Interview with Peter Clausi, President, CEO of CBLT Inc. (TSXV: CBLT): A Successful Canadian Cobalt Project Generator

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 5/17/2018

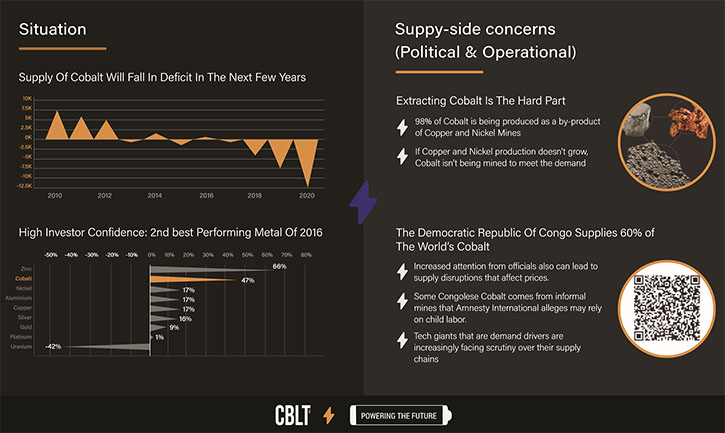

CBLT Inc. (TSXV:CBLT) is a Canadian mineral exploration company and a project generator with a proven leadership team, targeting cobalt in reliable mining jurisdictions. We learned from Peter Clausi, President, CEO of CBLT, that the company was one of the first to move into cobalt space three years ago and were able to acquire cobalt properties fairly cheaply. According to Mr. Clausi, cobalt is an essential ingredient in the electrification of the world; without it, we don't have efficient lithium ion batteries. In 2018 and 2019 the company plans to stick with their business plan to monetize some of the assets turning them into non-dilutive financings. With cobalt prices right now up roughly 400% since February of 2016 and with the supply chain for cobalt from Congo being so unsteady, Mr. Clausi believes that the cobalt market is going to skyrocket.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Peter Clausi, President, CEO of CBLT. Could you give our readers/investors an overview of your company, what's happening in cobalt, and why it's so important?

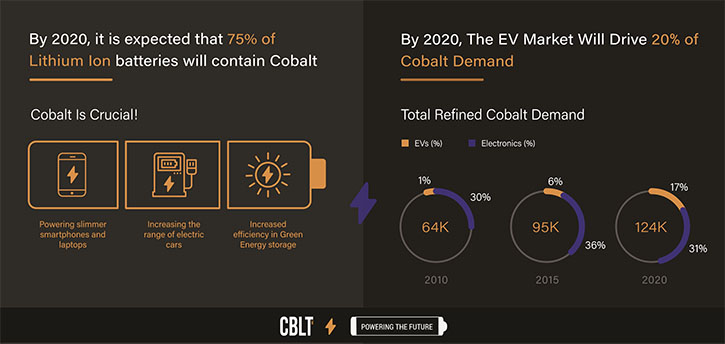

Peter Clausi: Sure, and thanks for taking the time to talk with us again. It's always nice to talk with you. Cobalt is an essential ingredient in the electrification of the world. Without cobalt, we don't have efficient lithium ion batteries. Roughly half of the world's consumption of cobalt is in lithium ion batteries of some configuration. Stop and think. Will there be more electric vehicles next year, or fewer? I don't know anybody who says fewer, and with the increased consumption of electric vehicles, electric toothbrushes, power tools, laptops, and cell phones, the consumption of cobalt continues to increase.

Dr. Allen Alper: Well, that's great. What role does CBLT play in this kind of revolution and the use of cobalt?

Peter Clausi: Our board set out about three years ago, looking for a new target. You'll probably remember that in 2014 and 2015 mining companies weren't getting a lot of respect, even if they had great assets. We analyzed the market, looked at lithium, but decided that there were too many lithium companies as it was, and quite frankly, nobody in our company really understood them, apart for Judy Baker, who is one of our directors, who is also with Nemaska Lithium. The rest of the board just didn't get lithium, so we looked for something else.

