Lithium Chile (TSX-V: LITH, OTC-QB: LTMCF): 15 Premier Lithium Projects, In the World’ Highest-Grade Lithium District, Interview with Steve Cochrane, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 5/11/2018

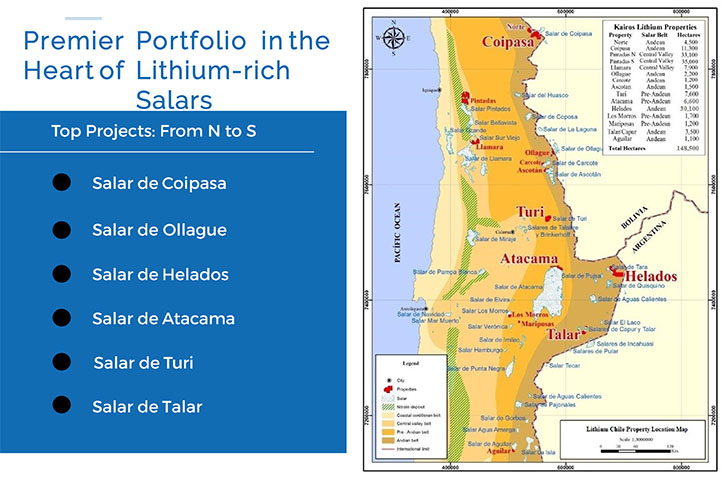

Lithium Chile (TSX-V: LITH) owns fifteen projects, encompassing 148,100 hectares on Li-rich Salars in Chile – which has the largest, high-grade lithium reserves and lowest-cost lithium production in the world. The portfolio includes projects, with high-grade lithium brines and excellent chemistry, at shallow depths – all of which have good access to infrastructure. The company is well-funded and has a top-tier team. Exploration is underway and the company is targeting initial resource estimates in 2018. We learned from Mr. Steve Cochrane, President and CEO of Lithium Chile, that out of the fifteen properties they have identified, six have large high-grade priority targets, near good infrastructure with easy access. Having completed the geo-physics survey on all of the properties, Lithium Chile applied for drill permits and hopes to start drilling before the end of the summer.

DR. ALLEN ALPER: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Steve Cochrane, President and CEO of Lithium Chile. Could you give our readers/investors an overview of your company, your focus and current activities?

MR. STEVE COCHRANE: Absolutely. And I appreciate the opportunity to speak with both you and your readers/investors. Once again Dr. Alper, thanks for giving me the opportunity to talk a little bit about our company, Lithium Chile.

I was the banker that took the company public in 2011. I knew the principals quite well. They came to me, with an opportunity to acquire six very perspective copper/gold properties in Chile. More importantly I acquired a gentleman by the name of Terry Walker, as VP Exploration, who has lived and worked in Chile since 1991. Terry knows the lay of the land, the opportunities and the prospects better than virtually anybody else who lives in Chile today. He had identified these properties over the course of his career in Chile, had picked them up in most cases himself, and they became the catalyst, the seed properties, when I took the company public in 2011.

Terry Walker, P.Geol. is a highly-experienced geologist. Terry has spent over 25 years in Chile’s mining industry and is well-connected throughout the sector. He is the co-founder of GeoServicios Piedra Dorada – an exploration and development services company, focused on Latin America. Previously, Terry was V.P. Exploration and General Manager for Polar Star Mining and International PBX Ventures in Chile. He has also acted as an independent consultant on project evaluation, generation and management in Chile for a variety of senior and junior companies including; Noranda Chile, Minera Teck, Hunter Dickinson Inc, Northern Dynasty, MK Gold and White Mountain Titanium Company. Prior to his work in Chile, Terry worked as a senior geologist for major and junior mining companies in Canada. Terry is a Qualified Person for the North American and Australian stock exchanges.

In 2012, markets for precious metals, and indeed copper, softened significantly. The company laid dormant pretty much through 2012 until mid-2015, when Terry came back to the board and suggested the lithium market was heating up, there's a lot of interest in lithium in Chile, and should he go out and look at prospective lithium claims.

With the support of the board, Terry did just that, from mid-2015 and still ongoing today. Terry and his team, which comprises some geologists, and a first-rate land department, have gone out and identified and staked over 148,000 hectares of properties of lithium prospects on 13 salars in Chile.

