Dr. Alper Interviews Suzette Ramcharan CPIR, Director of Investor Relations for Kirkland Lake Gold

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/1/2016

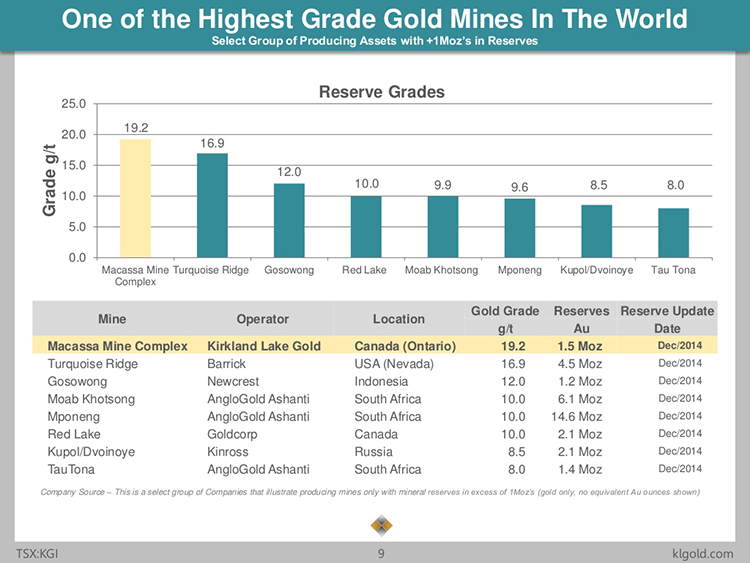

Kirkland Lake Gold is an Ontario focused gold producer that recently combined their assets with St Andrews Goldfields Limited. According to Suzette N Ramcharan, CPIR, Director of Investor Relations for Kirkland Lake Gold Incorporated, the main differentiator for Kirkland Lake is the high-grade nature of their flagship asset, Macassa Mine Complex. With a reserve grade of 19.2 grams per tonne and 1.5 million ounces in reserve, the Macassa Mine is seen as one of the highest grade gold mines in the world. Kirkland Lake Gold has a strong leadership team and is targeting to produce between 260 - 310,000 ounces in 2016.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, Interviewing Suzette Ramcharan CPIR, Director of Investor Relations for Kirkland Lake Gold Incorporated. Could you tell me what's happening with Kirkland Lake Gold? I know there're some exciting things, a lot of gold production.

