Telson Mining Corporation (TSXV: TSN): Two Producing Precious and Base Metal Mines in Mexico, Interview with Ralph Shearing, President

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 5/8/2018

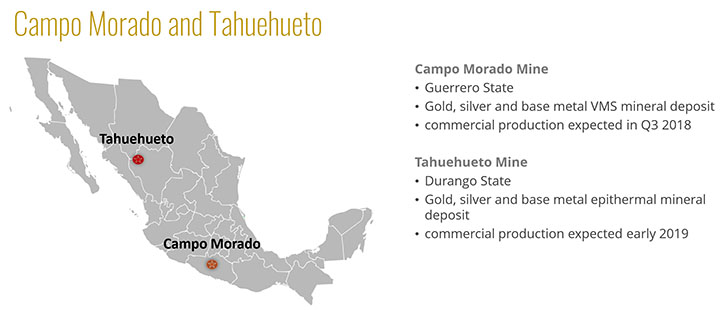

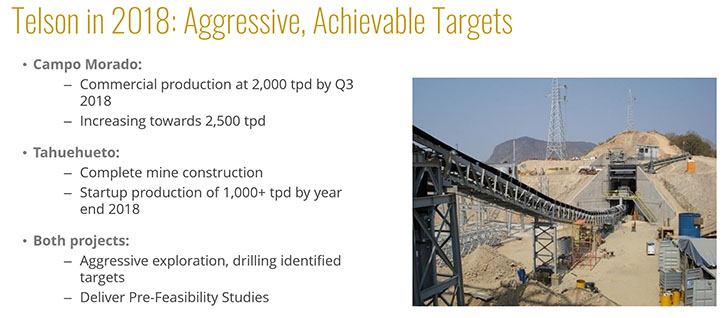

Telson Mining Corporation (TSXV: TSN) is a Canadian-based junior resource mining company, currently in pre-production at two Mexican gold, silver and base metal mining projects, and is advancing both towards commercial production, over the coming months of 2018. According to Ralph Shearing, President of Telson, the company is a new multi-mine producer in Mexico, delivering and selling metal concentrate from its two mines. At the recently acquired Campo Morado Mine in Guerrero, Mexico, Telson re-commenced mining and processing operations at 1,400 tonnes per day, in October 2017, recently, in April 2018, reaching 2,000 tonnes per day and intends to advance towards commercial production, at full capacity of approximately 2,500 tonnes per day, over the coming months 2018. Telson's Tahuehueto Project, located in north-western Durango State, Mexico is currently in pre-production at approximately 125 tonnes per day, utilizing a toll mill for processing and has entered a construction phase, with a timeline to be producing, on site, in its own mineral processing plant, capable of milling at least 1,000 tonnes per day, towards the end of 2018.

Ralph Shearing, President of Telson at PDAC 2018

Allen Alper Jr.: This is Allen Alper Jr., with Metals News, interviewing Ralph Shearing, President of Telson Mining Corporation. Could you update our readers/investors on your background?

Ralph Shearing: Gladly Allen, I'm the President and Founder of Telson. I started Telson quite some time ago. I'm a professional geologist and I've been working in the mineral exploration & mining industry for over 35 years. I've been managing public companies for 30 years plus. I have a strong background in public company management as well as mineral exploration and development.

Allen Alper Jr.: Tell us a bit about Telson. I understand Telson has some exciting opportunities.

Ralph Shearing: Yes Allen. Telson is what we would term a new multi-mine producer in Mexico. In this last year, we've put two projects into early production. They're basically in pre-production because we're just ramping them up to be able to announce commercial production in the near future. We have Campo Morado, which is a well-known Mexican mine. We purchased it in June of 2017, at a fire sale price, from the zinc smelting company, Nyrstar. They purchased it in a frantic takeover of Farallon Mining back in 2010 and they operated the mine for four or five years and then they shut it down, due to deteriorating commodity prices and claims of security issues and social problems in the state of Guerrero, which is known as a bit of a tough state.