That's the genesis. That brings us to where we are today. We have this extensive land package. We are arguably the largest landholder of lithium prospects outside of the government, which owns the lion's share of the lithium prospects, and secondly SQM, which is a Chilean company, famous for producing out of the Salar de Atacama. We'd be number three in the country in terms of our overall portfolio of lithium land prospects currently.

DR. ALLEN ALPER: Sounds Great! Could you tell us what kind of data you've accumulated so far?

MR. STEVE COCHRANE: Absolutely. After Terry had put together this large package of prospective lithium properties, the company raised a little bit of money in mid-2016 and one of the mandates was for Terry for go out and begin an initial sampling program on the properties.

Terry had the benefit of having access to some historical data on some sampling back in the 60s and the 90s on all of the salars in Chile. So, when he started to put these properties together and stake these claims, he had the benefit of having some preliminary data showing basic chemistry on all these salars. Terry focused on those salar and the property that had some of the highest lithium grades.

First we went back in 2016 through the first half of 2017 and began a methodical sampling program on all of our properties in all 13 salars. This involved taking all samples at surface, but also auguring down and taking near-surface brine samples where we encountered them. That was phase one of our exploration program, sampling the complete portfolio of properties and looking at not only lithium values, but other chemistry as well.

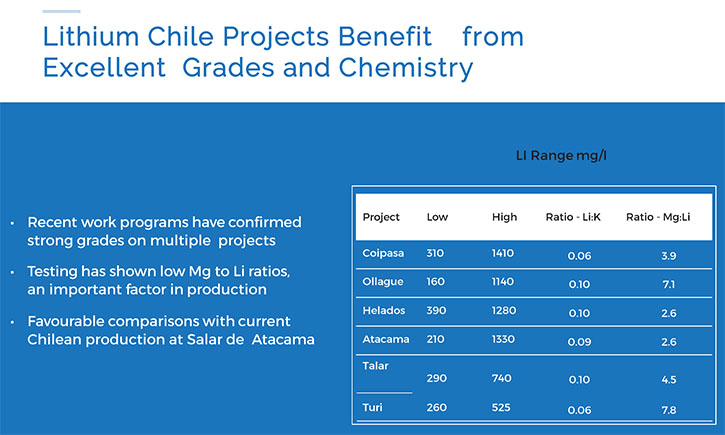

I'm sure, Dr. Alper, you're aware lithium grade is one of the critical criteria for a successful lithium brine producer and also chemistry. You want low magnesium ratios and higher potassium ratios. Terry's team not only sampled the lithium grades, they looked at the chemistry of the various other agents and impurities in the samples.

Based upon that program, Lithium Chile identified six of our priority targets. Six properties out of the 15 had criteria which we felt would make them our top choices from further exploration and obviously a potential development project going forward. Number one was grade and chemistry. The top six salars had some of the highest grades we've encountered. Some of the highest grades that have been seen during surface to near-surface sampling in Chile.

The second thing we looked at is size. If you're going to be a lithium brine producer and you're going to use evaporation as your primary concentration technique, you need a large footprint. You need a large space, on which to put these very large evaporation ponds. So, the second criteria in our prioritization was a large footprint, not only because of the potential of large lithium resources, but to have the necessary space to build out our facilities, if we go into production.

The third criteria we used was access. We want to make sure entrance and egress on these properties is no problem. We looked at infrastructure, power, natural gas, things that were either on the property of nearby to reduce our infrastructure costs.

So, based on those three criteria, grade, size and access, we prioritized the six properties: Salar de Coipasa, Salar de Ollague, Salar de Helados, our property on the Salar de Atacama, which hosts the only current production in Chile, and the Salar de Turi, and Salar de Talar.

The second phase of our exploration program was running geo-physics on all of the properties. To date, we have completed gravity on five of them, and we now have completed and received results back of transient electromagnetic program we run on the top five. We're still waiting on our data to come back on Salar de Turi. But right now, we've completed gravity and we have our data. Our geophysical transient TEM data shows you conductivity, which is important for brine-bearing lithium salars. They're essentially salt water. They're extremely conductive. Typically in Chile, they're shallow, so TEM works wonders in identifying these conductive bases in these conductive sources.

