Interview with David Reeves, Managing Director Calidus Resources (ASX:CAI): The Highest Grade (Over Two Grams) Open Pit-Able Gold Resource in Australia

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 6/20/2018

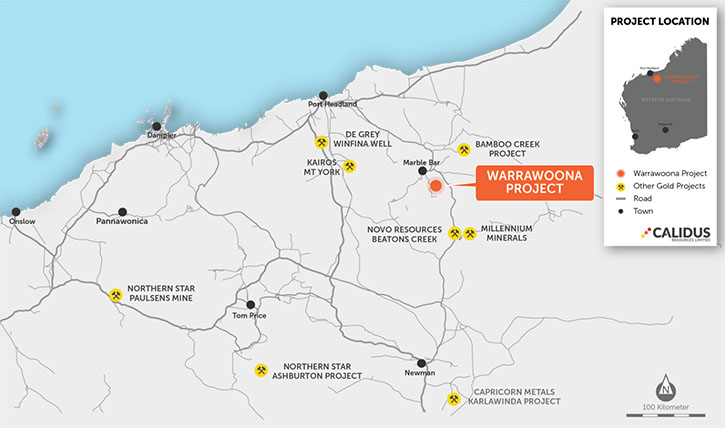

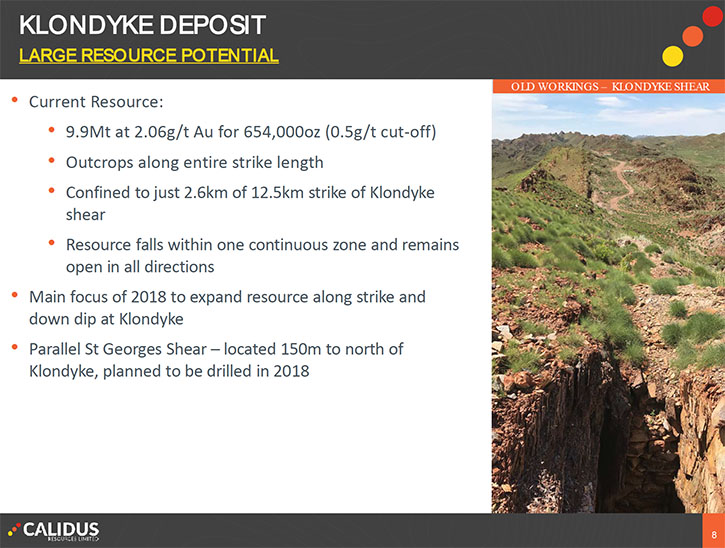

Calidus Resources (ASX:CAI) controls the entire Warrawoona Gold Project, in the East Pilbara district of the Pilbara Goldfield, in Western Australia. We learned from David Reeves, Managing Director of Calidus Resources, that they have a resource of 712,000 ounces, at 2.1 grams a ton, outcropping over 2.6 kilometers. It is open in all directions, and they have just commenced the resource extension program to exceed the million ounce mark this year. The main Klondyke deposit is a conventional shear-hosted gold deposit, with very good potential for an open pit mine. The metallurgical test work resulted in very high recoveries of 96% at a coarse grind, which promises potentially low operating costs. Plans for 2018 include a lot of drilling to upgrade the resource, and tests for the pre-feasibility study. According to Mr. Reeves, quite a few of the board members have taken projects to production before. Calidus is looking to bring the Klondyke project to production and plans to start development early 2020.

Warrawoona Gold Project, Australia

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mr. David Reeves, Managing Director of Calidus Resources Limited. I wonder if you could give our readers/investors, an overview of your company.

David Reeves: Calidus Resources, is a gold development company. We're in the Pilbara area of Western Australia, targeting shear-hosted gold. We have a resource of 712,000 ounces at two point one grams a ton. That resource is outcropping over two point six kilometers. It is open in all directions, and we have just announced we've commenced our resource extension program, where we aim to push that over the million ounce mark this year.

Dr. Allen Alper: That sounds excellent. Could you tell us more details about the projects?

David Reeves: We control just over 550 square kilometers, in the Pilbara. It's an area where gold was first discovered in 1896. There are over 200 historic workings on our tenements, but due to fragmented ownership, it's really had no modern exploration. Due to consolidation, we have now put together this contiguous package, which has allowed us, so far, to prove up a resource of 700,000 ounces.

