Interview with Justin Brown, Executive Director, Element 25, Developing World Class High Purity Manganese Production for Li-Ion Batteries

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 5/27/2018

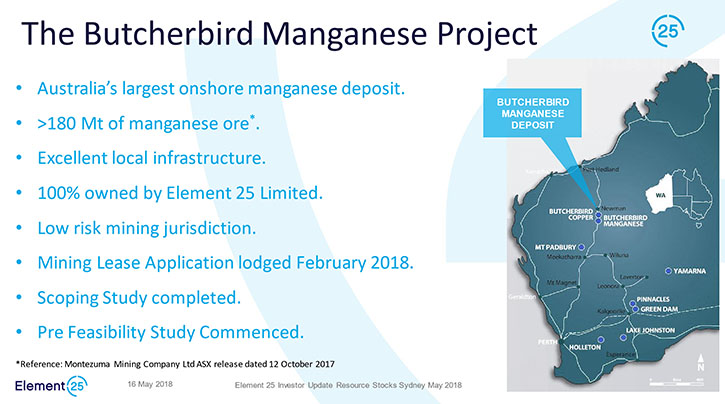

Element 25 (ASX: E25) (formerly Montezuma Mining (ASX: MZM)) is focused on the development of a high purity manganese production facility at their world class 100% owned Butcherbird manganese Project, located in Western Australia. We learned from Justin Brown, who is Executive Director of Element 25, that as manganese prices started to pick up in 2017, due to the demand for manganese for use in lithium ion batteries, the company in collaboration with the Commonwealth Scientific Industrial Research Organization (CSIRO) developed an innovative hydrometallurgical flowsheet to allow for rapid, low cost extraction of manganese from the unique Butcherbird deposit, which boasts in excess of 180Mt in resource. According to Mr. Brown the test work was incredibly successful as was the recently published scoping study. Near term plans include a pre-feasibility study for the next 6 to 12 months before they move into a definitive feasibility study phase, where they will finalize project financing and then move into construction.

Element 25 (ASX: E25) formerly Montezuma Mining (ASX: MZM)

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Justin Brown, who is Executive Director of Element 25 Limited. And you've recently changed your name to Element 25, is that correct?

Mr. Justin Brown: Element 25. Manganese is the 25th Element of the Periodic Table. So the name is derived from that.

Dr. Allen Alper: Very good. Could you give our readers/investors an overview of your company, your focus and current activities, Justin?

Mr. Justin Brown: Certainly. Montezuma became Element 25 in the last couple of weeks. It has been a public company for around 11 years, until recently primarily focused on exploration. We've had exposure to a number of commodities including gold, nickel and more recently manganese.

We discovered the Butcherbird manganese deposits in 2009, 2010, and we proceeded to drill out a very large manganese resource to the tune of about 180 million tons of ore. We did a lot of work beneficiating the material to produce a sellable concentrate for use in the steel-making industry.

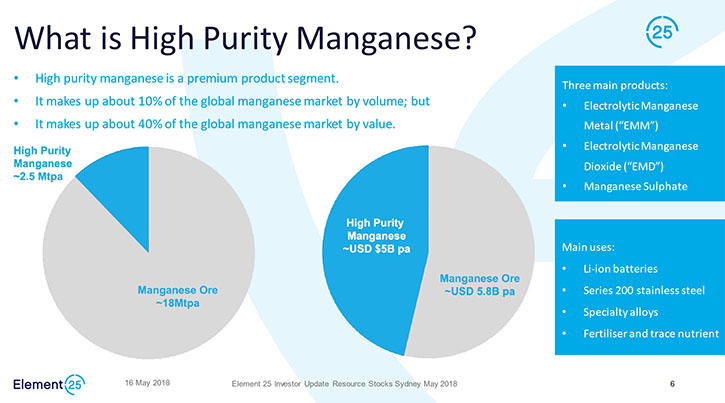

Then the market turned against us and the manganese price fell away a lot for a period from 2012 to 2016, and then started to pick up in 2017. In 2017 we partnered with the Commonwealth Scientific Industrial Research Organization, an Australian federal government research organization, which has a minerals processing unit. With them we worked on changing the logic a little bit from a bulk mining strategy to a high purity manganese strategy because of the expected surge in the demand for manganese for use in lithium ion batteries as the world transitions from traditional energy sources to renewable energy and storage, and of course the electric vehicle revolution as well.

