Interview with Ben Mossman, President and CEO, Rise Gold Corp. (CSE: RISE, OTCQB: RYES): A Major Past-Producing, High-Grade Gold Mine, Located in California, USA

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 6/26/2018

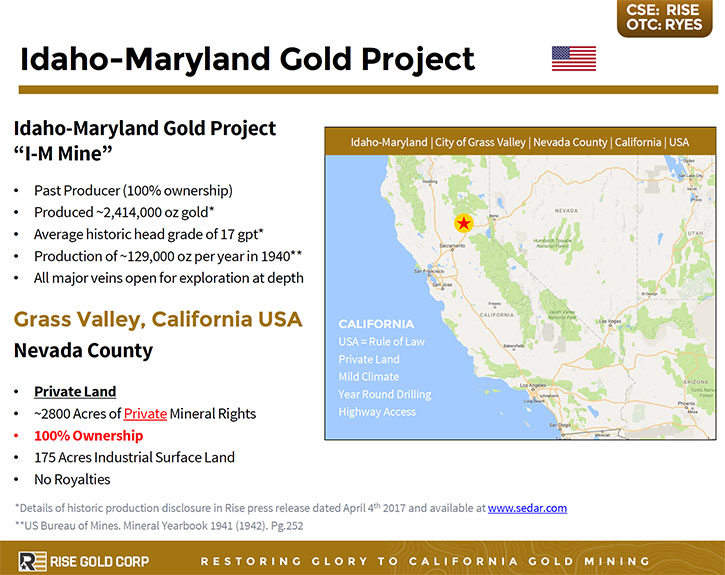

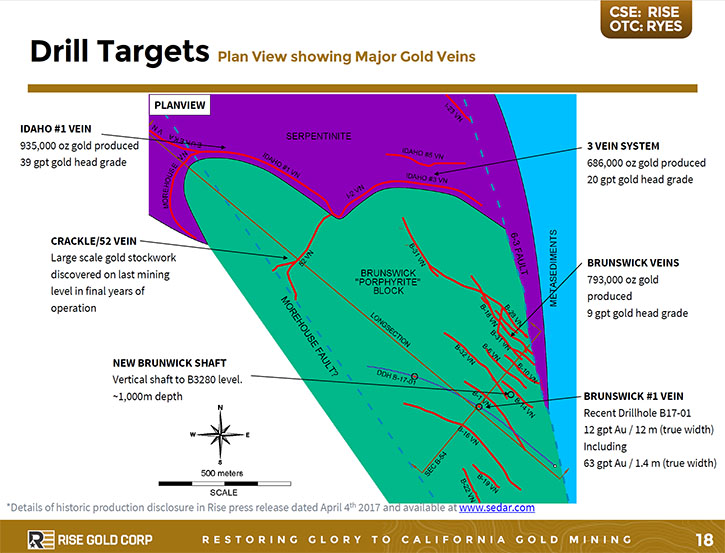

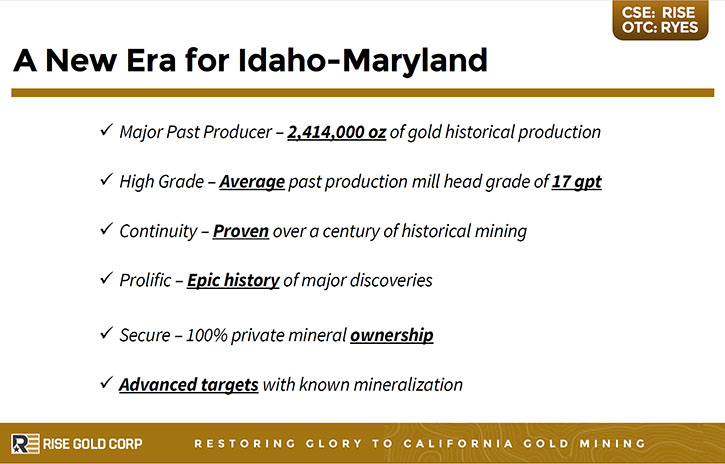

Rise Gold Corp. (CSE: RISE, OTCQB: RYES) owns 100% of the major past-producing, high-grade Idaho-Maryland gold mine, located in Nevada County, California, USA. The Idaho-Maryland Gold Mine is one of the United States’ greatest past producing gold mines, with total past production of 2,414,000 oz. of gold at an average mill head grade of 17 gpt gold from 1866-1955. We learned from Ben Mossman, President, Director, and CEO of Rise Gold, that this year they started the first exploration drilling program on the mine and the first hole on the Brunswick #1 Vein Set produced intercept of 12.2 gpt gold over 14.9 m (7.8 m est. true width). Currently they are drilling underneath the level, where the old mining stopped. Plans for 2018 include drilling a number of advanced targets, underneath the very high-grade Idaho mine in mid-June. We learned from Mr. Mossman that Rise Gold team plans to determine the resource and the cost to restore the mine before deciding whether to sell it to a larger company or to put it into production by themselves.