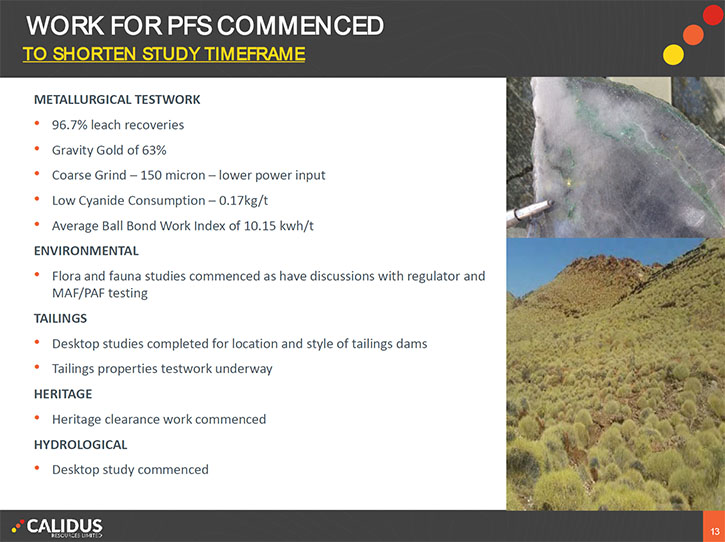

We have various satellite deposits, from what we call our main deposit, which is Klondyke, a conventional shear hosted gold deposit. It is two point six kilometers long on average between 10 and 20 meters wide, outcropping on the top of the hill, very good for a potential open pit mine. We've done our metallurgical test work and have reported very high recoveries of over 96% at a coarse grind of 150 microns, so potentially quite low operating costs. This coming year is about cracking that million ounces, and then next year onto the pre-feasibility study. And we're targeting a plus 100,000 ounce per annum gold company in Western Australia, in the not too distant future.

Dr. Allen Alper: That sounds excellent. So could you tell us a little bit more about your plans for 2018?

David Reeves: Our main plan is a lot of drilling. We've budgeted around 50,000 meters for this entire year of drilling. We've done some diamond drilling and a little bit of RC this year, but we really kicked off last week with the main resource drill-out, which will expand to two rigs on site in a couple of months. So lots of good news flow there. In the background, we're doing a lot of the work for the pre- feasibility study and permitting. So we're doing a lot of the environmental, including flora and the fauna. We're doing Geo Tech studies, furthering the metallurgical studies and heritage clearances. A lot of that work's going on in parallel. Once we complete the drilling and upgrade the resource, later this year, we can move through the pre-feasibility stages very rapidly.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a bit about your background, your directors and management?

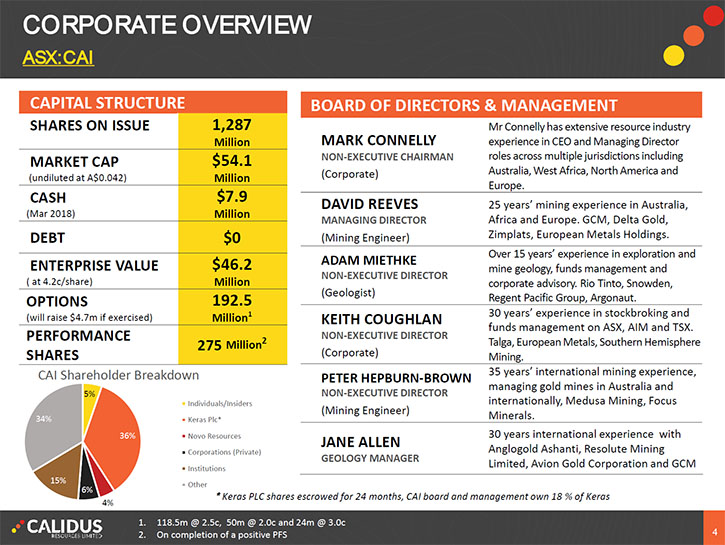

David Reeves: I'm a mining engineer by trade and have worked all around the world; Europe, Africa and Australia. My main experience is in feasibility studies, and building of mines. I've been involved in the building of three mines and have been mine manager at several. Our Chairman is Mark Connelly, a very experienced gold executive. He was the MD of a company such as Papillion, which was bought out by B2Gold for over 600 million US. So he's very well known, certainly in Australia and North America in gold circles.

