Dr. Diane Garrett, President and CEO, Nickel Creek Platinum Corp. (TSX: NCP, OTC-QX: NCPCF) Known for Extreme Success as a Mine Developer. Nickel Creek in the Yukon, Host to Measured and Indicated 2 B Lbs. Ni, 1 B lbs. Cu, 6 M oz. ("PGM's") , 120 M Lbs.Co

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 5/10/2018

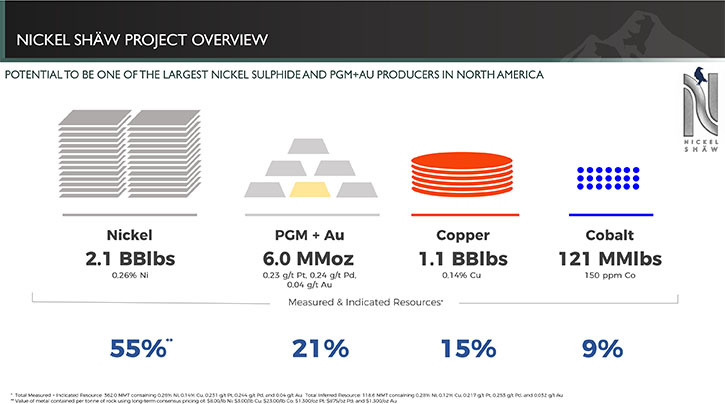

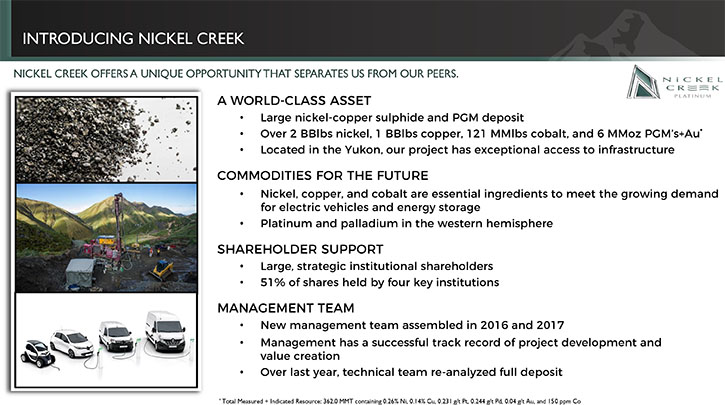

Nickel Creek Platinum Corp. (TSX: NCP, OTC-QX: NCPCF) is a Canadian mining exploration and development company focused on advancing its 100% owned Nickel Shäw project towards becoming Canada's next world-class nickel sulphide mine. Located in the Yukon, Nickel Shäw project is host to over 2 billion pounds of nickel, 1 billion pounds of copper, 6 million ounces of platinum group metals ("PGM's") and 120 million pounds of cobalt in the measured and indicated categories. We learned from Dr. Diane Garrett, President and CEO of Nickel Creek Platinum, that their world class project is uniquely positioned right off the Alaska Highway, in a great mining jurisdiction, and with exceptional access to infrastructure. The company is currently doing the metallurgical test work program for nickel-copper separation that has advanced into Mini Pilot Plant testing. Plans for 2018 include the updated PEA to be out towards the end of the third quarter and then they expect to make a decision to move straight into the engineering phase.

The Nickel Shäw project

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Diane Garrett, President and CEO of Nickel Creek Platinum. Could you give our readers/investors an overview of your company, your focus and current activities?

Dr. Diane Garrett: Certainly, Nickel Creek Platinum has the Nickel Shäw project in the Yukon, Canada. It's a very large world class project comprising a billion pounds of nickel, a billion pounds of copper, six million ounces of platinum group metals and gold and a 121 million pounds of cobalt. It’s uniquely positioned right off the Alaska Highway in a great mining jurisdiction and we are aggressively completing the necessary technical work to de-risk the project and prepare it for the next stage. The culmination of this work will be disclosed in the Fall of 2018 together with economics.

Dr. Allen Alper: That's excellent. Could you tell our readers/investors why nickel, cobalt and copper are so important and also what differentiates your project from many other nickel sources and why it makes it so ideal for use in lithium ion batteries?