The Idaho-Maryland Gold Mine

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Ben Mossman, President, Director, and CEO of Rise Gold Corp. Could you give our readers/investors an overview of your company?

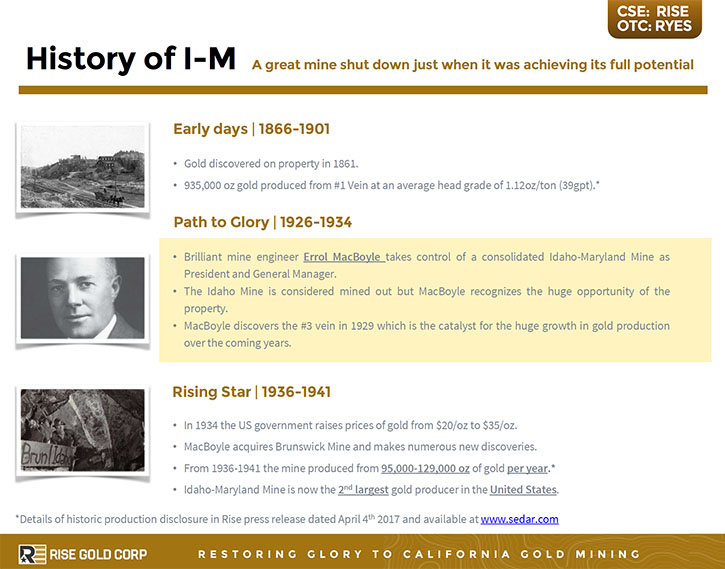

Ben Mossman: Sure. We're listed on the CSE, ticker RISE, and in the OTCQB it's RYES, so we're a public company. We own the Idaho-Maryland Gold project in Grass Valley, California. We own the entire project 100%. There're no royalties and it's all on private land. This mine is a famous past producing mine. It produced 2.4 million ounces at an average grade of 17 grams per ton, so very high grade past production. That's the actual grade of the material that was sent in to the mill, and had a couple stages in its production. The first mining was done from about 1865 to 1900 and they mined almost a million ounces from one single vein, which is the Idaho #1 vein. Then in the 1920s, an engineer called Errol MacBoyle came along and put all of the mines together into one company, and that's the property that we own today.

