Gran Colombia Gold Corp. (TSX: GCM): Currently the Largest Underground Gold and Silver Producer in Colombia, Interview with Mike Davies, CFO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 6/11/2018

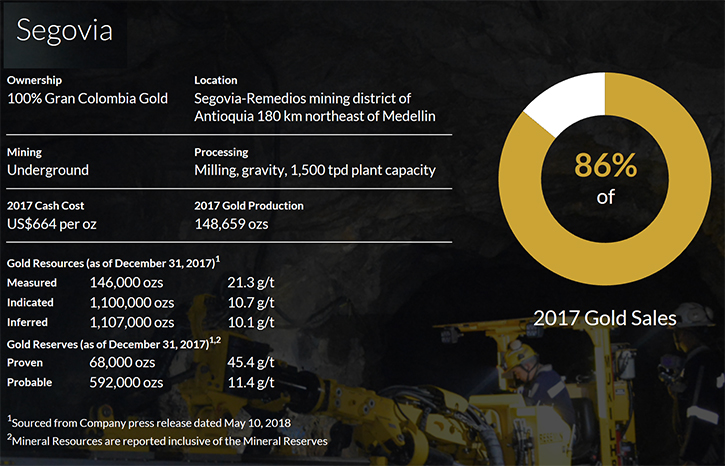

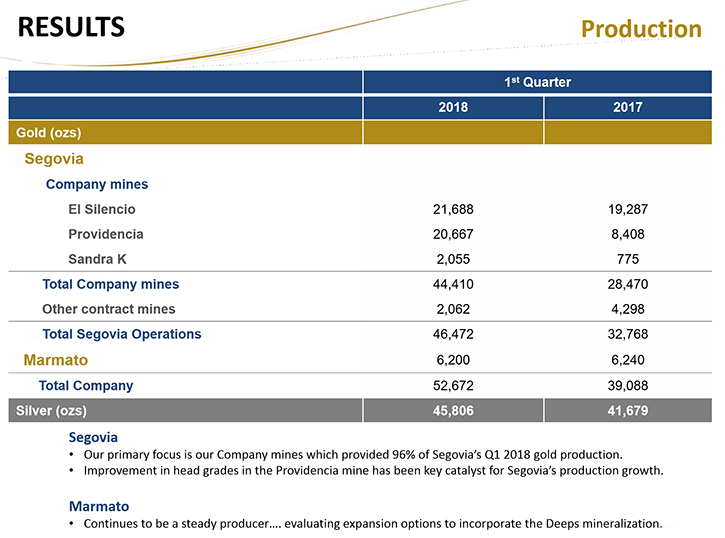

Gran Colombia Gold Corp. (TSX: GCM) is currently the largest underground gold and silver producer in Colombia with several underground mines in operation at its Segovia and Marmato properties. We learned from Mike Davies, who is the CFO of Gran Colombia that their focus is 100% in Colombia with the flagship Segovia project, delivering 86-90% of the company's production. We learned from Mr. Davies that they currently have three high grade mines in operation in Segovia mining, an average of about 16 grams per ton. As of the end of March 2018, the company's 12 months production is 187,000 ounces, with 162,000 coming from Segovia. Plans for 2018 include refinancing of some of their senior convertible debentures in parallel with the optimization mine programs at Segovia, as well as extending the project's resource. Gran Colombia Gold also owns a small Marmato mine where it is currently taking steps to identify ways for expanding, as well as the Zancudo project currently under option to Iamgold.

Gran Colombia Gold Corp

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mike Davies, the CFO of Gran Colombian Gold. Could you give our readers and investors an overview of your company?

Mike Davies: Yes, certainly. We are the largest underground producer of gold and silver in Colombia. We've been a public company in operation since 2010. Our focus is 100% in Colombia, we currently have three projects on the go. Our flagship project, our Segovia operations are in production, doing about 86-90% of our

production at the moment.

We also have 100% ownership of the Marmato project in Colombia, which represents our optionality for growth from a small mine in operation. We're currently taking steps to identify a path forward for expanding our underground mining operations, with a large underground resource.

A third project, called Zancudo, is currently under option to Iamgold. They are conducting a drilling program right now as part of their earn-in on the project.

Dr. Allen Alper: That's excellent. Could you tell us a bit more about the production and operation?

Mike Davies: Absolutely. Since 2014 we've seen the work that we've been doing, particularly focused on Segovia, which is a high grade set of producing mines. We have three mines currently in operation within Segovia, and by high grade we mean double digit grades. We're currently mining an average of about 16 grams per tonne.

