Harte Gold Corp. (TSX: HRT, OTC: HRTFF, Frankfurt: H4O): One of the Highest-Grade Gold Deposits, Commercial Production in 2018, Interview with Stephen G. Roman, Chairman, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 4/24/2018

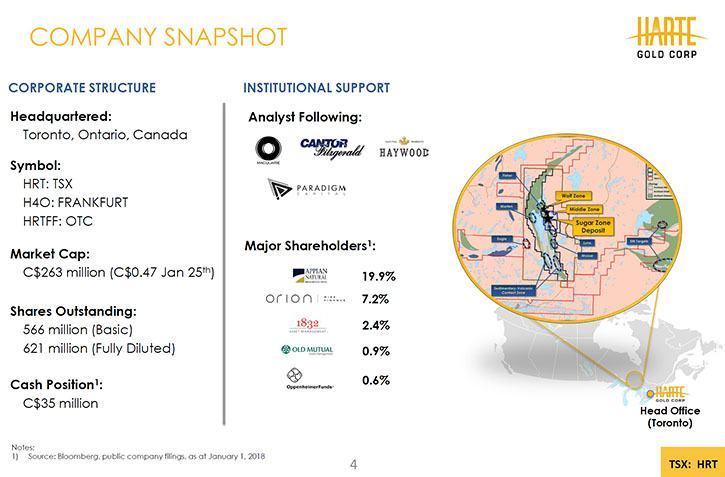

Harte Gold Corp. (TSX: HRT, OTC: HRTFF, Frankfurt: H4O) is focused on the exploration and development of its 100% owned Sugar Zone Property, in Ontario, Canada, where it has recently completed a 70,000 tonne Advanced Exploration Bulk Sample and mined 30,000 tonnes, under its Phase I Commercial Production Permit. The Sugar Zone Property is located 80 kilometers east of the Hemlo Gold Camp. We learned from Stephen G. Roman, who is Chairman, President and CEO of Harte Gold, that they currently have a quarter billion-dollar market cap, and recently came out with an update to their resource, which increased to 300% to the 1.5-million-ounce level. We learned from Mr. Roman that they have completed the construction of approximately 60% of the processing plant at Sugar Zone with start-up scheduled for July 2018.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Stephen G. Roman, Chairman, President and CEO of Harte Gold Corp. Could you give our readers/investors an overview of your company, your focus and current activities?

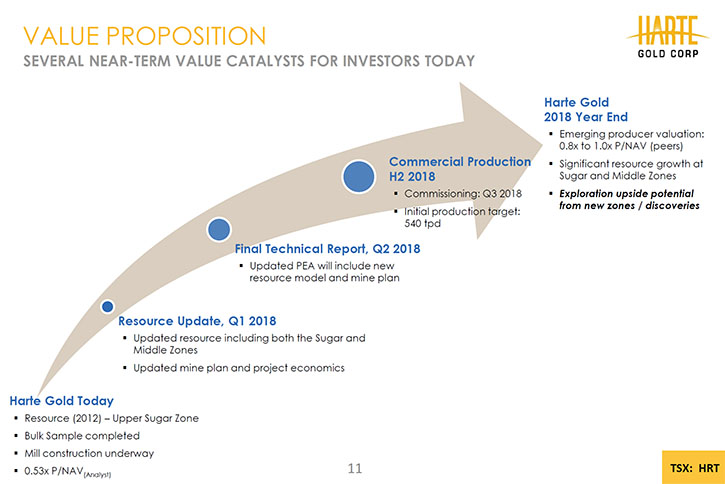

Mr. Stephen G. Roman: Harte Gold is a Canadian based gold mining company, doing both Exploration and Development. We are listed on the Toronto Stock Exchange. We currently have a quarter billion dollar market cap. We announced an update to our resource recently, which now stands at the 1.5 million ounce level. Drilling is continuing on the project, named the Sugar Zone Project. We are building a mining operation there, with the mill building and all the facilities approximately 60% completed as we speak.

Completion is expected by the end of June of this year. We expect to start running material through the mill in July and declaring commercial production sometime in the fall. This is a company that has moved from an initial exploration stage company, when we took over management in January 2009. We've now progressed from an early exploration stage company to over a million and half ounces and initiated a mining product, which will be going into production this summer. We are now classed as a development stage company, and clearly with cashflow starting this year we move into a different league.