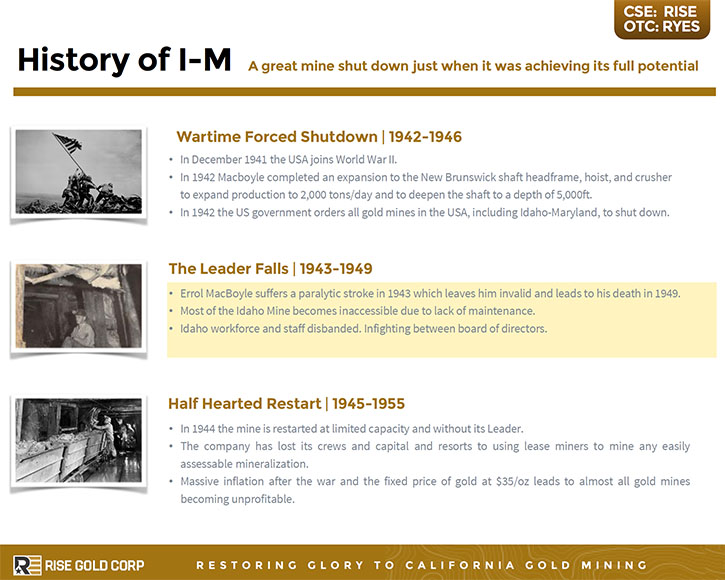

He quickly made a new discovery called the Idaho 3 vein in the '20s, ramped up production before World War II. In 1940 they produced up to 129,000 ounces of gold per year. It was the second largest gold mine in the entire United States, and just before World War II in 1942 they had completed expansion to double the production from 1,000 tons a day to 2,000 tons per day, and at the time they were already the second biggest gold mine. It was forced to shut down by the US government in World War II for the War Measures Act, and it along with all the other American gold mines was ordered to shut down because the government wanted the focus of mining to be on copper, zinc, and lead, so base metals to support the war effort. That was devastating to the company.

They never really recovered from that. The CEO had a stroke and was left paralyzed. After the war, they had very little capital, lost access to a lot of their highest grade reserves in the Idaho mine, and the production after the war when it reopened was about 50,000 ounces per year and very quickly because the gold price was fixed at $35 an ounce and cost inflation after World War II was quite high, very quickly you couldn't make money mining gold anymore. It shut down for good in 1956, and nothing's been done since then. They sold the equipment, let the mines flood, and after all this time not a single hole has been drilled underneath where they stopped mining, until we bought the property and started drilling last year.

Dr. Allen Alper: Could you tell our readers/investors your plans for this year and what kind of data you're getting?

Ben Mossman: We made the first drill hole on January 3rd, and it was quite a good intercept. 12 grams per ton, or 7.8 meters true width, and that was in the Brunswick 1 vein. We stopped drilling for a little while to raise some money. We raised $3.5 million about six weeks ago and now have restarted drilling, so we have three more holes completed. Right now we're drilling at the Brunswick mine, and those assays will start coming out in the next week or two. We're drilling underneath where they stopped mining on the Brunswick mine. They stopped mining at the 1,600 foot level, so we're drilling these holes from about 1,600 foot level down to about the 2,300 foot level and drilling in a number of the different Brunswick veins to show that these veins do continue below where they stopped mining. We'll drill on the Brunswick until about mid-June and then we're going to start drilling on the Idaho veins.

There are two different veins, at the Idaho, which are very high grade, and then the Brunswick, which are about 9 grams per ton. So we're drilling under the Brunswick now. We're going to switch to drilling underneath the Idaho mine in mid-June. The Brunswick targets are quite good and the Idaho are also good and quite high grade. On the very lowest level of mining on the Idaho mine at the 2,400 foot level, they have drifts coming from both sides of the vein, so coming from the western side. That face stopped in a full-face of ore in 1942.

They lost access to that area during the war. Basically the timbers collapsed. They didn't have enough manpower to repair it, so they started drifting from the eastern side and that face is also a full-face of ore and that was shut down in the final shutdown in 1954, so very good targets. Right above it you have almost a million ounces mined from a single vein and then on 2,400 foot level drifts on both sides of the vein that show the mineralization continues to that level. Now we're drilling underneath that to see how far down that vein's going to go.

Dr. Allen Alper: It sounds like you're doing great work and getting excellent results of high grade material. That's great. Could you tell our readers/investors a little bit about your background and management team?

Ben Mossman: I'm a mine engineer. I've worked in eight underground producing mines. I started out at the Con and Giant gold mines in Yellowknife.

I became interested in California and private land, because the United States is the only country, as far as I am aware, where you can privately own the minerals. In our case, because it's all on private land, all the future permitting is done on the county level, so on the local level. For example, because there's a historic mining district in Grass Valley, the zoning code has mining written right into it. So for exploration drilling on our own industrial land, no permits are required at all. When it comes to a point, where you would consider putting the mine back into production, all the permitting work is done with the county as the lead agency so in this case Nevada County, California.