The mines have been around for more than 150 years, and have produced over 5 million ounces in total over that period of time. When the company started out, we were operating at about 80-100 thousand ounces of total gold production a year, with most of that coming from Segovia.

We've since been able to raise that. We did 174,000 ounces in 2017 with 149 thousand coming from Segovia. And, with further growth in the first quarter this year, our 12 months production as of the end of March 2018 is 187,000 ounces, with 162,000 coming from Segovia.

So, our strategy to modernize, mechanize, and expand our underground operations in Segovia has been the cornerstone of our growth the last couple of years.

Dr. Allen Alper: That sounds excellent. Could you tell us a bit, some highlights on your balance sheet?

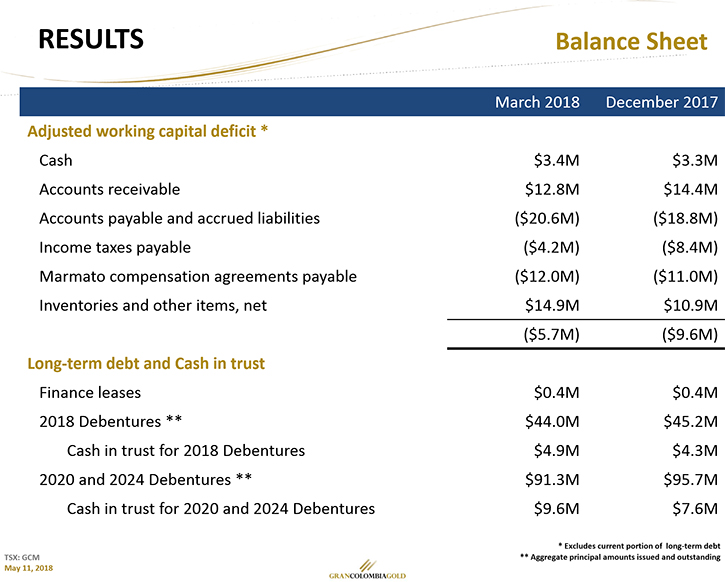

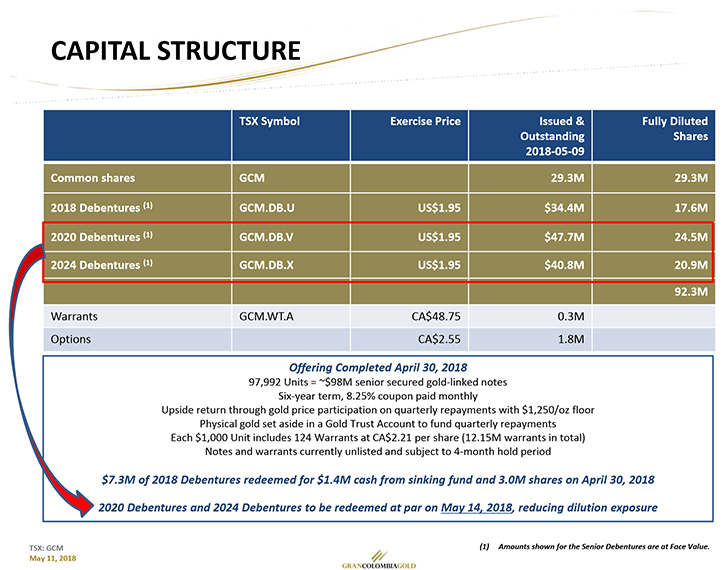

Mike Davies: Interestingly enough, we just went through a very important event for the company. Early 2016 we found ourselves completing a restructuring of our senior debt, which at the time stood at about 180 million dollars.

Over the course of 2016 and 2017, through conversion of the convertible debentures by holders into shares as well as the company's efforts to use its free cash flow to pay down the debt, we were able to bring that down to about 144 million by the end of the first quarter this year.

But, the most important thing we did happened on April 30, 2018. We completed a US 98 million dollar offering of gold-link notes. These notes have a six year term. They are repayable through gold from the Segovia project. We're roughly committing 10% of our production from Segovia, over the next six years, towards the retirement of this debt.

We simplified our debt structure. We will have one debt instrument moving forward after August. And, we reduced the overhang on our stock from a significant number of potential shares that could have otherwise been issued under the old, convertible debt structure.

So, a major event that cleaned up the debt side of the balance sheet and on the asset side of the balance sheet, put about 15 million dollars of additional cash onto our balance sheet to give us some additional financial strength as we go through the next phase of continuing to not only expand and develop Segovia, but start to do some evaluation work on our Marmato project.

