Paramount Gold Nevada Corp. (NYSE American: PZG): A U.S. Based Gold and Silver, Advanced Exploration Company, Over 4 Million Ounces of Gold (M&I)

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 6/25/2018

Paramount Gold Nevada Corp. (NYSE American: PZG) is a U.S based, precious metals exploration company, with a mineral inventory exceeding 6 million ounces of gold equivalent to shares outstanding, providing its shareholders with exceptional leverage to the gold price. Paramount owns 100% of the Grassy Mountain Gold Project, which consists of approximately 9,300 acres located on private and BLM land in Malheur County, Oregon. The Grassy Mountain project contains a gold-silver deposit (100% located on private land) for which a Preliminary Feasibility Study (“PFS”) has been prepared recently and key permitting milestones accomplished. We learned from Glen Van Treek, President, and Christos Theodossiou, Director of Corporate Communications of Paramount Gold Nevada, that during 2017 and early 2018, they focused, on advancing Grassy, completed a 30 hole drill program, initiated and completed a robust and economic pre-feasibility study, as well as advancing the permitting process on the project. They have also done about a $7.4 million financing in that timeframe. Plans for the remainder of 2018 include filing a Consolidated Permit Application to the state of Oregon and they expect to receive the permit within one year from then. In addition, the Company is planning an exploration program on several high priority targets, in close proximity to Grassy Mountain.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Glen Van Treek and Christos Theodossiou. Glen is President and CEO of Paramount Gold Nevada Corp., and Christos is Director of Corporate Communications. Glen, could you give us an overview of your company, and review your primary accomplishments over the past year?

Mr. Glen Van Treek: We're a US based exploration company focused on gold and silver. With the $200M acquisition of our Company’s parent by Coeur Mining in 2015, we parted ways with our Mexican asset and focused on the Sleeper Gold Project, located in Nevada. In 2016, we diversified our asset base, with the acquisition of the Grassy Mountain Project, in Oregon. In aggregate, the two projects have approximately four million ounces of gold plus over 30 million silver ounces of measured and indicated material, plus 1.5 million of gold inferred ounces.

In late 2016, we initiated a pre-feasibility study on the project. During 2017, we completed a 30 hole drill program, with the main objective being to improve and better define the resource, acquire materials for metallurgical testing and geotechnical purposes. Just last month we announced the results of a positive PFS for our proposed underground mine at Grassy Mountain.

Dr. Allen Alper: Congratulations on the completion of the PFS. Are you able to provide us with some highlights?

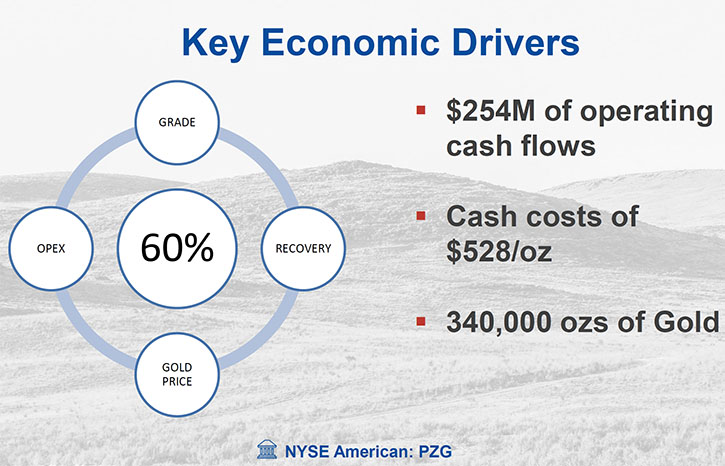

Mr. Glen Van Treek: The PFS assumed a 750 ton per day milling operation and a first stage of gravity separation followed by CIL recovery, resulting in the production of a DORE bar. The best case scenario was conducted at a gold price of $1,300 and yields an attractive IRR of 28% and an NPV which exceeds $87 million after taxes. The mine plan indicates average annual production of 47,000 ounces of gold and 50,000 ounces of silver for 7.25 years with a short payback period of 2.5 years. The average mill head grade exceeds 7g/T gold.

Dr. Allen Alper: Are you able to expand upon the capital and operating costs outlined in the PFS?

