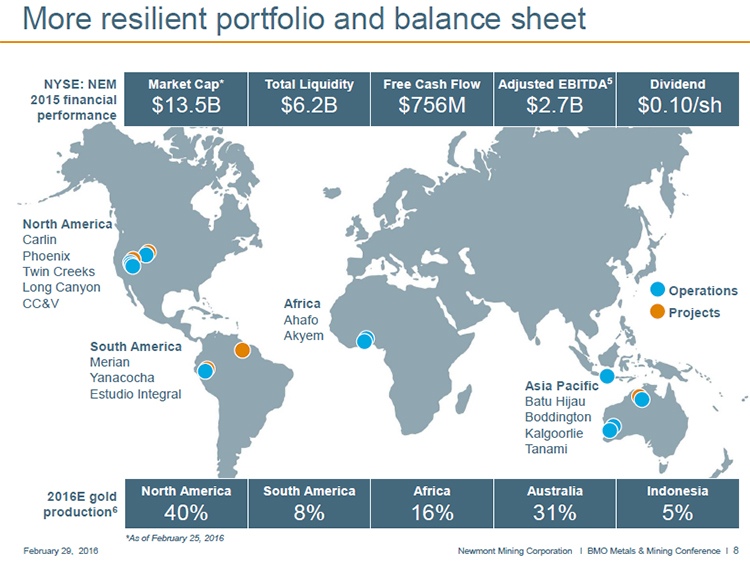

Newmont Mining Corporation is one of the world’s leading gold producers. Under the leadership of Gary J. Goldberg, President and CEO, and his team, the company has lowered costs, improved the balance sheet, increased cash flow, strengthened their asset portfolio, and become one of the industry’s leaders in health, safety and sustainability.

Dr. Allen Alper: I’m talking with Omar Jabara (the company spokesperson), an executive with Corporate Communications from Newmont Mining. I

know Newmont is one of the biggest gold mining companies in the world. Could you fill me in on what's happening with Newmont? What differentiates you

from other gold miners? A little bit about your extensive gold mining properties. And your plans for 2016.

Omar Jabara:Sure. Happy to do that. I will give you some background.

Newmont is one of the world's leading gold producers. On May 2 of this year, we will celebrate 95 years in business as a company.

We have operations on 5 continents around the globe. In North America, our operations are primarily in Nevada. We have a complex of mines there

including surface pit mines, underground mines, and a number of processing facilities. In addition to producing gold and silver out of Nevada, we have

an operation there, Phoenix, which also produces copper concentrate and copper cathode.

We operate 3 mines in Australia. In addition to producing gold, Boddington in Australia also produces copper concentrate.

We have the Batu Hijau copper and gold mine in Indonesia. Batu Hijau produces gold, but primarily is a copper concentrate producer.

We own and operate 2 mines in Ghana in Africa, Akyem and Ahafo.

All of our other operations around the globe are primarily gold producers.

In 2015, Newmont produced 5.04 million ounces of gold. For the coming year, we're anticipating producing about that amount, but quite possibly a

little bit more.

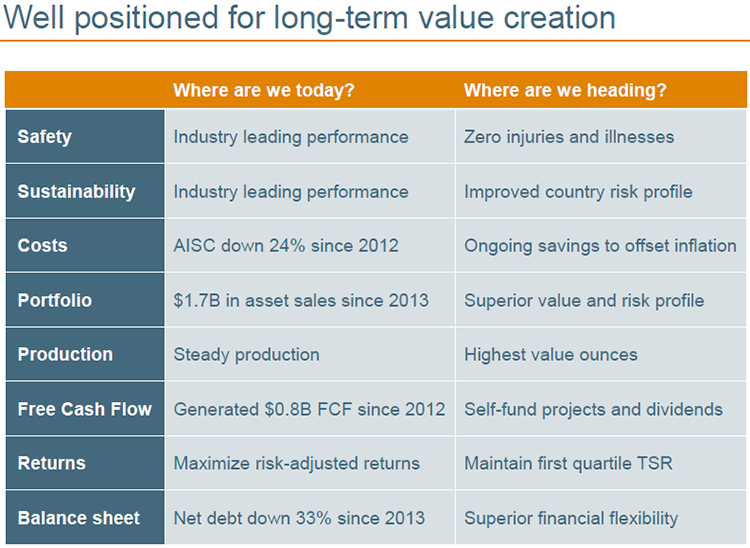

Newmont’s focus, as a company, has been on our strategy to be the best gold miner in the world. To do that, we are focused on making sure our

operations are safe, efficient, and responsible. We're proud of our industry-leading safety performance.

