Interview with Normand Champigny, President and CEO of Sphinx Resources Ltd. (TSX-V: SFX), Focus on Precious Metals and High-Grade Zinc in Quebec

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 5/20/2018

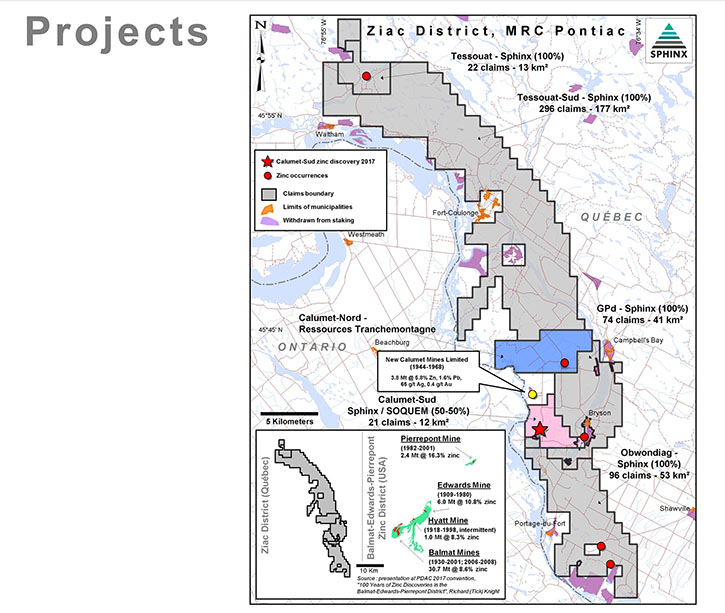

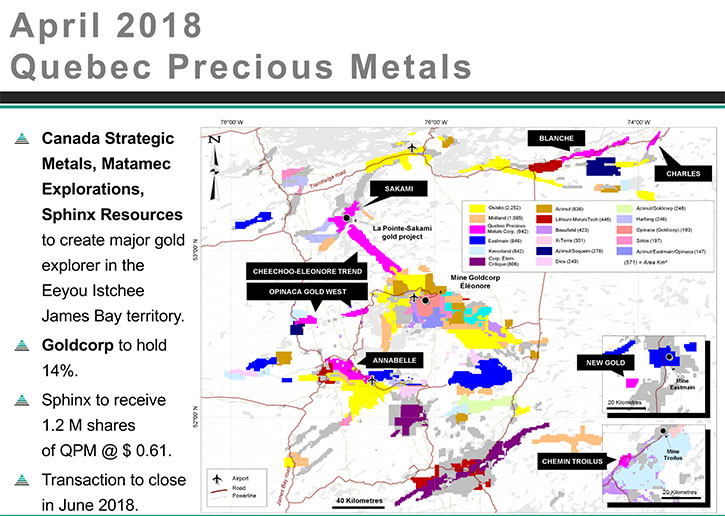

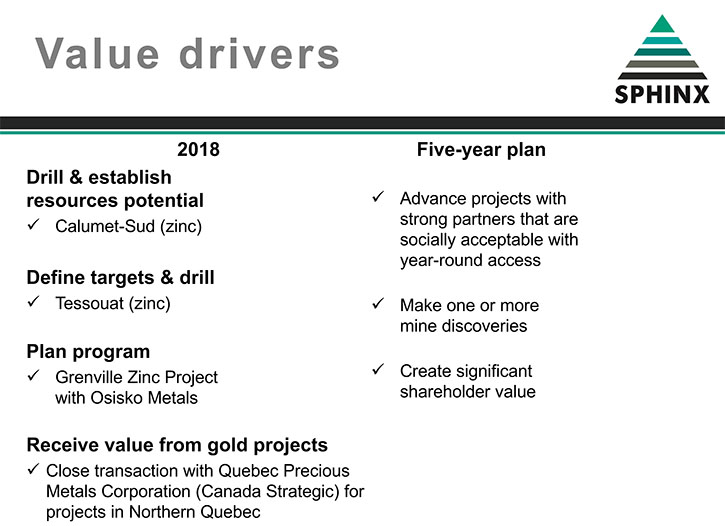

Sphinx Resources Ltd. (TSX-V: SFX) is engaged in the generation and acquisition of exploration projects in Québec, one of the world’s most attractive mining jurisdictions. We learned from Normand Champigny, President and CEO of Sphinx Resources, that they are currently focused on zinc and recently they've done deals with Osisko Metals to advance their Grenville Zinc Project, and also with SOQUEM for the Calumet-Sud zinc project. We learned from Mr. Champigny that zinc is a critical metal for infrastructure, and demand for zinc is rising, largely driven by new infrastructure investment in China, so zinc prices are climbing. We learned from Mr. Champigny that in April they helped create a new company called Quebec Precious Metals Corporation to create a leading gold explorer in the James Bay region of Quebec, and Sphinx will receive shares of the new company as part of the transaction. According to Mr. Champigny, they have an excellent team of actual mine finders. They are working in a very favorable jurisdiction, and the company's plans for 2018 include drilling the two exciting zinc projects.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Normand Champigny, President and CEO of Sphinx Resources. Could you give our readers/investors an overview of your company, your focus and current activities? And also, tell them all of the great new things that are occurring in your company.