Mr. Glen Van Treek: Yes of course. We are extremely encouraged with both the operating costs and the CapEx. The cash operating costs are $528 per ounce of gold, which assumes small silver credits and total costs including all capital of $853 per ounce of gold produced. The initial infrastructure for the 750 tonne per day mine and milling operation is $69.9 million and initial CapEx of $110 million, which includes additional costs for mine development and pre-production, owners and working capital and contingencies. The project has attractive operating cash flows of $254 million.

Dr. Allen Alper: Are there any other details of the PFS on which you’d like to expand?

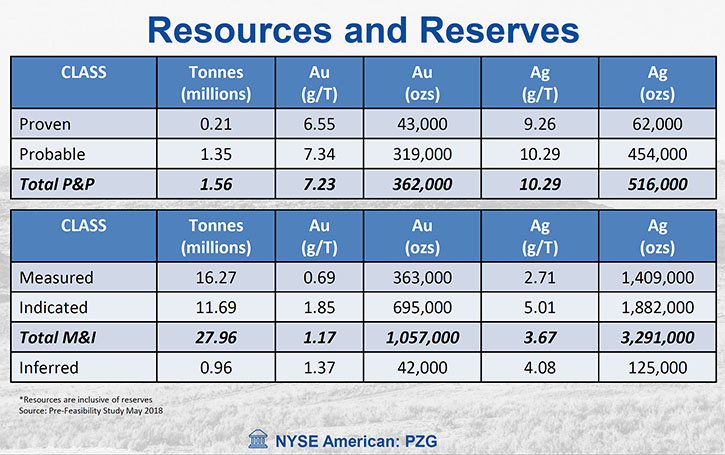

Mr. Glen Van Treek: The PFS updated the resource estimate at Grassy and the Company now reports its first proven and probable reserves. The proven and probable reserves contain 362,000 ounces of gold at a grade of 7.20g/T and 516,000 ounces of silver at 10.3 g/T. The PFS has ample opportunity for improving upon project economics and expanding the resource base and will be the focus of an upcoming exploration program, which we hope to conduct later this year.

Dr. Allen Alper: What then are your plans for the remainder of 2018?

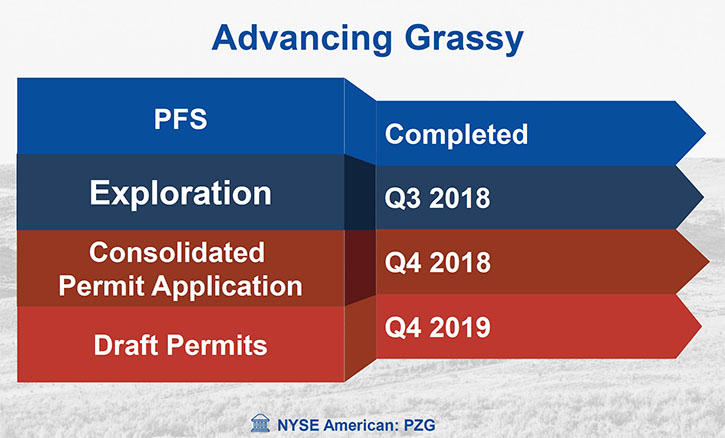

Mr. Glen Van Treek: For the remainder of 2018, our focus will still be on Grassy Mountain. We are advancing on all the permitting processes involved with both the state and federal government.

With the completion of the PFS, we now have all the necessary inputs to advance the Consolidated Permit application with the state of Oregon and expect to do so by years end. With that, the state has approximately a year to issue the draft permits. Given our communications and the rate at which baseline study approvals are being received, we are extremely confident that we will be the first permitted modern day gold mine in Oregon.

Mr. Chris Theodossiou: In addition to our permitting efforts, later this year, we plan to conduct an exploration program on several high priority targets, which are in close proximity to the Grassy Mountain deposit. These targets have been previously drilled to shallow depths, yielding positive assay results. Those results are supported by geophysical indications and lead us to believe there is the potential to find another Grassy style deposit at depth.