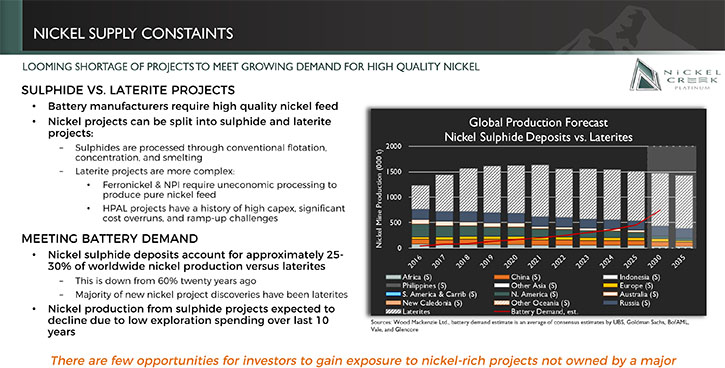

Dr. Diane Garrett: Certainly. Nickel is predominately thought of as a stainless steel commodity because you have to have nickel to make stainless steel, but with the rise of the electric revolution and all of the attention for the electric vehicle battery market, people tend to think of lithium and cobalt as the primary components of a lithium battery.

But in fact, an electric vehicle lithium battery is actually composed of 70-80% nickel and this nickel has to come from high quality sources – and nickel sulfide deposits, like our Nickel Shäw project, produce a very high-quality nickel product suitable for the EV market. But this supply of high quality nickel is constrained, as over 70% of global nickel production comes from nickel laterite deposits, which are located in warmer climates like the Philippines and Indonesia, but these generally do not produce the quality of nickel that is needed for the lithium batteries. Further, there has been virtually no project generation in the nickel sulfide space for many, many years and there's only a handful of these projects in safe geopolitical jurisdictions. So what makes our project really unique is it contains a very large nickel sulfide resource in a great mining jurisdiction, with excellent infrastructure and route to market.

Copper is also very important in the electric market, as there is approximately 4-5 times the amount of copper in an electric car versus its combustion engine equivalent. Copper is also essential for all the infrastructure to connect the charging stations and grid storage. And then there is cobalt, which has been generating a significant amount of interest lately. There is currently no substitute for cobalt and approximately 70% of global production comes from the Congo, South Africa, and Zambia. Our deposit has over 121 billion pounds of cobalt, and so from an electric vehicle market perspective, we have all of the metals that are key for that industry.

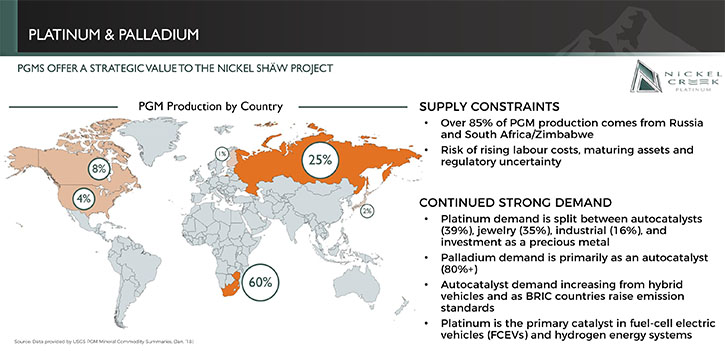

But what makes our project even more unique is the considerable amount of platinum group metals and gold. It is very unusual in a poly metallic deposit to have the amount and quantity of precious metals we have. The PGMs also add a precious metals component and will make our nickel and copper concentrates all the more valuable because we will get paid for the precious metals. We are also seeing PGM demand increase, due to rising emission standards and the need for these metals in hybrid and fuel cell vehicles.

Dr. Allen Alper: That sounds excellent. Also you've moved ahead this year in building a mini power plant and looking at separating your nickel from copper concentrates, is that correct? Would you tell our readers/investors a bit about that?