Mr. Normand Champigny: We are a TSX-V listed company. We focus on the province of Quebec. We have three actual mine finders on our team, people who found mines in Eastern Canada. Our focus, at the moment, is on zinc. Recently, we've done a deal with Osisko Metals to explore further for zinc in Southern Quebec. The gold projects that we used to have, have been put into a new vehicle, in which we are participating, called Quebec Precious Metals, which is supported by Goldcorp. Now, our intention is to focus on the exploration and development of zinc assets in the province of Quebec.

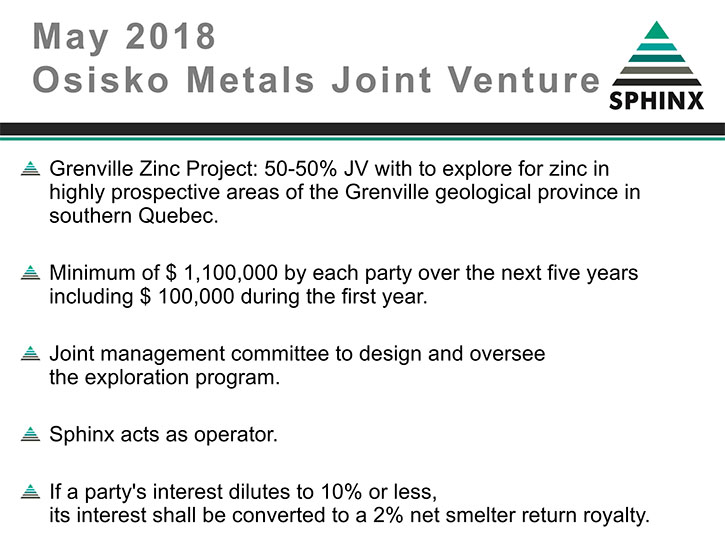

Dr. Allen Alper: That sounds great. Could you tell our readers/investors a bit more about the joint venture with Osisko Metals?

Mr. Normand Champigny: Osisko is a very familiar name to many people in the exploration industry in Canada and Quebec. Over the last year they have formed a company called Osisko Metals to explore for zinc in the well-known Bathurst mining camp in the province of New Brunswick and also in the Northwest Territories. Their Chair, Bob Wares is well known in the industry, a mine finder. He and we decided to look at finding giant zinc deposits in southern Quebec. We looked at what has been done in Australia, some of the largest mines, like Broken Hill, and Cannington to see what we can learn from that to find the same thing here in Quebec. On the basis of those observations, we have created this 50/50 joint venture, which is going to look at the large area in Southern Quebec called the Grenville Geological Province, which is characterized by high grade metamorphic rock. We'll apply those techniques on the ground to identify areas where we'll do detailed exploration, and then, eventually drilling. So, we have a great partner working with us to find some large mines in Quebec.

Dr. Allen Alper: That's great. From what I understand both of you are committed to putting in funds, but you'll be the active operator on the project. Is that correct?

Mr. Normand Champigny: Sphinx will operate the project with technical input from Osisko Metals. We're going to start the planning process very shortly to execute that plan in 2018 and 2019. Also, Sphinx will be involved in getting funds, as required, for advancing its zinc projects with Osisko and also with SOQUEM and elsewhere, where it has 100% zinc projects in southern Quebec.

Dr. Allen Alper: That's exciting. You might mention to our readers/investors about zinc and its importance. My understanding is there's a shortage in the supply of zinc. What are your thoughts on zinc and its importance?

Mr. Normand Champigny: Zinc is a critical metal for our society for rustproofing, for infrastructure, even for electric cars. There has been a declining supply of zinc in many places of the world where large mines have shut down, including Canada. Demand is rising, largely driven by new infrastructure investment in China. That has created a gap and put pressure on the price, which has gone from 80 cents to $1.40, $1.50 in recent times. So, there's a push to take advantage of that price by developing new projects.

Dr. Allen Alper: Well, that sounds great. Why don't you tell our readers/investors a bit about some of the other successful projects that Sphinx has?

Mr. Normand Champigny: At the end of April, we also announced that our gold projects are being put into a new company, Quebec Precious Metals, of which we're receiving shares as part of the transaction. This will be done when we close the transaction, which should happen around the end of June. Quebec Precious Metals will be focusing on drilling a project called Sakami in the same area where the Eleonore mine is, to advance the project to the resource estimation stage as quickly as possible. And, the plan is to have Quebec Precious Metals deliver a first resource estimate by the end of 2019.

Dr. Allen Alper: Sounds excellent. What will the participation of the Sphinx shareholders, be in the new company?

Mr. Normand Champigny: As part of the transaction, Sphinx will receive 1.2 million shares of the new company.