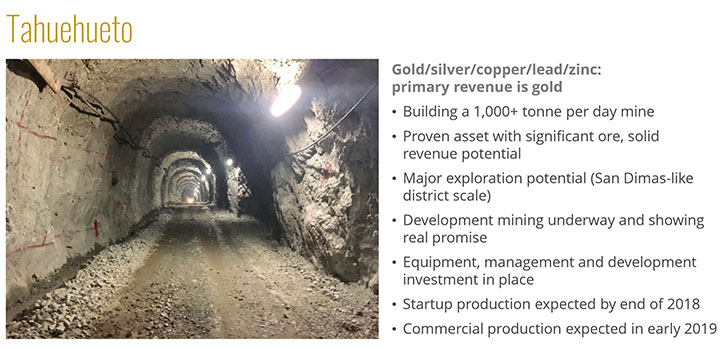

But, going back to the second project, which is really our company's first project. We had Tahuehueto in northwestern Durango long before we bought Campo Morado. Tahuehueto is an epithermal vein system, hosting prolific strong mineralization. We've developed a resource and a reserve and have published a pre-feasibility study. We just started construction of the mine at Tahuehueto at the beginning of 2018, although we have been developing underground during the last half of 2017. We have also initiated a small-scale pre-production effort to generate cash, which has been quite successful.

So we have two mines up in pre-production now because we're milling at Tahuehueto 100 to 135 tons per day, shipping the ore about 150 kilometers to be processed at a toll mill. Cash sales from this pre-production is averaging between $1 - 1.5 million per month and we probably have an operating profit of about 20 -30% at Tahuehueto.

We are in pre-production, while we build the mine. The mine should be up and running by the end of 2018. Targeting around 1,000 tons or slightly more per day, in an underground cut and fill mining operation.

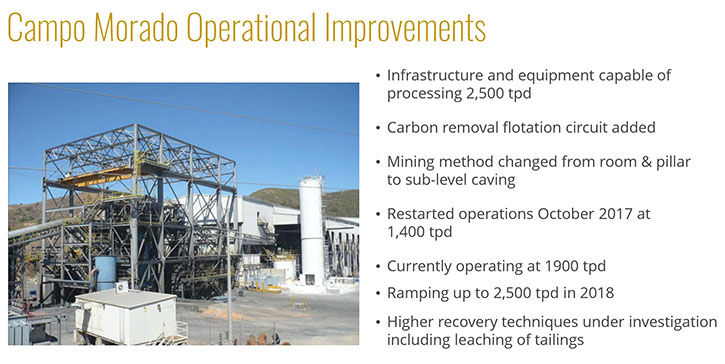

When we purchased Campo Morado in June, it was a moth-balled project on care and maintenance. The mine was fully equipped with surface and underground mobile mining equipment and a sulfide flotation mill, capable of producing 2,500 tonnes per day. Telson purchased the mine, with all the infrastructure, equipment and development work in place. After we made the offer and purchase, our very capable hands-on technical Mexican management team were able to restart mining operations within three months of purchase.

Our Mexican mining team is headed up by Antonio Berlanga, who has over 35 years of mining experience in Mexico. Some of the projects, in which Antonio has participated, through Reyna Minas, include: El Oro in the State of Mexico, La Negra in Queretaro and Pinzán Morado in Guerrero, among others. He has also promoted important mining assets, with Canadian companies, the latest being the Morelos Sur and El Barqueño projects with Cayden Resources. So, he's built mines, he's operated mines. He's even introduced a couple of mines that he knew to Canadian companies, which propelled excellent growth in Aurcana Resources and a friendly takeover of Cayden Resources by Agnico Eagle, valued at over C$210 million. So, Antonio, our CEO has excellent experience building and operating mines in Mexico as well as experience in public companies within Canada.