Dr. Diane Garrett: Absolutely. It's a very exciting time for us. Last year we demonstrated that we could produce a very good quality, saleable bulk concentrate, which contains both the nickel and copper, as well as all the other metals. But when we went to the smelters to get quotes on the bulk concentrate, we asked “what if we separated the nickel and copper and sold two concentrates?” It became obvious that splitting the bulk concentrate into two concentrates – nickel and copper – would return significantly higher payable terms. So we decided that before we finalize the mine plan, and all of the costs associated with developing the deposit on a bulk con basis, that we would do the analysis and metallurgical testing to see if nickel-copper separation were a viable alternative for us.

Last year, we drilled across the deposit and in the fall shipped 8,500 lbs. of material to XPS’ labs in Sudbury, Ontario to begin the program. As we recently announced, we have had very good technical successes and we are excited to be moving into the final stage, which incorporates the mini pilot plant. The mini pilot plant is owned and operated by XPS – who is one of the leading independent metallurgical labs in the industry and experts in nickel-copper separation. It is important to note that nickel-copper separation is not a new technology. It has and is being utilized worldwide. Whether or not it is economically amenable to your particular deposit, is unknown until you do the test work. So we have very good technical success and now we are running the mini pilot plant test, which will mimic real field conditions and will generate the grade and recoveries associated with those. Once that is complete, we will take all of that information and wrap in all of the other technical work, we've been doing over the past year, and produce new economics on the project.

Dr. Allen Alper: That's outstanding. So you have a fantastically large deposit, with huge amounts of nickel copper and also cobalt. You also have the platinum group metals. So it sounds like a fantastic project and you have a way of separating the copper and nickel. Sounds excellent! Could you tell our readers/investors, refresh their memories about your background and your team, and your board.

Dr. Diane Garrett: Certainly, my background is mineral economics and engineering. I began my career with US Global Investors, working as their Senior Mining Analyst and then portfolio manager. I then moved to the corporate side, I worked with Dayton Mining, where we put a very large gold project into production in Chile, and I worked with Beartooth Platinum in the Stillwater Complex of Montana. Most recently I was CEO for Romarco Minerals, where we took a gold discovery in South Carolina from an early stage through to becoming a multi-million ounce mine, after which it was acquired by OceanaGold, right after we initiated construction. I hope to replicate this as CEO of Nickel Creek. We’ve built a team that has experience in operations and de-risking projects to take them up the value chain. Whether we move the project into production ourselves, or whether we bring in a partner, will all depend on which avenue provides the best return for our shareholders.

On our current management team, we have Heather White, as our Chief Operating Officer. She is remarkably talented in the base metal space, specifically nickel. Earlier in her career, she was part of the design team and was mine manager of Voisey's Bay. Following this, she headed up Vale’s worldwide nickel marketing business, which represented approximately 25% of global nickel trade. She's been a consultant for Electrum for the last many years, and after working with us to re-analyze the project, she decided to join our team last year. I think that's a real testament to what we are doing with our project. We also have Graeme Jennings, who was formerly an analyst with Cormark Securities, and joined us as our Vice President Investor Relations and Corporate Development. Joe Romagnolo is our CFO, with whom I worked at Romarco, where he was our controller. We also brought in James Barry, who helped re-interpret the geology at Romarco and turned that into a very significant discovery. James is a very talented geologist and understands big geologic systems.

Dr. Allen Alper: It is great to have a management team led by someone who has such a proven track record of success. Investors and institutions have confidence in supporting you and your team. Excellent!