We are also proud of our operational production performance in 2015.

Also, in 2015 Newmont was named the mining industry’s overall leader in sustainability by the Dow Jones Sustainability World Index.

Dr. Allen Alper: That's great. Could you tell me a little bit about your management team?

Omar Jabara:Certainly. Our company is headed up by Gary J. Goldberg, who is president and CEO. He has been our Chief Executive since March 1

of 2013.

Gary J. Goldberg

He heads our executive leadership team and has 9 direct reports that include Executive Vice Presidents and a Vice President.

Dr. Allen Alper: Now, could you tell me a little bit about your capital structure?

Omar Jabara: Certainly. We have approximately half a billion shares outstanding. Our market capitalization is approximately $15.5 billion.

Our share price also recently reached a 52-week high.

Dr. Allen Alper: That's great. Looks like the market for the gold mining industry is picking up a bit. What are your thoughts on that?

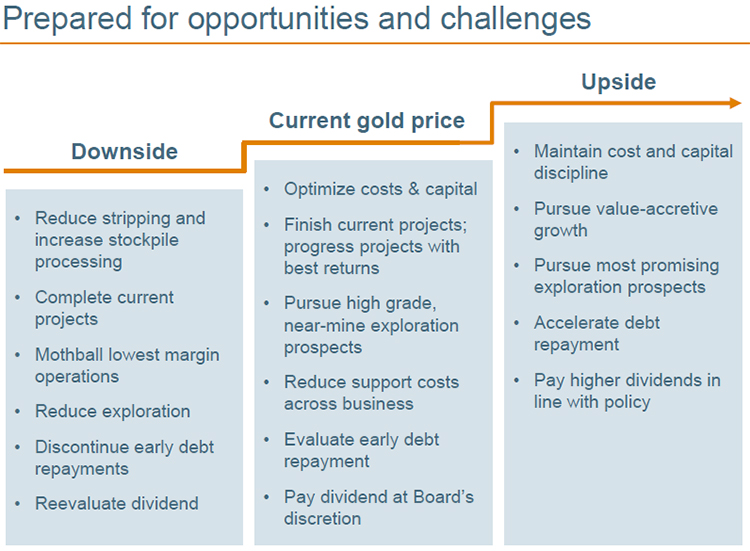

Omar Jabara: Yep. Well, our focus has been on running our operations as safely, efficiently, and responsibly as possible, so that we are

able to deliver value to our shareholders in any commodity cycle. Whether gold prices are trending up or trending down, our focus is on being in a

position to generate shareholder returns.

In the broader market, as far as gold is concerned, gold has been volatile for some time and you've probably notice that gold hit a peak in 2011. I

believe it was September 2011 where it topped up over $1900 an ounce, and then saw a pretty precipitous decline from that point through 2013 and into

2014. It's been volatile ever since. During that time, Newmont made significant changes to ensure our operations were as efficient as possible. That

involved optimizing our existing operations. It also included selling off non-core assets. Since mid-2013, Newmont has generated $1.9 billion in the

sale of non-core assets.

We've also been able to generate strong cash flows for six consecutive quarters.

Our goal is focused on generating EBITDA, which is earning before interest, taxes depreciation, and amortization. In 2015, our EBITDA increased by 29%

over the previous year.

Dr. Allen Alper: That's great. That's fantastic.

Omar Jabara: It increased by 29% to $2.7 billion. That was despite a 9% decrease in the gold price.

Dr. Allen Alper: That's a great accomplishment.

Omar Jabara: Yes. We more than doubled our cash flow in 2015 to $756 million. That was, again, doubling it compared to the previous

year.

