Interview with Rudi Fronk, Chairman and CEO, Seabridge Gold (TSX: SEA; NYSE:SA): The Best Leveraged Play to a Rising Gold Price

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 6/7/2018

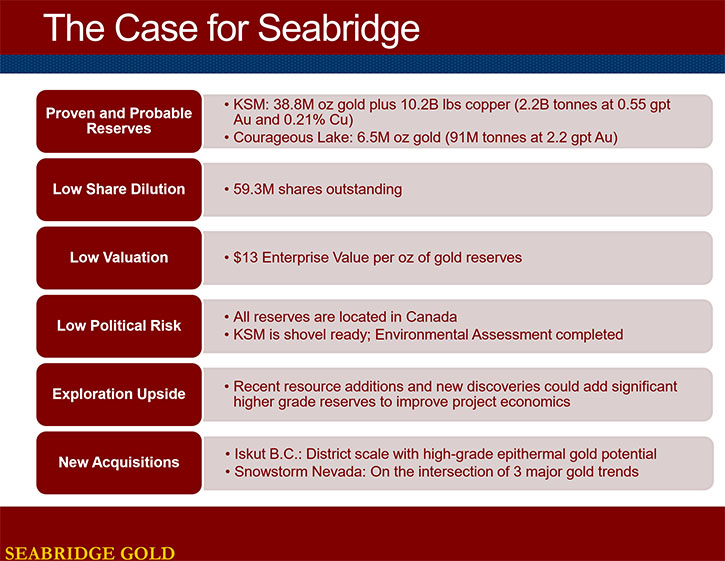

Seabridge Gold (TSX: SEA; NYSE:SA) holds one of the world's largest resource bases of gold, copper and silver, with the objective of growing gold resource and reserve ownership per share.

