Interview with Heye Daun, CEO, Co-Founder and Director of Osino Resources: Discovering Namibia’s Next Significant Gold Deposit in the Namibian Pan-African Gold Belt

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 6/23/2018

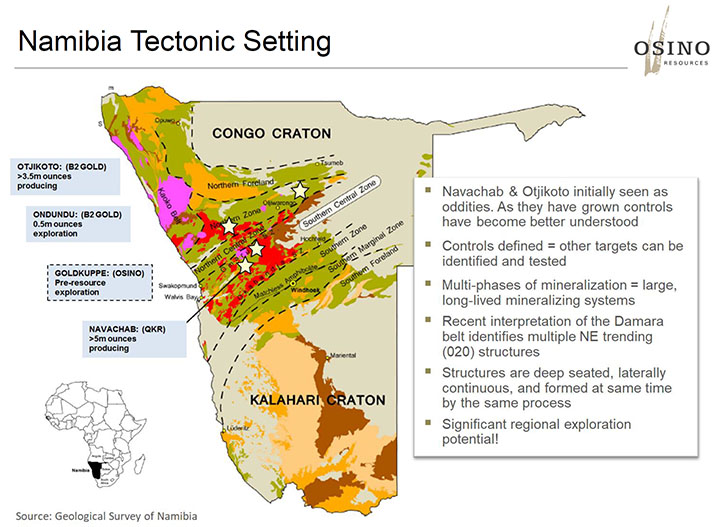

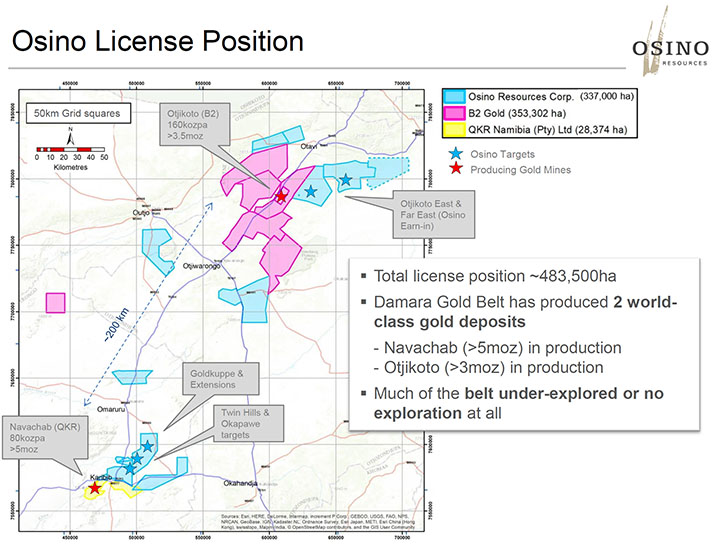

Osino Resources Corp. is a soon-to-be public Canadian company, developing large and prospective gold concessions, in the emerging Namibian Pan-African gold belt, with the vision of finding Namibia’s next significant gold deposit. Osino expects to start trading on the TSX-V by around 28 June, under the symbol OSI. Osino holds a prospective, 5,700km2 portfolio including the Goldkuppe discovery and a growing pipeline of targets. We learned from Heye Daun, CEO, co-founder and Director of Osino Resources, that their land position, within the Pan-African gold belt, is book-ended by two major low-cost gold deposits, with respectively 8 and 4m ounces in historical gold resources. Plans for 2018 include taking the company public as the first milestone, as well as completing their $6 million exploration program that includes drilling, aero-magnetic surveying and regional geochemistry. According to Mr. Daun, Namibia is a mining-friendly country and one of the continent’s most politically and socially stable jurisdictions, with well-established infrastructure.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Heye Daun, CEO and co-founder and director of Osino Resources. Could you give our readers/investors an overview of your company, your focus and current activities?

Heye Daun: Sure. Osino is a gold exploration company with assets in Namibia. The essence of our company is threefold. We are led and we were formed by a team of people that have a good track record of delivering value. I can tell you more about that later. We are in a great country, Namibia, which for North Americans who may not be so aware of Africa, it's in southern Africa. Namibia has consistently been ranked as one of the top investment countries in Africa. All the usual things like enforcement of contracts and rule of law, et cetera, are all in place. So it's a great jurisdiction. It is comparable to the US or Canada. And we have a very large scale portfolio of assets.

We have a great shareholder base. Some of the who's who of Canadian mining investments are our shareholders. So, that's the essence of the company.

Dr. Allen Alper: That's excellent. Could you tell us a little bit more about your resources and deposits in Namibia?

