Southern Silver Exploration Corp (TSX: SSV) Completed Mineral Resource Estimate on Cerro Las Minitas Silver Project Located in the Durango State of Mexico with Joint Venture Partner Electrum Global Holdings

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/31/2016

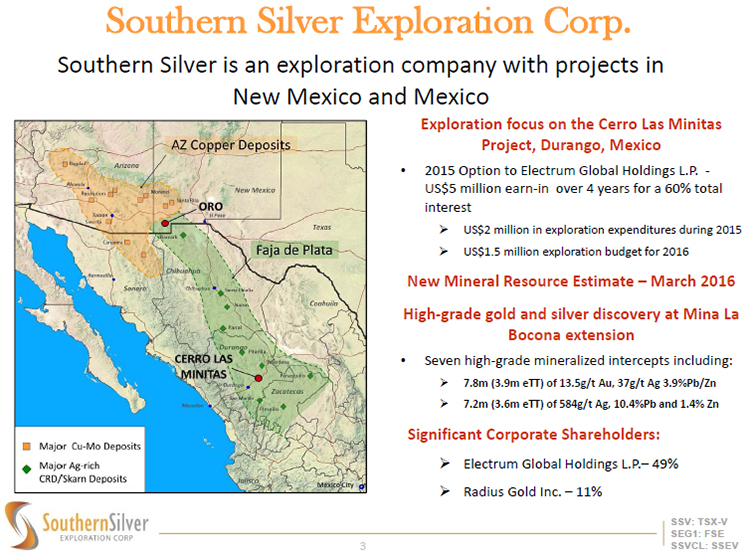

Southern Silver Exploration Corp (TSX: SSV) with the support of their very strong Electrum Global Holding partner and their very capable team are making very good progress exploring Cerro Las Minitas Project, Durango, Mexico.

Lawrence Page, President of Southern Silver Exploration Corp (TSX: SSV) and his team recently announced the completion of a mineral resource estimate on their Cerro Las Minitas silver project located in the state of Durango, a mining-friendly jurisdiction of Mexico with the support of their joint venture partner Electrum Global Holdings.

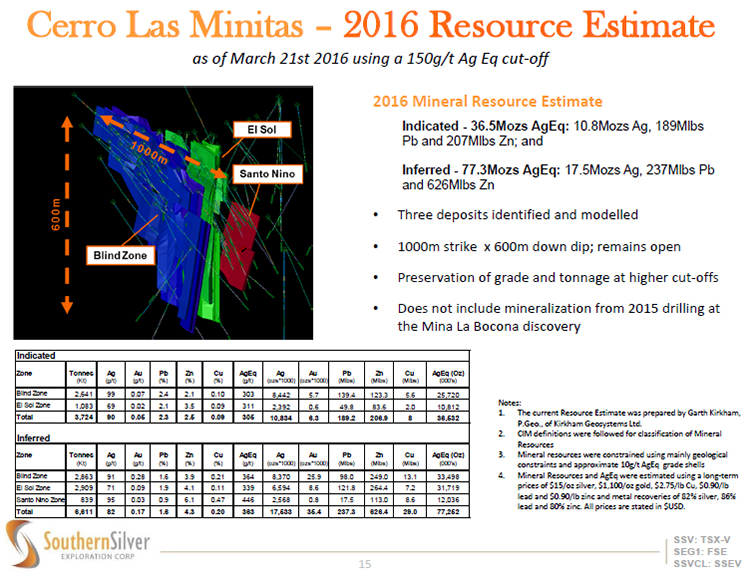

According to the company, the completed mineral estimate covers initial grades and amounts for more than one deposit held by the company. In a release from the company, they said, “The resource estimate provides initial grade and tonnage estimates for three mineral deposits on the property at the Blind, El Sol and Santo Nino zones which have been the focus of much of Southern’s exploration activities on the property since 2011, but does not include mineralization from the newly discovered Mina La Bocona zone.”

The results of this study showed that there was a 150g/t AgEq cut-off value calculated using average long-term conservative prices of $15 dollars per ounce of silver, $1,100 per ounce of gold, $2.75 per pound of copper, $0.90 per pound of lead and $0.90 per pound of zinc. The estimates included metal recoveries of 82% silver, 86% lead and 80% zinc.

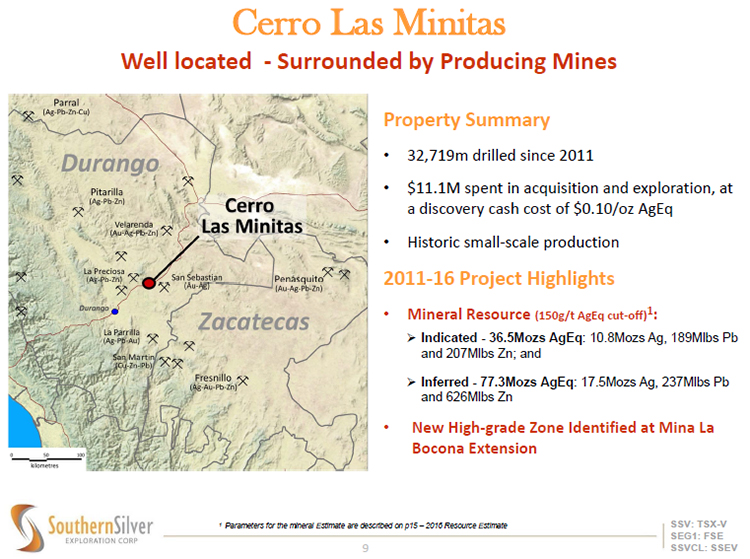

Page said, “Since May 2011, Cerro Las Minitas has developed from a prospect into a resource with great potential to become a significant economic deposit. Continued growth is expected along the 25 kilometers length of the 13,700 hectare property. We have succeeded, during one of the most severe bear markets in recent history, in purchasing the property for a cost of US$3.6 million, conducted extensive geophysical evaluation and 32,719 meters of diamond drilling, at a cost of $7.5 million resulting in the resource announced today. Significantly, the property is not burdened with royalties thus enhancing the economics of mining and processing.”

