Mayo Lake Minerals (MLM): Exploring for Gold in the Heart of the Yukon, Interview with Tyrell Sutherland, VP of Exploration

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 5/8/2018

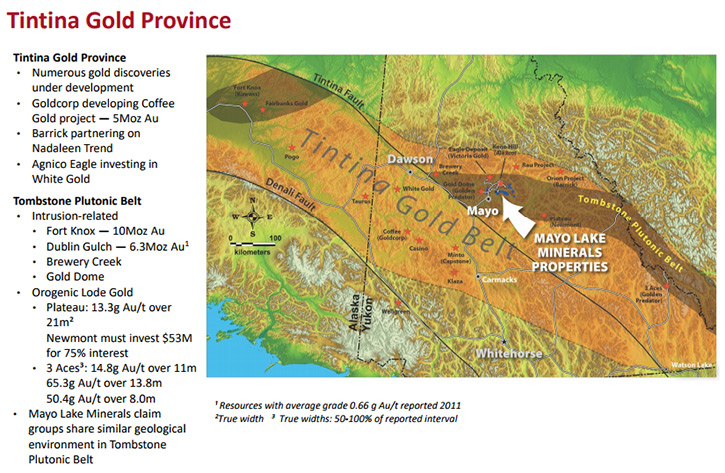

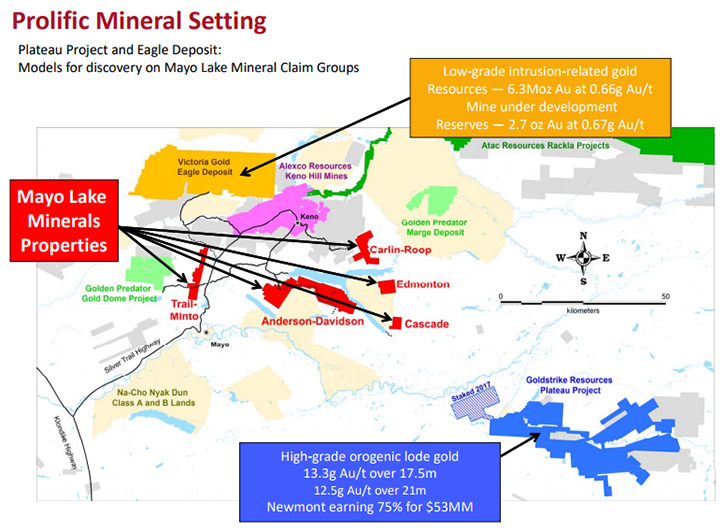

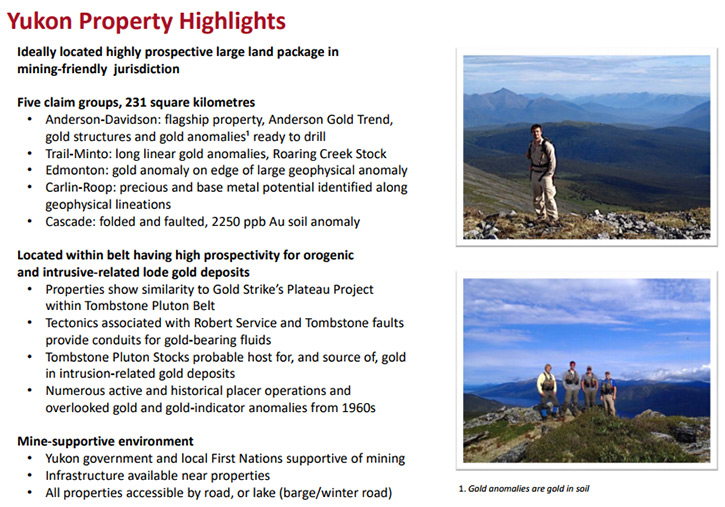

Mayo Lake Minerals (MLM) is a private Ontario-based company that owns a 100 per cent interest in five claim blocks, presently consisting of 1,117 claims, in the Mayo Mining District of the Yukon. These claim groups all lie within the Tombstone Plutonic Belt of the Tintina Gold Belt (TGB). We learned from Tyrell Sutherland, VP of Exploration for Mayo Lake Minerals, that these are all brand new properties, never drilled before. Plans for 2018 include a 1,200 to 2,500 meter drilling program. Judging by the amount of placer operations that have been active in this area and based on the style of soil anomalies, Mr. Sutherland is confident they are going to find gold mineralization on their claims.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Tyrell Sutherland, VP of Exploration for Mayo Minerals. Could you give our readers/investors an overview of your company, your focus and current activities in the Yukon?

