Sherritt International Corporation Interview of Flora Wood, Director, Investor Relations and Communications

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/19/2016

Sherritt International Corporation is a low cost nickel producer using HPAL with assets that have mine lives of 20+ years, so 20 to 30 years. The company is one of the largest nickel producers in the world, operating in Cuba, Canada and Madagascar. In Cuba, Sherritt is also an energy producer, where they are “a clean power success story” according to Flora Wood, Director of Investor Relations and Communications for Sherritt International Corporation. The company has a lot of cash on the balance sheet, enough to wait out a down market in the commodities.

Dr. Allen Alper: This is Dr. Allen Alper, editor in chief of Metals News talking to Flora Wood, Director, Investor Relations and Communications for Sherritt International Corporation. Could you tell me what’s been happening at Sherritt? I know you're a great nickel producer in three countries. Could you update me and our readers and investors on your properties, your production and what your plans are for 2016?

Flora Wood: We’re one of the largest nickel producers in the world. Through our two joint ventures, one in Cuba, one in Madagascar, in the year that’s just ended, our share of nickel production through these two joint ventures was over 35,000 tonnes in 2015, and on a 100% basis, it was approximately 81,000 tonnes. Our nickel is all produced using High Pressure Acid Leach, abbreviated as HPAL. It’s all coming from nickel laterite sources. Nickel geologically occurs either in sulfide deposits or in laterites.

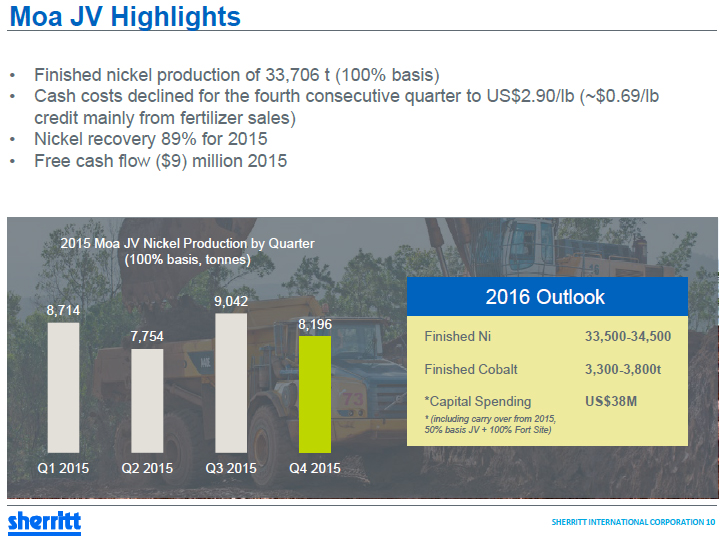

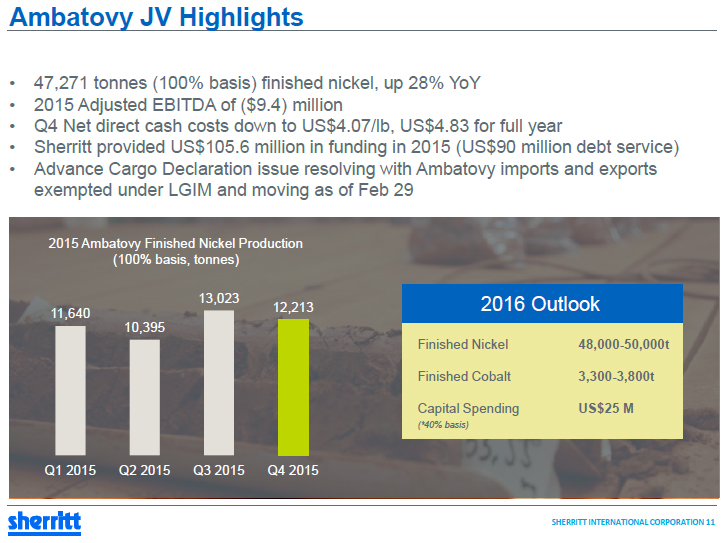

It’s estimated that about 50% of the world’s production is coming from sulfide and the other 50% from laterite. About 70% of the remaining resources of nickel that have been identified worldwide are in laterites. The future of nickel is going to depend on companies getting good at this HPAL process or an equally complex pyromet or hydromet process to succeed with this challenging ore type. Sherritt’s HPAL operations have been described by some analysts as the most successful in the world in the sense that both the MOA joint venture and the Ambatovy joint venture run between 80% to 100% of their designed capacity. MOA, at close to 100%, and Ambatovy at about 80%.