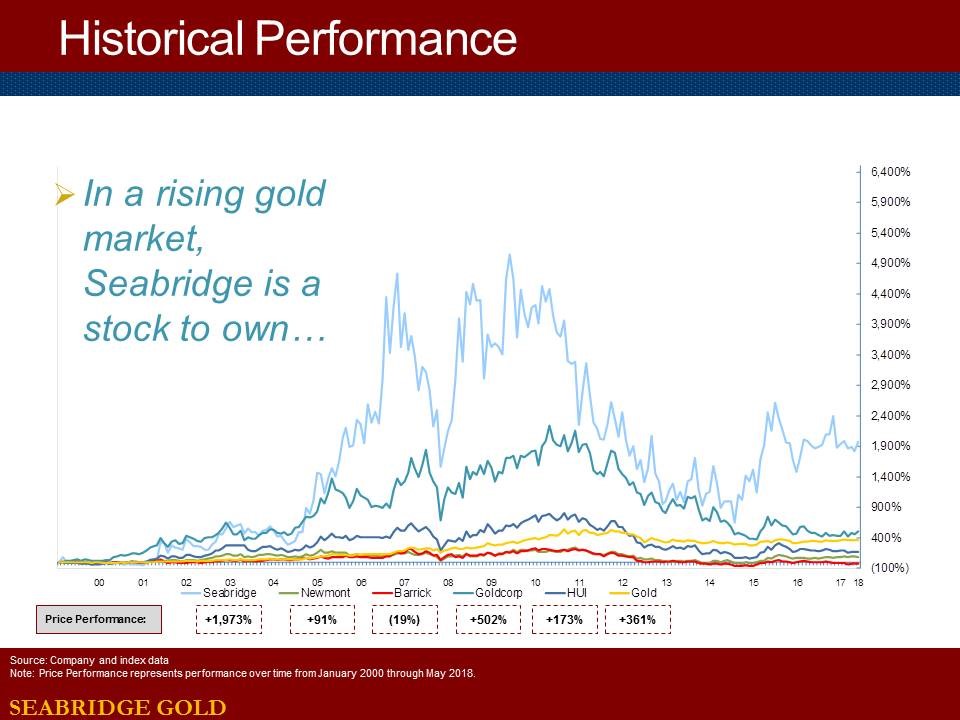

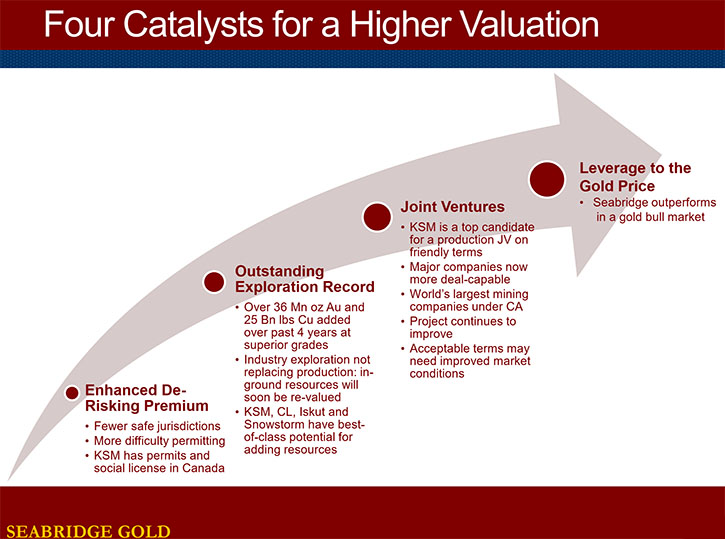

We learned from Rudi Fronk, who's chairman and CEO of Seabridge Gold, that he started Seabridge almost 19 years ago with a contrarian view on gold and with the intention to build the best leveraged play to a rising gold price, so that their share price would outperform not only gold but also other gold equities. As a result, any 10% increase in the price of gold over the past 19 years, has resulted on average in a 50% increase in the company's common share price.

The company follows a risk-reducing, project generator strategy that includes acquiring North American deposits and advancing them through exploration and engineering to the point where they can be sold or joint ventured to established producers for mine construction and operation. Objectives for 2018 include finalizing a joint venture agreement, with a major mining company at their KSM project, located in northern British Columbia, Canada, with the goal to maintain a meaningful interest in the project while minimizing capital exposure. Seabridge also plans exploration drilling at their Iskut project in northern British Columbia and geophysical surveys at its recently acquired Snowstorm project in Nevada. With 30% owned by insiders, the company has a very tight share structure and has maintained a very long loyal shareholder base for the past 20 years. They have a very seasoned board and a very strong experienced management team.

KSM Project

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Rudi Fronk, Chairman and CEO of Seabridge Gold. Could you give our readers/investors an overview of your company, your focus and current activities?

Rudi Fronk: Certainly. We started Seabridge in October of 1999 with a contrarian view on gold. Gold then was trading at about $260 an ounce. We believed that gold would go substantially higher over time, which obviously it has. Our goal back then, which remains the same today, was for Seabridge to be the best leveraged play to a rising gold price. We do that through the concept of growing ounces of gold per common share. Everything we do from acquisitions through exploration is based on our belief that these activities will result in growing ounces per share.