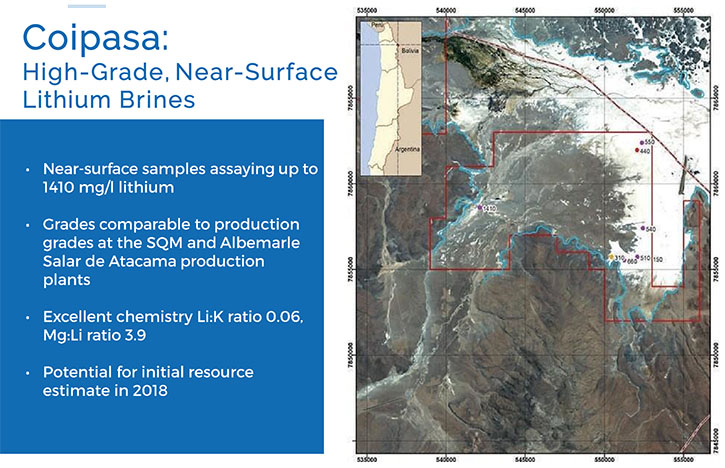

We've completed Coipasa, Ollague, Helados and Atacama. I don't know if you saw this, Dr. Alper, but just recently, we put out a press release showing the TEM data on our Coipasa salar. It looks outstanding, very large, very conductive. You could almost see the lake or the potential brine aquifer in the geophysical data. Of course, until you drill it, you just never know.

That brings me to phase three, reconnaissance drilling. Currently we have applied for reconnaissance drill permits on three of our priority salars, Ollague, Helados and Atacama, 4-5 holes per property with the Ministry of Mines and Resources in Chile.

We just received the data back from Coipasa. Our geological team is identifying the most promising targets. We will put four or five drill holes in the Salar de Coipasa this year, hopefully between now and summer. Certainly before the end of summer, we hope to have holes on all of them.

That will be our final phase of exploration, this reconnaissance drilling program on those top four right now, a total of 16-20 holes. Our target depth is somewhere between 50 and 300 meters per hole because that's typically the producing horizon in Chile. However, in Coipasa, the data came back showing that we have a very large conductive anomaly on the property that is in some places over 300 meters deep. So, there's a very real possibility that we would drill deeper on Coipasa than the proposed 300 meters.

MR. STEVE COCHRANE: Certainly. We've already applied for the drill permits on the properties. On Coipasa, we've begun the negotiations with the local community for their permission, but we haven't actually filed our drill permits yet.

DR. ALLEN ALPER: That sounds excellent. Could you tell us a little bit about your Capital Structure?

MR. STEVE COCHRANE: The Company went public in 2011. We only raised $600 to $800,000 initially. They did that at a dime. The company laid dormant. The Chairman, at the time, kept the company alive by doing various private placements to cover audit fees and such.

In January, 2017 they approached me about finding a management team because they felt they had some very strong, attractive lithium potential in the properties they acquired. I was with an investment firm at the time. I want out and not only introduced them to people that I knew in the industry as potential resource people, I also raised $2,000.000 at 20 cents. That was the backbone for the expanded sampling program and beginning of the geophysics.

It was in May of 2017, I realized this was a great opportunity, a great basket of highly prospective lithium properties. So I made it known I would be interested in the job of President and CEO if they were interested in me. Gladly, they accepted. I joined August 1st. At the time, I think there were 66-million shares outstanding when I joined on August 1st. I set out to raise about $4-million to meet what I thought was our necessary exploration program to show that we had something interesting there.

We wound up raising $7.5-million initially. That was in October/November of last year. That took us from $66-million to $94-million, and I just completed another raise at a dollar a share for about another $3.8-million. So where the company stands currently, we have around 98-million shares issued and outstanding, fully diluted with warrants and options for $104-million. The company to date has about $9.5-million cash in the bank. No debt.

DR. ALLEN ALPER: That's great. It's good to have cash to move forward and explore your properties. Excellent!

MR. STEVE COCHRANE: It certainly is. It give us the option of moving a bunch of these highly prospective properties forward with our own cash and showing the world and the marketplace that we feel we have something. Because that would be a major inflection point, certainly in terms of shareholder value, showing that we do have a brine deposit, and more importantly that is contains high-grade lithium. I think that really changes our market valuation.

That's what our potential Chinese investors or partners want to see, a resource or a potential resource. It makes them a lot more interested in financing us and investing in us going forward.

The capital we have now, on our own and in the bank, gives us a lot of flexibility in creating some value for our shareholders today, without having to raise any more money.

DR. ALLEN ALPER: Sounds excellent! Could you tell our readers/investors how it is working in Chile?