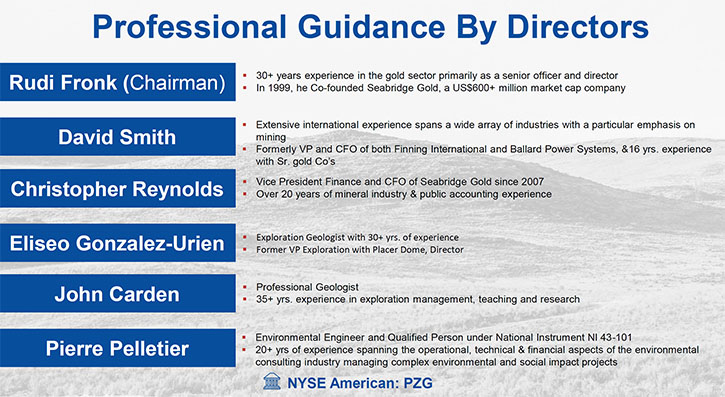

Dr. Allen Alper: That's great, very important! Could you give our readers/investors an update on your background and the background of the management and the board?

Mr. Glen Van Treek: I'm a professional geologist and have been involved in all stages of mining exploration, from early stage exploration through to feasibility. Also, I've been involved in production geology in both copper and gold operating mines in many countries. To date, I've been in the mining industry for 27 years and counting.

Carlo Buffone, our CFO, has been in the mining industry and the Company for eight years now. He's been key in all the mergers and acquisitions and financings, including the acquisition of X-Cal Resources and the Sleeper Gold Project in 2010; the 2015 acquisition of Paramount Gold and Silver by Coeur Mining; and in 2016, our acquisition of the Grassy Mountain Project.

Christos Theodossiou has been a part of Paramount for over 10 years. He's the Corporate Secretary and Director of Corporate Communications.

Our board of directors have all been involved in mining for most, if not for their entire careers. Their combined broad skillset is definitely an asset. Their skills range from geologists, mining and environmental engineers, and financial professionals.

Rudi P. Fronk is the Board’s Non-Executive Chairman. He is also the Chairman and co-founder of Seabridge Gold Inc., a mining company in Canada with very substantial gold reserves. He's been in the mining industry for about 40 years and brings a lot of experience and knowledge to the Board.

Dr. Allen Alper: Rudi Fronk is a very impressive man. I've interviewed him several times. I'm very impressed with him and Seabridge. He's a great asset to your company.

Mr. Glen Van Treek: Yes he is. Rudi and I have known each other and worked together on several occasions over the past 20 years

Dr. Allen Alper: Could you tell us a bit more about your share structure and key investors?

Mr. Glen Van Treek: Yes, Christos why don’t you walk them through that?

Mr. Chris Theodossiou:

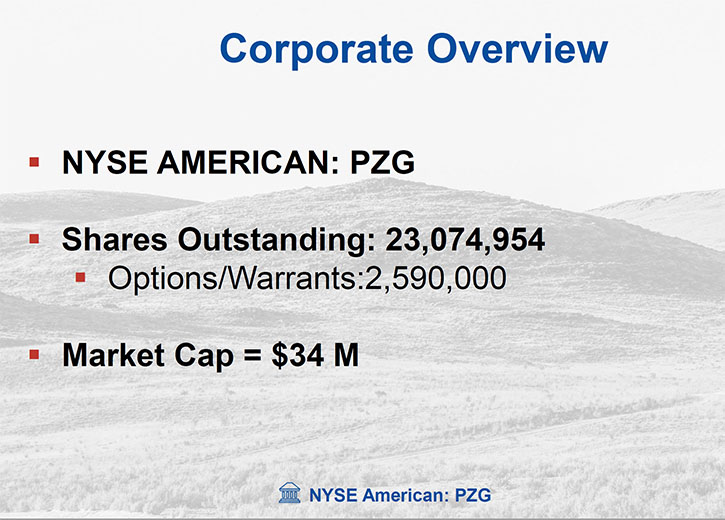

Yes, of course. Hi Allen. Paramount is listed on the New York Stock Exchange, under the symbol PZG. We have approximately 23.1 million shares outstanding and 25.1 million shares outstanding on a fully diluted basis. Our market cap is approximately $35 million US.

Our two largest stockholders have been in the industry for many years and are long-term gold investors. The first is FCMI Financial, an investment management firm. The second is Seabridge Gold, who has one of the world’s largest gold, copper, and silver resource base. Cumulatively, they own 28% of our outstanding shares.

Dr. Allen Alper: Excellent!

Mr. Glen Van Treek: Both of those investors, FCMI and Seabridge, participated in our latest financing. FCMI maintained their ownership in the Company and Seabridge increased their position in the company.