If you're going to look at lithium for its consumption you inevitably run up against cobalt, and after doing our research, after looking at the properties that were available, after looking at the horrible supply chain conditions out of the Congo, we decided to attack cobalt assets. And that was a fortuitous decision for us and for our shareholders. We were one of the first companies to move in this space. We aggressively bought properties, and as you might imagine, three years ago we got them fairly cheaply. We are now selling those same assets to partners for considerably more than we've paid for them.

Dr. Allen Alper: Well, that's great, and what are your plans going forward in 2018 and on to 2019?

Peter Clausi: We're going to stick with our business plan to monetize some of the assets. Every time we dispose of an asset, we sell it for cash and for stock in another reporting issuer. By following this strategy, we've turned a $114,000.00 portfolio in Gowganda into roughly $700,000.00 of value with more to come. We're in negotiations for further M & A on some of our other non-core assets. What we are doing is, in effect, non-dilutive financings. If our plan works out, we should have roughly 1 to 1.2 million dollars of cash and negotiable securities on the balance sheet by the end of the summer, and we can put those hard dollars to work into our properties. With that strong a balance sheet, it'll be quite simple to also raise the flow through dollars in Canada so that we can work our Canadian cobalt assets. Overall, we're setting up to have a tremendous 2018 and 2019.

Dr. Allen Alper: That sounds fantastic! Could you elaborate more on your properties’ potential, for our readers/investors?

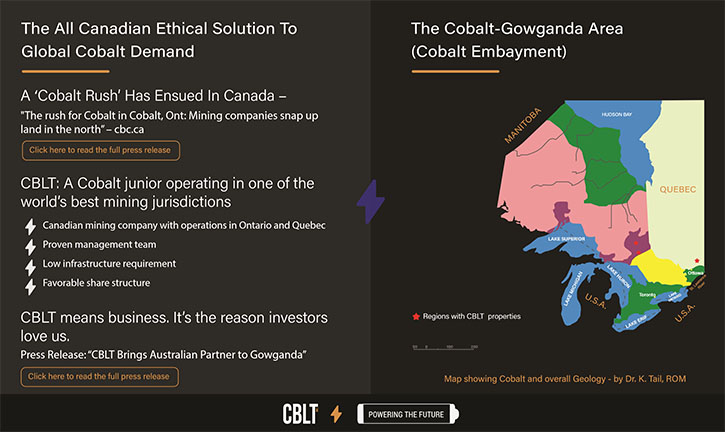

Peter Clausi: Sure. Most of the cobalt juniors have lagged their peer markets, and I think it's because people don't understand cobalt deposits. They think it's all in the Congo with vast laterite deposits, like in the southern end of the Congo. And while it's true that roughly 60% of the world's cobalt comes from that part of the world, there are cobalt deposits elsewhere, and Canada is a prolific producer of cobalt.

In Canada, you have three main regions that produce cobalt. One is in the vast VMS properties that we have; the other is around Sudbury, where it's mixed in with the nickel and the copper. But the third part is up in Northern Ontario in a town, funny enough, called Cobalt, and to the west, a town of Gowganda. Those two areas together are called the Cobalt Embayment, and it's a very rich producer of silver and cobalt. Historically, mines have worked in that area since about 1908, and that's been the target of many companies from around the world. They're heading to Northern Ontario to get the cobalt and the silver.

Dr. Allen Alper: That's great.

Peter Clausi: We have properties in Sudbury, we have properties in Gowganda, and we have a property in Quebec, in the Grenville sub-province, and we're actually flying a drone survey on that in about three weeks. So we're very excited to get those results back.

Dr. Allen Alper: That sounds excellent. Could you update our readers/investors, on your background, your team, your board?

Peter Clausi: Sure. I already talked about Judy Baker, who is also on the board of Nemaska Lithium, which is on track to become Quebec's first producer of lithium, which is a great accomplishment. I'm a lawyer and investment banker, shareholder rights activist, and public company executive. I have this funny belief that the shareholders actually own the company and that I work for them. I know in the mining world that seems a little odd, but I've run into too many people who take the shareholders for granted. That's something we never want to do.