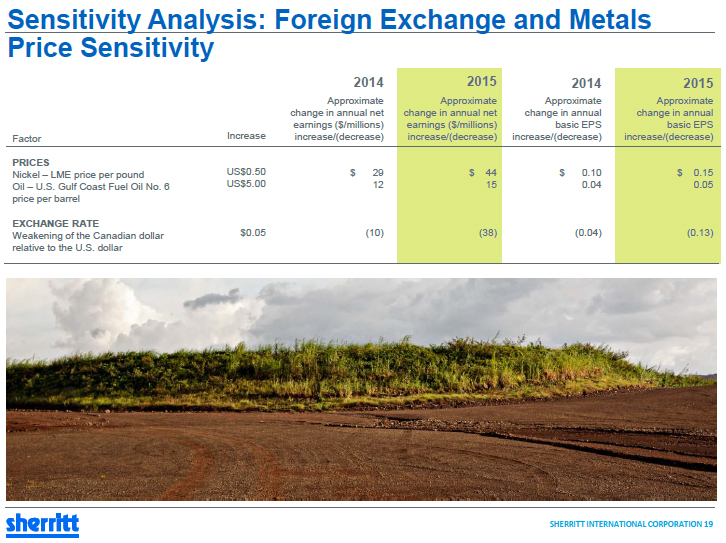

We produce at a Net Direct Cash Cost, similar to the industry definition of C1 costs, in the three to four dollar per pound U.S. range. That would put us in between the first and second quartile of reported C1 cash costs tracked by Wood Mackenzie. We’re basically a low cost nickel producer from lateritic sources using HPAL with assets that have mine lives remaining of 20+ years, so 20 to 30 years. Then in Cuba, we’re also an energy producer. We have our joint venture in power where we have a one third interest in Energas which processes natural gas and generates electricity for Cuba’s national grid. The business model is that we have financed, constructed and commissioned gas treatment and power generation from natural gas sources that occur as a cap on existing oil fields, including our own oil fields. We treat these gas sources, which would otherwise be flared, and capture the steam to drive turbines. When I talked about our own oil wells, we have limited production of natural gas in Pakistan and limited oil production in Spain, but mainly have a Cuban oil operation where we explore and produce wells we’ve drilled in partnership with CUPET, the state owned oil company, on a Production Sharing Contract basis. It’s unusual in the small cap base metals universe to have both energy and base metals segments within the same company, but in our case, the two came about because of Sherritt’s prominence as a Joint Venture partner and foreign investor in the early 1990s at a time when Cuba was actively seeking partners to develop sources of potential income, with natural resources being the most promising place to start. Our energy business, or at least the oil production, is as old as our nickel business in Cuba.

With power, we found a way to basically meet objectives that the country had of producing cleaner power, so we’re basically using as a fuel source natural gas caps on existing oil resources that would otherwise be flared. We’re capturing that and using it to drive turbines.

Dr. Allen Alper: That’s great.

Flora Wood: Yeah.

Flora Wood: Yeah, so when you asked about differentiators, that would be a big differentiator. What the investor base has been focused on lately has really been our Ambatovy joint venture in Madagascar. At the time that Ambatovy was built, it was the world’s largest HPAL laterite construction project. It cost about 8 billion US to build, when we count capital over-runs. Sherritt was, and still is, a relatively small company. Despite being small, Sherritt had the HPAL expertise and track record to attract larger partners and sources of capital like Sumitomo and KORES.

Flora Wood: Our partners in the joint venture are Sumitomo and the Korean Resources Corp, which is the Korean government strategic metals entity. They were willing to lend us money to satisfy our equity contribution. Their loans to us are meant to be repaid out of cash distributions when Ambatovy is producing cash. To try to explain it a bit better, Ambatovy cash generated after deductions for cost of sales, capex, tax and project debt service, is allocated in our case to repayment of those loans before any meaningful percentage can be returned to us. We have a waterfall chart that explains the breakdown, but looking at that chart, 70% of the distributions go to pay back the loans from our partners. The 30% remaining comes back to us, and remember that any new funding that we provide is at our JV share of 40%. So we’re funding 40%, but can only receive 30% of our 40%, being essentially a 12% economic interest until all of those loans are repaid. However, the corollary of this is that there is no recourse to Sherritt’s balance sheet if those loans never get repaid or never get fully repaid during the course of the mine life at Ambatovy.