Dr. Allen Alper: Outstanding! Really admirable! I am very, very impressed with what you have done in such a short time. Excellent!

Mr. Stephen G. Roman: Thank you.

Dr. Allen Alper: Could you tell our readers/investors a bit more about your plans for 2018?

Mr. Stephen G. Roman: In 2018 the plan is to complete the construction of the mining and milling operation so that we can become a full-fledged mining company. We need to ramp up our production over the next 1.5 years to get up to our designed tonnage rate. Initially, we are starting at 540 tons a day. We expect to move fairly quickly to 800 tons per day, which will produce between 70 and 80 thousand ounces a year from the Sugar Zone Mine.

We are also studying ways to increase the size further. That's going to be part of our overall 2018 program of continued drilling, expanding the size of our deposits, producing updated mine plans and throughputs. We are doing exploration drilling on our entire property package, which has many prospective targets that we have defined but have never been drilled, which could host additional deposits.

We have a large exploration budget of over 10 million dollars for 2018. Once we have a sustained cashflow, a portion will be used to continue a property wide exploration program to increase our mineral inventory. We will be a self-sustaining gold mining company.

Dr. Allen Alper: Fantastic! That's really a great accomplishment. Could you update our readers/investors on your background and your board’s? I know you are an award-winning PDAC recipient.

Mr. Stephen G. Roman: I've been in the mining business my whole life. I started as an underground miner in northern Ontario when I was 19. My father was in the mining business as well, he started a company called Denison Mines Limited, which was the worlds' biggest uranium mining company. I, of course, cut my teeth working with Denison. I took geology in school and went into the exploration side of the business. At Denison and post Denison years, I've developed a number of mining projects. From large coal projects in western Canada to other gold mining projects in Ontario, potash projects in eastern Canada. I started my own shop and have been developing projects worldwide, in various commodities, including gold and uranium, and other resources like oil and gas.

I have a 40 year history in the resource industry. I was awarded the “Bill Dennis Trophy” for 2016 for our Gold Eagle discovery in Red Lake, Ontario. That project was a grass roots discovery that resulted in a buyout by Goldcorp, Inc. investment for 1.5 billion dollars in 2008. And of course with many shareholders making substantial returns on that, they financed me to go out and do it again. So a lot of my Gold Eagle backers have come in and been initial investors in the Harte Gold story.

Harte Gold has moved up from $.02 when I became involved. It hit a high of $.88, now it's been trading around the $.45 level, but we expect that it will have a re-rating, once we declare commercial production. That's going to move us into the producer category.

Dr. Allen Alper: Excellent! That's an excellent record of accomplishment, of which you and your family can be very proud. That's really great. Could you tell us a bit more about the other board members and your team?

Mr. Stephen G. Roman: The members of our team are all experienced people, primarily mining engineers, geologists and financial people. Our board consists of Derek Rance, the former President and Chief Operating Officer of the Iron Ore Company of Canada, a large iron ore producer, Richard Faucher, ex-VP from Noranda and President of Falconbridge Dominicana. We have PhD geologist, Richard Sutcliffe, who was instrumental in putting a couple of new deposits into production in Canada. We have Richard Colterjohn, ex-head of mining for UBS Bunting Warburg, and Michael Scherb, founder of Appian Capital, former JP Morgan investor banker and large shareholder of our company. In addition Fergus Kerr, who was General Manager of Denison’s Elliot Lake operations.

We have a good cross-section of technical and financial people on our board. All have over 30 years’ experience in this industry. A very accomplished board! Our management team equally so. We have Roger Emdin, who's our VP Operations. He was formerly at Glencore, a big company that was building a mine in Sudbury, Ontario, called Nickel Rim. Steve Ball, our mine manager, was the head of operations at Inco now called Vale, at their Voisey’s Bay operation in Labrador. This is the caliber of people we have. We have an A-team both on the board and management side, and people that have built many mines in their careers.

Dr. Allen Alper: Sounds fantastic, really excellent! Could you tell our readers/investors, a bit about your capital and share structure?