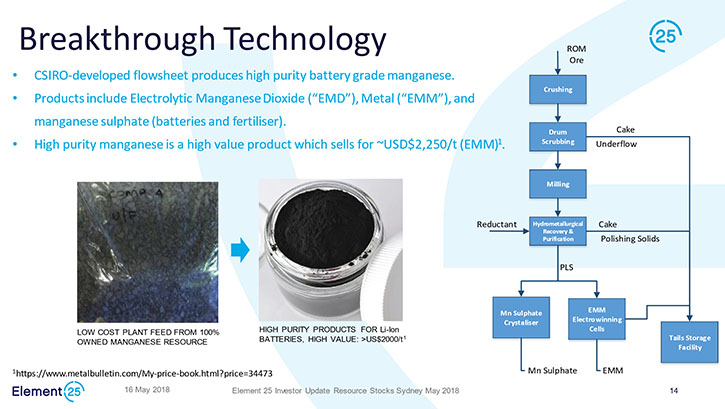

CSIRO worked on developing a flow sheet for us, which allowed us to produce very high purity manganese products from our ore at Butcherbird. The three main focuses were electrolytic manganese metal, electrolytic manganese dioxide and manganese sulphate for specialty steel, certain alloys and batteries. Manganese Sulfate, is used in some of the more cutting edge, NMC, lithium ion type batteries, which are a dominant emerging technology in batteries for electric vehicles.

So that test work was incredibly successful and we emerged from 2017 with a flow sheet that had been tested multiple times and optimized. We have just completed a scoping study phase of work where we examined the various possibilities for product selection and size of the production operation of Butcherbird. We completed that just last week and published it.

Now we're embarking on a pre-feasibility study, which will further optimize and explore the exact production scenarios that will best serve the company. We expect that to occupy us for the next 6 to 12 months before we move into a definitive feasibility study phase, where we'll finalize product financing and then move into construction.

So, we're pretty focused on it now. We see it as a fantastic opportunity for the company to transition from an exploration company to a developer. And we see a lot of value in the opportunity for shareholders as well.

Dr. Allen Alper: Oh, that's fantastic. How long do think it would take you, once you get funding and everything, to build a plant and get into production. What is the time frame on something like that?

Mr. Justin Brown: We are looking at a 12-month construction period in the time line. That'll become clearer as we move through the feasibility phase. But, that's the number in the plan at the moment. First production is likely '20, '21. We see that as conditional on successful financing, et cetera, but we see that time frame as pretty optimal as the electric vehicle transition really picks up pace. So we think that's a good time frame to work toward.

Dr. Allen Alper: Well that sounds excellent. Could you tell our readers/investors a bit more about your property, the size, the purity and all.

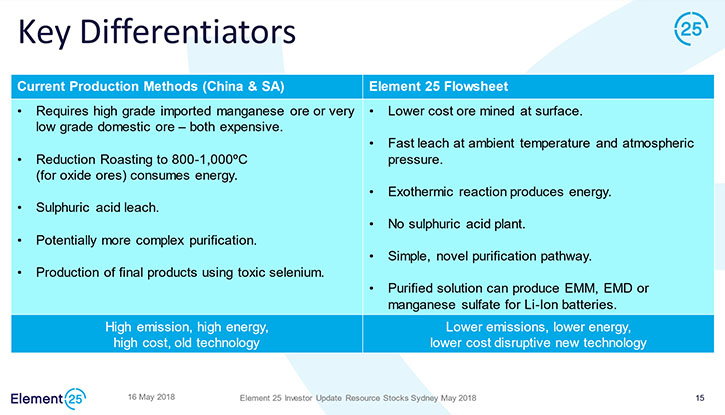

Mr. Justin Brown: The resource is located about 120 km south of a town in Western Australia called Newman, which is a big iron ore mining center. It's about 550 km south of Port Hedland, which is the nearest port with capacity for bulk commodities. We've drilled out the deposit. We have 180 million tons at an average grade of about 11% manganese. When we mine the material, we put it through a "scrubber" and we wash out the fine material which is mostly clays. Once we've done that, we have a concentrate which is about 30-32% manganese and very low in impurities other than silica and a couple of other inert materials. Then we use a hydrometallurgical process to extract the manganese into solution. We discovered, when we did the work with CSRO, that it's very leachable, much more leachable than most manganese ore. It has some interesting mineralogy associated with it and it leaches about 95% of the manganese in about 30 minutes on that lab scale, at ambient temperature and atmospheric pressure.

So it leaches very quickly. From that point we have the option of either producing high purity manganese sulfate crystalline products or electrolytic products, including electrolytic manganese dioxide and manganese metal.

The project has fantastic infrastructure. A highway runs straight through the project. It has a gas pipeline that also runs through the project so we have access to comparatively cheap energy. We're also looking at the integration of wind and solar into the solution as well, because that part of Australia is well placed for the application of renewables. In doing that, we think we can get the power solution costs really low. That's important because electrolysis consumes a lot of energy. If our power solution can be proven, we can be incredibly competitive on a cost basis with other producers, primarily in China. The opportunity is there because China has largely depleted their domestic manganese reserves and so they have to source manganese predominantly from Africa. We are in a fantastic position to take advantage of that opportunity.

Dr. Allen Alper: Sounds excellent! Could you tell our readers/investors a bit about your background, your Board and your team?