The public company side of Telson is being operated and managed from Vancouver, British Columbia by a group of experienced professionals, with technical, administrative, accounting and capital markets experience. So, we have strong teams on both sides of the border.

Antonio has an understanding of the public company side of things, as well as hands on mine building experience and operations in Mexico. His team has put Campo Morado back in production in record time. No one thought we would achieve production there for a year or more due to the mine’s former history. Antonio and his team brought the mine back into pre-production, within four months of its acquisition, pre-production until we declare commercial production. We have a mine there that's up and operating again and all the discovered resources have been fully drilled and outlined, so we know what we're dealing with.

Telson has retained an independent engineering firm to prepare a PFS technical study for Campo Morado and we'll have that out in the next few months. In the meantime, we started up pre-production in October 2017. Up to the end of the year, we produced about 106,000 tons of ore and are running that through the mill to produce zinc concentrates and lead concentrates. We’ve been selling the concentrates to Trafigura Mexico S.A. de C.V., a market leader in the global commodities industry. Operations have been running smoothly on a continuous 24 x 7 basis for over six months. We have increased the mill throughput rate to just under 2,000 tonnes per month during April 2018. We hope to declare commercial production in the next couple of months, at 2,000 tonnes or more per day. But we will be ramping it up to 2,500 tonnes per day through 2018. So mid to late 2018, we should be operating at capacity.

Telson is changing the mining method from room and pillar to sublevel caving mining. We also have a much smaller workforce than the previous operator, who employed over 700 people in operations to support mining. We are running the mine with about 280 employees at the moment. We'll probably max out at about 350 employees at Campo Morado once the mine reaches its ultimate production capacity. Telson’s Mexican management team has embraced the local community and employed a large percentage of the mine’s work force from the local communities. We've helped a group of truckers, by providing them long term contracts for hauling concentrate from the mill to the buyer’s warehouse in Manzanillo. This has allowed the truckers to finance their trucking cooperative business and to get them working again.

We've been very well accepted by the community, because we've made it a priority to involve the community, allowing them to become part of the operations, which gives them a vested interest in the project.

Antonio Berlanga is not your standard CEO of a Canadian public company. He spends probably 50% of his time on the projects or talking to local communities and keeping everybody informed about what we're doing, explaining our mindset and how we operate. So Telson’s Mexican management team has developed a very solid base within Mexico and around the projects. This team is really pushing the company forward. We've made huge progress in the last two years, which has no doubt increased shareholder value and will continue to do so.

Before we met Antonia Berlanga, our stock was trading at half a penny in one of the worst mining markets I have ever experienced in my long career. When I think back to those tough years in 2015, our company has accomplished a lot in just two short years, under Antonio Berlanga’s leadership. We're now trading, around 70 - 80 cents with about a C$90 million market cap.

While we are in pre-production at Campo Morado, we're building a new mine at Tahuehueto. This new mine should be operating by the end of 2018. But in the meantime, we're toll milling and producing lead and zinc concentrates and selling them as well, from Tahuehueto.

So all in all, a lot is happening. We actually have ideas for future acquisitions, but we want to make sure our two current projects are up and running before we get too far ahead of ourselves. However, Antonio Berlanga is very well connected and he knows a lot of projects in Mexico, so we anticipate new acquisitions are on the horizon for the company as well.

Allen Alper Jr.: So what do you see as your biggest challenges at this point?

Ralph Shearing: I think Guerrero is known as a bit of a tough state. But we've dealt with potential issues very well. We don't believe we're going to have that much trouble. We can never say we won't have problems, but the way we've embraced the communities and made them a part of it, goes a long way to helping us out in securing a long-term operation.

We have initiated construction at Tahuehueto, so there's a construction risk. But we don't feel that is a great risk. We have all the equipment for the mill purchased as well as some mobile mining equipment. Now it's just implementation, construction, pouring concrete, putting it all in place. The mine plan is well in advance. We're advancing underground development, so we can feed the mill once it's up and running.