Dr. Allen Alper: Ah, that sounds excellent. Could you tell us a little bit more about your plans for 2018?

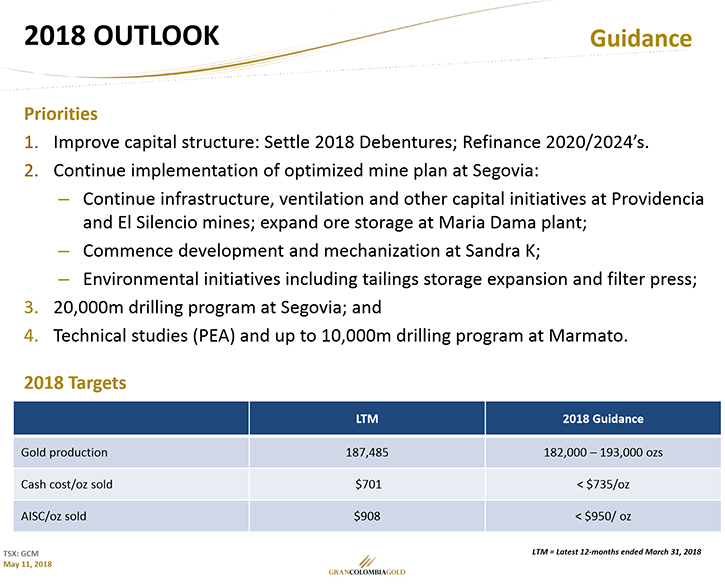

Mike Davies: Our key focus for 2018 is a continuation of a strategy we've had in place for a couple of years. Our most important priority that we can now put a check beside, was the refinancing of some of our senior convertible debentures, with the new gold link notes offering.

The only other capital structure change will come between now and August as the remaining junior convertible debentures come due in August of 2018. Those are expected to be fully settled with shares.

From an operations standpoint, we have three major goals that we're focused on this year. The first is the continuation of our optimization mine programs at Segovia, to further expand the operations, to take us forward on that project.

We're following up last year's successful drilling program at Segovia with another 20,000 meters of drilling this year, to further extend the resource and add further reserves to the first initial reserve, we announced in March, of 660,000 ounces for Segovia.

The third thing, operationally, is working with JDS Energy and Mining, looking at some technical studies around the Marmato project's underground resource, to get a handle on what the potential scale and scope of operations could be.

We're supporting that with up to about 10,000 meters of drilling this year. We hope this will all lead, by the end of 2018, to a preliminary economic assessment that will give us an idea of where we can take this project as we move ahead.

Dr. Allen Alper: That sounds excellent. Could you tell us a little bit about your management team, your board, and your background?

Mike Davies: Certainly. The company was founded by two entrepreneurial gentlemen. Serafino Iacono and Miguel de La Campa. I think they've put together a good management team for taking us forward, and certainly Lombardo Paredes, who's our CEO based in Medellin, is very hands on in orchestrating our operational improvements. Everything we've seen, the past couple of years, has not only increased production, but more importantly, has taken our annualized EBITDA from around 10 million dollars a year to 89 million dollars as of the end of March. Focusing on results has been Lombardo's cornerstone. He’s worked on a good number of very large scale projects.

Dr. Allen Alper: That's great.

Mike Davies: Our Vice President of Exploration is Alexandro Cecchi. He’s had at least a dozen years of experience in Colombia. Very much so on the Marmato project as well as on the Segovia project, and has been getting great results.

Myself, I've worked with this group for about 11 years. So, I have extensive experience operating with and working with companies in Colombia. I think that would be sort of the core of our operating management team.

Dr. Allen Alper: Ah, that sounds like a very strong, excellent, accomplished team that you have. Could you tell us a little bit more about your share structure?

Mike Davies: That's been the beneficiary of the work we've been doing recently. The biggest focus of our recent financing was reducing share dilution. We currently have 30.5 million shares outstanding, and there's up to another 17 and a half million shares issuable under the conversion of the 2018 debentures, which we expect will take place either at holder election, prior to maturity, or on maturity in August.

So, that would bring us up to about 48 million shares. With the financing, we issued warrants. The warrants are priced at 2 dollars and 21 cents Canadian. So a high probability based on our current share price of being exercised at some point, that's another 12.2 million shares, and with 1.8 million stock options that are in the money right now, our fully diluted shares, under the current structure, comes in around 62 million. That's over 30 million share reduction compared to what we were prior to the end of April, when we were fully open to potential share issues under the convertible debt that previously existed.