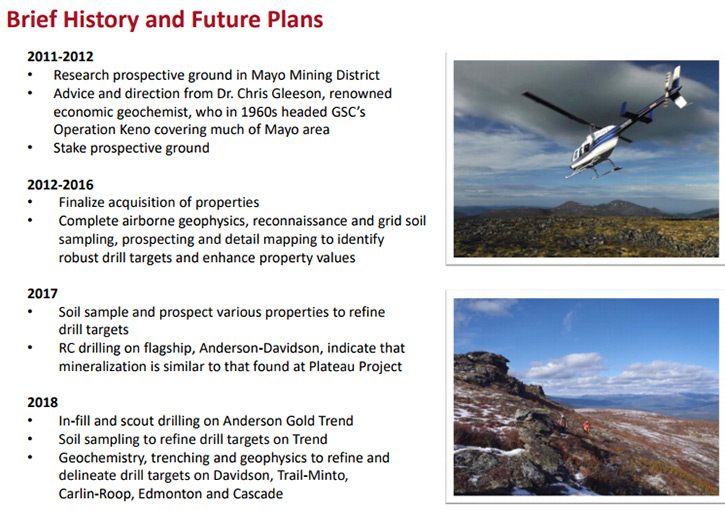

Tyrell Sutherland: I'm happy to speak with you and thank you for the interview. Mayo Lake Minerals was founded in 2011 to look for the source of placer gold in the Mayo Placer District. This is a placer district that initially worked about the same time as the Klondike but has never really had any work, looking into the source of all this placer gold. We're the first people on the ground here, looking for the bedrock source of this gold.

Our first claim-staking in 2011, was based on old Operation Keno results, a geochemistry program done by the GSC back in the 1960s. Because it was much older data, it was never digitized into any of the Yukon's databases. As a result, it was largely overlooked during the last staking rush. Vern Rampton, the President of our company, had previously been running Kinbauri Gold Corp, which was taken over by Orvana in 2009 to the tune of about $50 million. His partner in Kinbauri was Dr. Chris Gleeson, who had been in charge of Operation Keno. Chris alerted him to this data and together they picked out a few high potential areas.

We came in a bit towards the end of the staking rush, so it wasn't an ideal time. But that unused geochem data and the placer gold activity in this area provide a really compelling story. We started off with some airborne geophysics over all the claim groups. The results prompted us to dig into this deeper, because there were these major structures crosscutting large areas. Every drainage coming out of these structures was a previous placer creek. We following that up with ridge and spur sampling in 2012 and found a whole pile of really interesting-looking anomalies.

That's about when the bottom fell out of the market. Since then, we've been making do with small private placements and government grants to help support our exploration. Since 2012, we've managed to do work on these projects every year to move them forward. Last year, we did the first drilling ever.