We don't see a huge amount of risk there. There's obviously construction risk, market risk and commodities risk. But I think, overall, we're in a pretty good commodities environment for metals. Zinc is high priced these days, it's projected to stay high priced for quite a while. Gold is looking good. Overall, we're in a reasonably low risk environment for mining, in my opinion.

Allen Alper Jr.: Can you tell us a little bit about your share structure?

Ralph Shearing: Sure. The company has just over 130 million shares issued. Probably 54% of that is owned by the insiders and control group people. We have some Chinese shareholders that own a decent amount of stock, maybe another 15, 20%. So we have a pretty tightly held share structure, which is great, but it also sometimes hampers us a little bit because it's sometimes considered too much of a controlled position. Future equity funding's are planned, which will begin to dilute the major control position as the Company matures and taps the market to raise funding.

Allen Alper Jr.: So you obviously believe in the project and have a lot of skin in the game?

Ralph Shearing: Obviously. My life is in Tahuehueto. I was involved in Tahuehueto for over 20 years. We acquired it 20 years ago. If you look at the life cycle of a junior public company, you can only explore when you can raise money. So, although we've owned Tahuehueto for 20 years, we really have only explored it for six or seven years, when money was available. In the scheme of things, it's developed reasonably quickly, when we were actually able to raise money and explore, but overall, 20 years is a long time.

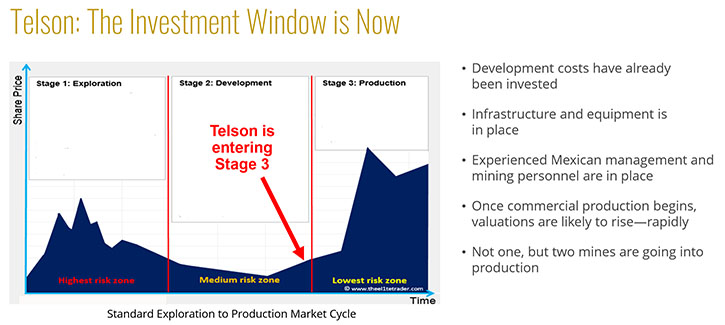

However, we're there now. One of the things that I point out to investors is that if you look at a standard chart for a typical exploration company that has gone through development and is building a mine, you can see the stock has a really good spike during exploration discovery. Then as the discovery becomes more mature and goes into a development phase, when the company starts building the mine, it's kind of a quiet period for investors and the stock price generally declines. But then when you get into production, the real value is created in a mining company. And we're right on the verge of taking Telson into commercial production, as we now are in pre-production at Tahuehueto, and very close to declaring commercial production in the next several months at Campo Morado. At Tahuehueto, we'll have the mine built this year and should be able to declare commercial production at this mine early 2019.

In 2019, we will be in full scale production in both projects and have a considerable cash flow. We'll have a considerable pre-production cash flow from our projects in 2018 based on our projections and Telson is rapidly growing into a new substantial mining company.

Allen Alper Jr.: What do you think are the main reasons our high-net-worth readers/investors should consider investing in Telson?

Ralph Shearing: Telson’s projects are at a stage, where all exploration risk has essentially been removed. For a mining company, with two projects in pre-production, soon to be in commercial production, Telson is very undervalued. Any CEO is going to tell you his company is undervalued. But I think if you really look at ours and compare it to other similar companies, who are in production with one or more operating mines in Mexico, you'll see that the case I'm making is very real. Telson’s peer companies with Mexican mining operations on a similar scale to Telson’s Tahuehueto and Campo Morado projects are trading at over seven times EBITA while Telson is trading at only three times our projected EBITA for 2019

Campo Morado is a project we acquired for $20 million. Where can you buy an operating mine for $20 million and in four months, start producing?