Mr. Justin Brown: My training formally is as a geologist. I cut my teeth in Western Australia in the early '90's. I've worked on a number of commodities over the years, both in the exploration phase and the development phases, including resource definition and mining. I moved into more of a corporate roll about ten years ago, when I listed Montezuma Mining on the Australian Stock Exchange. Since then I've been a Managing Director, or Executive Director with the company.

I've held multiple directorships with other companies as well, so I'm quite experienced in the corporate space as well as having a strong technical background. My fellow directors include Seamus Cornelius, who is a lawyer by training. He spent 20 or so years in Shanghai as a partner. He's extremely experienced in Chinese markets, where a lot of these products potentially will be purchased. He speaks fluent Mandarin, so that's incredibly useful from the negotiation point of few with potential Chinese partners.

The third director is John Ribbons, who has a finance background. He's an accountant, a non-executive director and the Company Secretary as well.

It's a pretty well rounded board. We also have excellent technical people. Other than that, we're still a pretty small team of about five people, but we'll be looking to grow quickly as we move into the feasibility phase of this project.

Dr. Allen Alper: Sounds excellent! Could you tell our readers/investors a bit about your capital structure? It looks like it's a very tightly held company.

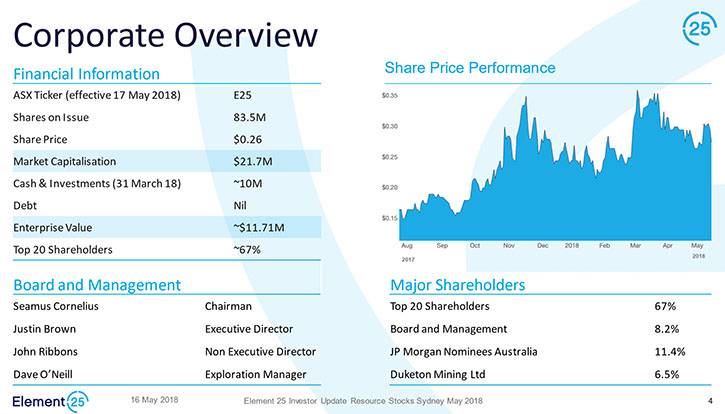

Mr. Justin Brown: Compared to most of our fellow Australian-listed exploration companies, we do have a very tight capital structure for a company that's been listed for 10 years. We only have around 83 million shares on issue, which is quite remarkable and keeps it very tight. That provides leverage as we move to a successful development phase, which improves the returns for shareholders. It's that way because we've been quite successful in conducting corporate transactions, over the life of the listed company, as well as the exploration activities. That includes the purchase and sale of different mineral assets to raise capital without going to the market. So yes, a very tight capital structure. We think that's important in terms of getting the best return for shareholders as we develop this project.

Dr. Allen Alper: Sounds excellent! What are the primary reasons our high-net-worth readers/investors should consider investing in Element 25.

Mr. Justin Brown: That's a good question. If you look at the investment proposition, we have just demonstrated the economic viability of the project at a scoping level. We have a market capitalization which is very modest, about $20, $25 million dollars. We have a balance sheet, which comprises about ten million in liquid assets, cash and a couple of key investments that will provide further capital for us. So, we're fully funded for the budgeted pre-feasibility and feasibility study phases, so there will be little or no dilution for that period. That type capital structure will be maintained as we realize the value of the project.

I think the market for manganese is looking very buoyant, particularly in the high purity segment. We've engaged several experts to provide market research for us. They’ve made very bullish forward looking forecasts, both on volume and price for these high purity manganese products. The Chinese manganese market is declining because of their lack of domestic ore. On a cost basis, I think we can be incredibly competitive with other producers of these products. Because of the size of the resource, it's imminently scalable. We can come in at a modest capex and get underway, generate cash and then we can grow quite aggressively. The upside case in the medium term is incredibly bullish for the business.

I think it's financially robust, if you buy it today you get in at a comparatively low price. I think the future looks very bright for us.

Dr. Allen Alper: Sounds excellent! Sounds like you have an outstanding project. It's a unique project. It's very large. You're close to the market. It sounds excellent.

Mr. Justin Brown: All those things you said are true. It's well positioned. It's big. It's going to have a very long mine life. If we were to produce 100,000 tons of manganese metal a year, which would generate in excess of $200 million US dollars in sales, a relatively small case, but even at that size we would have a lucrative business. It just demonstrates the scalability. If we can double, triple, quadruple that volume as we move forward and the mine life's not constrained by the resource side, the large, very simple resource at surface, very low strip ratio, very low cost mining, the fantastic infrastructure and the project. The timing, change in market demand and price are all good, all in favor of us. So I think we have a bit of a tail wind working for us and I think we're going to have some great success.

Dr. Allen Alper: Sounds excellent!

http://montezuma.com.au/

http://www.element25.com.au/

Justin Brown

Executive Director

Phone: +61 8 6315 1400

Email: jbrown@e25.com.au

|

|