Heye Daun: Osino currently does not have resources. We aim to find Namibia's next significant gold deposits. The Pan-African belt, which is a geological belt, is located in Namibia. It's a new gold belt. It has very significant gold deposits in Egypt and in other places. But it's an emerging gold belt. Within that, in Namibia, we have two major gold deposits, namely Navachab and Otjikoto. Navachab is currently around five million ounces. It's a past and current producer. It used to be owned by Anglo. It's now owned by a London private equity group. The other gold mine is the Otjikoto Gold Mine, which is currently one of the lowest-cost producers in the world. It's a producer of around 200,000 ounces a year and is owned by B2Gold. Our license position is book-ended by these two world-class deposits.

The co-founders of Osino, myself and my colleagues, developed the Otjikoto asset and sold it to B2Gold, so there's a long history there. When I talk about our history of delivering value, I'm also referring to that. It's an important part of the Osino story, our history with defining that other project.

Dr. Allen Alper: That's excellent. What are your plans for 2018?

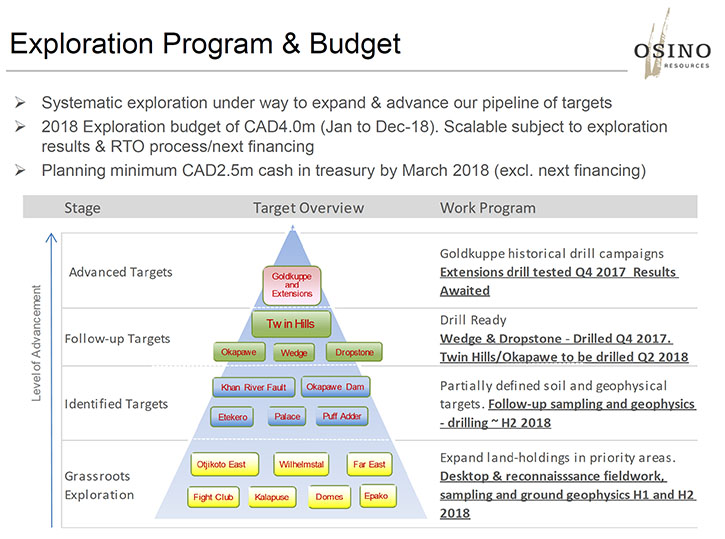

Heye Daun: Our corporate plans are, firstly, to take the company public later this month. We're doing this via RTO onto the TSX-V. We are currently still private, but we have negotiated a deal with a shell and we're going public via RTO. So that's the first milestone. The expected listing date is around 28 June 2018.

Secondly, we have a $6 million exploration program for 2018, which we have completed about halfway. The program incorporates a range of drilling, aeromagnetic surveys, regional geochemistry, and so forth. So we have quite an extensive exploration program, with multiple upcoming catalysts.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a bit about your background and your directors and management?

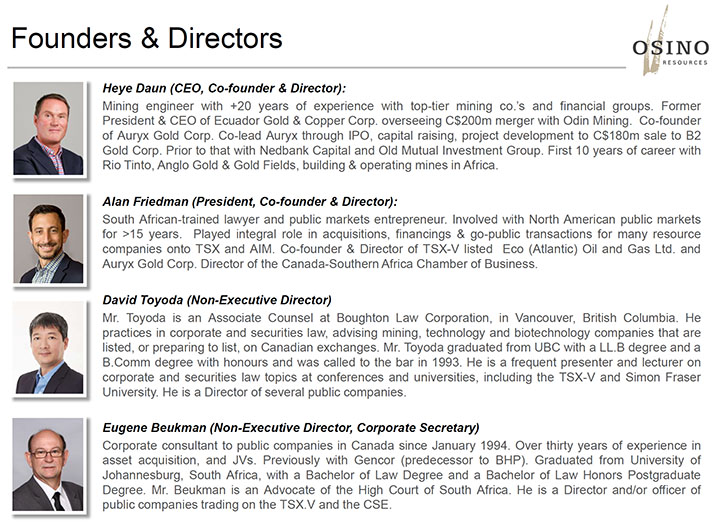

Heye Daun: I'm a mining engineer with about 20 years’ experience. I am of German descent, but I was born and grew up in Namibia. My experience encompasses building and operating gold mines in Africa. I spent 10 years with Rio Tinto and Anglo in various parts of Africa, primarily in gold, building and operating gold mines and other mines. Thereafter, I went into mining finance for a few years and then became an entrepreneur. I've had a number of successful exits, most notable has been a company called Auryx Gold, which I founded and sold to B2Gold in 2012 for $200 million. And then in 2016 I merged an Ecuadorean explorer into one of Ross Beaty’s companies, which resulted in Lumina Gold Corp., which was also a $200 million exit. So that's my background.