Mr. Stephen G. Roman: Yes we've raised significant capital to develop the Company in late 2016 and until the end of 2017. We raised about 100 million dollars. It's all equity, so we have no debt in the Company. We have approximately 650 million shares outstanding. We expect, once we achieve positive cashflow, we'll be able to start buying stock back under a Normal Course Issuer Bid. We don't plan any consolidations.

Over the years we raised money at low share prices, but in December 2016 we made a deal for 25 million dollars with a UK based Private Equity group, Appian Capital. Last December, we did another deal bringing in another Private Equity group, with another large raising. We have a solid backing from two Private Equity firms that combined hold about 27% of the company.

Another 30% + are in very solid hands, myself and people I've brought in when I took over the Company in '09. The rest of it is widely held. We have a few institutions in the shares now that have participated in our financings, and we expect that to ramp up once we achieve production.

We also have three firms, Cantor Fitzgerald, Macquarie Bank, and Haywood Securities analysts covering the company. Since the end of 2016, we've managed to ramp up our activities and accelerate our entire development process, including the exploration drilling and moving ahead to become a producer. That's all happened in the last 12 to 15 months.

Dr. Allen Alper: That's fantastic. What are the primary reasons our high-net-worth readers/investors should consider investing in Harte Gold?

Mr. Stephen G. Roman: The best reasons to invest in Harte Gold Corp is our very good location, right in the heart of a large gold-producing area, with Barrick Gold as our nearest neighbor, at their Hemlo operation. We have Richmont Mines that was acquired recently, for almost one billion dollars by a company called Alamos Gold. They're just south of us. Another company, called Wesdome is also nearby. We are in the neighborhood of gold mining companies that are very keen to grab what we have.

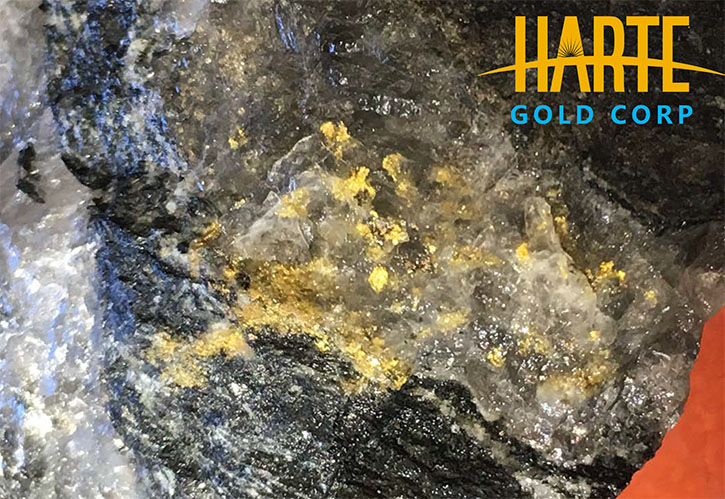

From the point of view of potential M&A transactions in the future, we rank very high. The next very important aspect is that we have a very high-grade deposit. Our deposits ranges from 8-10 grams per ton, putting us in the top decile of gold mining projects worldwide, as far as grade. With high grade comes very low operating costs. We expect costs in the $600 range to produce an ounce of gold, which gives us a high profit margin on this project.

In addition, our management team and Board are focused on developing significant value over the coming year through the addition of more gold resources and new discoveries on our extensive land package.

We have an “A” team, motivated to succeed.

With continued exploration, we expect to come out with additional upgrades to our resources. They are continuing to grow. With our mine coming on stream, the last very important thing to mention is a re-rating in our shares because we're moving from an explorer to a producer.

Dr. Allen Alper: Excellent! Sounds like very strong reasons for our high-net-worth readers/investors to consider investing in Harte Gold, a great opportunity. Is there anything else you'd like to add, Stephen?

Mr. Stephen G. Roman: Well Dr. Alper, I think that covers it. We're very excited about the Company and the project. We've assembled an A-1 team to move this ahead, and we expect to start pouring gold this summer. Just stand by for more news as we continue our development.

Dr. Allen Alper: That sounds excellent.

https://www.Harteegold.com/

Stephen G. Roman

President and CEO

Tel: 416-368-0999

sgr@Harteegold.com

|

|