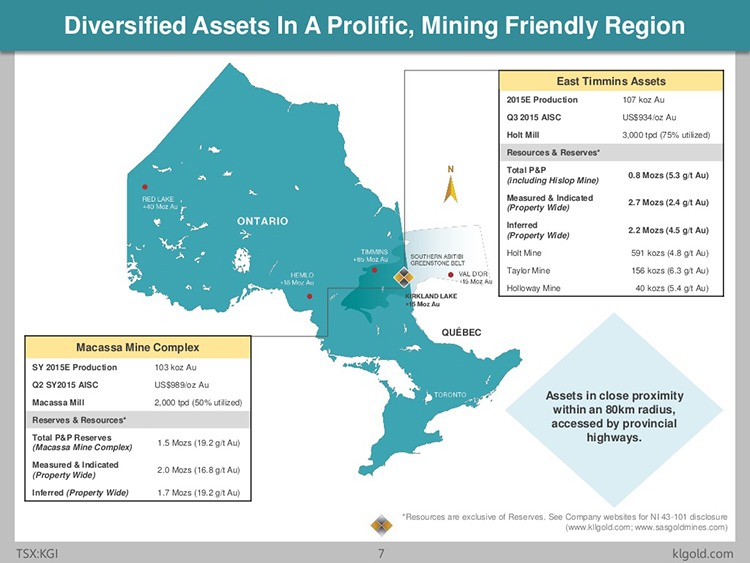

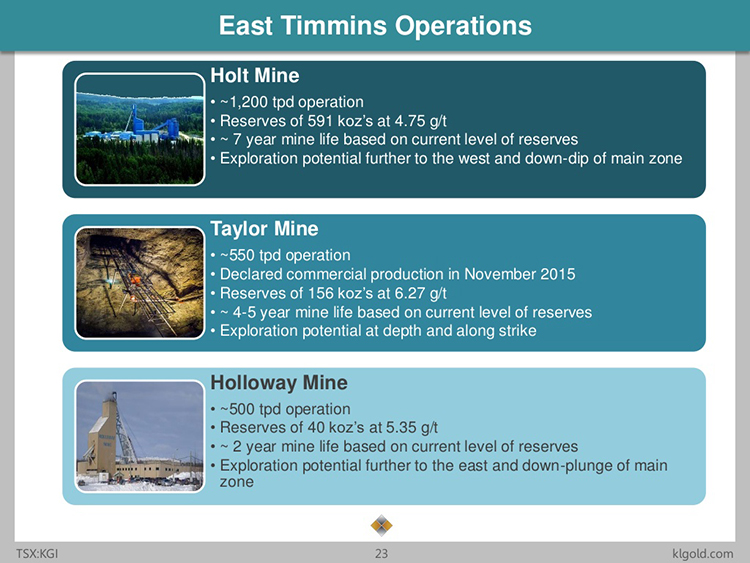

Suzette N Ramcharan: Yes, certainly. For starters we just closed the transaction whereby we acquired all of the outstanding shares of St Andrews Goldfields Limited. They were a junior producer with assets in close proximity to ours, in northeastern Ontario within the Abitibi Greenstone Belt. They were producing approximately 107,000 ounces of gold last year. We closed that transaction at the end of January and we're currently working through the integration process with the combined assets which gives us four mines and two mills. We're looking at an initial guidance of production between 260 - 310,000 ounces for 2016.

Dr. Allen Alper: That's fantastic. Could you tell me what differentiates Kirkland Lake Gold from other gold mining companies.

Suzette N Ramcharan: I think one of the main differentiators for us would be the high grade nature of the Macassa Mine Complex. When we look at other assets around the world that have plus one million ounces in reserve category that are currently in production, the Macassa Mine Complex with a reserve grade of 19.2 grams per tonne and 1.5 million ounces in reserve is seen as one of the highest grade gold mines in the world and this is definitely one of the major factors that differentiates us.

Dr. Allen Alper: Does that give you a cost advantage?

Suzette N Ramcharan: Yes, for sure. We've changed the mining plan over the past two years and are trying to mine as close to reserve grade as possible. As the grade increases we believe that the cash cost, and the all in cash cost, will come down substantially.

b>Dr. Allen Alper: Good. Could you tell me a little bit about why that's such a good area for gold?

Suzette N Ramcharan: Our assets are now sitting in two very historic and robust camps. The Kirkland Lake Gold camp has been around for over a hundred years. There were seven mines along a trend called the ’04/Main Break that produced a total of over 25 million ounces of gold. Kirkland Lake owns five of those former producers, and those five producers historically produced over 22 million ounces of gold at a head grade of approximately fifteen grams per tonne. We're only mining and exploring on one of those assets and we've started a regional exploration program along the remaining four assets along strike. There's definite exploration potential within the Kirkland Lake camp

With the newly acquired assets, which we're calling the East Timmins Assets, we sit on top of the Porcupine-Destor Fault Zone which is a major fault structure that runs from the Quebec area westward along to the Timmins gold camp. Along this trend there've been over 100 million ounces produced over a hundred years. We control 120 kilometers strike line or 56,000 hectares of land and this is also another underexplored area where we believe we can unlock the value.

Dr. Allen Alper: That's great. It's amazing how much gold there is in that area and that you have such high grade gold deposits. Would you like you tell me a little bit about the management team?

Suzette N Ramcharan: Certainly. The management team is led by George Ogilvie. He's the current President and CEO of the company, who joined in November of 2013. George is a mining engineer and spent the formative years of his engineering experience in the deep mines in South Africa. He then moved to Canada and operated mines with Hudson Bay Mining and Smelting and, before joining Kirkland Lake, was out in the east coast running a copper-gold mine called Rambler Metals and Mining. George has been instrumental in turning the company around and returning to profitability and free cash flow.

Over his seniorship he's enhanced the management team with our VP of Operations Chris Stewart, who's also a mining engineer, who worked with George at Dynatec and FNX. We also have Perry Ing, who's the Chief Financial Officer, who joined us from McEwen Mining. Our VP of Exploration, Doug Cater has worked in the camp for a number of years. He actually cut his teeth at the Macassa Mine and then went over to St Andrew before joining us after the transaction. Keyvan Salehi, is our VP of Corporate Development, a mining engineer and holds a Master’s in Business Administration. Keyvan also worked in the camp with Lakeshore Gold prior to joining St Andrew and now works at Kirkland Lake. Jenn Wagner, our legal counsel, has over ten years of experience and myself, I started in mining with an exploration company in 2000 and I worked at St Andrew for five and a half years before I joined Kirkland Lake as well. We're all very familiar with the camp and very familiar with the industry.