If you consider that as exploration expense and development expense that was the cheapest investment opportunity Telson has ever had. US $20 million gave us ore bodies, the underground development, the surface and underground mobile mining equipment, the mineral processing plant plus all of the infrastructure needed to run the mine at 2500 tons per day. Campo Morado has an estimated 12 year mine life at 2,500 tons a day. There is huge exploration potential at Campo Morado, as there is at Tahuehueto. So both of these projects could be expanded with the discovery of new resources and reserves once we get them into commercial production. Telson Mining Corporation most definitely is an extremely undervalued company at this point in time.

Allen Alper Jr.: Tell us a little bit about what you guys are doing with Campo Morado.

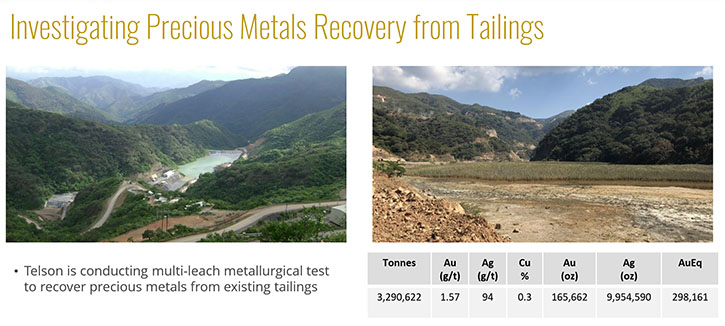

Ralph Shearing Campo Morado is a base metal VMS mineral deposit with Zinc, copper, lead plus gold, and silver. The recoveries that the previous operator was getting were in the 25 to 30% range for gold and 40 to 45% for silver. So as a consequence, there's a lot of gold, silver, and a decent amount of copper in the tailings facility at Campo Morado. Due to the refractory nature of the fresh ore, precious metal recoveries are low. To achieve higher precious metal recoveries oxidation of the mineralized material is required. So precious metal recoveries in fresh ore are challenging. But interestingly enough, because the milling grinding at Campo Morado processes the ore to a very fine grain, the tailings appear to have been oxidized as they were being laid down in the tailings storage facility based upon our initial leaching recovery testing. During our initial leach testing of the tailings, about 30 tons were collected within three backhoe pits from different areas of the tailing facility. This material was homogenized and from that a one tonne sample was processed in a cyanide, agitation leach test at our internal mine site lab. I want to point out that this was not an independent test however, this testing returned excellent gold recoveries along with decent silver and copper recoveries. Now this is not 43-101 compliant testing as it is not independent, but we are following up on this by sending material to an independent and compliant lab to verify our internal results. Cyanide consumption was fairly high, however, there is technology that's being used successfully in Mexico, where the recovery process is conducted in a closed circuit system, which allows recovery of precious metals as well as produces a copper participate allowing partial recovery of the cyanide reagent. This process allows sale of the recovered precious metals plus a high grade copper participate and reduces your cyanide consumption to levels that could be very economic.

The indications that we may be able to recover these metals from the tailings have opened up a really new exciting possibility of starting to get much better precious metal recovery at Campo Morado and that obviously is going to really help the economics being achieved at the mine.

Allen Alper Jr.: Fantastic!

Allen Alper Jr.: Is there anything else you'd like to add before we wrap up?

Ralph Shearing: I would just invite your readers/investors to come join us. We're going to have a lot of fun over the next little while. We're planning to grow this company even past the two mining projects we have now, with our Mexican team that is very capable and well connected in Mexico. They know of many good projects, some of which we intend to evaluate for potential acquisition. This company is going to grow rapidly over the next several years.

Allen Alper Jr.: Well thank you very much. It sounds very exciting!

Ralph Shearing: Thank you.

http://www.telsonmining.com/

Ralph Shearing, P.Geol, President and Director

Glen Sandwell

Corporate Communications Manager

ir@telsonresources.com

Tel: +1 (604) 684-8071

|

|