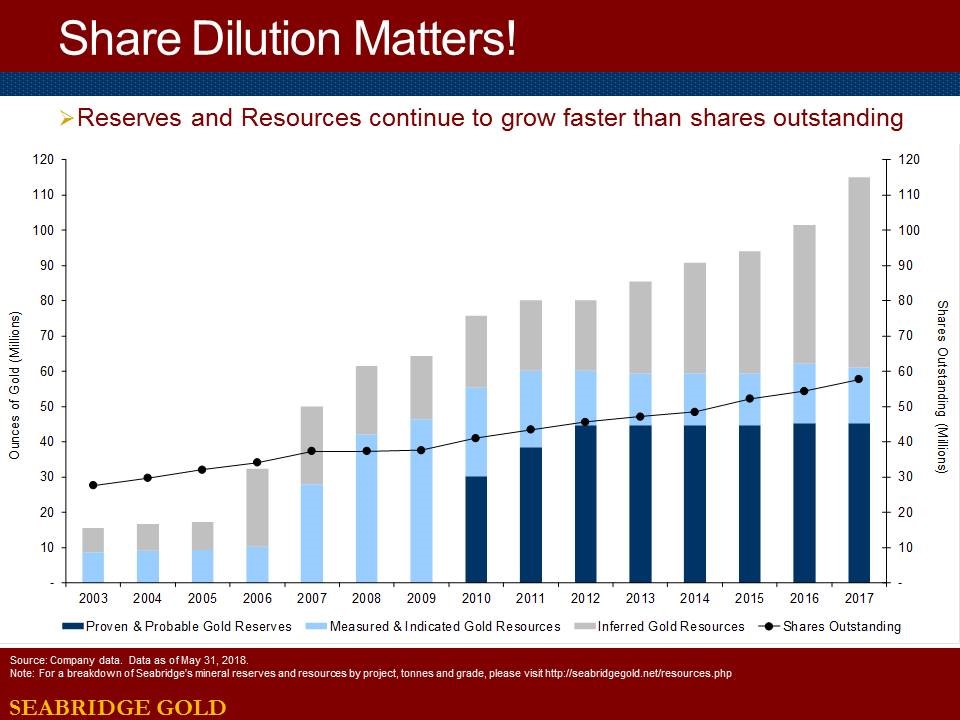

The junior gold industry as a whole continues to issue shares, after shares, after shares, without offsetting that dilution with added value. Our goal is to offset any equity dilution with accretion in gold ounces. We look to grow ounces in the ground faster than shares outstanding. As a result of this discipline, if you look at our track record over the past 19 years, on average Seabridge common shares have outperformed the prices of gold by over 500%. Over this time period, a 10% increase in the price of gold, on average, has resulted in a 50% increase in our common share price.

Dr. Allen Alper: Fantastic! That's really benefited your shareholders. You can be really proud of that.