In 2015, we also reduced out net debt 19% compared to the previous year, and continued to invest in profitable new production in Australia, Suriname,

and the United States.

We have a new operation, the Merian Gold Project in Suriname, that's under construction and we expect it to come online and deliver new, profitable

production starting in the second half of 2016.

In the United States, we've expanded production at Leeville in Nevada, which is a large underground gold mine complex we have there. We recently

completed an expansion there with a new shaft to improve ventilation. That project finished on schedule and on budget.

In Australia, we're also investing in generating new profitable production out of the Tanami operation in the Northern Territory. We have a project

there to expand production and reduce costs.

Dr. Allen Alper: That's excellent.

Omar Jabara: Despite the decline in gold prices over the last 3 years, and in spite of the fact that we've sold some non-core assets,

Newmont has largely maintained its production profile of around 5 million ounces per year. During that time period, gold prices dropped and we

maintained our production profile, reduced costs substantially, and continued to deliver value to shareholders.

Dr. Allen Alper: That's excellent work. You all should be complimented on the work you've done in a very difficult time. That's excellent.

Gary must be a great leader.

Omar Jabara: Yeah, he came in at a very difficult time for the company. We were seeing the price of our product, gold, losing nearly 40% of

its value after coming off a high of more than $1900, sinking down to just below $1100 for a little while.

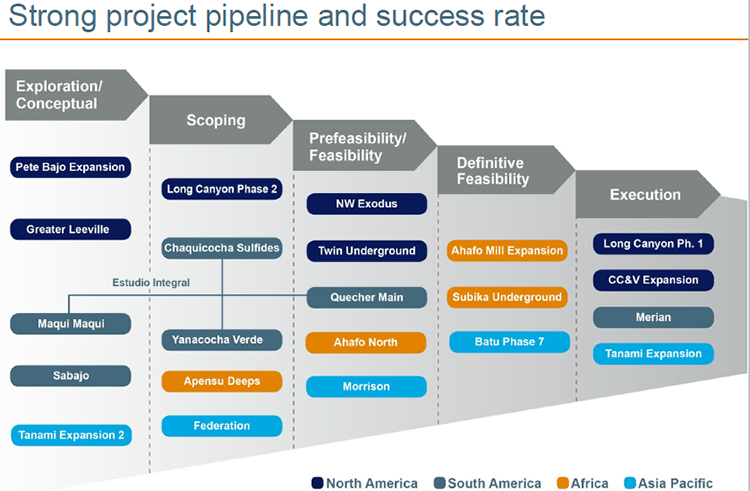

Also, at Newmont and other places in the industry, there were a lot of projects that were being developed that had either been delayed, or gone over

budget quite a bit. Gary came in and with a focus on optimizing our operations by focusing on our core assets and selling off those assets that were no

longer a strategic fit. This included optimizing our project pipeline, so that we could continue to develop our most profitable and best margin

projects, and bring those online and continue developing them despite the volatility in gold prices.

We're proud of our project pipeline, which we think has some of the best new projects in the gold industry that are either under construction, or have

recently, or will soon come online.

Dr. Allen Alper: That sounds excellent. Do you have any feel for what you're overall cost per ounce is?

Omar Jabara: Certainly. In 2015 we reduced our all in and sustaining costs by 10% compared to 2014 and we've kept them below a thousand

dollars per ounce for 6 consecutive quarters. In 2015, we lowered our gold all in sustaining costs to $898 per ounce, a

10% reduction compared to the previous year.

Dr. Allen Alper: That's very good.

Omar Jabara: The cost applicable to sales were also down 10% over the previous year to $633 per ounce.

Dr. Allen Alper: That's very good. That's very good work. The whole company has done an excellent job. That's very admirable. Could you give

me 4 reasons why wealthy investors should invest in Newmont?

Omar Jabara: Certainly. First and foremost, I think as a company the way we are governed and managed is key to our success -- we have a very

strong management team. Also, our governance from the board level on down provides accountability and transparency to investors.

Our CEO’s compensation package is directly tied to the performance of the company in terms of: Are we delivering on safety? Are we delivering on

responsibly managing costs? Are we delivering on production? Are we delivering on generating new reserves in the ground? Are we delivering on project

execution? Are we delivering on being sustainable and responsible?