Our chief financial officer is Brian Crawford, who is a very, very seasoned pro. He's a tremendous resource and keeps us in governance, keeps us in compliance, and helps to reduce our legal costs, which are, on an industry standard, quite, quite low. Also on the board is Ed Stringer, of Sudbury, Ontario. Ed's a very well-known figure in Canada's mining circles. And Dr. Tom McCandless, who is our P.Geo. and occasional qualified person for some of our press releases. Tom is one of the people generally credited with the Renaud Diamond Mine in Quebec, amongst other things.

We also use advisors in the field. Because cobalt is such a regional metal, we use regional geologists in each area where we have properties, and they form part of our advisory team.

Dr. Allen Alper: Well, that all sounds great.

Peter Clausi: They're all good people, and they're all happy to argue with me. I enjoy that. Nobody wants to work with a team where everybody just agrees with you all the time, and our board is more than happy to point out weaknesses in our thinking, risks that we hadn't considered, possible other avenues to explore. And I quite enjoy working with them.

Dr. Allen Alper: That's excellent. It's nice to have an open relationship with your team and your board, where everyone has an opportunity to contribute, and the team can benefit from that synergy. That's excellent. Could you tell us a bit about your share and capital structure?

Peter Clausi: Sure. We have roughly 55 million shares issued and outstanding. No debt apart from the usual trade debt, like the transfer agent, and stock exchange, and things you pay on a 30 day basis. Other than that, we have no share class other than the commons, and we trade on the Toronto Stock Exchange Ventures under the symbol CBLT, which is also the name of the company. Truth in advertising, Al. Cobalt, that's what we are.

Dr. Allen Alper: That's great. What are the primary reasons our high-net-worth readers/investors should consider investing in CBLT?

Peter Clausi: Generally they should consider investing in a company with exposure to cobalt. At some point the cobalt market is going to skyrocket, and the juniors, as you know, leverage up with that. The price of cobalt itself is up roughly 400% since February of 2016. The juniors have not moved that much. It won't take much, though, to move that needle. Another supply chain crisis in the Congo, increased consumption of batteries, when the Congo changes its mining tax again.

I feel so sorry for the people in the Congo. They've been just battered for over 100 years. The 2016 presidential election is scheduled to be held in December of this year. That gives you some perspective on how rocky the Congo is, and why the supply chain for cobalt has been so unsteady. All of that manifests itself into the price of cobalt, and there will be a run on the juniors, so your readers need some exposure to them. Whether it's our company or another, I'm not going to slag any other company that's out there. We like our assets, and other companies have good assets too. But we have a disciplined structure. We have a management team that cares for the shareholders. We're rather parsimonious with the shareholders' money, and we are showing that we know what we're doing by converting our non-core assets into cash and negotiable securities at a considerable profit. So we don't have to worry about a financing. We don't have to worry about sourcing capital. We're just making the capital from our transactions with other companies.

Dr. Allen Alper: That sounds like excellent reasons for our high-net-worth readers/investors to consider investing in CBLT. Is there anything else you'd like to add, Peter?

Peter Clausi: We're just emerging from what has been a very tough mining market. The price of gold hasn't moved much in five years. Price of copper hasn't moved much. The price of silver hasn't moved much. Some of the more exotic metals have moved, but we're not seeing any life really back in the mining market yet. So as everybody's hero, Warren Buffett, said, "Be greedy when others are fearful." Right now, people are afraid of the mining market, so now is the time for savvy investors to sit on bids and to fill their boots. And when the market turns, they will be justly rewarded for their foresight.

Dr. Allen Alper: Well, that sounds very good.

Disclosure: I own shares of CBLT Inc.

http://www.cbltinc.com/

Peter M. Clausi

CEO and Director

pclausi@cbltinc.com

1 416-890-1232

|

|