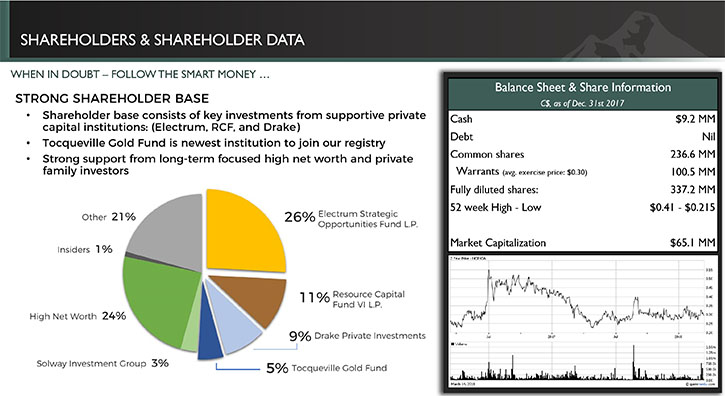

Dr. Diane Garrett: That's great. Our institutional shareholder base also recognizes not only the quality of the asset, but of the team as well. Electrum Strategic Opportunities funds 26% of our company. RCF, Resource Capital Funds, based out of Australia and Denver, owns 11% and Tocqueville Asset Management took a 5% position last year. In addition to that, we have about another 20-30% of private, high-net- worth money. Our key institutional shareholders have a reputation as some of the smartest investors in the mining industry and to have them own these levels of our company at this stage, is a very important investment consideration.

Dr. Allen Alper: That's fantastic. Could you elaborate a little more on where your shares are listed and the number of shares, etc.

Dr. Diane Garrett: Certainly, we are currently listed on the Toronto Stock Exchange, under the ticker symbol NCP, we are also listed on the OTCQX, under the ticker symbol, NCPCF. We have 236 million shares outstanding and about 337 million fully diluted. This difference is predominantly due to warrants held by Electrum and RCF from earlier financings. RCF also holds a 1% NSR on the property. We have just over 7 million Canadian in cash and no debt.

Dr. Allen Alper: That's excellent. It sounds like your company's very well positioned, with your huge deposits and financial support and an excellent management team, so that's really fantastic. Could you tell our readers/investors a bit more about your plans for 2018?

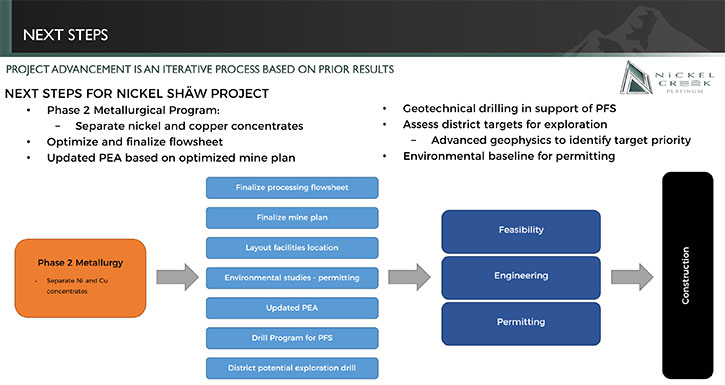

Dr. Diane Garrett: Certainly. We are very fortunate to have a significant shareholder base that understands the necessary groundwork that needs to be completed on the project. They financed us to get all of this technical work done over the last 18 months. We are coming to the end of that work, in the next few months, with the mini pilot plant testing. We will have that news out towards the end of the second quarter, early third quarter. Then we will take that information, together with all the work that we've done over these past many months, which includes: optimizing the mine plan, operating costs, capital costs, and throughput rates, and we will wrap them into a Preliminary Economic Assessment.

The PEA is expected to come out late third quarter, but we should note here that a lot of the work that will be included will have a substantially higher level of technical confidence than an average PEA. For example, by running our metallurgical program to a mini pilot plant level of testing, these met results will be closer to pre-feasibility or feasibility level versus a typical PEA. So we believe that investors will be able to be confident in our economics and the project potential.

Following this, we expect to make a decision on advancing into the engineering and the pre-feasibility stage. While we are doing that, one of the things we have been spending some time on is looking at the district potential of our project. The Nickel Shäw deposit is about 2.2 kilometers in strike length, but it sits within an 18 kilometer trend within our land package. Along this trend there are numerous other target areas, which have had very limited drilling over the last few decades. We do believe we are sitting in a district and we would like to drill- test that assumption. We did some mapping last year. We are conducting our own geophysics this summer and while we are going through the engineering, we would like to drill-test some of those high priority targets to demonstrate whether or not we are truly sitting in a district.

Based on our resources today, the Nickel Shäw project is already over a 20 year mine life and we haven't found the limits of it. To demonstrate we are in a district in that area would be very meaningful to the larger strategic investors and certainly the larger companies that are involved in this space, so we are very excited about that.

