Argo Gold Inc. (CSE: ARQ): Exploring High-Grade Projects in Ontario. Interview with Judy Baker, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 5/20/2018

Argo Gold Inc. (CSE: ARQ) is a Canadian company focused on gold exploration projects, with indications of economic viability, located in central and northwestern Ontario. All of Argo Gold’s projects are 100% owned. We learned from Judy Baker, President and CEO of Argo Gold, that their flagship Woco Gold Project is a small high-grade gold vein located 50 kilometers east of Red Lake. Argo Gold is advancing gold exploration with the target of identifying enough ounces to advance the project to a small gold producer. Plans for 2018 include bringing a strategic corporate investor onboard to execute a 5,000 meter drill program at the Woco Project. Ms. Judy Baker believes that the Woco Project has a lot of upside potential given the high-grade of the mineralization that was initially discovered in 1993 and the lack of exploration since then.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Judy Baker, President and CEO of Argo Gold. Could you give our readers/investors an overview of Argo Gold?

Judy Baker: Okay. Argo Gold was founded in March of 2016. We are focused on high-grade gold projects in northwestern Ontario. Why? Canada has become the 5th largest gold producer in the world, up from number eight five years ago. Mining companies want to have capital and infrastructure in western world countries. The assets they have here have continued to produce for them because they can hire the best people. We saw northwestern Ontario as an area with a lot of long-term producing goldmines, yet not a lot of activity in terms of exploration and development.

Argo Gold initially staked the McVicar Lake Gold Project near the past producing Gold Patricia Mine in May of 2016. Golden Patricia was 600,000 ounces at 14 g/t gold mined in the 1990’s. Argo Gold then acquired its flagship Woco Project in November of 2016. Woco is 50 kilometers east of Red Lake, it's at the south end of Birch-Uchi Greenstone Belt. On the local project, there's historic grade of 0.33 ounce per ton, and the true width of and the historic resource is about a meter wide. It is a small high-grade gold vein but the business model is for exploration to expand the project ounces to the point where a small 50,000 ounce per year mine could be a possibility.

If you look at companies like Wesdome and Richmont Mines, they've produced, from small high-grade goldmines. Wesdome's produced for 20 years. Richmont Mines produced 50,000 ounces per year for eight years, and got into Island Deep, where they doubled the grade, doubled the width, produced 80,000 ounces per year without an increase in m year, and was recently taken over for a billion dollars.

The Woco Project was initially a 1993 discovery by St. Jude Resources but the exploration climate was not favorable in Canada. Windy Craggy - a large copper-gold deposit in BC - was expropriated by the BC government for park land in 1993 and risk capital for mineral exploration left Canada. As well, the world was opening up for mineral exploration. High-grade projects like Woco in Canada were left behind.

So when Argo Gold identified that mining companies wanted to be back in western world jurisdictions, we targeted high-grade gold projects in northwestern Ontario as the area is further afield than Destor - Porcupine and Cadillac-Larder Lake Breaks of the Abitibi Greenstone Belt.

We continue to consolidate ground around the Woco Gold Project after our initial field work in May-June of 2017. We picked up the adjacent Northgate Gold Project in the summer of 2017 and then in early 2018 acquired the adjacent Geisler patents. We have a 5,000 metre drill program planned for the Woco Gold Project as well as a stripping and sampling program for the Northgate area and we are currently looking for a strategic corporate investor to come onboard with Argo Gold to execute the project.

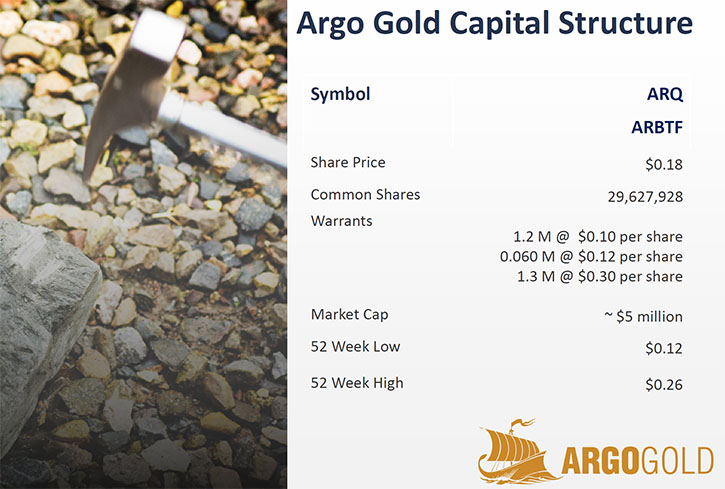

Argo Gold is a small company with 29 million shares out and a market cap of less than Canadian $5 million so it is great price value for the six 100% owned projects. The company trades as ARQ on the Canadian Stock Exchange (the CSE) and the in the US under the symbol ARBTF on the over the counter board (OTCB). The Argo Gold website is www.ArgoGold.ca. Thank you very much.