Dr. Allen Alper: That sounds great. Could you tell us a bit more about the Sleeper Gold Project?

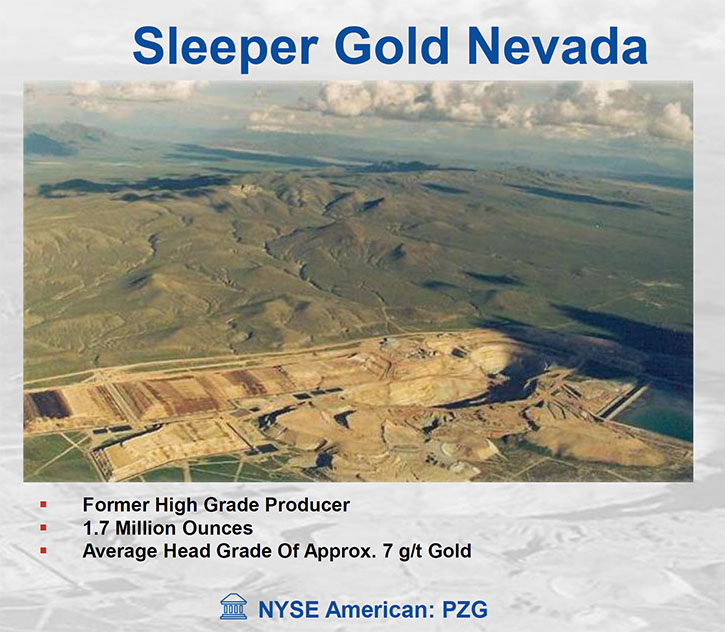

Mr. Glen Van Treek: The Sleeper Gold Project is in Nevada and was a former high grade operating mine that produced over 1.5 million ounces of gold, with a head grade of approximately 7g/t gold. Since we acquired it, we've conducted exploration and established a resource of over 3 million ounces of gold and 29 million ounces of silver of measured and indicated material, and close to 1.5 million ounces of gold in the inferred category.

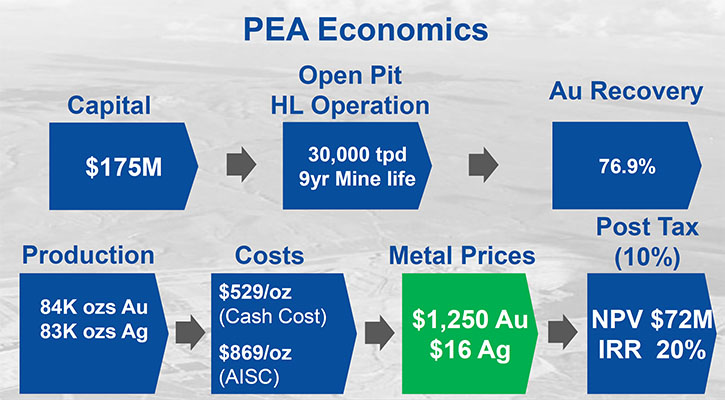

The project is currently at the PEA level. The PEA is based on a 30,000 ton per day, nine year operation to process the highest grade portion of the deposit and the best material in terms of metallurgy, in an open pit Heap Leach mining scenario. As mentioned, we are currently focused on Grassy and therefore we are only maintaining the environmental compliance at Sleeper. However, as we move forward with Grassy and given the cash flows it is expected to yield, we will be able to grow Sleeper organically. Our team has identified several priority targets and we believe there is a strong potential to find another high grade, ‘Sleeper style’ deposit.

Dr. Allen Alper: That sounds very good. What are the primary reasons our high-net-worth readers/investors should consider investing in Paramount Gold Nevada?

Mr. Glen Van Treek: For investors, who believe, as we at Paramount believe, that they should have exposure to gold, Paramount provides outstanding leverage to the price of gold with its over 5 million ounces. With a proven team and history for bringing projects to the production decision, Paramount has a mine, worth building, with Grassy Mountain. It will generate exceptional cash flows and produce gold at a very impressive cash cost per ounce. We expect to receive our mining permits in the very near future and grow the resource base at Grassy Mountain to make the project economics even better.

Dr. Allen Alper: That sounds Excellent.

Company website: www.paramountnevada.com

Follow the company on social media:

|

|