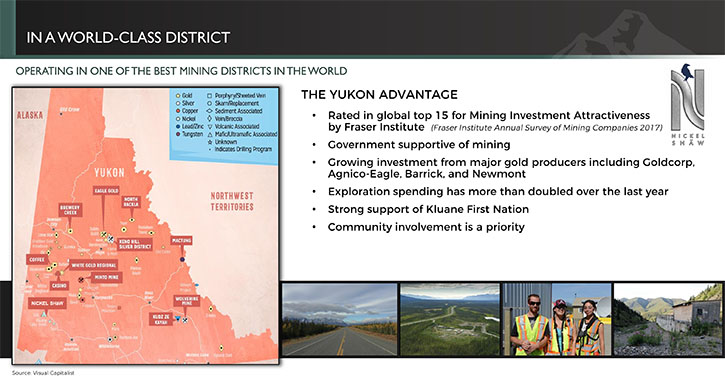

We are the only nickel PGM project in the Yukon, so it is a very strategic play. As we all know, the major gold companies are very active in the Yukon because it has become such a good jurisdiction in which to do business. So those are our plans for the immediate term and over the balance of this year and we're really looking forward to getting our economics out to the market and showing them the significance of our assets.

Dr. Allen Alper: That's excellent. They'll be bringing a lot of new news and new data and new information for new investors to look at and for you to firm up your resource in this year. Could you tell our readers why the location is such a favorable location?

Dr. Diane Garrett: The Yukon itself has been rated as a very favorable jurisdiction. We've seen the government put a lot of money into infrastructure for the mining sector and they are very positive and favorable towards the mining industry.

Our project is located on the settled land of the Kluane First Nation, and they have been very supportive of the project and we work closely with them. But one of the key features in our project is infrastructure, which can often be a bit challenging in the Yukon. The Nickel Shäw camp is located right beside the Alaska Highway, so if you fly to the capital of the Yukon, we are a three hour drive West on the Alaska Highway, and you will know you are there as there is a sign on the Alaska Highway with our name on it. From the camp, the deposit is accessible via a 14 kilometer (8.7 mile) all weather access road. When we produce our concentrates, we will be able to truck them from the site, along the Alaska Highway to the deep-sea shipping ports of Haines or Skagway, Alaska. From there we have direct route to market to China or to Europe or anywhere we need to go to deliver our concentrate. From an environmental perspective we have no endangered species, we have no bad actors in the rock. It is just a beautiful location and really checks a lot of the boxes for what you want to see in a mining project.

Dr. Allen Alper: That sounds excellent. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Dr. Diane Garrett: We all recognize that the electric revolution is here to stay and that electric vehicles are the wave of the future. We know that China has said by 2030, everything will be all electric. There's going to be a significant demand placed on nickel-sulfide deposits, of which there are very few. Ours being in a very safe jurisdiction, with good infrastructure, will certainly put us near the top of that list. We also know that when nickel prices turn, they turn very quickly and so you want to be positioned in a company with a large, yet quality, nickel-sulfide project.

The project itself and its location are well positioned for the market that we are in, with all the commodities, which are very hot right now. Then you add to that a team that's done this many times before, very successfully, as well as an incredible weighty institutional shareholder base of very smart money. It's the right place, it's the right size, it's the right jurisdiction, it's the right people, it's the right investors – for people to put their money in, if they want to participate in the growing market for commodities related to electric vehicles and grid storage.

Dr. Allen Alper: Sounds like excellent reasons for high-net-worth readers/investors to consider investing in Nickel Creek Platinum. It sounds like an outstanding opportunity. Is there any else you would like to add Diane?

Dr. Diane Garrett: Even for the precious metals investor, we have 6 million ounces of platinum group metals and gold. These platinum group metals are very rare to find in the western hemisphere and we have a significant amount of them. They are predominately produced in Russia and South Africa, jurisdictions that can be somewhat unpredictable as far as trade. So even for the precious metals investors, we have a little something for everybody. It is still a very significant deposit.

Dr. Allen Alper: Sounds excellent!

http://www.nickelcreekplatinum.com/

Graeme Jennings, CFA

VP Corporate Development and Investor Relations

1-416-304-9322

gjennings@nickelcp.com

|

|