There's a big advantage to that because the decision making is on a local level, not at California State. There's no involvement of the BLM or the US Forest Service. It is a much better situation than most places in the world and this county has a track history of permitting mines. It permitted an open pit gold mine a couple years ago, a large scale disturbance, about 90 acres of surface disturbance. And of course the Idaho-Maryland is an underground mine. All the mining was done underground and all the resources are below 1,600 feet. If we're successful, find the resource and do the economic studies it will be an underground mine.

Other members of our board are; Tom Vehrs, who recently retired from Fortuna Silver. He has a long history as a geologist. We have Alan Edwards, Chairman. He has a lot of experience in many different companies, including Grasberg, where he was a senior executive at the Grasberg mine. He was Chairman for AuRico Gold before it merged with Alamos. Recently, we brought on John Proust, who has a long history in business. His company, Southern Arc, invested $2 million and they're the largest shareholder of Rise Gold. They own about 17%. We also brought into that group three technical advisors, including Bob Gallagher, who is the ex CEO of New Gold and Director of Yamana.

We have a really strong board and management. Before Southern Arc invested, of course they did a lot of due diligence into the geology of the mine, the exploration potential, and then the permitting situation for the future.

Dr. Allen Alper: That sounds excellent. What are your plans with Rise Gold? Are you going to take it into production? What are your thoughts there?

Ben Mossman: The strategy that we're going to follow would be similar to what would be done if it were to be purchased by a larger company, or if it were to be put into production by Rise Gold. I think in this case, if you look at the past production, which was quite substantial, up to 129,000 ounces of gold per year, when it was forced to shut down, and also the 2.4 million ounces of production at an average head grade 17 grams per ton, and compare that to a recent M&A, just last year, when Integra was bought for over $500 million. When they went into production, they proposed a production rate that is very similar to the past production at this mine, the Idaho-Maryland. Then you also have Island Gold, which was in production, but proposed to expand production to something similar to what the Idaho-Maryland was doing way back in 1940. That was before any of the modern mining tools had been invented. There were no water mine drills for exploration, no hydraulic drills for production, so a very impressive production, given the time period. Even today that is a lot of gold per year.

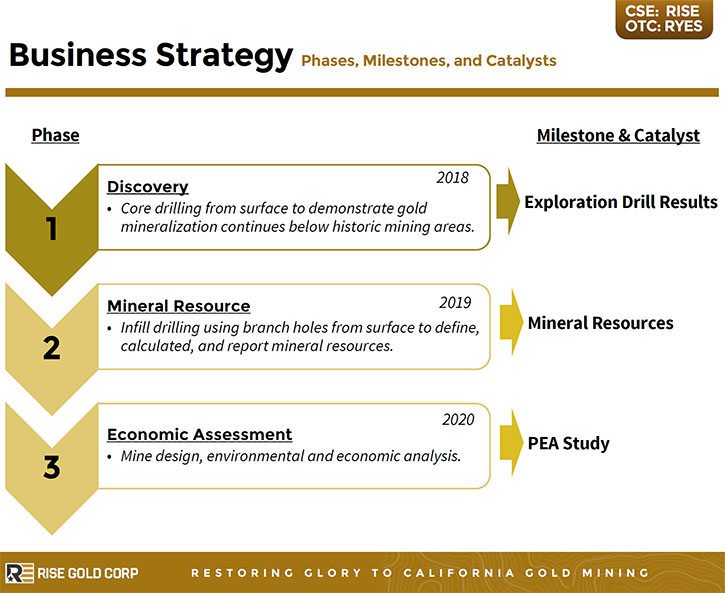

So we'll do the drilling and as there's no resource on the property, we have to do the drilling to show these veins continue at depth and then do the infilling to be able to calculate our resource, and then the next step, once we know the resource is in place, would be to move towards doing the economic studies to determine what it would cost to put the mine back in production. Once that's done, we'll start on the permitting work.

So there are a lot of things that have to be done. There are very few deposits like this left. It would be an attractive property for many large companies. It's very rare.

Dr. Allen Alper: It sounds very good. Could you tell our readers/investors a bit about your share structure?