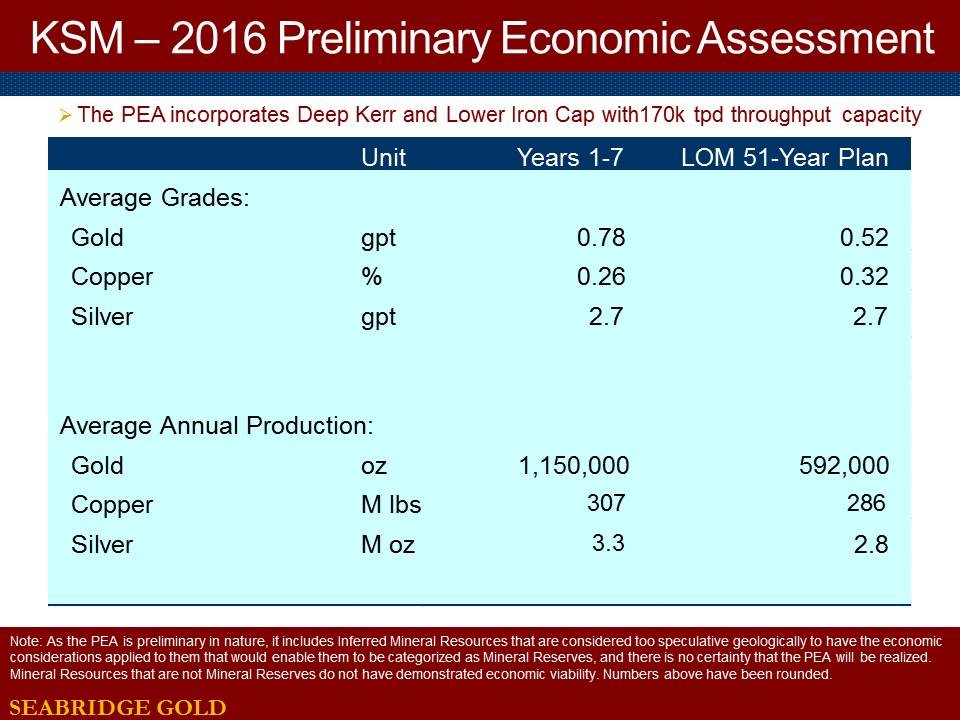

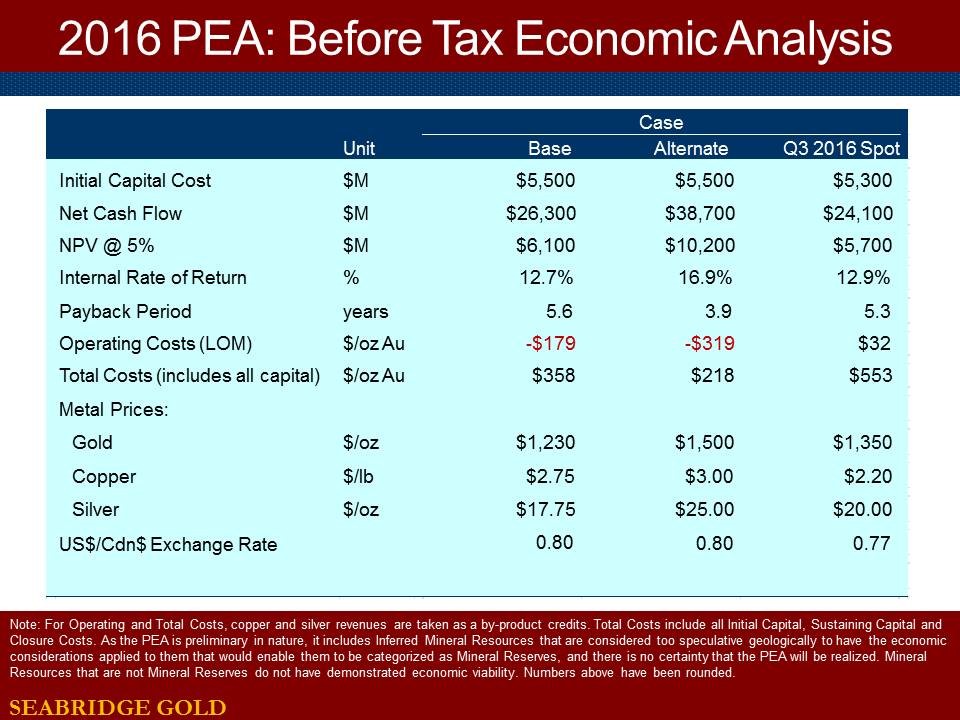

Rudi Fronk: It is not just ounces of gold per share it's also the quality of our resources and reserves. At KSM we now have the largest undeveloped gold-copper project in the world today as measured by gold reserves. KSM has 39 million ounces of gold reserves and just over ten billion pounds of copper. In addition, over the past several years we've added another 36 million ounces of gold and 25 billion pounds of copper resources at grades that are higher than our reserves. A 2016 technical study shows that with these recent resource additions, KSM’s all in cost of production, including up-front capital, sustaining capital, closure costs, and operating costs, net of base metal credits, would be about $300 an ounce at today's gold and copper price meaning that it's a very capital efficient project. In addition, KSM could become one of the largest gold mines in the world producing over 1.0 million ounces of gold per year for the first seven years of production with a mine life that is expected to exceed 50 years!

Dr. Allen Alper: That sounds excellent. Could you tell our high-net-worth readers/investors your primary goals for 2018?

Rudi Fronk: Yes, our primary goal for this year is to complete a joint venture agreement at KSM with a major mining company. KSM’s reserves and resources are so large, that in our view, there are fewer than 10 companies that have the technical, financial and social skills to build and operate KSM. We have dialog going on with some of the largest gold and base metals companies in the world. Our objective in a joint venture is to maintain a meaningful interest in the project, while minimizing our capital exposure. We have recently turned down proposals that did not meet these objectives. We only get to do this once and terms trump timing.