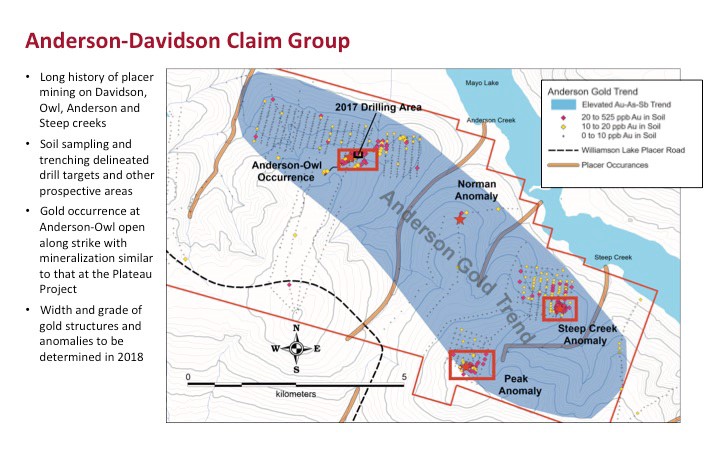

One of the challenges in this area, the reason nobody's looked at this area before despite all these placer operations, is a thin veneer of cover over everything, about one to two meters of overburden, so not much by way of outcrops. The old-timers, chasing these creeks up to the source, never saw the outcrops. However, we found, from the soil sampling, pretty major geochemical anomalies that we could trace. These were very narrow, long, linear features. They were drill-ready based on some very detailed soil sampling. That was some of the work we completed from 2013 up to last year.

We'd bring these great soil anomalies to people, and they'd say, "What’s the old drilling look like?" These are all brand new properties. No one's put a hole into any of these areas ever, prior to us, so we needed to get a few hard numbers. We started a small scout RC program to test one of these anomalies and confirm these are bedrock sourced. Our goal, for that program, was to find some mineralization in the bedrock.

On two holes, we tagged into mineralization right at the bedrock interface. In one of them, we had six meters of 0.8 grams from the bedrock interface, and then drilled out, so we only have the footwall contact for this mineralization in this area. We've hit that structure in two different drill holes, but we don't have the hanging wall contact. Because it was an RC program, we didn't know until we got the samples back from the lab. We’d hit this mineralization in two holes with 40 meters of strike length, but we only hit it right where it comes to surface. We don't know how big it is, what the main part of its grade is going to be.

We plan to go back and hit this with a diamond drill, so we will know when we're in the zone and can get a good idea of what this main structure looks like. It helps us, when we're going to money guys, to be able to say there's a drill hole on the property that we can chase up and say, "There are hard numbers in the bedrock and we need to do some real work exploring these."

Dr. Allen Alper: Sounds very good. You plan is to do more drilling in 2018?

Tyrell Sutherland: Yes, we're planning to start off with a 1,200 to 2,500 meter program, depending on funds available.

Dr. Allen Alper: Sounds great! Looking at your team, It sounds like you have real strength in geology, your CEO, yourself, and Jeff Ackert, the Chief Technical Officer and Director. Could you tell us a little bit more about your team?

Tyrell Sutherland: The main drive behind this was Vern Rampton. He was working up in the Yukon in the '60s, then all over Canada and internationally in mineral exploration. He organized the purchase of the El Valle gold mine in Spain in 2005. In 2007, Orvana came through and took them out for $50 million. All investors did pretty well from that one. That's his main claim to fame and he's been up in the Yukon on and off since the '60s.

Jeff Ackert is really active with both this company and our sister company when we were in here staking a lot of these claims. He's also been President and CEO of Carube Copper Corp.

I came into this story a bit later than the other two, still back in 2011, right when it was founded, to run programs in the Yukon. Since then, I've gotten up to the Yukon every year and developed a relationship with both the First Nations group, the Na-Cho Nyak Dun, and also a lot of the local companies and contacts there. The support we receive, from both the government and the First Nations and the locals in the Yukon, really comes together to make exploration easy and significantly less expensive, more effective for the dollars spent.

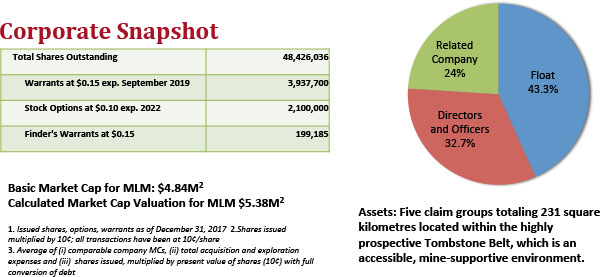

Dr. Allen Alper: That sounds excellent. I notice, looking at the share structure, it's a private company, mainly owned by insiders, is that correct?