The company has enjoyed assistance from their joint venture partners, which have assisted with the exploration costs. Page said, “Aggregate acquisition and exploration expenses of $11.1 million, much of which has been contributed by our joint venture partners, equate to a ‘finding’ cost of $0.10 per silver equivalent ounce. Expenditure of an additional three million dollars to be provided by Electrum on the next phases of drilling, exploration and development will undoubtedly further enhance the value of the property with programs to enhance both the class and quantity of current resources in the Blind, El Sol and Santo Nino deposits and specifically, the recent high grade discovery at Mina La Bocona.”

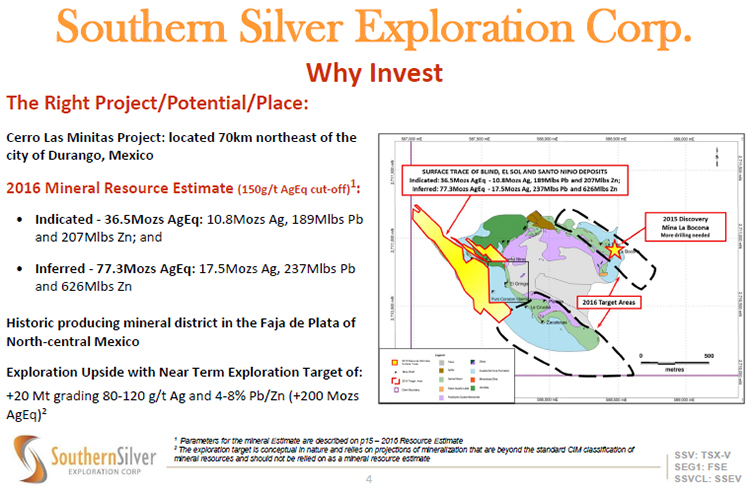

There are good reasons to invest in the company. According to the company, the Cerro Las Minitas project is located in the “right place at the right time,” with the location of 70 kilometers northeast of Durango, Mexico. The newly released mineral resource estimate indicated that there are 36.5Mozs AgEq: 10.8Mozs Ag, 189Mlbs Pb and 207Mlbs Zn. Inferred resources include 77.3Mozs AgEq: 17.5Mozs Ag, 237Mlbs Pb and 626Mlbs Zn. Located near the historic producing mineral district in the Faja de Plata of north‐central Mexico, the company believes that there is significant exploration upside in addition to their near term targets.

The leadership of the company has been critical to the development of the partnerships that have funded the exploration as well as the long term advancement of the property. According to Page, “Southern Silver features an experienced Board of Directors and a strong management team with an extensive track record of exploration, discovery and development success.”

During 2016, the company is focused on moving the exploration and drilling program forward. According to the company, they said, “Our Partner, Electrum Global Holdings L.P., is committed to funding Phase II Drill program for 2016.” This drill program will focus on aggressive expansion of known mineralization at the site where they are already working to increase the resource to depth and along the strike area. In addition, the company will be working to identify new discoveries in the area of the Cerro and other district‐wide targets that can be added to the mineral resource.

It is important to note that there are areas of the project that have not been explored as of yet. According to the company, “Significantly, the current resource does not include any drill results from the east side of the Central Intrusion in the area of the Mina La Bocona target, which to date remains un-modelled. Drilling at Mina La Bocona in 2015 returned thick high-grade zones of mineralization including a 3.9m est. true thickness of 13.5g/t Au, 37g/t Ag, 2.2% Pb and 1.7% Zn (1093g/t AgEq) and an 8.2m est. true thickness of 0.5g/t Au, 150g/t Ag, 3.7% Pb and 0.7% Zn (325g/t AgEq) in drill hole 15CLM-078 (see NR-10-15, October 01, 2015). Further drilling on the Mina La Bocona target is planned for the 2016 exploration program in order to properly delineate this target.”

At this point, it looks like the company will pursue an underground mine in the future based on the results that have been released. According to the company and the report that was provided as part of the mineral resource estimate, “KGL suggests that an underground mining scenario is appropriate for the project at this stage and has recommended a 150g/t AgEq cut-off value for the base-case resource estimate. Also reported are 100g/t, 150g/t, 250g/t, 350g/t and 450g/t AgEq cut-off values, which demonstrate both a significant increase in tonnage and contained precious and base-metals at the lower 100g/t AgEq cut-off value and significant increases in precious and base-metal grades at incrementally higher cut-off values.” The follow up to this report will be the posting of a NI 43-101 report within the next few months.

For more information on the company, results and investor information, visit the company at http://www.southernsilverexploration.com/.

Investor Relations Contact

Tel: +1 (604) 641-2759

Email: ir@mnxltd.com

Suite 1100, 1199 West Hastings St.

Vancouver, BC, V6E 3T5 Canada

Tel: +1 (604) 684-9384

Fax: +1 (604) 688-4670

Email: info@mnxltd.com

|

|