Melior Resources Inc. (TSXV: MLR): Well-Funded with Offtake for Sale of Ilmenite and Apatite, Production Scheduled for this November, Interview with Mark McCauley, Director and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 5/10/2018

Melior Resources Inc. (TSXV: MLR) is the owner and operator of the Goondicum ilmenite mine, a past-producing ilmenite and apatite mine strategically located in Queensland Australia. We learned from Mark McCauley, Director and CEO of Melior Resources, that the ilmenite price has been very strong and stable for the last twelve months and just a week ago the company completed its funding and off-take package, which enables it to restart the Goondicum Project and be back in production in November this year. According to Mr. McCauley, Melior Resources plans to start shipping ilmenite to China, early next year and will be cash positive by second quarter of 2019. Ilmenite is used in manufacturing general consumable items, such as paint, plastics, ink, cosmetics and sunscreen. The project also contains high quality apatite that is excellent for manufacturing organic fertilizer and the company partnered with an Australian domestic organic fertilizer manufacturer. The other half of the corporate strategy, according to Mr. McCauley, is to grow the business via mergers and/or acquisitions.

Melior Resources Inc.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mark McCauley, Director and CEO of Melior Resources. Could you give our readers/investors an overview of your company?

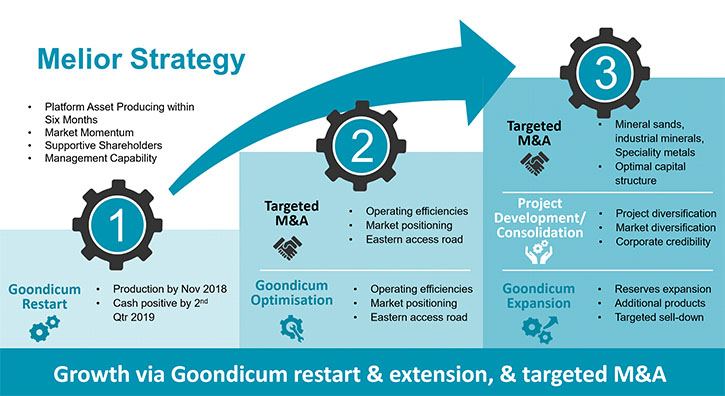

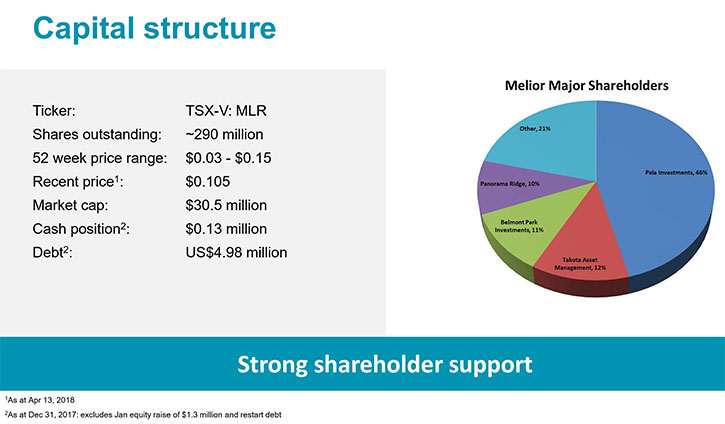

Mark McCauley: Melior Resources is a TXSV listed company. The ticker is MLR. We have a market cap, currently around thirty-five million dollars, and our primary asset is the Goondicum Ilmenite and Phosphate Rock Project in Central Queensland, Australia. The big news for us is just a week or so ago we completed putting together our funding and off-take package, which now enables us to restart the Goondicum Project. Goondicum has been on care and maintenance for the last two years, biding its time due to low ilmenite prices.

The ilmenite price has been very strong and stable for the last twelve months, so with this funding package and off-take agreement, we have decided to restart that project. We'll be back in production in November this year, shipping ilmenite early next year, and cash positive by second quarter 2019. It's very exciting for us.

Dr. Allen Alper: Well, that's fantastic news! Your off-take agreement is with a Chinese company that will be easy to ship to. Is that correct?

Mark McCauley: That's right. China is a natural market for our product. They are one of the world's biggest consumers of ilmenite, and the partner that we have just joined forces with, Hainan Wensheng Special Materials, a very good quality Chinese group, in whom we have a lot of confidence and will be a great partner. Not just for this project, but potentially for projects in the future, as well. They have provided us a prepayment of five million U.S. dollars that will be repaid over the next six years, along with six hundred-thousand tons of ilmenite production that we will sell directly to Hainan Wensheng. So I think that's a great outcome for both Hainan and Melior, and we really look forward to working with them going forward.