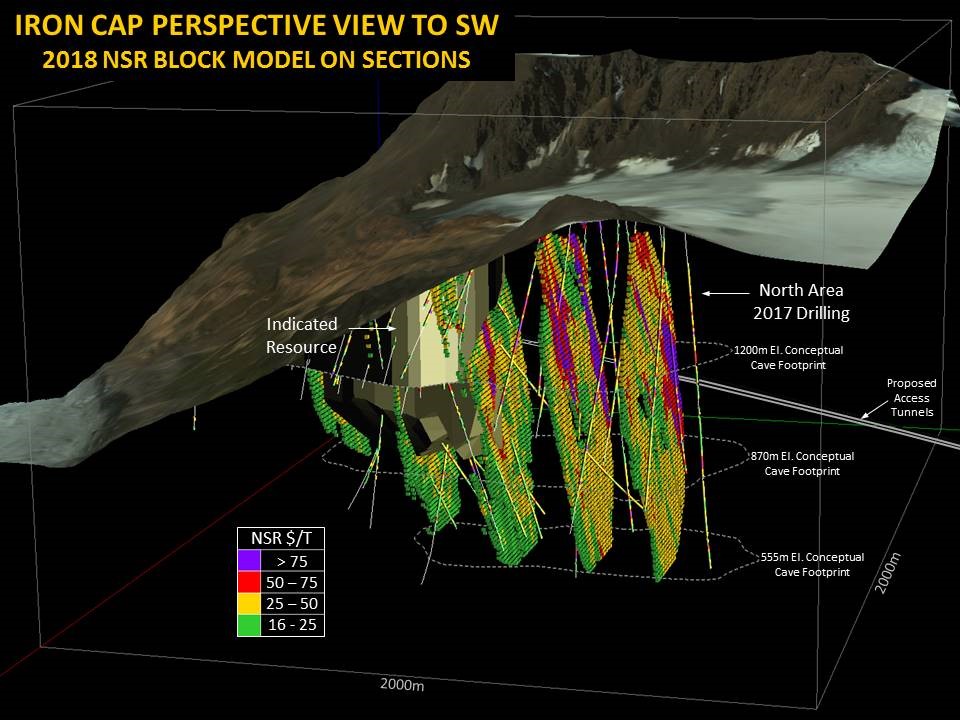

A second objective for 2018 is to follow-up on the tremendous exploration results we achieved last year at KSM’s Iron Cap deposit where we added over 14 million ounces of gold and nearly 7 billion pounds of copper in the inferred resource category at grades that are higher than KSM’s reserves.

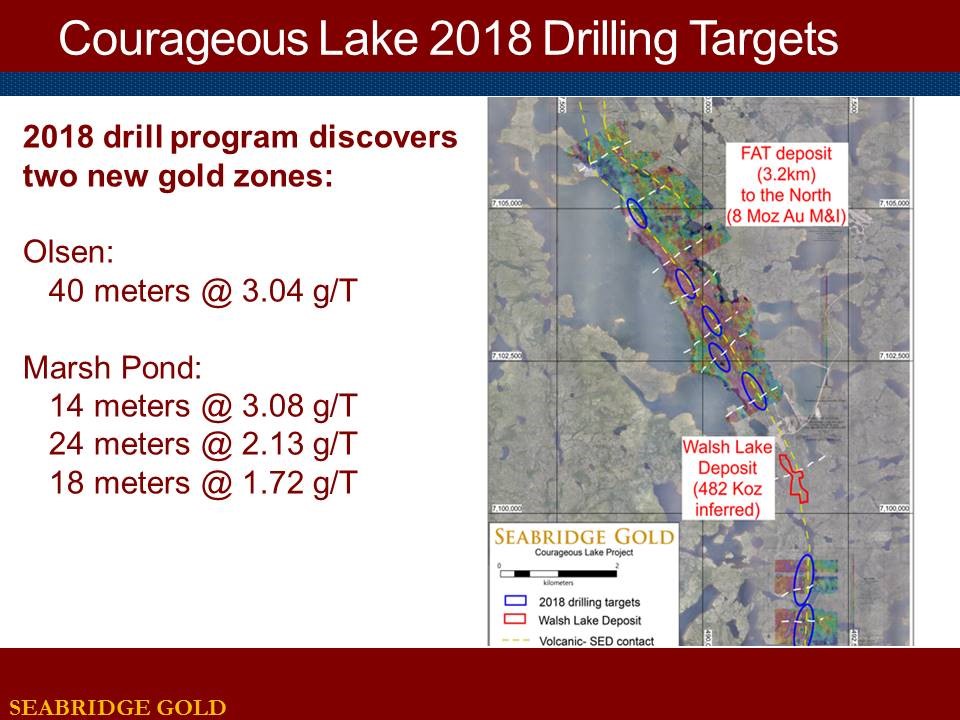

Another objective for 2018 was to complete a drill program at our Courageous Lake project located in Canada’s NWT by testing targets that we believed could improve the project’s economics. We recently announced the results of this program which discovered two new deposits that could add resources and reserves at grades higher than Courageous Lake’s reserves.