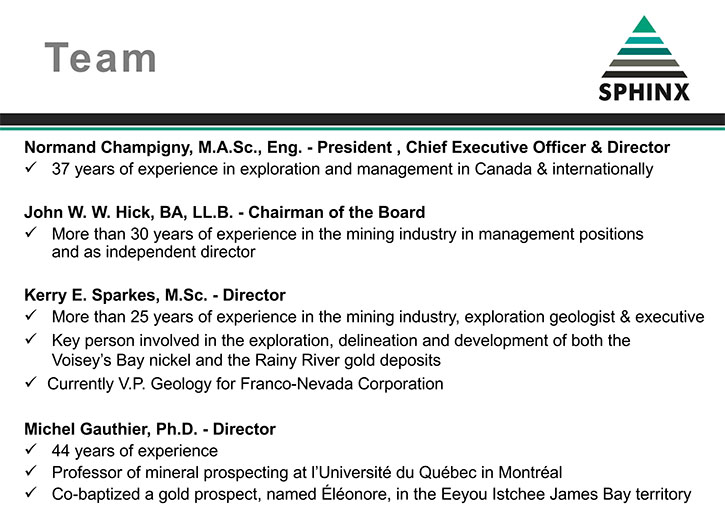

Dr. Allen Alper: That sounds good. Could you update our readers/investors on your background, your team, your board?

Mr. Normand Champigny: So, the team has three actual mine finders that are working with the company. Kerry Sparkes, involved in Voisey's Bay discovery and nickel mine, Rainy River gold discovery, now a gold mine in Ontario. Michel Gauthier, who's the largest shareholder at Sphinx and involved in the discovery of Eleonore. Robin Adair is still helping us and continues to help us and he's been involved in nickel discoveries at Raglan and zinc discovery at Bracemac-McLeod. Having three mine finders makes us unique, makes us stand out from other juniors.

In addition to that, we have John Hick, Chairman of our Company, who has created, run and also been a director of many publicly traded companies, gold companies and other commodities. We have Francois Biron, with over 40 years’ experience in mining and engineering, who has directed operations in Quebec and internationally. And our CFO is Ingrid Martin, lots of experience with publicly trading companies as a CFO.

Dr. Allen Alper: That's a fantastic team. Could you tell our readers/investors a bit about your share structure, capital structure?

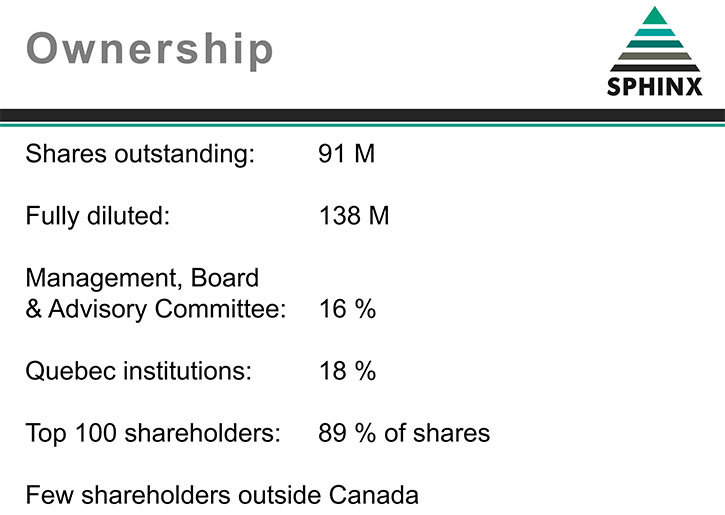

Mr. Normand Champigny: Currently, we have 91 million shares outstanding. We diluted 138 million, management, board and advisory committee, 16%, Quebec institutions, 18%. So that's important to mention as well. In Quebec, we have pension funds, institutions that support companies such as us. A better known one is CDPQ. Top hundred shareholders hold 89% of the shares. We have very few shareholders outside of Canada.

Dr. Allen Alper: That sounds great. Sounds like you have very strong support. Could you reiterate the philosophy of Sphinx, how you operate, your objectives and goals?

Mr. Normand Champigny: That's a very good question. To select and generate our projects, we apply three criteria. First of all, the project has to be socially acceptable, which means that locally the people have to want the projects as much or more than we do. We need to have ground access to the project 12 months of the year. That accelerates the excavation process, also allows us to explore more economically. We're focusing on gold, which we have now put into another company, and also base metals, which includes largely zinc, now. We focus on areas of complicated geology, where we have the ability to unravel the geology and find mines.

Dr. Allen Alper: Well, that sounds excellent. What are the primary reasons our high-net-worth readers/investors should consider investing in Sphinx?

Mr. Normand Champigny: We are a micro-cap company at $6 million market cap right now. With the team that we have, partners that we have and our projects, we believe we can be valued a lot more than that in the near future. Our plans in 2018 include drilling on zinc projects, receiving value from the gold projects that we put into Quebec Precious Metals and our joint venture exploration project to find large zinc mines with Osisko Metals. They're exciting. I think it's a good time to be a shareholder of Sphinx.

Dr. Allen Alper: That all sounds very exciting!

https://sphinxresources.ca/

Normand Champigny

President and Chief Executive Officer

514.979.4746

info@sphinxresources.ca

|

|