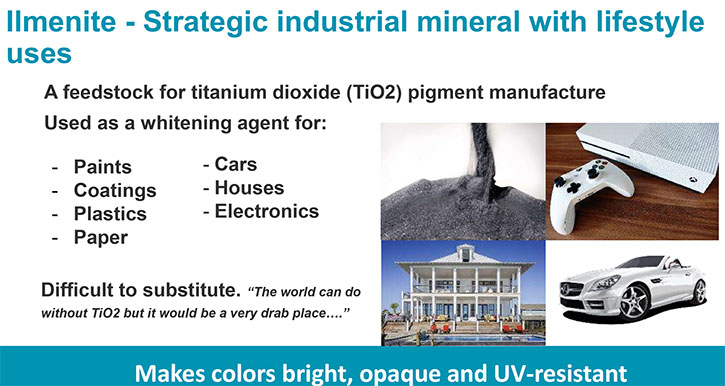

Dr. Allen Alper: Sounds great! Could you tell our readers/investors a bit about the uses of ilmenite forming TIO2?

Mark McCauley: Ilmenite is one of the three mined titanium oxide feedstock minerals, mined around the world, which includes ilmenite, leucoxene, and rutile. Leucoxene and rutile have a higher TIO2 content, and they're primarily used for titanium metal manufacturing and some chloride pigment manufacturing. Ilmenite, which Goondicum will produce, with TIO2 content around the fifty percent mark is primarily used for sulfate pigment manufacturing, and that's the primary use of our product.

So ilmenite is a black sand, which goes to make very white powder, and the powder has very good properties, blocking out the sun's rays, the ultraviolet rays and lights, and so titanium pigment goes into all sorts of general consumable items, such as paint, plastics, ink, cosmetics, sunscreen, that sort of thing. Its consumption is directly linked to GDP growth, so as economies evolve and grow, they consume more titanium pigments, and hence, we've seen a big uplift in Chinese consumption in the last ten years. Interestingly enough, China still only produces less than fifty percent per capita consumption of TIO2 pigment than its colleagues in North America and Europe. There's still plenty of consumption upside left in China, so we're very excited to be in this. We think it's going to be very strong for the next three or four years, at least. On the supply side, supply from new projects is limited in the medium term, and we think that the demand side will remain quite robust.

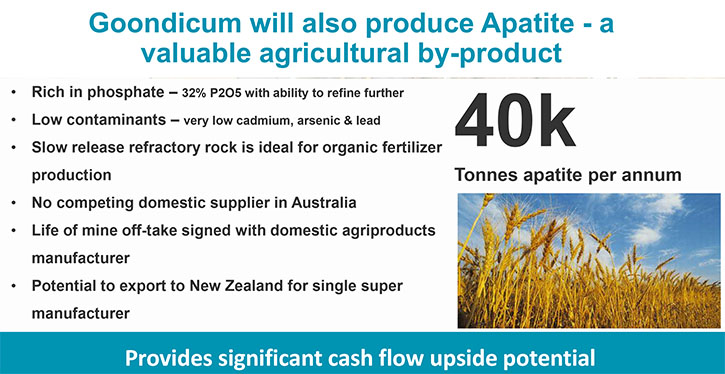

Dr. Allen Alper: Well, that sounds excellent. You also have apatite in your mining. That's a phosphate for agriculture. Could you tell our readers a little about that?

Mark McCauley: Yeah, that's a great product. It's calcium phosphate rock. So our phosphate rock is quite high-grade at thirty-two percent P2O5 content. The key to our rock is it's an igneous refractory mineral and it has quite low reactivity and very low cadmium and other heavy metals, so it's very clean. It's an excellent product for the manufacture of organic fertilizer. Hence, we do a lot with an Australian domestic organic fertilizer manufacturer, who will take all our products at a hundred and fifty Australian dollars per ton FOT. That’s a great contract, and the Australian group is a great partner to have to use our apatite.

Dr. Allen Alper: That sounds excellent. So it sounds like you've had a long period, a tough period, but now it looks like things have really turned around, and this year and next year will be great years for Melior Resources.