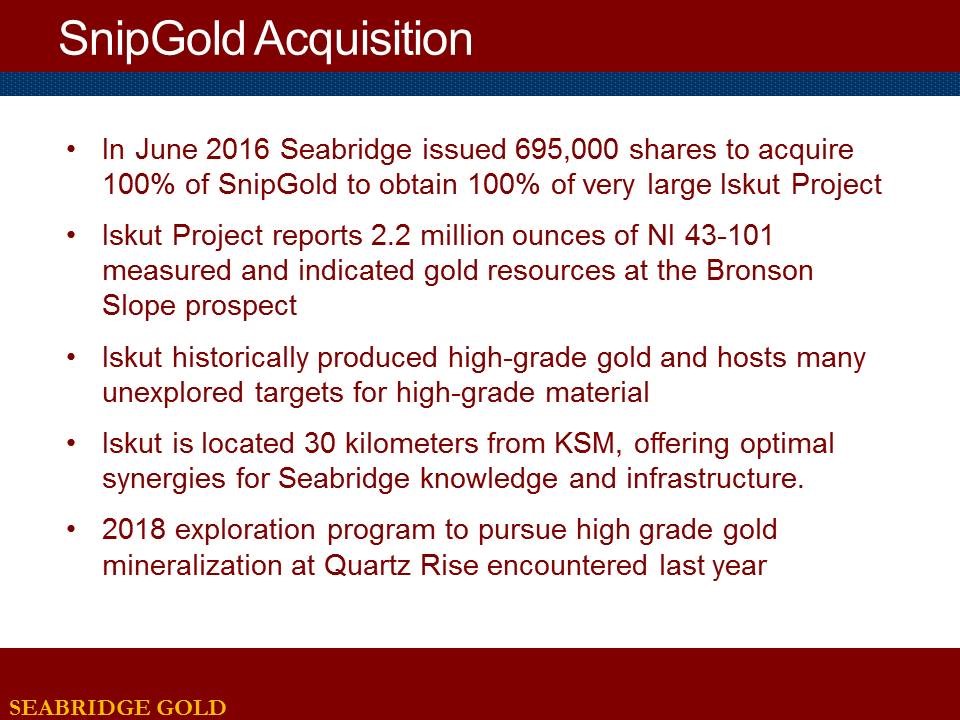

Another exploration objective for 2018 is to complete our second drill program at our Iskut property, located in northern British Columbia. It's a project we acquired a couple of years ago when we purchased a company called SnipGold. It is another large porphyry system like KSM that we believe also has high grade epithermal gold opportunities that we will be pursuing this year.

Another objective every year for us is to continue to improve our social license. In today's world, you need the support of local communities and indigenous peoples to ensure success at your projects. We have worked conscientiously on that at KSM for well over a decade. In connection with our commitment to social license, when we bought Snip Gold, we acquired an old mine, called Johnny Mountain, where we have taken on the responsibility for its reclamation. We recently filed a five year reclamation plan to clean up the mess made by previous operators, starting this year.

Finally, as we look to do every year, we expect to continue to grow our ounces of gold per common share. We recently issued 1.15 million shares at a 27% premium to market to fund this year’s exploration activities. We believe that the 2018 KSM drill program will more than offset this recent equity dilution.

Dr. Allen Alper: Sounds like it's going to be a fantastic year. Sounds great! It's going to be a year where a lot of news will be coming forth and I believe your shareholders will benefit from it. Could you refresh the memory of our readers/investors about your background?

Rudi Fronk: I've been in the mining space for 38 years now, originally trained as a mining engineer at Columbia University. I also completed graduate degrees at Columbia in mineral economics and finance. Before I started Seabridge in 1999, I worked for several larger mining companies and was involved in building gold mines in places like Nicaragua, Honduras, and Panama. I love what I do! At Seabridge, we have a seasoned team in place with a great asset base

Dr. Allen Alper: That sounds fantastic. It's great to do something you love, be successful and have the opportunity to keep on doing it. That's really great. Could you tell me a bit more about your team and board?