Tyrell Sutherland: Yes, predominantly Vern Rampton, some of the management, directors, insiders, and then a small, select group of shareholders. The claims were originally staked by a related company, Auropean Ventures, that still retains a portion of MLM. Auropean has the same core shareholder base and management.

Dr. Allen Alper: That's very good, sounds interesting. It’s always good when management and the team has skin in the game. Could you tell our readers/investors why this area is so interesting, something about the geology, and why you're confident you're going to find gold and minerals there?

Tyrell Sutherland: The really interesting thing is that no one has looked at this prior to us. Just south of Mayo Lake, there have been tens of thousands of ounces of gold pulled out. In the last 20 years, they've pulled out at least 10,000 ounces of gold, which is not a huge amount, but this has been on and off on every single one of these creeks for over 100 years. Someone, working up on Ledge Creek, was finding gold nuggets still wrapped around the rocks that are locally sourced. We know these gold nuggets came from this local area, but no one has ever put a real effort into searching for the source. We're the first ones to really look at it and that means unlimited upside and a lot of low hanging fruit to test.

Based on the style of our soil anomalies on our flagship Anderson-Davidson project, it looks like these things are linear meaning structurally controlled type gold anomalies. We're not looking at big, amorphous blobs. We're looking at tight structures, 50 to 100 meters wide by up to 2 to 4 kilometers long. Based on that, our model for this is the Plateau deposit.

Our anomalies are very similar to what they're seeing down at Plateau, except there the glacier scoured off all the overburden, so they can see all these structures right where they come to surface. We think we have the same kind of vein-type structures, but they're covered by a meter of overburden. They're having quite a bit of success down at Plateau. I know Newmont went into them for about $53 million for the full deal. I think the anomalies we're finding are going to be similar in value to what they have down there. They have a 10,000m drill program planned for 2018.

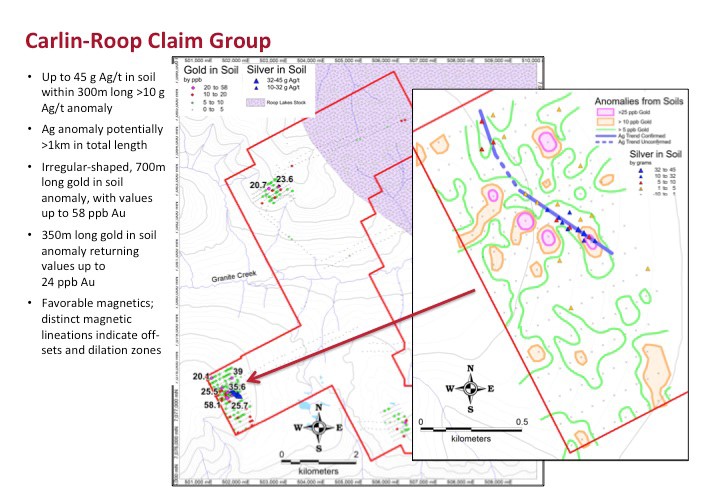

We do have some other blue sky properties, where we have some great anomalies we picked up in our ridge and spur sampling, and also some of our grid sampling over the past few years. On our Carlin-Roop property, right on the eastern edge of the Keno Hill Camp and in the same rocks as Alexco’s silver mine, we defined a kilometer-long silver anomaly with a central zone of 14-45g of silver per tonne in soil. That is in the soil, anywhere else that would be a screaming anomaly in Keno it is still pretty good. This appears to be a structure that was unknown during the heyday of the Keno Camp due again to lack of surface exposure.