Mark McCauley: Yeah, I think that's right, Allen. We had some tough periods in the cycle; however, we haven't been sitting around doing nothing. We have been preparing the project for a restart when the market inevitably turned, as it has now. I think we're in very good shape, and the restart of Goondicum is half our strategy. We will restart Goondicum, optimize it, and it will generate genuine cashflow very quickly. But the other half of the corporate strategy is to look around for opportunities for mergers and acquisitions and grow the business that way. We think that's a great way to lever off the restart of Goondicum and build a bigger specialty minerals and metals mining business.

Dr. Allen Alper: That sounds excellent. What minerals and metals are you looking for?

Mark McCauley: Primarily mineral sands and titanium feedstock. We can also look at industrial minerals, including phosphate rock, which we already produce, silica sand, as long as the product is of the best quality. If you're going to be in industrial minerals, you want to have the best quality products, and Goondicum has the best quality ilmenite and very good quality phosphate rock, and so we want to continue that trend.

We can also look a little further up field, and look at specialty metals, such as tungsten or antimony. We have some targets in mind, and we're in the early stages of investigating those, so hopefully in the next six to eight months, we will acquire another target and move forward from there.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors about your background, Mark, your board and your team?

Mark McCauley: I've been mining for thirty years. I'm a mining engineer originally. I worked in coal and gold and mineral sands, and I've been fortunate enough to be involved in several groups, including the creation of Felix Resources, which was an ASX listed coal company in Australia. The similarities with Melior and Goondicum are interesting. In that company, we started off with a small coal mine, merged into a listed asset, optimized the small coal mine, and then bolted on acquisitions over the subsequent three years, and took that from a market cap of thirty-five million dollars to a billion dollars in three years. So that was a great outcome.

We have aspirations to do similar things with Melior, over the next three or four years, so that's very exciting. We have some very supportive shareholders, including Pala Investments and Martyn Buttenshaw, the chairman of Melior, is a senior exec within Pala Investments. We have Rishi Tibriwal, who has a Toronto-based finance background non-executive director, and we are actively talking with high-caliber candidates for some additional non-executive roles that we're likely to appoint in the next few weeks. The management team; myself, Jonathan Mattiske, the CFO, based in Brisbane, as well. We have administration manager, Helen Cobcroft, and a site team, which is obviously key to the restart of Goondicum, headed up by Alaster Bauer, and Alaster is a very smart individual, very good operator. He's been associated with that project for the last three or four years, knows it exceedingly well, and he's building a team, as we speak, to enable the restart of Goondicum, within the six-month time period that we forecast. So everything's very busy within Melior at the moment, and we're very excited about the place and the future.

Dr. Allen Alper: That's really excellent. You have a very strong team, very strong backing, and you have a property with a nice offtake agreement. It sounds like you're very, very well positioned to move forward and start making some real money, so that really sounds great.

Mark McCauley: Yeah, I think you've summed that up nicely, Allen. We're all hands on deck, and we're moving forward.

Dr. Allen Alper: That's great, Mark. Could you elaborate a bit more on your capital structure?

Mark McCauley: Yeah, we have two hundred and ninety million shares issued as of today. We have some options, it is part of a last raising, which we did at eight cents in February this year. Share price is now eleven, twelve cents. As far as that raising, we issued some options at ten and a half cents, they are in the money. We have a feature which sees the exercise of the options accelerated if the share price hits fifteen cents, so that will potentially be some more money into the company hopefully in the next six months. We have about fifteen million U.S. dollars in debt, or will have by the time Goondicum has been restarted.

Dr. Allen Alper: Well, that sounds very good. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Mark McCauley: Well, I think that we have a very clear corporate strategy, which is now well on the way to being realized. We're fully-funded, with respect to our project, it will be back in production in November and shipping products soon after and cashflow positive by second quarter of next year. That's a great asset. We will embark on M and A program, which we, the senior executives, have done before successfully, and it provides great exposure to the titanium feedstock industry, which we see as starting to gain real momentum and becoming a great area for investors.

Dr. Allen Alper: Sounds great! Strong reasons and potentially a great opportunity for our high-net-worth readers/investors to consider. Is there anything else you'd like to add, Mark?

Mark McCauley: No, I don't think so, Allen. The key for us is execution over the next six months, and we intend to do that. We'll keep investors and interested parties updated with the progress, but I think it's now just a matter of doing it. We're very excited about that, and I look forward to getting back into production very quickly.

Dr. Allen Alper: That sounds fantastic.

http://www.meliorresources.com/

Mark McCauley

Chief Executive Officer

+61 7 3233 6300

info@meliorresources.com

|

|