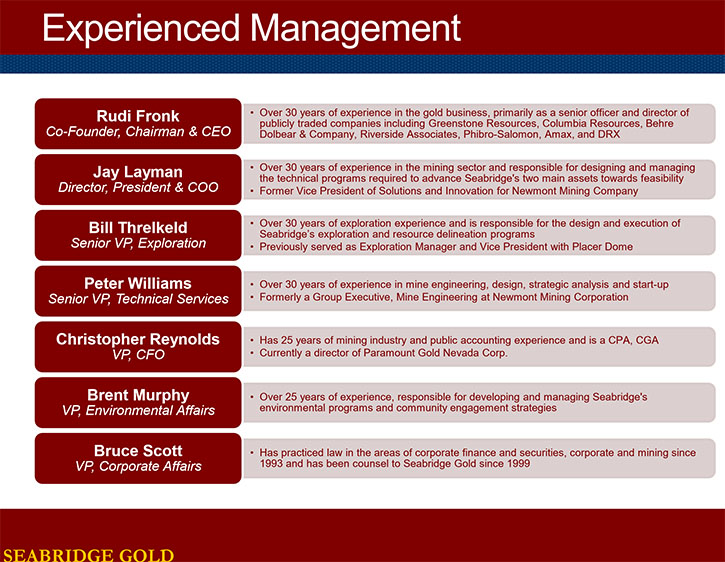

Rudi Fronk: On the engineering side, most of the engineers we have at Seabridge are from Newmont Mining. Jay Layman, who ran technical services at Newmont for several years, is our President and Chief Operating officer. Peter Williams, who ran their global mining engineering, is now our senior VP of technical services. We recently added another top engineer from Newmont named Mike Skurski. On the exploration side, we have Bill Threlkeld, who spent a significant portion of his career at Placer Dome where he ran all of their Latin American exploration programs in the 1980s and 1990s. Supporting Bill on the exploration side are a number of highly qualified exploration geologists including Mike Savell who was Noranda’s top porphyry geologist. Our permitting activities are led by Brent Murphy who successfully completed KSM’s environmental approvals over the past decade.

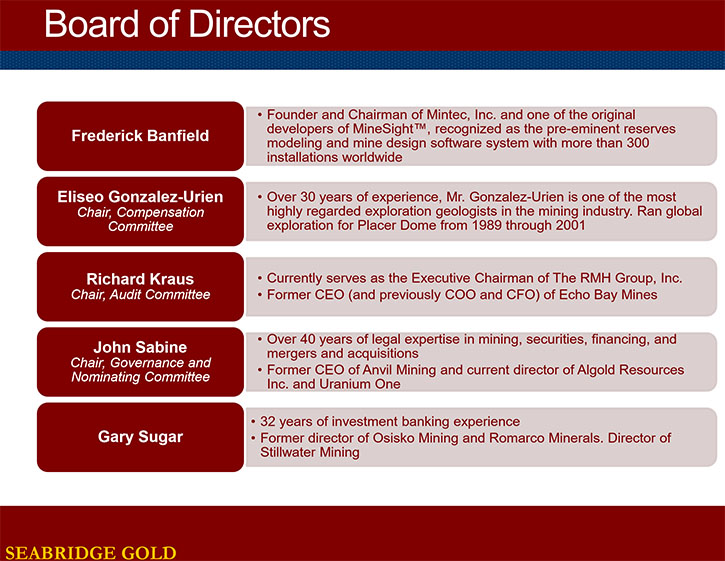

Our board is comprised of seasoned mining industry experts covering financial, engineering, exploration, legal and permitting disciplines.

Dr. Allen Alper: Sounds like it's a very experienced, very balanced and extremely strong team. Excellent, and you have an outstanding background.

Dr. Allen Alper: Could you tell our readers/investors a little bit about your share structure?