My co-founder of Osino, Alan Friedman, is an ex-South African lawyer. He's based in Toronto and he's very much a public markets guy. And then we have some other directors to lend credence to the Board, which I'll tell you about.

Dr. Allen Alper: Could you tell us a little bit more about your Management team?

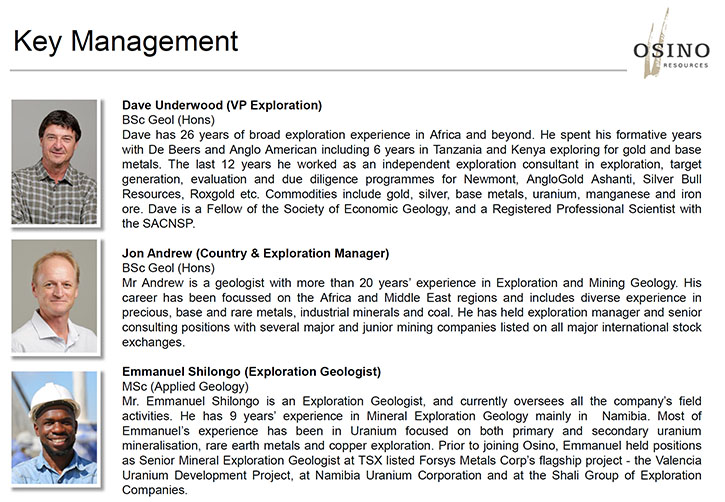

Heye Daun: Most importantly, being an exploration company, who are the geologists? We have two in particular. Our VP Exploration is a chap by the name of Dave Underwood. He was previously a deal-scout for Newmont in West Africa. Before that he was with Anglo and he has a long track record of finding and evaluating gold projects in Africa. He's a very experienced gold exploration geologist. He's found deposits before and worked with major companies.

We also have Jon Andrew, he's our Exploration Manager. He's an ex-BHP exploration geology with a lot of experience, mainly in base metals. He is very strong on execution and gets things done. He has built our Namibian team and infrastructure, now comprising about 35 staff, various vehicles & pieces of infrastructure and an active office and field presence. Jon is executing our exploration program as we speak.

Then, of course, there's myself. I'm the CEO and my primary role is to set strategy, raise money, oversee the various corporate activities and promote the company. I am very detail oriented also, and make sure that we have systems in place to control our various activities. So that's really the essence of our management team.

Dr. Allen Alper: Oh, that's great, it sounds like you have a fantastic background and a great track record and you have put together a great team, both Board and Management team. Could you tell our readers/investors a bit more about operating in Namibia?

Heye Daun: Certainly. Namibia is a fantastic place to operate. As a North American, you can imagine it like Texas or Western Australia; it's very arid, it's very sparsely populated, it's very accessible. At the same time, it has all the ingredients of a first-world society, including services, car hire companies, lawyers, accountants. We have excellent enforcement of contracts and a very good judicial system. It's very stable. So it is a great place to operate. In my view, it's easier to operate there than in Canada or the US. To back that up, the annual Fraser Survey, with which some of the readers might be familiar, is a survey that compares jurisdictions worldwide on investments and so forth. The Fraser Survey has ranked Namibia together with Botswana as the top African investment destination consistently for many years.

Dr. Allen Alper: That sounds excellent. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Heye Daun: The primary reason is that I believe we represent an excellent opportunity to make a discovery. Technically and geologically, what we have put together holds that promise. But as your readers/investors know, in order to be successful you need to have deep pockets and you need to have enough funding to execute.

And I think that's the second reason. We have excellent shareholders. One of them is Ross Beaty. Another one is Resource Capital Funds out of Denver. These are deep-pocketed investors with a long-term view, who support us. As an investor in our company, after it goes public, it also represents life insurance in the form of financial backing, which addresses the financing risk, which is one of the primary risk factors in junior exploration investing.

The third part of that is we have a management team that's done it before. We look after the investors and deliver returns.

Dr. Allen Alper: That sounds excellent. It's great to have investor support and investors that know what they're doing and have sufficient funds to back you up. That's excellent.

Heye Daun: Sure.

Dr. Allen Alper: Is there anything else you'd like to add?

Heye Daun: I appreciate the opportunity to talk to you and your investors, Al. Thank you very much!

http://osinoresources.com/

Heye Daun

CEO

hdaun@osinoresources.com

+27 (82) 566 4494

|

|