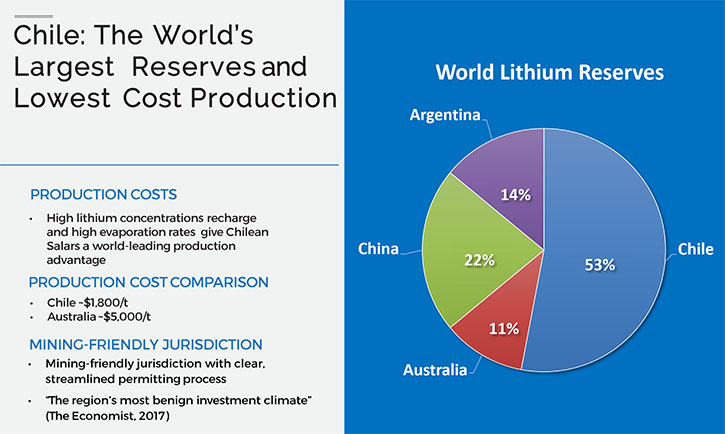

MR. STEVE COCHRANE: Chile is a wonderful country. I had never been there before. People are friendly. It's one of the strongest democracies in South America. The Economist in June of 2017 ranked it number one of the three; Argentina, Chile and Bolivia for lithium investment, for mining investment, for lack of corruption. In fact, while it was just behind Australia in terms of their measurement of corruption, from a lithium investment overall perspective, the Economist ranked Chile number one, even ahead of Australia.

So, to date, I've enjoyed working in Chile. Access is great. Roads are terrific. The politics is very stable. Chile has been a mining jurisdiction for many, many, many years, so you have a government that's willing and supporting of the mining industry. You have skilled and qualified people in the industry there, so access to technical and geological personnel is easy because of their history of mining. The other nice thing about Chile is there's equipment readily available, and skilled labor in terms of drillers and production people.

To date, I've certainly enjoyed the experience and found everybody very supportive. Access to the right people, the right equipment hasn't been a problem.

One of the challenges that comes up is, yeah, but what about lithium? Chile's had an open-door policy for copper, gold for many, many years, but in '79, lithium was made a strategic mineral along with uranium by Pinochet. As such, lithium comes underneath the guidance of the Ministry of Mines and Resources, like your copper and irons and golds. But you have a second regulatory body, Chilean Nuclear Regulatory Authority that has to approve any lithium exploitation/exportation in Chile. The red tape has discouraged people from looking at it, not so much because they've turned anybody down, but the additional regulatory hurdle has been enough, over the years, for a lot of companies to say, well, rather than having to deal with that second body, we'll look at Argentina, we'll look at Australia, we'll look somewhere else, where we know it's a fairly seamless process.

So, while Chile is perceived as being more difficult, the irony of it is that a lot have not gone out and applied for exploitation/exportation because of that perceived hurdle. The result is that with people chasing lithium prospects in other countries, it has given Lithium Chile the ability to go out and stake and acquire, very high-grade, very prospective properties.

But now people have started to look at Chile. There's been a change in the government recently, as you may be aware. In March of this year, the Sebastián Piñera government was installed for a four year term. President Piñera ran in the fall under a platform of opening up mining, returning Chile to its former glory as one of the top ten mining countries in the world. Under the last government it slipped to number 34, I think. President Piñera wants to streamline the regulations. He wants to encourage investment.

On his platform, he said he'd like to see junior and intermediate companies come to Chile. He wants to encourage that because they tend to be the risk-takers. They tend to be the explorers and the risk-takers. Chile is the world's number one lithium producer currently, but he wants to make sure that Chile stays the number one lithium producer in the world, expands that footprint. It's not coincidental, I guess, that within 48 hours of Piñera assuming the role as the new president, he approved the exploration/exportation license for a lithium property on the Salar de Maricunga to a consortium that is primarily headed by a junior Australian company called Lithium Power International, but also includes a Canadian junior called Bearing Lithium, with above 17/18-percent of the property. So, the first license to be granted to a non-government related entity in 25 years was granted 48 hours after the new government was installed, and was given to a group of juniors. I think that sends a huge message that Chile is open for business and is really looking at re-doing the way things have been done there.

I think the message is that Chile is here. Chile's open for business, and Chile is and will be the number one producer of lithium in the world.

DR. ALLEN ALPER: That's great. I know there was some concern about Chile and I'm glad you have clarified it and brought our readers/investors up to date. Excellent!

What are the primary reasons our high-net-worth readers/investors should consider investing in Lithium Chile?