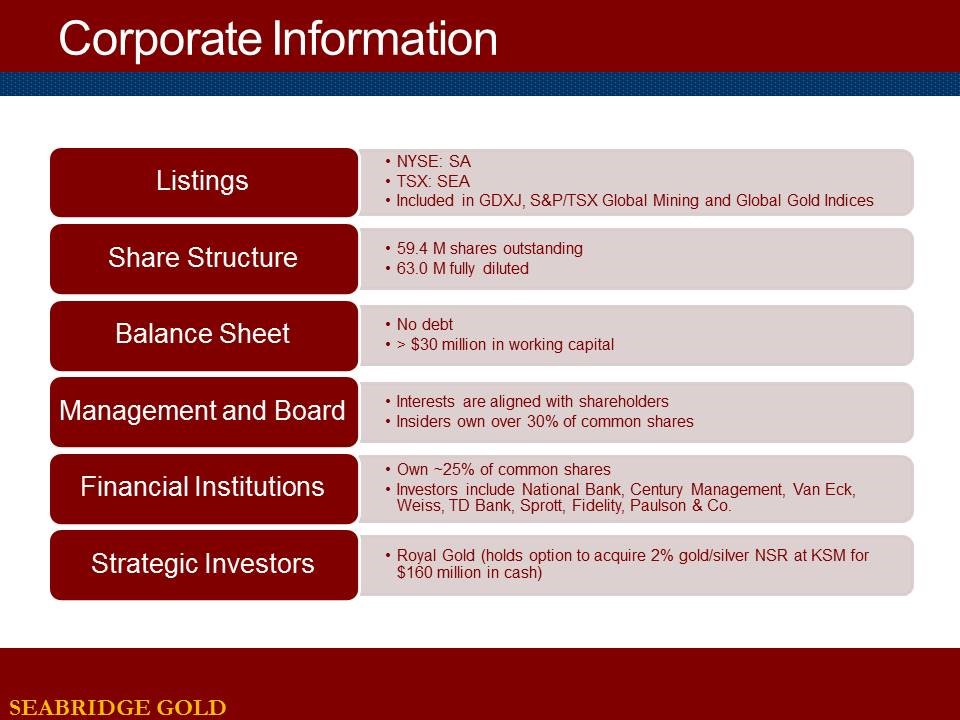

Rudi Fronk: Very tight. Insiders own over 30% of the stock. A good chunk of that is owned by Albert Friedberg, who runs a currency and commodity business in Toronto. FCMI, his firm, owns 19.4% of the company. Officers, directors, co-founders own another 10% plus of the company. We only have 59 million shares outstanding. Considering that Seabridge has now been around for almost 19 years and has developed one of the world’s largest portfolios of gold reserves and resources, having only 59 million shares outstanding is a very significant accomplishment and probably is what I am most proud of. In addition to insider ownership, we have good financial institution ownership including Century Management, Van Eck, Weiss Asset Management, Sprott, Fidelity and Paulson & Co.

Dr. Allen Alper: Excellent! What are the primary reasons our high-net-worth readers/investors should consider investing in Seabridge Gold.

Rudi Fronk: Great question, its one we get all the time. I think it's the leverage we have to the gold price. If you're looking for a gold investment as part of a balanced portfolio, our track record shows that Seabridge shares will give you the best bang for your buck. Another factor that we expect to drive value going forward will be the successful completion of a joint venture partnership at KSM. There's a lot of disbelief in the market right now that we will actually be able to secure a partner on terms that will make sense to both sides. In fact the combined NYSE/TSX short position in Seabridge is about 10 million shares, or 25% of our float. We believe that when we successfully complete a KSM joint venture, we could see a tremendous short covering rally.

Last but not least, it's the discipline we've shown in terms of keeping our share count low. People know that they can trust us in terms of maintaining a low share count and not blowing shares out just for the sake of raising dollars, and making sure that we offset any equity dilution with increasing ounces on a per share basis. This is a guiding principle that we have maintained for 19 straight years, and will continue to do so in the future.

Dr. Allen Alper: That sounds excellent. Very compelling reasons for our high-net-worth readers/investors to consider investing in Seabridge Gold. Rudi, is there anything else you'd like to add?

Rudi Fronk: I believe we covered a lot today and I look forward to answering any questions your readers may have.

Dr. Allen Alper: Thank you. I enjoyed talking with you again, and I'm very, very impressed with what you and your company are doing.

http://seabridgegold.net/

Rudi P. Fronk, Chairman and CEO

Tel: (416) 367-9292 · Fax: (416) 367-2711

Email: info@seabridgegold.net

|

|