Abitibi Royalties Inc. (TSX-V: RZZ) Focuses on Developing Royalties in Canada with a Flagship Property of the Odyssey Zone of the Canadian Malartic Mine

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/4/2016

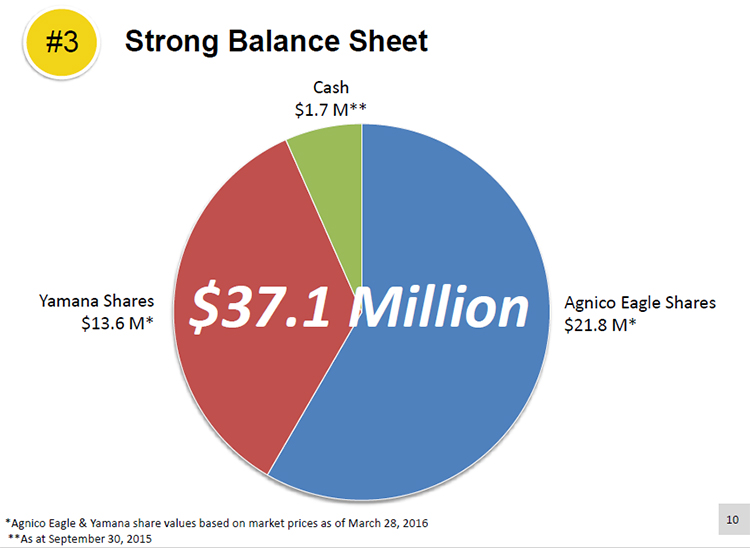

Abitibi Royalties Inc. (TSX-V: RZZ) is offering to pay exploration companies the fees/taxes on their properties, for a period of time, in exchange for the net smelter royalty. All properties have to be evaluated by the Abitibi Royalties’ team before being added to the company’s portfolio. Currently, the company has royalties in Canada and Turkey with the largest asset called Odyssey North at the Canadian Malartic mine. According to Ian Ball, CEO of Abitibi Royalties, the company has a strong balance sheet, generating cash flow of 2 to 2.5 million dollars per year, and is currently buying back its shares.

Ian Ball, CEO of Abitibi Royalties, Inc. (TSX: RZZ), took some time to update readers on the progress that the company has made on their royalty projects in Canada and Turkey. He said, “The context was to create a website where geologists, miners and junior mining companies could upload their geological data with the belief that it is still a difficult market for metals producers and exploration companies and they may not be able to pay the costs and the fees.”

Once the data is added to the site, the experts at Abitibi evaluate each property carefully to see if it might be a good fit for they royalty program. Said Ball, “In uploading the data, we are offering to pay the taxes or the claim fees associated with an exploration property in exchange for a royalty. When you look at it though, the criteria that we set out are quite specific. The properties have to be located near an operating mine, they need to have good geology and we are looking for properties that have signs of mineralization through previous exploration results. That has been the model.”

Additional features help Abitibi Royalties retain additional upside in the project, while providing more capital to the owner. Ball said, “We have also added an additional feature where we would be willing to double the payment to the individual in exchange for a right, should the property ever be sold or joint ventured, we would be entitled to 15% of the proceeds. To date, we have had approximately 90 submissions that have come our way and we have completed approximately eleven transactions to date on a number of properties that are mostly in Canada, but also one in Turkey.”

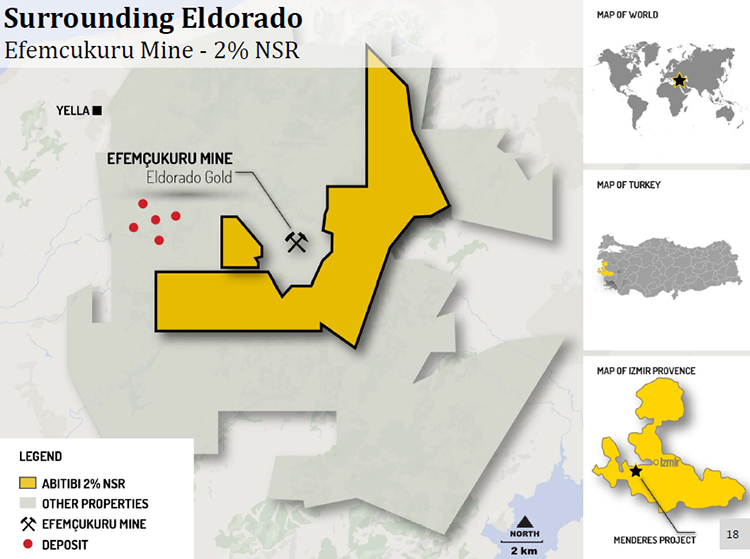

The property in Turkey is one where Abitibi Royalties was able to help out Frontline Gold get access to lcapital, with the benefit of Abitibi being able to get royalty in the process. Ball said, “The one in Turkey is a situation where El Dorado Gold has been mining there for the last several years. It is a high grade operation and produces approximately 100,000 ounces of gold per year at a rate of eight grams per ton. It is a junior mining company that had the property that surrounds the mine on three sides.”