Also on the board is Adam Miethke, who is a geologist. He has been involved in funds management, and metals and mining at a brokerage firm. Keith Coughlan is a financier. Peter Hepburn-Brown, another mining engineer and Jane Allen is our Geology Manager. She had most recently held the title of Brown Fields Exploration Manager for Anglogold Ashanti for all of Continental Africa. So a very experienced lady. This results in a team that's very focused, and has the skills for building a mine and financing a mine.

Dr. Allen Alper: That's an extremely great team you have. You have an excellent mining background. With your background do you plan to bring this property into production? Or will you be looking for a partner?

David Reeves: We'd certainly be looking at bringing them into our production ourselves. Quite a few of the board have done it before. That's where we see real value uplift and we believe we have the skill set to do it.

Dr. Allen Alper: That sounds excellent. What do you think the timing is to bring it into production?

David Reeves: We should start development early 2020. By the time we do a pre-feasibility in the first four to five months of next year, we need to complete the definitive feasibility, which will take about another eight months, so end of quarter one, beginning quarter two, we should be looking at developing in 2020.

Drilling July 2017

Dr. Allen Alper: Excellent! Could you tell our readers/investors a bit about your share structure?

David Reeves: We have a reasonable amount of shares on issue, because we reversed the project into a two cent shell company. So we do have about one point three billion shares on issue. They're currently trading at about four point two cents. So we've had steady growth in the share price that gives us a market cap of approximately 54 million Australian dollars. We had eight million Australian dollars in cash at the end of last quarter. There are some options/warrants and some performance shares outstanding. That was part of the vend of some of the properties in these performance shares, which totaled 275 million to be issued on a successful pre-feasibility study.

Diamond Drilling

From an ownership perspective, we have a company called Keras Resources PLC sitting at around 36%. They're a London company, who vended the projects in, and is where we actually put the project together. Then we have a whole range of institutions and some other mining companies. We have Novo Resources in at just under five percent. We have various institutions, such as Sprott Asset Management and Dynamic Funds from North America, quite a few funds from Singapore, and the east coast of Australia. So we have institutional holdings, including Novo of around 25%, which leaves retail of around 35 percent.

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors a bit about the area, in which you're operating, some of the advantages, anything about the roads, the infrastructure, et cetera?

David Reeves: For sure. The Pilbara of Western Australia is the largest iron ore mining center in the world, so a lot of infrastructure in the area. We fly into a place called Port Hedland, which is Australia's largest port. I think it exports about 250 million tons per annum of iron ore. There are six or seven commercial flights a day from Perth. It's a two hour drive out on a Bitumen road, to Marble Bar, which is a little town near where we have our leases.

From Marble Bar, it's 20 kilometers drive, on an all-weather dirt road that's maintained by council, into the middle of our lease area. Marble Bar itself has a mining registrar, nursing station, police and bitumen airstrip and about 100 single rooms in town. So that's a great location to base ourselves for any future development.

Dr. Allen Alper: Sounds great to develop a mine, with all that infrastructure, and development that's available for you. What are the primary reasons our high-net-worth readers/investors should consider investing in Calidus resources?

David Reeves: I think we have a very exciting year ahead, and lots of good news flow, with the drilling. Cracking that million ounce mark, will be very important for us. It puts us on the radar a lot more with investors, with other mining companies, and allows us to underpin that plus 100,000 ounce per annum operation. That size operation is essential to get a lot of interest from the institutional market.

When you have a look at Australia, it's a very safe jurisdiction for mining, but there are very few opportunities to look at independent gold producers that can do over 100,000 ounces per annum. We're one of very few Australian companies that are looking to develop such a mine. We believe we have the highest grade (over two grams) open pit-able resource in Australia at the moment. And with that, potentially a very low cost base. So adding all of those up, we think there's a long way to go in the valuation of Calidus, and it's a good time to get involved.

Klondyke Drill Core

https://www.calidus.com.au/

Dave Reeves

Managing Director

dave@calidus.com.au

|

|