His compensation package, as well as the rest of the team’s, is directly tied to the company’s performance in those areas. There is accountability that

cascades down to all employees.

On the strength of our management team, and governance and accountability, I think if you're an investor looking for a company to invest in, you want

one that is well managed where there's that accountability and visibility into how the company is run.

Second point I would make is that in addition to being well managed, we have great assets in terms of our producing operations right now. Over the last

3 years we’ve focused on building a portfolio of longer life, lower cost mines with lower risk. That involves, as I mentioned, selling off non-core

assets that no longer fit with that strategy. We want to have mines in our portfolio that are lower cost, longer life, and represent lower risk.

That's been our focus. When you invest in Newmont, that's what you're going to get because that's what we will continue to deliver.

Dr. Allen Alper: That's great. Continue.

Omar Jabara: That speaks to our existing portfolio of producing mines and operations. I believe we have the best project pipeline in the

gold mining industry in terms of new projects that are under development, as well as our exploration program. In 2015 we added 5 million ounces of new

reserves to our reserve base. We continued executing on building all those projects I mentioned earlier. Merian in Suriname, the Turf Vent Shaft in

Nevada, Long Canyon, also in Nevada, and the Tanami expansion in Australia. We have a number of other projects further down in the project pipeline that

are in earlier stages that are under development. They will have to pass through what we call the various stage gate hurdles to earn the right to secure

full funding for development, and then move into operation.

We have a very strict, rigorous process for evaluating whether a project deserves to move to the next stage of funding and development. It'd have to

meet certain criteria in order to move to the next stage.

When you're investing in Newmont, you know that you're investing in a company that is focused on delivering value for shareholders over volume. Some

companies like to focus on the volume of ounces they produce, and we like to focus on the value from the ounces we produce. They're profitable ounces.

Again, we've managed through what we call our full potential program to improve efficiency and productivity in such a way that we were able to maintain

stable production over the last 3 years despite a nearly 40% drop in the price of gold. Along with the ongoing volatility in the price of gold.

Dr. Allen Alper: That's excellent. That's really great. Really first class company I must say.

Omar Jabara: Well, thank you for saying that.

Dr. Allen Alper: One thing that also impressed me about Newmont - about once a year I get a phone call from an independent survey group asking me

about Newmont and other companies that I'm familiar with on their safety records, their approach.

I've always held Newmont in high regard from things that employees and former employees have told me. I think it’s very wise getting a survey to

find out what people think of you. It's a great approach.

Omar Jabara: Well, good. I just want to thank you for taking the time to answer those surveys because they are important.

Dr. Allen Alper: You’re welcome.

Omar Jabara: We need to know how we're being perceived externally; it's another way to evaluate whether we are doing our job properly.

Management uses that information to make corrections and improvements where needed.

Also to celebrate our successes and continue doing the right things.

Dr. Allen Alper: That's excellent. That's great, there's no doubt about it. It's a well-run, well focused company. I like to see a company

that's focused on safety and also profitability. That's excellent.

Omar Jabara: That all stems from our CEO Gary Goldberg. Newmont previously, even before him, was very focused on safety, and profitability,

and responsibility. Gary took it to the next level. Gary's philosophy on safety is that if you are running your operation safely, that means you are

being well-managed in a whole host of other areas. He sees safety, profitability, and responsibility as part of the same thing. He doesn't believe that

you can have a business that's profitable and sustainable and not safe.

Dr. Allen Alper: That's excellent. That's an excellent approach.

Omar Jabara: Yeah, and that's his philosophy.

Dr. Allen Alper: Before I started Metals News.com in 1999, I ran the largest tungsten manufacturing facility in the world. I had like 2,000

people reporting to me. We also stressed safety as well as profitability and responsibility in each of the 7 plants reporting to me.

I've enjoyed talking to you Omar.

Omar Jabara: Yeah, I've enjoyed talking to you.

Dr. Allen Alper: I was always impressed with Newmont, but now after talking with Omar, much more impressed. I must say you do an excellent

job of speaking for your company.

|

|