Frontline Gold was cutting it close in terms of being able to further their exploration. Ball said, “El Dorado, from what we could tell, was mining about 200 meters away from the property boundary and they were drilling approximately fifty meters away from the property boundary on that project. The junior was short of capital and we put up a total of $35,000 dollars and received a 2% royalty. So that was one that we found to be quite attractive because there was very good geology on the property that showed that there was a good possibility that the veins that El Dorado was mining could possibly extend over to Frontline’s property.”

The company is also quite active in Canada and has positions near some of the most prolific projects that are currently in production or development. Ball said, “If you look to Canada, in some of those situations we bought royalties near New Gold’s Rainy River project, Goldcorp’s Red Lake mine, near the Canadian Malartic mine as well as near Agnico Eagle’s Lapa operation in Quebec, so we have been getting interesting early stage royalties on several properties in Canada.”

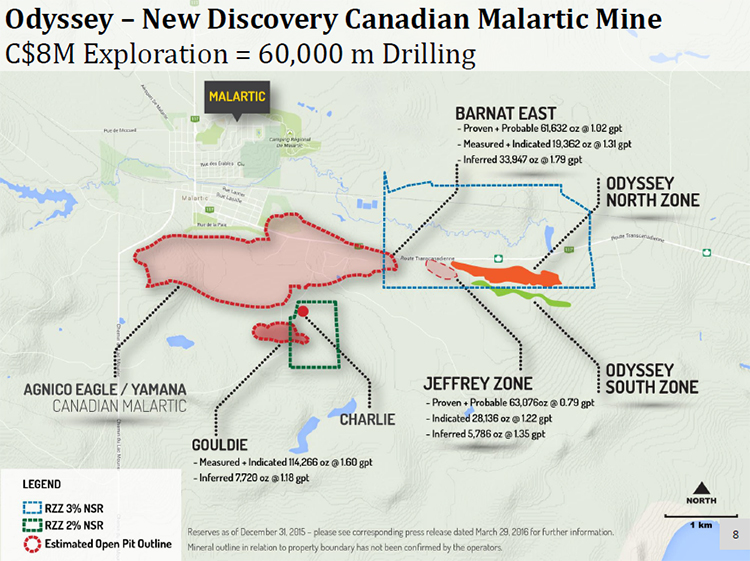

The largest royalty that the company has is related to the Canadian Malartic mine and a new zone of development, called Odyssey. Ball said, “Our biggest royalty is the one that we believe will deliver the biggest value to shareholders. It is a 3% royalty on a new discovery called the Odyssey zone. This is a new zone that was discovered in the Canadian Malartic mine that is the largest gold mine in Canada. Last year, Agnico Eagle and Yamana spent approximately $3.5 million dollars drilling at Odyssey. This year they have increased that to approximately $8 million dollars and they are going to be completing 60,000 meters of drilling. They are looking to have a resource completed on this by the end of the year and then they will be doing an internal scoping study. From our standpoint, we like what we are seeing at Odyssey and the size of it based on the information that we have. We like that Odyssey is part of the largest gold mine in Canada. As more news is released, we think that will drive our valuation. We are generating cash flow of 2 to 2.5 million dollars per year. We are currently buying back our shares. We have 10.9 million shares outstanding and have approval to buy back 500,000 of those.”

As one of the youngest CEOs in the sector, Mr. Ball has plans for his own career and the development of the company during 2016. He said, “I started my career in Goldcorp in 2004. After Goldcorp, Rob McEwen took over US Gold and then that became McEwen mining. After ten years of being there, I was promoted to President. I built and ran the El Gallo mine and discovered the El Gallo two project in Mexico. That is a project that we took from initial drill hole to full mine permit. The upcoming plans for Abitibi Royalties this year are getting an update on Odyssey from Agnico and Yamana. Though it is out of our control, they said they will be coming out with a resource estimate at the end of this year. Until that comes out, we won’t know what the results will be.”

http://abitibiroyalties.com/

2864, chemin Sullivan

Val-d’Or, Québec

J9P 0B9

Telephone: 819 824-2808

Facsimile: 819 824-3379

E-mail: info@abitibiroyalties.com

|

|