We're very pleased with the result to reduce the fully diluted count to 62 million and tighten up our structure.

Dr. Allen Alper: Sounds great! Could you tell us a bit about who has invested in your company?

Mike Davies: They're broadly based. The largest holders are obviously the founders. Management has the largest stake, as well as individuals such as Frank Giustra. We know we have a number of institutional funds that have come in. Certainly, a number came in through the debt offering.

Right now we don't have any holders over 10%, 20%, at this moment. A couple that are just under 10% but, it is fairly broadly held. We’ve seen more interest coming in from an institutional standpoint as of late, we've seen our share price rise from two dollars at the beginning of this year to this past week to a new 52 week high of $3.45, currently trading around $3.25.

So, we're starting to see a fair bit more investor appetite and that's happening continuously, new players coming into our stock.

Dr. Allen Alper: Ah, that's excellent. Could you tell us a bit about how it is operating in Colombia?

Mike Davies: I think, one of our advantages as a company, is that our founders have been involved in Colombia right from the beginning. With most of our management team being on the ground in Medellin, we have a really good sense of what it takes to operate in Colombia, given that our management team and founders live there.

It's had its challenges over time. I think the biggest thing that Colombia as a country has worked to try and resolve is the influence of illegal mining on the mining sector. Certainly in our title in Segovia, we feel that we've been successful in eliminating illegal mining in our title and it's largely been through our approach to socialization of the project through the implementation of a contract-miner model, so that artisanal miners, within our title, who are not operating within our three primary mines, still have an avenue to continue to mine, but by doing so under contract with us, bring in and sell the material to us, we process it, it's a win-win-win, as far as we, the miners, and the government are concerned.

It's an ongoing environment of challenge, but I think it's one that our company is well-positioned to meet, given the physical location of our key management. Also that the type of social approach we've taken, operating within our titles.

Dr. Allen Alper: Ah, that sounds like a very good approach, and a very experienced management team to handle it. Sounds excellent!

Mike Davies: It's not been without challenges. Last year we had a 42 day civil disruption caused by illegal miners that prevented our operations from operating at full capacity during that strike. But it resulted in a much greater level of awareness of the issues around illegal mining in Colombia, and how companies such as Gran Colombia can work to be part of the solution for those in the mining industry.

We've since had continued peaceful operations and a growing production result. So, we feel we're certainly doing well. But, the country is grappling with its ongoing agenda around illegal mining.

Dr. Allen Alper: Sounds like you have a team experienced in operating in Colombia.

Mike Davies: Yeah, I feel we do, that's one of our advantages.

Dr. Allen Alper: Very good! Could you tell our readers/investors the primary reasons they should consider investing in Gran Colombia Gold Corp.?

Mike Davies: I'd be happy to. I think there are a number of reasons. We have a high-quality producing asset based in Colombia, we are the largest player and we are cash generating. We're internally funding our growth. We just recently strengthened our balance sheet, so we're poised to continue funding that growth and expansion of profitable operations and have tremendous upside in our resource expansion.

But, I think the number one reason that investing in Gran Colombia is worth a look at this moment is the fact that, even though we've gone through a recent surge in share price, we still believe that we are undervalued compared to our peers, and we still represent a very attractive entry point for those interested in getting into our common shares.

Dr. Allen Alper: That sounds excellent. Is there anything else you would like to add Mike?

Mike Davies: No, I think we've covered the primary aspects. I mean, I can't say enough about what the recent success in the financing has done for us as a company in terms of tackling probably the number one concern that investors had for the last two years, which was the heavy burden that the potential dilution overhang placed on our share prices. It made it very difficult for investors to really come up with a per share value of the stock.

They recognized the quality of the asset, they could figure out evaluations on the assets, but there was a lot of uncertainty as to just how many shares would ever be out there? I think we solved that riddle with the financing, but I think more importantly it really settled down and strengthened our balance sheet. We went through the financing, and it really came to light that the key thing that investors were looking at is the blue sky potential of our Segovia operations, which are a high grade set of mines that have lots of opportunity. We've really only touched upon a small percentage of the total opportunity there to add more reserves and resources.

So, I think that's the area that investors will find as they watch us going forward, we're really going to be putting a lot more activity around taking Segovia further, because it truly is a very high quality, high grade asset.

Dr. Allen Alper: That sounds very good. Very exciting.

www.grancolombiagold.com

Mike Davies

Chief Financial Officer

(416) 360-4653

investorrelations@grancolombiagold.com

|

|