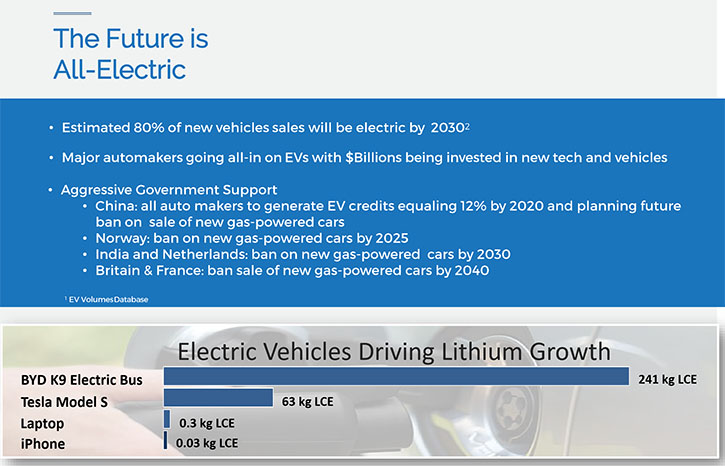

MR. STEVE COCHRANE: Absolutely. There are three reasons, why lithium? There's just no question that the lithium battery is here. It's the only source of energy for the revolution that's taking place in the transport business. In my reading and discussions, as much as you hear people say that there are other alternatives out there, there's nothing that we see on the horizon for seven to ten years that will replace lithium as your electric, light and your energy source.

Why Lithium Chile, first of all? I think lithium as a commodity is going to receive increasing demand and I think that demand is going to be far greater than even some of the pundits have forecast to date. I think you're going to see the adoption and the uptake of this new mode of transportation, not only embraced by the consumer, but also mandated from the top down. I think governments, when they see that there's a viable alternative to the internal combustion engine, it's going to impose additional pressure. So lithium is one.

Why Chile? Chile is the world's largest producer of lithium. Chile has 53-percent of the world's known global reserves of lithium. And most importantly, Chile is the lowest cost producer of lithium in the world with prices per ton of lithium carbonate ranging from $1700/$1800 to $2200 U.S. per ton.

I've heard people talk about Chile being the Saudi Arabia of lithium. You want to make sure you to go to where your cost of a commodity is cheapest, then you won't be focused on the price swings, the commodity swings. You'll always make money. Being in the jurisdiction with the lowest cost production, if you're an investor in lithium, it's where you want to be.

And thirdly, why Lithium Chile? So, why lithium, why Chile, and now, why us. Quite simply, we have the largest land package now outside of SGM and the government of prospective lithium properties. So, we think if you're looking for an exploration story in lithium, we are the go-to company.

With our prospects. With the size of them. With the quality of the grades. In our six priority salars, on the two salars with the lowest grade, that grade is still higher than, or at least equivalent to, the production grade in Argentina on average. If you look on the very back page of our presentation, page 24, Talar and Turi had the lowest grades that we tested at 525 on Turi, 740 on Talar. Well, the average production grade in Argentina is only 600. So our two lowest-grade properties are as good, if not better than the production grade in Argentina.

And you look at our best properties, Coipasa, for example, had a near-surface brine test of 1,410 milligrams per liter. That's equivalent to the production now coming out of the Salar de Atacama, and more importantly, it's double the production grade in Argentina.

Not only do we have a great land package, we have a sizable land package. We have early-stage exploration results that are second-to-none. If those grades exist sub-surface at any size, we have the potential for a world-class discovery.

So, we're excited. We're excited about what we're seeing geophysically. We're excited about what we're seeing on our sampling and exploration program. Now, we're quite eager to get the drilling rigs turning and show that what we're seeing at and near surface, what we're seeing on the geophysics, actually does exist in a large potential brine aquifer at depth.

So that's our focus now. We hope to be drilling our first target, Ollague, before the end of the month. In fact, the local community has signed off. We're just waiting for the council to approve it. So, we're very optimistic we'll be drilling soon and we'll be taking this exploration play from a ‘what if’, to a ‘what we have’ kind of scenario in the very near future.

DR. ALLEN ALPER: Sounds excellent! Sounds like very strong reasons for our high-net-worth readers/investors to consider investing in Lithium Chile.

https://www.lithiumchile.ca/

http://www.lithiumchile.ca/learnmore/

Steven Cochrane

President & CEO

info@lithiumchile.ca

|

|