Dr. Allen Alper: Sounds great! Could you tell our readers/investors a bit about your background, your team’s, and your board’s?

Judy Baker: I have a geology degree and an engineering degree from Queen's University. I've worked in the business for 25 years. Argo Gold is the third company that I've founded. The business plan for Argo Gold was a business plan of Delio Tortosa, Bill Kerr, and myself. Delio is an expert in the Wawa area, where Argo Gold originally had five 100 percent owned projects, in and around Wesdome and Richmont Mines. Bill Kerr is experienced in the greenstone belts of northwestern Ontario where he initially worked with Dome Exploration.

The Argo Gold board of directors includes Paul Olmsted, who was formerly with IAMGOLD and Bill Nielson who was instrumental in the discovery of the Bisha Mine in Eritrea. Advisory board members include Phil Walford, who's President and CEO of Marathon Gold and Jay Hodgson who was chief consulting geologist with Barrick for 10 years who also works actively with our exploration team. SO there is a really good technical team built for Argo Gold to execute its business plan.

Dr. Allen Alper: That's an extremely powerful thing you have there.

Judy Baker: Yes. Thank you for recognizing the team at Argo Gold.

Dr. Allen Alper: That's great, and you have a great background.

Judy Baker: Thank you.

Dr. Allen Alper: Could you tell our readers and investors the primary reason they should consider investing in Argo Gold?

Judy Baker: Argo Gold has six 100% owned projects. All the projects are owned by the shareholders, so there's no option or joint venture agreements. All project upside is to the shareholders of Argo Gold. It's a tight float with only 29 million shares outstanding and the market cap is less than five million Canadian. The flagship Woco Project has the markings of a small high-grade narrow vein gold producer. There is excellent upside.

Dr. Allen Alper: That sounds like a very good reason and like this might be good timing too.

Judy Baker: Absolutely!

Dr. Allen Alper: That's really good; is there anything else you would like to add?

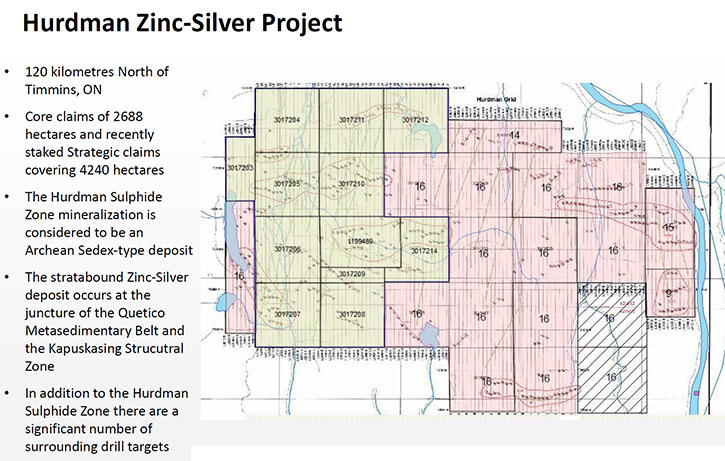

Judy Baker: Yes, Argo Gold also has a material zinc-silver project sitting in the background located 60 kilometres north of Timmins. We recently completed an in-house resource on the Hurdman Silver-Zinc project and there is three million tons of 1.5% zinc, 12 g/t silver and 0.5% g/t gold. Perhaps another company has to be created for this asset for the shareholders of Argo Gold to get value for the asset.

Dr. Allen Alper: That sounds very good, and zinc is in high demand right now.

Judy Baker: Absolutely and the Hurdman Silver-Zinc Project is a metamorphosed SEDEX deposit - the same type of deposit as Broken Hill in Australia – which is one of the largest deposits in the world.

Dr. Allen Alper: That sounds very good. Is there anything else you would like to add to?

Judy Baker: No, thank you. It's a pleasure to talk with you again today. Argo Gold – ARQ on the CSE - take a look!

Dr. Allen Alper: I know I will.

http://www.argogold.ca/

Judy Baker

jbaker@argogold.ca

365 Bay Street, Suite 400

Toronto, Ontario M5H 2V1

T: 416 786-7860

F: 416.361.2519

|

|