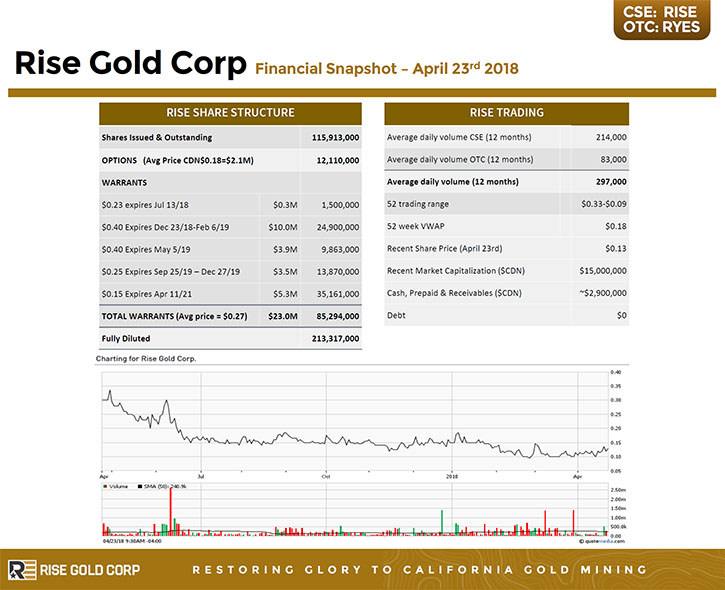

Ben Mossman: We have about 115 million shares outstanding. The stocks trade at a very good volume for a small company. It trades lately between about $.11 and $.13, so a market cap of around $12 million, very cheap right now and a lot of that value is actually in physical real estate, so we've invested $3.9 million US into real estate. We own 2,800 acres of subsurface land. We own the land below 200 feet, and then we own 175 acres of surface land, and that's all M-1 industrial land.

Dr. Allen Alper: That sounds excellent. That's a great position to be in. What are the primary reasons our high-net-worth readers/investors should consider investing in Rise Gold Corp?

Ben Mossman: We have a significant past production, 2.4 million ounces of gold at an average head grade of 17 grams per ton. There's a lot of information from that actual production that brings out the confidence that should we discover extensions to those veins and build resources, a lot of the major issues have already been dealt with. These veins are continuous enough that they were mined in the past. Even with mine dilution, issues with the mine recovery, they still have an average head grade of 17 grams per ton. There's a lot of information on the historic milling of the ore, the metallurgy. They achieved 96% gold recovery, and most of that by gravity, so there's a lot of data already on the metallurgy of the deposit, which is very good, and then the targeting.

The exploration drilling is quite simple, we're just drilling right underneath where they stopped mining. We have all the documents that the family that owned the property had preserved, so hundreds of drawings, prints, all the mine workings, which have been digitized and put into three dimensional models, with the veins modeled, so we know where to drill, below where they were mining. It's a big advantage on a property like this rather than a greenfield exploration, where you don't understand the nature of the deposit. You don't know exactly where you should drill.

In this case we know where to drill. We know that the veins are good. We know that it had been mined in the past and the system is big obviously with 2.4 million ounces of past production. Right beside this mine Newmont owns all the land adjacent to us, and the Empire Mine produced 6 million ounces. It is a very significant gold district, of which we own the entire centerpiece, which is the Idaho-Maryland mine.

Dr. Allen Alper: That's excellent. Anything else you'd like to add, Ben?

Ben Mossman: There are going to be a lot of things coming up. The first, since we bought the property over a year ago, was buying the land, so purchasing the mine property. We purchased the property adjacent to it, which is an old saw mill site so that land is going to be important for the future should we decide to re-access the mine. We've spent a lot of time doing the data work, legal work to make sure that the title is good to the land that we bought. Now the drilling has started in full, so there's going to be a lot of excitement for Rise Gold and its shareholders in the near future and ongoing throughout the year.

Dr. Allen Alper: Sounds excellent!

https://www.risegoldcorp.com/

Benjamin Mossman

President, CEO and Director

Rise Gold Corp.

Suite 650, 669 Howe Street

Vancouver, BC V6C 0B4

T: (604) 260-4577

info@risegoldcorp.com

|

|