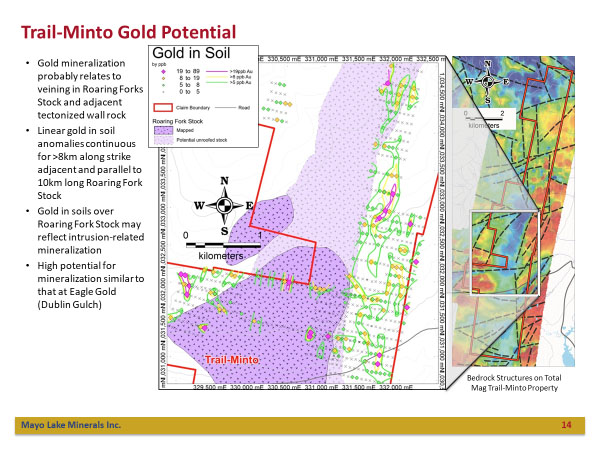

Our Trail-Minto property sits on a Cretaceous intrusion similar in age and right between, Victoria Gold’s Dublin Gulch Project and Golden Predator’s Gold Dome Project. This thing is covered with gold in soil anomalies but nothing tight enough to drill. For both Carlin-Roop and Trail-Minto we will do a little bit of trenching to bring them to the drill ready stage for next year.

One awesome characteristic of our major properties and unlike a lot of the other gold projects in the Yukon, we have infrastructure that goes right up on to our claim groups. You can actually drive right onto three of our claim groups. Some of them have major trails that wouldn't take much upgrading to bring them right to where the anomalies are. Not only that, the Wareham Lake Dam is only 20 kilometers away from our flagship property, so power is extremely close.

Dr. Allen Alper: That all sounds practically ideal.

Tyrell Sutherland: Yeah. If we need to hook up to grid power, it is not a huge capital cost setting these things up.

Dr. Allen Alper: Mayo Lake Minerals' properties are in the Tombstone plutonic belt, near the Tintina Gold Belt. Is that correct?

Tyrell Sutherland: Yes. The Tombstone Plutonic Belt is defined by a group Cretaceous stocks that run from the southern Yukon to Alaska and really defining the northern and eastern boundaries of the Tintina Gold Belt. A lot of gold deposits in the Yukon and Alaska are based around these types of intrusions. You look at Fort Knox, Brewery Creek, Dublin Gulch, they're all related directly to these Tombstone intrusions. Then You look at things like Three Aces and Plateau and they are also within this same Tombstone Plutonic Belt, I'm not suggesting these are all causally related, but there are a lot of these orogenic and intrusion-related gold systems focused here. It's a very fertile belt within the Tintina Gold Belt itself.

Dr. Allen Alper: That sounds very good. Could you just summarize what are the most important features? What makes Mayo Lake Minerals’ properties important? What makes you confident that there's something there?

Tyrell Sutherland: Okay. I think the fact that we're located so close to infrastructure and there's evidence that there is very locally sourced gold on a lot of these properties. We've had a couple majors come in and look at this, and they said, "Hey, there are roads right up onto this. It wouldn't take much to build this." Leveraging that infrastructure makes it exponentially cheaper for us to explore, and eventually build. And the placers mean we know the gold is there we just have to find it.

In addition to that, this is such a fertile area that's never been investigated prior to this. We're the first ones ever looking on these properties. We're the first ones who have ever put boots on the ground in these areas.

Dr. Allen Alper: Excellent! It sounds like 2018, when you do your drilling, will be a very exciting time.

Tyrell Sutherland: Yeah. It's an exciting year for us. We're aiming for a listing on the CSE. We're going to hammer out the details over the next couple weeks, but we have a plan in order to go public prior to the drill season this summer.

Dr. Allen Alper: That sounds very good.

Tyrell Sutherland: It is great working in the Yukon. From locals though all levels of government people understand that mining can benefit everyone. We go there and we have such a good relationship with the First Nations group that we can call them up and say, "We might need this," and they're there to help and push us along, because they want to see the development, and help us bring jobs to the people there, and really develop this area. Same with the government. We have a very good relationship where we can talk to them and say, "Hey look, what is the best way to do this," and they're really there to help out, and keep everything moving along and help us avoid major pitfalls. It is a real breath of fresh air to work in a jurisdiction like that, where everyone's so interested in making things happen and working together.

Dr. Allen Alper: Excellent!

http://www.mayolakeminerals.com/

Tyrell Sutherland, M. Sc.,

P. Geo., VP Exploration

613-884-8332

tsutherland@mayolakeminerals.com

|

|