Dr. Allen Alper: That's great, great team. Could you share your thoughts on what the experts are saying about gold prices going out?

Suzette N Ramcharan: We know that the gold gurus or the gold experts are looking for gold to rebound this year into next year. While we'd like to see that, what we've seen in the past with the volatility in the gold price and the sub-U.S. $1200 gold prices, we plan the business and would like to run the business in order to operate at those lower gold price levels. Anything that we can do on top of that would just be additional margin and cash flow for the company. While we believe that gold will continue to rise we're not sure where it will end up in the next year to two years but definitely we feel there's room for some additional value to be put back into the commodity. We're going to run the business on sort of a worst case scenario so we can maintain some value for our shareholders and create cash flow for the company.

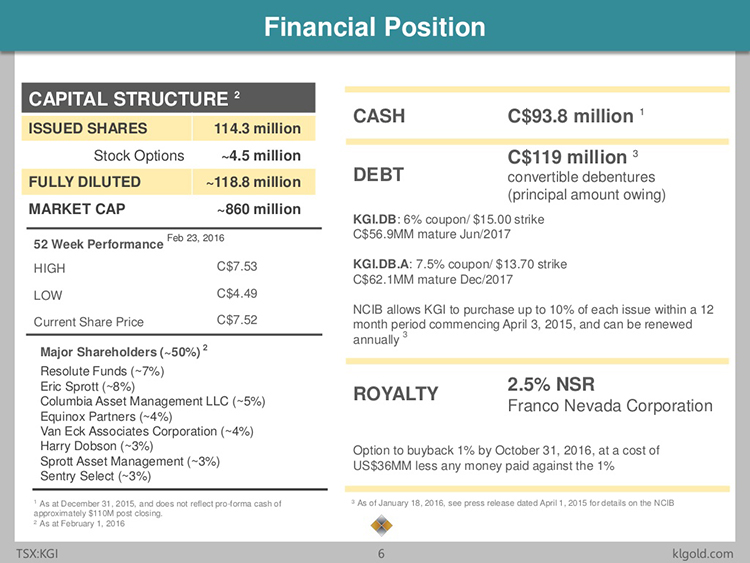

Dr. Allen Alper: That sounds like a very wise way to run the company. You’ll be good if gold prices are low and better if gold goes up, as predicted by some gurus. Could you tell me a little bit about the capital structure?

Suzette N Ramcharan: Currently we have about 114 million shares issued and outstanding. The one thing that sets this company apart again, if you look at the high grade nature of the reserve grade and the current gold price, you also look at the capital structure. It's a nice, tight capital share structure with 114 million issued and outstanding. Even if we look at our stock options we'd be looking at 119 million fully diluted. You look at our competitors they have anywhere from 300 - 400, 500,000 shares outstanding. We believe that our stock has a tremendous torque when the gold price goes up for the share price to appreciate with that.

We have a number of major institutional shareholders that make up about 45% of the share capital. We believe that we have a good standing with our shareholders and they will see value if the company continues to mature and grow.

Dr. Allen Alper: That sounds very good. Could you give me four reason why investors should invest in your company?

Suzette N Ramcharan: For sure. Kirkland Lake has a strong leadership team from an experienced Board of Directors and a wealth of knowledge on the management team. We're an Ontario Focused Gold Producer, so we're highly leveraged to be Canadian dollar gold price and we're targeting between 260 - 310,000 ounces for 2016. With that production, we have a combined strong future cash flow generation from these assets. We have a healthy balance sheet with over $100 million dollars in cash. We have about 7 to 14 year mine life at the current assets with exceptional exploration potential for future growth.

Dr. Allen Alper: That sounds great. Is there anything else you would like to add?

Suzette N Ramcharan: I do want to highlight again, when we talk about exploration, we did the transaction with St Andrew to give us immediate diversification and de-risking of the business, but I think the organic growth potential for the company is in two side by side historic camps. We're probably sitting on a very good wealth of exploration potential that has yet to be unlocked by the previous management team with both entities.

http://www.klgold.com/

95 Wellington Street West, Suite 1430

Toronto ON M5J 2N7

Tel: 416-840-7884

Toll-free: 1-866-384-2924

Suzette N Ramcharan, CPIR

Email: info@klgold.com

Telephone: 647-361-0200

|

|