Nickel has fallen from prices as high as $22 to where it is now, trading around $3.85, and it’s gone as low as $3.50. These are lows not seen since 2003. In this kind of climate, Ambatovy doesn’t generate enough cash to pay its costs, which is a consequence of an environment where up to 70% of nickel production is underwater even on a cash cost basis. We’re in negotiations with our joint venture partners and the lenders to the JV to basically resolve what’s going to be the go forward in our operating structure. Because not knowing how long the trough is going to last, there has to be some kind of new agreement to reflect the current price reality. Let's see, what else can I tell you?

Dr. Allen Alper: Tell me a little bit about your thoughts on what might happen to nickel pricing, what experts are saying about it.

Flora Wood: Yeah, sure. We talked a little bit about where nickel's trading now and how unprecedented that is. Nickel last year was the worst performer amongst the base metals, so down, I think, 42%. At the same time, it was the commodity that most experts were predicting was going to do the best. Most of the base metals analysts have forecasts for nickel that are more than double what the current price is. That's based on fundamentals, mainly that the last nickel projects that were really built, the big ones, were built at the same time Ambatovy was built. The other issue that is hurting the nickel market is that when prices are this low, roughly 70% of global nickel production is underwater, even on a cash cost basis, so even just sales minus the cash cost of sales.

That's obviously not a structural situation that can persist indefinitely because that means that everybody that is underwater is being financed from their company balance sheet. Longer term, the experts still think that nickel's going from a period of years of surpluses to years of deficits, which should be good for nickel on a long-term basis, but it will take a while for that to show up in the short-term price because there is so much nickel supply out there relative to the demand. I think I remember when I looked at your site, you had a lot of articles, I think, on lithium. You had some stuff on graphite. You've had articles on metals that have really been fundamentally driven by Chinese production and/or Chinese consumption, right?

Dr. Allen Alper: Yes.

Flora Wood: Nickel definitely fits into that category. About 50% of the world's consumption comes from China, and about 25% of the world's production. The boom years in nickel were the years when China went from being a net importer of steel to a net exporter of steel because about two-thirds of nickel consumption is in stainless steel production. Now we're on the opposite reaction to those boom years where China's actually cracking down on steel-making that is loss-making. There's not very much transparency about just what is the real demand in China and what's it likely to be. We're suffering along with the other kind of China-dependent metals. We're suffering from that lack of transparency and soft demand. The only thing that basically counters that, in terms of being hopeful for the price, is just that this situation with 70% of production losing money just can't persist.

We have a lot of cash on the balance sheet, so there was 435 million at the end of December. We believe we can get through this year without a major drain on our cash and keep the operations running until the cycle turns and we still have about 28 years left in remaining mine at Ambatovy to participate in future peaks.

Dr. Allen Alper: Well, that sounds very good. I appreciate that kind of summary of the marketplace and your position in what's happening. Could you give me four reasons how investors should invest in your company?

Flora Wood: Sure, I think it's the only small cap trading on the TSX that is a nickel producer and falling within the world’s top producers. That's one. Sherritt has unique exposure to Cuba, being the largest foreign investor in Cuba. As interest in Cuba-US relations opens up, this is the logical company to be a joint venture partner of choice in that country. Another one would be that it's got around 435 million in cash, or at least that was the most recently reported cash position, so enough to wait out a down market in the commodities. Another one would be a pretty long track record in producing both nickel and oil, so close to 20 years in Cuban energy production. The expertise as a nickel producer goes back way longer than that, prior to the company’s entry in Cuba.

Dr. Allen Alper: That sounds great. Now, is there anything else you'd like to add that I didn't ask about that would give our investors a better understanding of Sherritt?

No, you seem to have asked all the good questions! But maybe if you have readers in Toronto, they might be interested in our upcoming AGM May 10. We always like to see existing or potential new shareholders, so hope to meet you or some of your readers!

http://www.sherritt.com/

181 Bay Street,

26th Floor, Brookfield Place

Toronto ON M5J 2T3

Canada.

1 800 704 6698 1 800 704 6698 FREE (toll free from within North America) 1 800 704 6698 FREE (toll free from within North America)

1 416 924 4551 1 416 924 4551 (outside North America) 1 416 924 4551 (outside North America)

info@sherritt.com

|

|